Inflation and Gold

Wednesday, August 17, 2005

Inflation ticked up a bit yesterday with the Consumer Price Index showing a year over year increase of around 3%. Then inflation ticked up again this morning, with the Producer Price Index showing a year over year increase around 4%.

These numbers would probably tick up a bit more, probably a lot more, if they more accurately represented what most people experience in their lives. But, we know how that works. None other than Alan Greenspan once lamented that savings is confiscated through inflation (see the main page side-bar quote from 1967).

We prefer to think of inflation as a stealth tax. Really, is there any difference between people sending their money to the government and people keeping their money as it loses its purchasing power as a direct result of government fiscal and monetary policy?

The real trick is to make people think that the money they keep isn't losing it's purchasing power. Or, better yet, a more believable story would be that it is only losing its purchasing power at a rate of two or three percent a year. That trick, the trick of the confiscators, seems to have worked quite well for some time now.

Pay no attention to the budget deficits, soaring debt of all kinds, or the increasing difficulty in making ends meet, and repeat after me, "inflation is benign", "longer-term inflation expectations remain well contained", "the breakeven TIP spread shows no inflation impact from oil", "the current cycle of non-inflationary prosperity can last for many years".

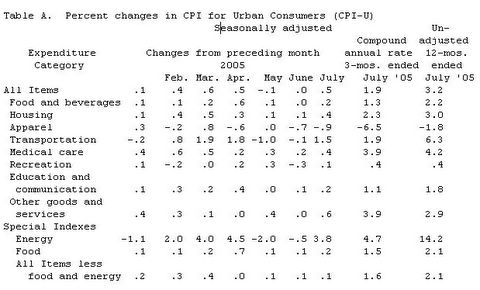

Here's yesterday's Consumer Price Index summary:

Click to enlarge

Examining the right-most column we find that total year over year inflation clocks in at 3.2%. Despite the 0.5% monthly increase, the inflation beast is apparently still heeding its master.

The sole negative number in the last column we understand - clothing, clothing accessories, and shoes are all going down in price and have been for at least the last ten years, as we discovered here. These low cost goods, manufactured overseas, help balance the cost of other, more expensive, goods and services provided by people in this country.

Transportation costs have gone up 6% in the last year, and energy costs have risen 14%. That doesn't quite explain how $1.80 per gallon gas is now closer to $2.50.

Or, how about that turkey sandwich in the cafeteria that used to cost $2.25 a couple years ago, then last year it was $3.00, and now it's $4.00. But food costs are only rising at the rate of 2% per year. That $2.25 sandwich should be more like $2.40, not $4.00.

And, housing is up only 3%, not 15% like you read in the papers. Does anyone else think that maybe if housing prices begin to decline and rents go up, that there will be a great realization that the housing component of the CPI needs to be re-jiggered to more accurately reflect housing ownership costs for the two-thirds of the population that own homes, rather than using "equivalent rent" which has been relatively flat in recent years?

Someday we will dig into this data some more, but until that time we don't believe what we are told - it doesn't jive with our own experience in the world, and if oil keeps doing what it's doing, at some point people will awake from their slumber and realize that their savings is being confiscated at an alarming rate, despite what the government statistics indicate.

Gold

In yesterday's post we forgot to mention Mr. Roach's passing reference to gold. It went like this:Today’s nearly 6.5% US current-account deficit underscores America’s unprecedented external vulnerability in the midst of an energy shock. The more income-short American consumers keep on spending to defend their overly-indulgent lifestyles, the larger the US current-account and trade deficits are likely to be -- and the greater the possibility of an external funding problem that could result in a weaker dollar and/or wider cross-border spreads for US interest rates.

We never think of gold as something that is "sniffing" anything. In fact, we are sure, there is no "sniffing" involved at all - gold just sits there, inanimate, waiting.

So far, only the dollar -- and possibly gold -- seem to be sniffing out this possibility.

Waiting for another generation of smart people to rediscover its enduring value.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

2 comments:

You site is one of my favorite places on the web. I love how the CPI is so low and inflation tame last month, brought down in large part due to the employee pricing on new vehicles, since eveyone in america bought cars last month this makes sense. And of course your spot on about housing how it weighs so heavily and yet acts like home prices have barely risen due to equivilant rent, and yeah your right once prices start to fall im sure they will alter this. You might enjoy the following link from rueters yesterday about the CPI

http://today.reuters.com/news/newsArticle.aspx?type=reutersEdge&storyID=2005-08-16T181550Z_01_N16175863_RTRIDST_0_PICKS-ECONOMY-INFLATION-ENERGY-DC.XML

CDs are gettting better every month, but everyone should own at least a couple of one ounce gold coins - just to be able to hold them in the palm of your hand to remind yourself what real money feels like.

Post a Comment