Is There a Housing Jobs Bubble?

Monday, July 11, 2005

The major newspapers now seem to be asking more and more questions about what happens if the housing boom stops booming. One topic that is getting increasing coverage is the impact on the overall job market if housing related employment stalls.

The anecdotal accounts in these newspaper stories are almost always intriquing, but beware of the statistics ...

On Saturday, the New York Times ran this article, where they completely misrepresented the significance of real estate related jobs to the overall economy, and may have scared quite a few people in the process:Encompassing everything from land surveyors to general contractors to loan officers, the sprawling [real estate] sector has added 700,000 jobs to the nation's payrolls over the last four years, according to an analysis by Economy.com, a research firm.

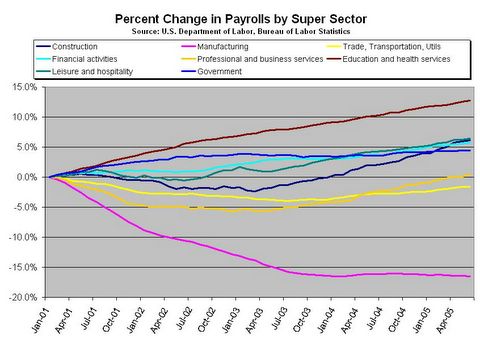

While both of these statements are true, this is only a small part of the jobs picture. During this time, the number of manufacturing jobs decreased by almost 3 million, education and health services jobs increased by over 2 million, leisure and hospitality gained almost a million jobs, as did government. The net result was a loss of 400,000 private sector jobs.

Combined, the rest of the economy has lost nearly 400,000 jobs over the same span, which stretches back to the start of the most recent recession, in 2001

While the Times article is not technically incorrect, it leaves the impression that only real estate jobs are being created, which is not true.

A look at the chart below shows that since 2001, of all the major (super) sectors, education and health services was the clear leader by percentage, and since it has a larger base, it is also the leader in absolute terms. Yes, real estate jobs are part of the construction, trade, and financial activity sectors, but when combined they are still less than education and health in absolute terms.

Click to enlarge

This is not to say that the number of real estate jobs created in recent years is insignificant - it is very significant. Asha Bangalore of the Northern Trust Company is often quoted from a May study (pdf):Employment in housing and related industries (sum of employment in the establishment survey under various categories related to housing industry) accounted for about 43.0% of the increase in private sector payrolls since the economic recovery began in November 2001.

While this too is true, it is also misleading. What happened in the job market during 2001 up until mid-2003 is dramatically different than what happened since mid-2003. In all, during the first period, roughly 2.5 million jobs were lost and during the latter two years about 3 million jobs were added.

Real estate related employment has been the one constant during the entire period, adding jobs at a steady pace all four and a half years. In recent years other sectors have been more important, notably, professional services and trade, transportation, and utilities - both of these sectors experienced declines between 2001 and mid-2003.

Most would argue that this was by design. When the Federal Reserve dropped rates from around 6% to 2% in 2001, this was the desired effect - to stimulate housing in order to help the rest of the economy. To that extent, this monetary policy was a success - to the extent that housing has become another asset bubble, maybe it wasn't so successful.

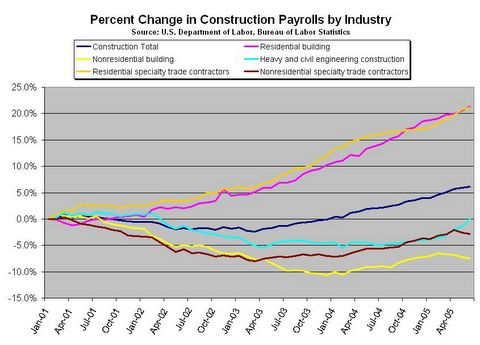

The chart below clearly shows the results of this policy. Starting in early 2001, when rates first came down, residential construction and home improvement took off. Compared to the nonresidential equivalents, which continued to fall until mid-2003, residential construction was booming.

Click to enlarge

In the last two years, nonresidential construction employment, as well as employment in many other sectors and industries has been improving dramatically. Many believe a large part of this increase is a result of the wealth effect created by the housing boom which started in 2001. Again, this is likely the intended effect, but the question remains whether the other sectors can maintain their momentum if housing falters.

So, is there a housing jobs boom?

No.

Is there cause for concern that the free-spending ways, enabled by the wealth creation of the housing boom, may come to an end.

Yes.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

0 comments:

Post a Comment