Fundamentally Different Recoveries

Monday, January 16, 2006

Time and again it has been stated that job creation during the current economic recovery has been the worst on record - that is, the current recovery, when measured by the number of jobs created, is the weakest since World War II.

While acknowledging that the data presented to support this claim is accurate, it is now clear that there are other factors to consider when interpreting the historical jobs data.

These other factors lead to the conclusion that the "weakest ever" characterization for the current recovery is misleading, and to some degree, unimportant.

Economic expansions and contractions have fundamentally changed since the early post-war years.

The Weakest on Record

The latest example of the "weakest ever" jobs recovery argument comes from a Northern Trust Daily Commentary from earlier this month. The commentary from Asha Bangalore and Paul Kasriel is normally excellent, and generally speaking, it is difficult to find fault with any organization that produces commentary titled Greenspan's Legacy of Debt (PDF).

Importantly, Asha Bangalore was one of the first to note the unusually high number of real estate-related jobs created in recent years.

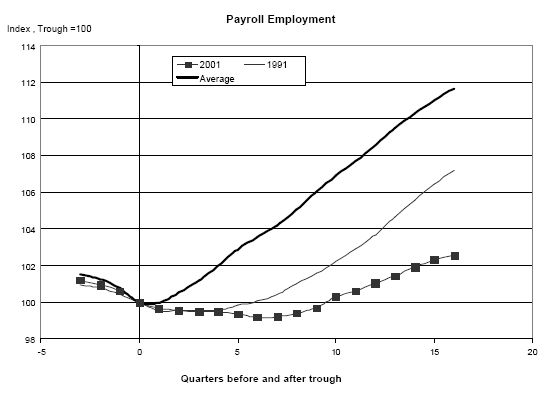

However, regarding the commentary from a week or so ago, Payroll Employment Remains Soft Even After Four Years of Economic Expansion (PDF), from which the chart below is reproduced, there is a bone to be picked.

In looking at the chart above, one could imagine that long ago there was some sort of utopian job creation machine in this country where occasional adversity was followed by years of consistent job growth and prosperity.

But, from a job creation and job loss point of view, this is far from the case.

Many years ago, the economic cycles were much closer together, job loss was much more severe, and job creation during recoveries was much more robust than in recent recessions, making comparisons to recent recoveries inherently unfair.

The more severe the recession, the stronger the recovery. We'll get to all that in a minute.

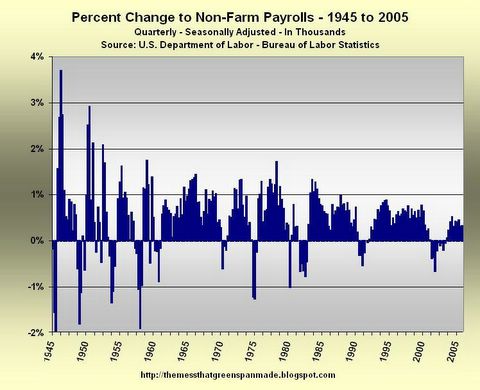

First, the chart below shows the level of non-farm payroll since 1945. Note that each of the dips in payrolls corresponds to a recession - 1945, 1949, 1954, 1958, 1961, 1970, 1975, 1980 ,1982, 1991, and 2001.

Click to enlarge

That's a lot of recessions and a lot of ebbs and flows in the labor pool over the last 60 years. Sustained economic expansions? They didn't start until the 1960s, during Johnson's "guns and butter" years, as the U.S. Dollar began the process of breaking free from its gold tether.

Economic expansions since that time have been longer, and job loss has been less severe during recessions, due, at least in part, to the ability to liberally stimulate the economy with money whose creation was less constrained than in previous times.

The change in the duration of economic cycles becomes clearer when looking at the quarterly changes to payrolls over the same period of time.

Click to enlarge

But, the above chart really doesn't give an accurate picture. In 1945, the population of the U.S. was less than half of what it is today - the gain or loss of a million jobs would have a markedly different feel if it represented over two percent of the workforce, as it would have in the 1940s, versus less than one percent of the workforce, as it would today.

To more clearly see the difference in economic cycles over time, it is best to look at non-farm payrolls as a quarterly percent change as shown in the chart below.

Now it becomes clear that the pre-1960s economic cycles were distinctly different from more recent contractions and expansions - short and severe labor force cut-backs, followed by short and robust job growth.

This cycle was repeated many times just after World War II.

The economic expansions that make up about half of the "post-war" recoveries were fundamentally different than recent recoveries, and, for that reason, it is unfair and misleading to compare today's recovery to these.

The strength of the recovery in job creation should be viewed in context with the frequency and the magnitude of the contractions in the labor market.

Click to enlarge

Yes, job growth since 2001 does look tiny in the chart above, but look what preceded it - one of the longest periods of continued job creation in history. From the chart above, it seems as if there is a damping effect - longer cycles, fewer jobs created, and fewer jobs lost.

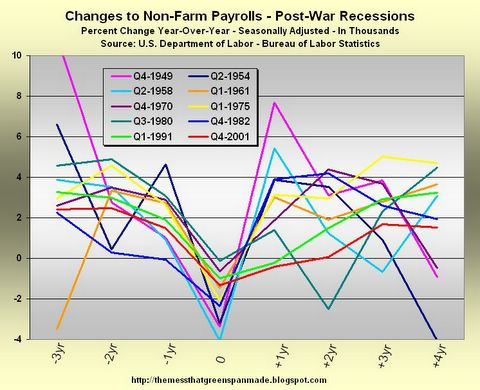

Another way to look at this is in the year-over-year changes to payrolls for the three years prior to each recession and for the four years after each recession, as shown in the chart below.

In all cases it seems, the steeper the decline, the sharper the rebound.

Imagine if today, the nation were to experience a three or four percent loss in jobs over the period of one year, as happened three times during the middle of the 20th century. With today's workforce, that would be nearly five million lost jobs.

Click to enlarge

When viewed in the context of the severity of job loss and the length of economic expansions, the quantity of jobs created in recent years does not seem nearly as bad as depicted in the first chart from Northern Trust. It has not been outstanding, but when considering other factors, it is respectable.

The quality of the jobs, on the other hand, leaves much to be desired.

For many months now, analyses offered in these pages have focused on the poor quality of the new jobs (see this search), rather than the questionable quantity - the case has been made that there are too many new Starbucks baristas and granite countertop installers, while higher paying, higher skilled employment has been lacking.

Moreover, the coffee pourers and home improvers are likely to be scarcer as the housing market begins a painful reversion to the mean, and homeowners become less apt to spend their home equity.

It's not the quantity of the new jobs that should be troubling people, it's the quality.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

7 comments:

One thing I can't stand from the supposed "pro-business" administration, is the touting of job and economic growth, but a side-stepping of the fact that more families *need* to have both parents working, and that many workers have "downgraded" the quality of work they do just to keep paying the bills. During the "roaring 90's", where the chart shows sustained job growth, I would see many parents of people I knew in highschool lose their high-wage white-collar jobs. They had four options: try to find an equivalent white-collar job (unlikely), work at the home depot, take a low-wage clerical job, or be forced into early retirement (and work at wallgreens). Companies at the time discovered that they could fire the expensive, old farts and hire unexperienced but cheap college grads.

I would love to see an analysis on this site not just the breakdown of "types" of jobs (though it's very interesting to see the burgeoning quantity of real-estate related and service jobs), but on the median income versus living expenses. Have the gains in income offset the extra "expenses" in our economy? Are cars, healthcare, and housing more expensive? What about expenses on child care because Mother cannot stay at home and must work? What about necessites that didn't exist 20 years ago (such as internet access and cell phones)? Transportation costs due to longer commutes and higher gas prices?

As always, a very interesting blog, I always love to hear more from you guys.

I have always felt that the quality, not quantity of jobs have been decreasing; you can see this in the extreme competition for some of the plumb union and administrative positions here in Canada (and by all means they are not great jobs--just high wage and relatively secure), while the McDonalds and sales clerk help wanted signs are permanently posted in the malls. And it's pretty tough for anybody to think about going into business for themselves and start up a small retail or manufacturing store--too much competition from cheap imports and bulk buyer box stores.

I think this is a deflationary effect of globalization that doesn't get mentioned enough. I'm glad I've seen others recognize it and care enough to publish some of the figures and facts behind it. Truthful recognition of and factual reporting of the problems are the first steps to fixing them.

It's probably much worse this way - many people in our faith-based country want desperately to believe that this is a strong economic recovery and that things are going to be OK. Hearing people like Larry Kudlow and John Snow tell them how swell things are makes them think that all is well, yet many know in the back of their heads that there is something deeply wrong.

They're all going to be horribly disappointed and the road back is going to be so much harder than it would have been if we'd had a real recession a few years back.

remember, if you're a rich brazillian who has gotten even richer with their ecoonomy growing and the real going up big-time, having money even in the US isn't so bad.

Should be an interesting year for job creation with housing related jobs starting to disappear. From today's WSJ:

The home-renovation boom, spurred by low mortgage rates that made home-equity loans popular and cheap, appears to be cooling off.

The latest government construction-spending data -- for November -- shows spending on home renovations was down 4.1% from the month before, and down 5.6% from November 2004.

And the latest quarterly Remodeling Activity Indicator, a measure crafted by Harvard University's Joint Center for Housing Studies to predict trends before the government releases hard numbers, suggests the pace of home-improvement spending continues to slow. "We are starting to see signs of softening in the remodeling market," said Nicolas P. Retsinas, the center's director. "Rising short-term interest rates and slowing home-price appreciation have tempered homeowner spending on home improvements."

I read about a year ago that Countrywide had set up a program to lend money to undocumented aliens. Now there's a safe bet! Lend money to someone barely getting by and who can be deported at any moment, using a loan with terms he can't understand and at the top of a real estate market! I immediately bought puts in Countrywide. ;-)

When these Brazilian illegals can no longer pay for their loans, they will disappear, go home to Brazil, change their names (and pay someone off to burn the paper trail) and live happily ever after with the assets they are purchasing with their home equity extraction.

Holy crap, why didn't I think of that. Oh, that's right, my parents didn't raise me to be a crook.

Post a Comment