Returning Dollars

Tuesday, November 08, 2005

An interesting question about foreign holdings of U.S. Treasuries was asked in the comments section of last week's post, Fun With the Public Debt - it deserves a little more attention. Whether any of the answers are correct is anyone's guess - surely it will become clear in the coming years, and maybe there is something to be learned by talking about it.Q. What else are the Japenese and Chinese gonna buy besides US securities?

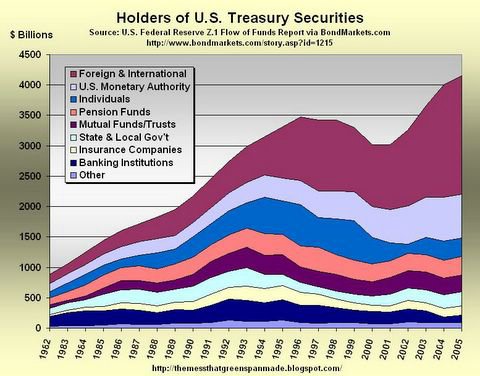

Here's the same chart that was used for last week's post showing the dramatic increase in foreign Treasury holdings for the last ten years, and in particular the last five years. A similar pattern would be apparent when looking at foreign holdings of mortgage backed securities.

A1. chubbyray said... Better investments have existed for a while. The Chinese are aggressively pursuing energy and commodities WW. Tipping point will come when that is widely perceived as the place to park money. Can't buy earthquake insurance during the earthquake.

A2. Tim said... Buying commodities and investing in natural resource companies are at the top of the list. The question of when will Asia stop taking those dollars and lending them back to us is really the question of the decade.

It should really be viewed not as "investing" the money, but as "what can they do with the dollars that would serve their interests best?" Right now, their interests are best served by keeping the U.S. budget deficit funded and continuing to loan money for U.S. housing in order to keep our economy going and their exports going.

The problem for the U.S. is that, what is in one's best interest changes over time - the U.S. has become overly dependent on borrowing money from abroad.

A3. Anonymous said... I figure China see their hoardings of dollars as a sort of weapon in reserve, which they can drop on the market when and if the US should ever seriously annoy them. The financial loss they would thus inflict upon themselves has surely already been written off.

Click to enlarge

The Current Arrangement

So, U.S. dollars used to purchase goods from Asia get recycled back into U.S. debt in the form of U.S. Treasuries and residential mortgages. This keeps bond prices up and hence long term interest rates down, which has been a major factor in sustaining the housing boom of recent years that has helped to fund much of consumer spending through home equity extraction, which has kept Asian exporters busy.

Asian fiat currencies are pegged to the dollar either implicitly or explicitly), which helps to keep import prices from rising in dollar terms (as they should in response to the huge trade deficit), and life goes on - the imbalances grow and the debt grows, manufacturing and service jobs are created in Asia, while real estate related and consumer spending related jobs are created here.

Many people believe that things can continue this way indefinitely.

With the intractable problems of federal budget deficits and both lackluster job creation and wage growth amidst rising consumer prices for everything that is not imported from Asia, both the U.S government and the U.S. consumer are highly dependent on ever more debt to continue spending at current levels.

With consumption such a large share of GDP, if there were to be a significant pull-back in consumption, growth rates would quickly plummet, perhaps causing a cascading series of contractions around the world, the worst of all scenarios.

What Happens If Dollars Stop Returning

Should dollars stop returning to the U.S. to purchase new U.S. government debt, there would be little choice other than to monetize the new debt. That is, to print money "out of thin air" in order that the government can pay its bills (see U.S. Monetary Authority in the chart above). Rapidly increasing monetization of U.S. debt, when viewed by the rest of the world, would likely cause a panic/loss of confidence in the dollar in some ways similar to the problems in Argentina in the 1990s.

Should dollars stop returning to the U.S. to purchase mortgage securities, long term interest rates (set by the bond market) would naturally rise, making housing even more unaffordable, likely causing home prices to decline precipitously, bringing to an end the housing-ATM financed American consumption that has fueled global growth in recent years.

No one has an interest in stopping dollars from returning to the U.S. as debt - not Asia, and certainly not the U.S. - but, at some point a rebalancing must occur.

It is naive to think that it won't - it's just a matter of the timing.

Two Scenarios

It seems there are two scenarios here - one that is rosy for the U.S., one that is not so rosy.

The rosy scenario is that somehow, Americans start innovating more and maybe spending a little less. It has long been said that we are the great innovators - they sweat, while we think. Unfortunately, the biggest innovations in recent years have been in mortgage finance, while what is needed is something like the 1990s technology boom to once again separate the U.S. from the rest of the world by providing high paying service jobs to justify the lifestyles to which we have become accustomed.

In this scenario, Americans will continue to benefit from the combination of inexpensive imported goods, while at the same time earning good wages for jobs that must somehow remain in the U.S. - not an easy thing to achieve, but possible. Falling behind the rest of the world in education, as discussed often by Alan Greenspan recently, does not make this task any easier.

The not-so-rosy scenario is that Asia emerges as the next economic superpower in the coming years and decades, much as the U.S. emerged as a superpower after Britain in the last century. In this scenario, surely the Asians would not accept this same arrangement when it comes to recycling U.S. dollars for debt.

Many believe that this is the nature of empires, that they rise and then slowly decline - that this will be long tortuous process for the U.S. where Asia exerts increasing clout in the rest of the world, slowly weaning itself off of its reliance on exports to the U.S., developing a robust consumer society for its manufactured goods to ensure continued demand regardless of the what happens in the U.S.

Which scenario will it be?

Who knows.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

11 comments:

As bad as it looks for the U.S., there are some big potential problems for asian economies in the pipeline: 1) an aging population that will need to be supported, driving up the cost of services and therefore taxes (or whatever the heck the chinese communists use in lieu of taxes), 2) massive corruption that inevitably puts the brakes on development, and 3) rising expectations of workers in these low-wage nations for better working conditions and higher pay. In effect, the desire to be middle class will raise the costs associated with output.

Once taxes and labor costs go up, China and its ilk don't have much to offer over the western nations. So it's not all peaches and cream over there.

ahem... may I introduce something that has not been talked about. It is the by far largest economy in the world. People call it the EU. European Union. It has an economy that is 25% larger than the US economy, buys more than the US from the rest of the world and it sells even more, meaning it has an export surplus. The growth rate of what we buy and sell has been between 6-8% per year in the last ten years.

This means that the current economic superpower is located east of the United States. And this superpower has a currency, which has and will appreciate against the dollar and gain market share as the world’s reserve currency. At some point in time, there will be a critical mass of economic actors who will switch from buying dollar-denominatedcommodities to buying euro-denominated commodities. This will bring the exchange rate close to 2 dollars per euro. And this will finally force the Chinese and Japanese to adjust their currencies upwards as well because they sell more to the EU than they sell to the US. I don’t think the effect on the US will be that big, as close to 80% of GDP is service related and obviously is immune against exchange rate movements. The gas-guzzling will be over, but the amazing thing about the US of A is the rate of change the society is capable of. All in all I think it will be the best thing that could happen.

By the way, China as an economic superpower is in my view far, far off. The Chinese economy has to grow for 30 years at the current pace (8%) per year to match the current GDP per head of the West. This assumes no growth in the West for the next 30 years.

Re: when will the dollars stop returning

I would not expect it to stop soon. Though far from ideal, the current situation is working for China. The dollars will slow and then stop when it does not. Notice that, in aggregate, their standard of living is rising while ours is falling. Note also see that their society and markets are steadily becoming freer, more open while ours is becoming less so. I've read estimates where US government spending is already ~30% of GDP. Can you say centrally planned economy?! If this trend is allowed to continue, the Chinese trade arrangement will someday we will collapse us much like what happened to the USSR. The only way out is to stop the credit expansion, stand back and allow the liquidation of malinvestment to play out. I don't see that happening.

Re: largest economies EU and US in GDP terms

If comparing to Asia bloc ex-Japan, need to adjust for local cost of living. Better to compare physical volumes, not USD or EUR volumes. Asia economies are larger than most think - see Marc Faber's stuff and Stephen Roach's stuff.

Aside: 30%-35% of the WW population had been witheld from the modern global economy for about a half century and is now being reintegrated. No use trying to fight it. There is no competing in the long run. Niches aside, supply/demand says they can do what we can do for less. To prosper, look to what they need. The Asian bloc, in per capita terms, is labor rich but resource poor. Where in the West is the opposite of that? Say, Canada and Australia? Cheers!

I wouldn't say China needs a GDP per capita greater than ours to be a superpower. A GDP greater than ours will do it, and that will be in only a few years.

Regarding the EU: Can you say "French constitutional referendum"? If that's too much of a tongue-twister, try "Berlusconi wants the Lira back."

In other words, as much as I like Europe, I would not hold my breath waiting for the Euro to "assume its proper role as a reserve currency."

Much the same thing can be said for the Japanese Yen.

So, as ugly as the Dollar looks, she's still the best looking girl on the dance floor.

It's hard not to see the parallels in the relationships between Britain and the U.S. a hundred years ago and the U.S. and China today - current empire/emerging economy, trade, and debt.

On the size of the respective economies, the GDP vs PPP debate is interesting:

"Using traditional gross domestic product, adding up all the goods and services in the economy, China is sixth in the world with a GDP of about $1.4 trillion, ranked between France and Italy. The U.S. is first at $10.9 trillion.

But if another method, called purchasing-power parity (PPP), is used, China soars to second place with a $6.4 trillion economy, ahead of Japan. There are other changes as well — India is the fourth-largest economy with the PPP method."

Wikipedia on PPP.

"However, if we look at some production figures, it becomes obvious that the US economy is nowhere near ten times as large as the Chinese economy or more than 20 times the size of India's GDP. Neither do the G7 countries have a GDP ten times larger than the emerging Asian countries. According to The Economist's World in Figures 2003 directory, China ranks as the world's largest producer of cereals, meat, fruits, vegetables, rice, zinc, tin, and cotton."

Asia the place to invest after a US financial crash

chubbyray said:

"To prosper, look to what they need. The Asian bloc, in per capita terms, is labor rich but resource poor. Where in the West is the opposite of that? Say, Canada and Australia? Cheers!"

I couldn't agree more!

Speaking of which, does anyone have any opinion on the "commodity CD" or New Zealand Dollar CD" from Everbank?

john_law_the_II: Production, or more generally creation of value, goes beyond manufacturing (of specific items). Clearly the software, and related "IP", that US companies (still?) produce has a value in terms of utility, and hence people are willing to trade other goods or their labor for it. Likewise for movies and other entertainment items that people want to enjoy. Then a good measure of business and financial services. It's not just all fluff and hot air, though some sure is.

Not to forget, research and other non-fiction publications.

Post a Comment