The DataQuick Spin

Monday, November 21, 2005

Last week, DataQuick released three reports on California real estate - one for the state as a whole, one for Southern California, and one for the Bay Area. Overall, compared to a year ago, sales were down slightly but prices rose by about 15 percent.

California October Home Sale Report

Southland home sales, prices still near peak

Continued sales slowdown in Bay Area, appreciation flat

In reading these three reports and looking at the data contained in them, it's not hard to see that there's some spin coming out of DataQuick headquarters - maybe a lot of it. Perhaps having been more interested in the data in recent months, the commentary has not been sufficiently scrutinized - this will have to be watched closely in the months ahead, as the California real estate market continues to react to rising interest rates and changing public perceptions.

Southern California

Regarding Southern California, DataQuick President Marshall Prentice seems particularly intent on shaping public opinion about what the future holds:"The big question is still whether or not the real estate market will end this cycle with a crash, or with a soft landing. Right now the latter scenario is still the most likely. Home values have doubled in the past four years and almost all, if not all, of those gains are here to stay," said Marshall Prentice, DataQuick president.

So, that second sentence is passable as sound analysis of the current situation - no evidence of anything crashing yet. But that third sentence is really very prescient, no? Divine omniscience? Didn't know that you had that in you Marshall - how else to explain stating as fact that an early 1990s style pull back in price levels is out of the question?

The Bay Area Real Estate Market

On Bay Area real estate, Marshall draws conclusions about the market's strength which seem to contradict both the headline and much of the rest of the article:"We look at today's market as normalizing. Everybody seems to have gotten used to the records set last year and the year before. The fact is that last month was the third-strongest October since we started keeping records in 1988. It was about twenty percent above average," said Marshall Prentice, DataQuick president.

So just how do you measure a market's strength? Marshall didn't say the third best year-over-year price increase, he said the third-strongest October. And, there's that twenty percent number which lately hasn't appeared in DataQuick reports with near the frequency it used to.

While it's not clear what "It" is in the last sentence or how "It" was twenty percent above average, it does sound nice to hear those words - "twenty percent". Californians have become accustomed to twenty percent gains on their median priced half million-dollar homes - that's $100,000 a year, about double the median income.

Life is good out here.

So let's look at how one might measure a market's strength. The recent year-over-year percent changes for median price and total sales for the month of October appear below (curiously, no data is available for the last few months of 1999, which must have been one of the wildest periods in the history of Bay Area real estate, given what was going on with the internet boom at the time).

Year..Price...Sales

-------------------

2005...17.2...-6.0

2004...17.5...-4.7

2003....9.3...23.8

2002...11.5...20.4

2001...-0.8..-19.6

2000...26.2....0.2

When looking at price changes and sales changes to measure the strength of a market, it really looks like October 2005 places fifth out of the last six (or possibly sixth out of the last seven). In fact, if you simply use the sum of the two numbers as a proxy for strength, then 2002 and 2003 are by far the strongest.

If changes to inventory were included in the strength measure, then surely October 2005 would not look nearly as good as the DataQuick President would like people to believe. As it is, it is accurate to say that October 2005 was third best in the last six years for price appreciation, and second to last in changes to sales volume.

Had Marshall just said, "Last month, prices were up almost twenty percent from a year ago", it wouldn't have been a big deal. As it is, the words that were ultimately chosen are clearly designed to mislead and confuse, and frankly, they sound a little desperate.

Financing the Boom

In the first DataQuick article about real estate trends in California as a whole, the following statement appears - a statement that most people probably think little about.The typical mortgage payment that home buyers committed themselves to paying last month was $2,081, a new peak. That was up from $2,004 in September, and up from $1,745 for October a year ago.

So, the first thing to notice here is that the "typical mortgage payment" has risen about twenty percent in the last year - that's interesting. But how is this "typical mortgage payment" calculated?

Using any mortgage calculator, it quickly becomes clear that this is the standard twenty percent down, 30-year fixed calculation. In this case, financing $363,200 (eighty percent of the October median price of $454,000) at the October rate of 5.6 percent yields a monthly payment of $2085. Close enough.

The next question to ask is how this perfectly understandable monthly mortgage payment squares with the median income in the state of California - after all, median house price, median family income, median family awareness of how the real estate and lending businesses work today - surely there is something interesting to be learned here.

Let's first finish the PITI calculation (Principle-Interest-Taxes-Insurance). For a the median priced $454,000 home, taxes at 1.25 percent per year works out to be $473 per month. To this add another $60 per month for basic homeowners insurance, and you get a grand total of $2614 per month for basic housing expenses.

According to the Census Bureau, the three-year-average median household income in California for the years 2002 through 2004 was $49,894. Making allowances for modest wage gains in the last two years, that would put the median household income at around $52,500 today.

So, during the month of October, as a percent of gross monthly income, the typical California home buying family has committed to paying 60 percent of their gross monthly income to basic housing expenses?

By now everyone surely knows the answer to this - it just seems funny that DataQuick and other news reporting agencies continue to report this 20 percent down, 30-year fixed calculation. This is the same calculation that is used to figure the affordability index which last month came in at 15 percent.

Why the Boom Goes On

Obviously, the average homebuyer is not paying sixty percent of their gross income towards PITI, so there must be some other explanation. Where would one look to find the answer? Let's start with Yahoo!

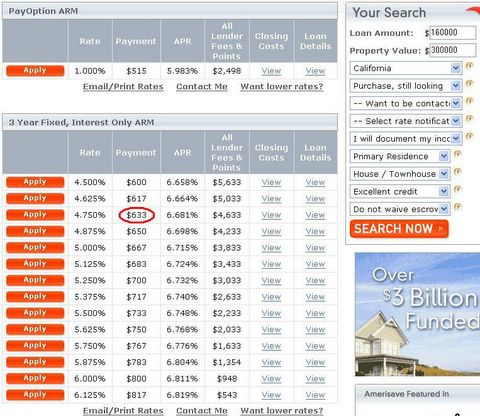

Click to enlarge

Just using the numbers shown here, the picture becomes clearer -$160,000 for $633 per month yields a mortgage payment of $1437 for the above example, which when combined with the fixed costs for taxes and insurance brings the new lower total to $1970 per month - 45 percent of gross monthly income.

This still seems high, and it still assumes a 20 percent downpayment. Not too many years ago lenders would limit PITI to 28 percent of gross income and total debt to 42 percent of gross income.

Wow, things have really loosened up, huh?

So what kind of loan buys $160,000 of house for only $633 per month?

Through Bankrate.com, it is very easy to find Amerisave.com where answers are quickly revealed - the most important answer relating to a particularly poor choice of the word "buy" in the previous question.

Click to enlarge

There are one or two other combinations, but the obvious one here is the one circled in red above - the 3 year fixed, interest only ARM. Not really a way to "buy" a house - more like a way to rent a place while gambling that home prices will continue to go up and make you rich.

This seems to be the weapon of choice for Californians - a state where well over half of all new home loans are interest only and forty percent of all first time buyers put no money down.

Note the option ARM monthly payment quoted above - why would they not put that in the Yahoo ad? Certainly that would attract more people. That must have been an interesting meeting to attend, where someone stood up and said, "That's crossing the line - we can offer that product, but we can't use that monthly payment to attract people to our website".

So, this is the foundation for what DataQuick President Marshall Prentice calls a strong market?

With loan terms and debt to income levels like these, we should expect that "almost all, if not all, of these gains are here to stay"?

In the months ahead, in addition to the statistics that DataQuick publishes, Marshall's commentary will be greatly anticipated.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

14 comments:

this guy sounds worse than David Lereah of the National Association of Realtors

Look, if you don't like California real estate, then sell you house and move to Detroit. I hear houses in Detroit are cheap and about to get a lot cheaper.

I'll have to keep an eye out for the Wells Fargo report - I thought fifteen percent was bad, or nine percent in certain areas, but three percent?

I wonder if they'll ever change how they calculate affordability, and if so what they would use. From what I calculated for this post, in order to allow the median family income to afford the median priced home, you'd need 20 percent down, a 3 year fixed, interest-only ARM, that could take 45 percent of your gross income each month.

I guess that's how people are doing it.

This is interesting in light of the Money magazine story from yesterday. Somebody who is paying 45-60% of income for a house is showing the same type of disipline and sacrifice as the Money magazine guy, but they are paying all the money to Countrywide and then hoping the real estate market will pay them something back.

Oh, there's something else misleading. The Dataquick numbers are for closed sales, and hence reflect transactions that went under contract some time earlier...probably at least 1.5 months on average. So, October numbers, I believe, reflect houses sold in august/september...perhaps sooner. This is NEVER pointed on in news stories containing Dataquick numbers. In light of all the recent indications of high inventories and slowing sales (beginning in ~early september), I think it would be especially important to point this out. Otherwise, average joe readers might believe the DQ numbers more than their own eyes (open house signs everywhere) and ears ("Hey Joe I'm having a really hard time selling my house").

Be careful not to "buy on the dip". In the case of this overblown, off-the-scales, leveraged to the hilt real estate market, WAIT for the inevitable plunge. If you don't see investor suicides, blood in the streets, cries for some kind of federal bailout, etc. you will be buying in too early. Another good yard stick is that prices should drop BELOW 2001 levels to be considered a good buy. The rubber band will snap and it will snap hard because it is stretched to the breaking point. When it does, prices will decline with a vengeance. Investors clamoring to get out (and no bankrupty protection to help them any longer), retiress scrambling to save what they thought was going to be their nest egg, and just regular homeowners who got sucked into the "big lie" that was the real estate boom with interest-only and negative amort. mortgages will all be trying to get "their money" out and will converge to create the largest real estate fire sale in history. I expect in 2006 or 2007 to be buying properties for 30-40 cents on the dollar (2005 dollar). Don't believe it? Well, all I can say is go ahead and use that line of credit for a nice bahama vacation ... I'd love to own your home.

Has there been any research into what the average income of home-buyers is? This article looks at median house prices and median incomes, but do we really now that median-salaried people are buying median priced homes? Could it be that only the top 20% earners are buying right now, for example?

I agree with last comments. It's sounds very reasonable at least for Santa Clara county. How many home sale are made per year ? around 10000 ? How many people with google and other stock options are there ? I would bet much more than the number of homes sold per year.

Another be interesting stat I have never seen published for local areas is median net worth excluding home equity but including all equities. I'd like to see those stats among different age groups and look at historical trends with adjustments for inflation.

As everyone here in the Bay Area is aware, the high tech industry is not generating the millionares it was famous for in the 90s... I am really having a hard time understanding where the buyers are coming from, trading up okay, but new money - I just don't hear those stories anymore.

I am not surprised at all.

It takes a half brain to figure why NAR and these guys would keep spinning the stats - the longer and bigger the bubble => higher commissions and $ for them.

I can't conceive why anyone would believe in what they publish as factual data

To shoreup economy spending has to happen. The govt did that by reducing rate and letting no limit on mortgage lending.Home price wentup and people felt rich to spend on credit.

Now govt will spend more than 100B on construction effort in the hurricane hit south. This will take care the economy running for next 1 - 2 years.

Breaking the bubble is also in the best interest of the country. It will be done through

a. additional raising rates

b. it is considering abolishing capital gain

c. interest deduction up to certain amount of mortgage and

d. ceiling on Fannie & Fred.

All these actions will break housing bubble but not the economy.

DataQuick is shit!

Has been for some time. Those of us in the industry don't bother much with their "data" much anymore.

Several years back a bunch of key people left because DQ quality was going downhill so much. I had noticed they were sucking, but when I met up with some former senior mgt and got some of the story, it all made perfect sense. DataQuick, like Dick Cheney, is more and more irrelevant though the press insists on talking to them.

On other issues: how are people "affording" it? They aren't. There's a number of dynamics, but let me list a few:

1. "Liar's" loans aka stated and no-doc type of deals. A "don't ask, don't tell" type of loan. Even though a long-standing front end ratio of 28% is an accepted metric, that has long been blown out of the water. Oh sure, on paper folks look like they have only a 35% ratio but IN REALITY, because they have overstated their earnings, they are at $4 grand on their PITI or ITI (what with all the Int Only stuff going on) and only REALLY make $5 grand/mo. You tell me where these people's real ratio is at. I see it all the time...

2. Int Only and Neg Am - everyone probably already knows this song and dance since it has been getting more and more press as of late. What you may not know is that in 2007 $1 Trillion! of this adjustable paper is going to "reset". If interest rates are just 100bps (1%) higher, I have calculated that many folk's payments could jump 25-60%! BTW the 20yr avg of long term rates is in the 8% range. We may stay low for some time to come, but it doesn't have to move much to upset A LOT of people's applecarts.

Since the numbers don't really work any way you cut it, there's only one thing left that everybody is hangin their hats on - appreciation. That's right, "I'm gonna only be in this house for 3 or 4 years and then I'm gonna cash out for a HUUUUGE profit! Easy as pie! So who cares if I only pay interest?"

Slowdown cowboy - who the hell is going to be the buyer to bail you out of your already overpriced level?

Traditionally in CA RE cycles, once the affordability index breaks 17% on the downside, a correction is not far behind.

The top? Well I DO note with amusement that Time magazine has RE as their cover story in June. Funny if June 2005 (in hindsight) turns out to be the peak.

Speaking of which, all this effluence in the mainstream media about "is there a bubble or is there not". Most times the commentators approach the RE market NATIONWIDE. There is NO national bubble! But there SURE AS HELL are quite a few regional ones! The Bay Area market and, say, the Omaha market are apples and oranges and these media hacks just muddy the water when they attempt to simplify the "bubble" into one great big monolithic thing. I, for one, could give a rat's ass what's going on in Boston, Boca Raton, or even Las Vegas. My attention is focused on MY sandbox - the Bay Area. And the Bay Area is seriously overstretched.

Watch the downdrafts folks - buying into this thing is a bit like catching falling knives. Generally the downwave takes 5-7 years to bottom. Of course, Japan has basically been deflating for 15 straight years. But that may not be a fair comparison....

- da billygoat

tim's analysis is great. i love it when the frauds are exposed and those who act knowledgable & independent are shown to be imbeciles. keep it up, tim.

Post a Comment