Kudlow, Bernanke, and the Jobs Report

Saturday, July 09, 2005

In a special Saturday edition, today we take a look at some of the discussion that took place yesterday on CNBC Sqawk Box, after the employment data was released.

As tradition dictates, Larry Kudlow gets up early and heads into the studio for an appearance on Squawk Box when the employment report is released on the first Friday of the month. In what is now a Pavlovian response to the announcement of the report's headline numbers, Larry gushes for the camera and waxes about how great it is to be an American (what he probably really means is how great it is to be a "rich" American, because surely he knows little about what it's like to support a median family on a median income).

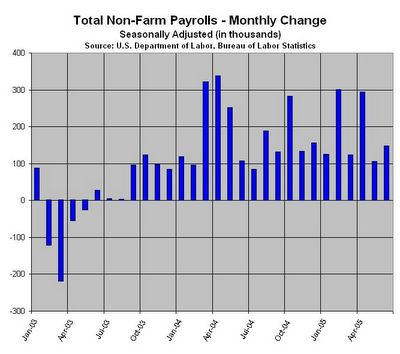

So how can this be a Pavlovian response? Doesn't the employment data vary from month to month - some months good, some months bad?

Well, since the household data and the establishment data always seem to go in opposite directions, all one has to do is pick the report that is favorable for the current month. As happened yesterday, the unemployment rate (from the household survey) always seems to go down when the non-farm payrolls number (from the establishment survey) disappoints, and vice-versa. So there's always a reason to cheer.

Let's go right to the initial reaction:Larry Kudlow: Fabulous. Fabulous. That is such a bullish report, because it shows good growth, but it doesn't show anything that is too hot, or too cold, or any of this nonsense that the market ... that's a great report with upward revisions. What a great country this is!

We like Mark Haines.

Mark Haines: Did I tell you? Did I tell you? Consensus is 200, it comes in at 146 - it's a great report!

As noted before, he's the only one who seems to do much thinking or ask interesting questions - everyone else just wants to cheer. While everyone does backslaps and high-fives, Mark Haines brings some needed sobriety to the discussion, as evidenced by this exchange with Mark Zandi, Chief Economist at Economy.com.Mark Zandi: It's a healthy report, a good solid number, 150K, right down the economy's strike zone. I think that suggests that we've got enough jobs to keep consumers spending and it's not too many jobs to cause a problem with the Federal Reserve or for bond investors. So, just a good all around number.

Wow! It probably wasn't wise to let that worldview slip, Larry, especially on national TV...

Kudlow: You go Mark! You go! You nailed it! Don't stop!

Haines: Wait, wait, wait, wait, wait. Excuse me, excuse me. I'm sorry, I'm not trying to be a wet blanket here, but I must say that I've noticed that over the course of the last six to nine months, the bar is being gradually lowered. Now all of a sudden ... 150 used to be just enough to keep pace with the growth in the labor force and therefore not a great number. Now we've transitioned into 150 is a great number.

Zandi: This is the reason. Six to twelve months ago, the job market was not at its capacity. We were worried about a job market that had a lot of slack - we needed more jobs to get that slack absorbed. But now we're at a point where we don’t' need that kind of job growth, in fact 150K is just about right.

Haines: Why not, because we haven't ... Steve just laid out the numbers ... we've been averaging about 180 - that certainly wasn’t enough to take the slack out ...

Kudlow: No. No. But some people Mark, some people believe that the break even point for job creation is down around a hundred thousand or so, like 98,000 - shifting demographics, early retirement.

Haines: I'm just a little concerned about what seems to be some revisionism going on here.

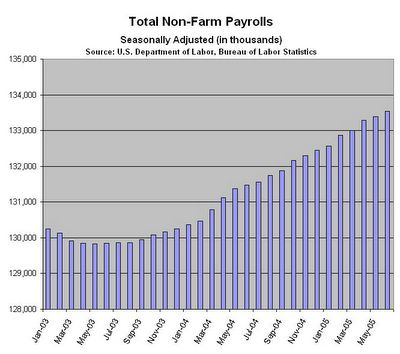

Kudlow: I just want to make a point that you’re knocking off here 150-160-170 thousand averages over a twelve-month period. This to me is the sweet spot of economic growth and we have nothing to fear, except to fear the Fed because I don't know what the heck they're looking at raising rates willy nilly. But in terms of the economy, don't you agree that a 5.0% unemployment rate is one heck of an achievement? There's 20 million unemployed in Europe, and they all want to give money to Africa instead of solving their own problems. I mean this is a heck of an achievement for this country.

About an hour later Ben Bernanke, possible future Federal Reserve Chairman and current chairman of the White House Council of Economic Advisers also appeared on the broadcast. He is first asked to comment on the employment data:Bernanke: Well, we had 146,000 net new jobs in June, we had 44,000 upward revision, so we really have 190,000 new jobs. A 181,000 average so far this year, I think we're right on track for 2 million new jobs in '05. It looks good to us.

So, let's remember this - next time there is a downward revision to the previous month's data, let's see if Ben subtracts those revisions and announces a new monthly total.

The discussion then turns to the "conundrum" of why long term interest rates remain so low, and possible explanations:Bernanke: I've talked about something called the global saving glut. I think that countries outside the United States, including a lot of emerging market economies, have a lot of savings that they are trying to find a place to put, and right now there's not enough high return options out there and it's driving real interest rates down. So, I think that's a pattern that might persist for a while.

Well, from the looks of recent treasury flow data, it appears that Asians, at least, have had enough treasuries for the time being - it now looks like they are more inclined to use this excess savings to buy things like Unocal, Maytag, and other companies with fine American brand names, but a poor bottom line.

Then to everyone's favorite subject, housing:Bernanke: Unquestionably housing prices are up quite a bit. I think it's important to note that fundamentals are also very strong. We've got a growing economy, jobs, incomes. We've got very low mortgage rates. We've got demographics supporting housing growth. We've got restricted supply in some places. So, it's certainly understandable that prices would go up some. I don't know whether prices are exactly where they should be, but I think it's fair to say that much of what's happened is supported by the strength of the economy.

With half of all new jobs being housing related, it's also fair to say that much of what's happened regarding the strength of the economy is supported by housing prices.

Somehow that doesn't sound as good as what Ben said.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)