The Week's Economic Reports

Saturday, January 13, 2007

Following is a summary of last week's economic reports. Rising credit card debt and robust retail sales for December highlighted the data - this will likely stoke new inflation fears in the weeks ahead. For the week, the S&P 500 Index fell rose 1.6 percent to 1,431 and the yield of the 10-year U.S. Treasury note rose 13 basis points to 4.77 percent. Consumer Credit: Credit card debt soared in November contributing to the $8.7 billion rise in revolving credit. After falling $1.3 billion in October, overall consumer credit rose $12.4 billion in November, likely an indication that consumers were feeling confident enough during the early holiday season to continue spending, using credit cards to fund purchases as home equity withdrawal wanes. Nonrevolving credit for purposes such as auto loans rose $3.7 billion.

Consumer Credit: Credit card debt soared in November contributing to the $8.7 billion rise in revolving credit. After falling $1.3 billion in October, overall consumer credit rose $12.4 billion in November, likely an indication that consumers were feeling confident enough during the early holiday season to continue spending, using credit cards to fund purchases as home equity withdrawal wanes. Nonrevolving credit for purposes such as auto loans rose $3.7 billion.

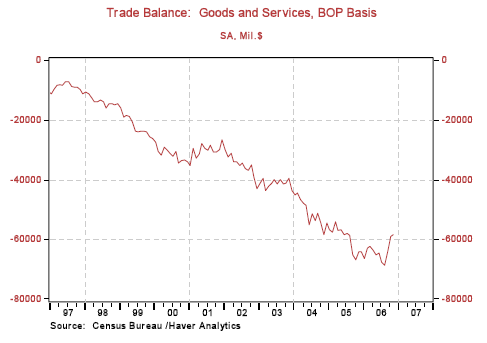

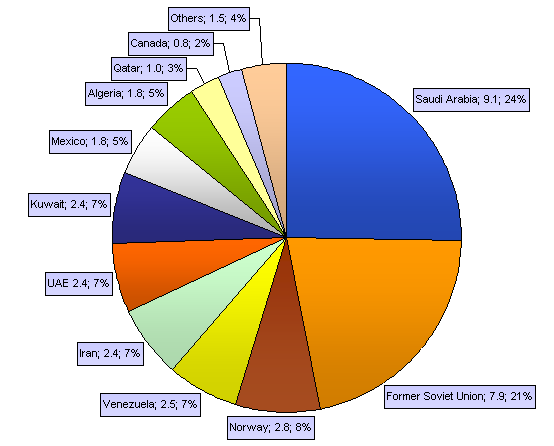

International Trade: The U.S. trade deficit contracted for the third consecutive month, from a revised $58.8 billion in October to $58.2 billion in November. The narrowing was due largely to an increase in exports rather than reduced imports, more civilian aircraft deliveries to international customers being the primary factor. Overall exports rose 0.9 percent while imports increased 0.3 percent.  Prices for crude oil fell from $55.47 per barrel in October to $52.25 per barrel in November, making the increase in the oil trade deficit much smaller than it would otherwise have been. The trade gap with China narrowed $1.5 billion to $24.4 billion per month while the deficit with Japan and OPEC countries narrowed by $0.4 billion and $0.7 billion, respectively. Most of the reversal in recent months is a direct result of lower oil prices and this will provide a boost to fourth quarter GDP.

Prices for crude oil fell from $55.47 per barrel in October to $52.25 per barrel in November, making the increase in the oil trade deficit much smaller than it would otherwise have been. The trade gap with China narrowed $1.5 billion to $24.4 billion per month while the deficit with Japan and OPEC countries narrowed by $0.4 billion and $0.7 billion, respectively. Most of the reversal in recent months is a direct result of lower oil prices and this will provide a boost to fourth quarter GDP.

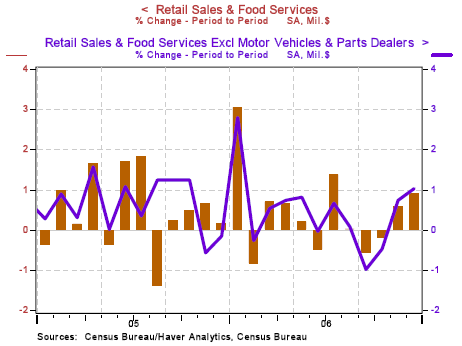

Retail Sales: The undaunted American consumer is alive and well, at least according to the latest retail sales data. Exceeding expectations, retailers reported an overall sales increase of 0.9 percent in December following a downwardly revised 0.6 percent rise in November. The two most recent months convincingly reverse the trend of the three prior months where sales fell on a month-to-month basis. Excluding automobiles, retail sales gained 1.0 percent in December after a revised gain of 0.7 percent in November. Strength in retail sales was broad based. One of the few categories losing ground was building materials which fell 1.1 percent, a result of a slowing housing market. Gains were paced by gasoline station sales and electronics, both up over three percent - rising prices at the pump were responsible for the former, however, this will be reversed in the months ahead as gasoline prices fall. On a year-over-year basis, overall retail sales were up 5.4 percent, once again exceeding wage gains over the last year, the difference being made up via new credit.

Strength in retail sales was broad based. One of the few categories losing ground was building materials which fell 1.1 percent, a result of a slowing housing market. Gains were paced by gasoline station sales and electronics, both up over three percent - rising prices at the pump were responsible for the former, however, this will be reversed in the months ahead as gasoline prices fall. On a year-over-year basis, overall retail sales were up 5.4 percent, once again exceeding wage gains over the last year, the difference being made up via new credit.

Import and Export Prices: Both import and export prices rose sharply in December, the rise in import prices largely due to a temporary rise in oil prices during the reporting period that ended in mid-December (note that the international trade report above in which falling oil prices were reported is a month behind most other reports). As oil imports are a very large component of total imports, the January report should show a hefty price decline.

The 0.7 percent increase in export prices was the largest monthly increase in nearly two decades, largely a result of higher prices for agricultural products. Prices for commodities such as corn and wheat have been rising rapidly in recent months and this is now showing up in the export data.

Summary: Higher consumer spending enabled in part by increased credit card debt has once again proved the old axiom, "Never count out the American consumer". The latest reports show that consumers are turning away from home equity withdrawal and are back to using credit cards after a long period of low credit card spending. What appeared to be capitulation during the months of August, September, and October was reversed in a big way over the last two months casting new doubt on whether a consumer led economic slowdown is in the cards for 2007.

The Week Ahead

Economic news in the week ahead will be highlighted by two inflation reports - producer prices on Wednesday and consumer prices on Thursday. Other reports include industrial production on Wednesday, housing starts and the Conference Board's index of leading economic indicators on Thursday, along with consumer sentiment on Friday.

[Note: This is one very small part of the Weekend Update published at the companion investment website Iacono Research. Since it contains no investment-specific information, it will appear here on Saturdays on a fairly regular basis. To have a look at the complete Weekend Update, including the model portfolio and much more, sign up for a no-obligation free trial today.]

All charts courtesy of Northern Trust.

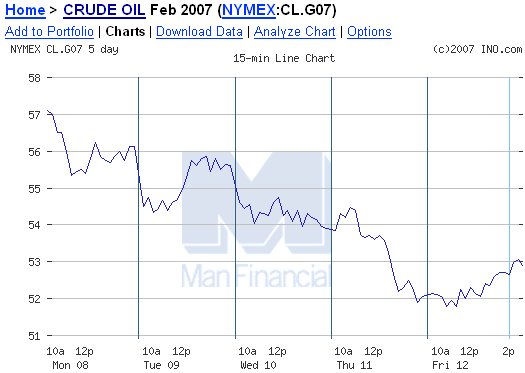

The big oil companies did a lot better than last week (though that's not saying much).

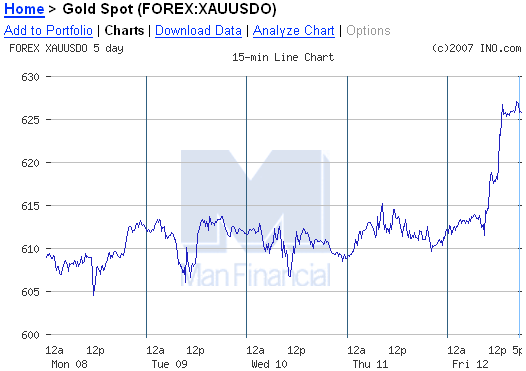

The big oil companies did a lot better than last week (though that's not saying much). It was a very good day for gold - it just kind of hung around all week waiting for the weekend to arrive. At noon on Friday it jumped $10 and punched out for the weekend.

It was a very good day for gold - it just kind of hung around all week waiting for the weekend to arrive. At noon on Friday it jumped $10 and punched out for the weekend. Gold goes up two percent, silver goes up four percent - that's pretty typical. Of course it's a lot more fun going up than going down - when going the other direction, it's more like gold goes down two percent, silver goes down eight percent.

Gold goes up two percent, silver goes up four percent - that's pretty typical. Of course it's a lot more fun going up than going down - when going the other direction, it's more like gold goes down two percent, silver goes down eight percent. Gold miners rebounded, though they made up only about a third of last week's decline - last week was pretty awful.

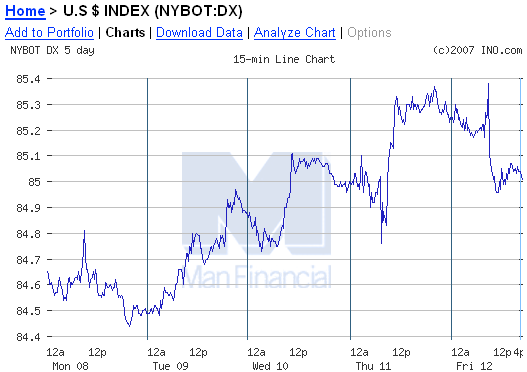

Gold miners rebounded, though they made up only about a third of last week's decline - last week was pretty awful. And the dollar continues to impress - up to 85 on the U.S. Dollar index before falling back into its old habits today. Is it time to buy Euros again?

And the dollar continues to impress - up to 85 on the U.S. Dollar index before falling back into its old habits today. Is it time to buy Euros again? The second week of the year was much better than the first. Hopefully, in this case, one week

The second week of the year was much better than the first. Hopefully, in this case, one week

Two women have thwarted all attempts at dominating the search phrase "Friday Lite" since that goal was first set and then achieved last year.

Two women have thwarted all attempts at dominating the search phrase "Friday Lite" since that goal was first set and then achieved last year. Not far from here an 1800 residence community with schools, shopping, parks, and an assortment of other infrastructure seems to have been stopped dead in its tracks. When the wind whips up, dust flies and tumbleweeds blow through while the few residents who call it home seem to walk around with a dazed look.

Not far from here an 1800 residence community with schools, shopping, parks, and an assortment of other infrastructure seems to have been stopped dead in its tracks. When the wind whips up, dust flies and tumbleweeds blow through while the few residents who call it home seem to walk around with a dazed look. In the press release Patrick noted, "In today's real estate market, many buyers are looking for deals. For these buyers, MLS-2.com allows them to search a complete MLS database of homes specifically for bargains, in new and unique ways."

In the press release Patrick noted, "In today's real estate market, many buyers are looking for deals. For these buyers, MLS-2.com allows them to search a complete MLS database of homes specifically for bargains, in new and unique ways." Having neither an institution or a contingency/liquidity plan, it's hard to come away from this feeling anything other than a bit unsettled as to why others are urged to conduct a test on theirs.

Having neither an institution or a contingency/liquidity plan, it's hard to come away from this feeling anything other than a bit unsettled as to why others are urged to conduct a test on theirs. TVC15 was a single by

TVC15 was a single by  So, despite the recent favorable price data, I believe it is still too early to relax our concerns about whether the run-up in price pressures in the spring and summer of last year is truly unwinding and whether it is unwinding rapidly enough to forestall a pickup in

So, despite the recent favorable price data, I believe it is still too early to relax our concerns about whether the run-up in price pressures in the spring and summer of last year is truly unwinding and whether it is unwinding rapidly enough to forestall a pickup in  By my standards,

By my standards,  To a significant extent, these financial developments reflect a high degree of confidence in future macroeconomic and financial stability, reinforced by the improvements in

To a significant extent, these financial developments reflect a high degree of confidence in future macroeconomic and financial stability, reinforced by the improvements in

Business daily Handelsblatt writes:

Business daily Handelsblatt writes:

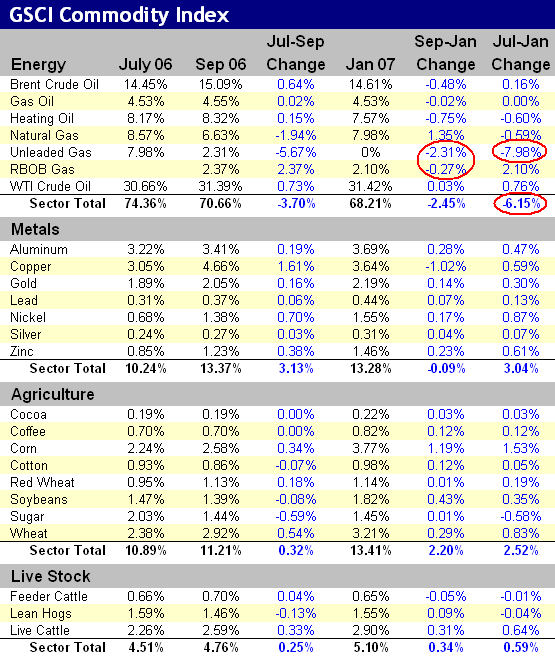

What this means is that there really is nothing new since last summer's announcement that the weighting of gasoline would be reduced by six percentage points by the end of 2006 as reported in the New York Times - the New York Post

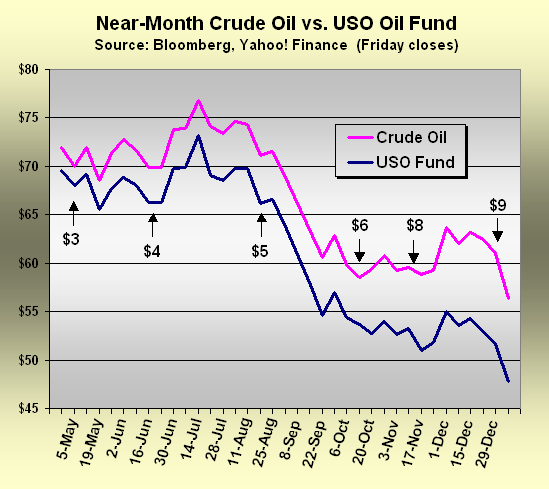

What this means is that there really is nothing new since last summer's announcement that the weighting of gasoline would be reduced by six percentage points by the end of 2006 as reported in the New York Times - the New York Post  There has got to be a better way for the ordinary investor to obtain exposure to the most important of all commodities.

There has got to be a better way for the ordinary investor to obtain exposure to the most important of all commodities.