Thinking Outside the Box

Monday, January 02, 2006

One of the arguments against gold as an investment is that it pays no dividends like stocks, no interest like bonds, and no rent like housing. So what? Gold and gold stocks have been far superior to any of these other investments over the last five years.

Well sure, over the last five years ... pick the right starting point and you can make up a chart that says anything you want it to. But the above statement would also be true if you looked back just one year, or two, or three, or four.

What about the five items that were chosen for the chart above? If you limited your real estate purchases to one of the bubbly markets, then you could have gains in excess of one hundred percent over this same period of time.

But then you could also pick another way to look at gold stocks. For example the Gold Bugs Index (HUI), the most common index of unhedged gold miners, is up 541% in the last five years.

The debate can be shaped into any form, but over the last five years, the answer remains the same - gold has been a terrific investment.

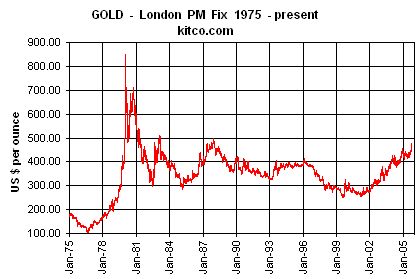

Most people who dismiss gold as an investment today would have you look at this chart:

This chart clearly shows that gold has been a horrible investment since 1980 - pretty terrific in the years just before 1980, but pretty horrible since that time.

Of course, things change.

Gold was a good investment in the 1970s because we had roaring inflation. We are told that inflation is now well under control (benign, they say, or better yet, "close to zero"), and that gold's historical role as a hedge against inflation is no longer applicable.

As more people look at home prices, medical expenses, and energy costs, more people doubt this line of reasoning and the price of gold continues to rise.

Listening to the advice you get from professionally trained investment advisors and personal finance magazines, you'd think that things never change - that you should plan the rest of your investment life based on the last bull market in stocks and bonds.

You are advised to "fill in the boxes" with your mutual fund choices so that your 65 percent allocation of U.S. equities is "diversified".

In recent years newer funds have been added to allow you to invest in international stocks - put ten or fifteen percent of your assets there, and go with bonds and cash for the rest.

Most retirement plans are severely limited in their investment choices, and most plans offer few choices outside of what investment firms would prefer that you invest in.

Stocks, held in their mutual funds, that they will pick for you.

Maybe it's time to start thinking outside the box - buy some gold this year.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

23 comments:

I think the main value of gold and gold stocks, as with REITs, is that the asset class is not correlated to other asset classes. So, on that basis, rather than on the basis of prjected futire return, I would say exposure to gold and gold stocks is appropriate.

I think most "professional" financial planners would make the same argument.

And, Happy New Year, Tim.

I do not buy gold as an investment but as a security from the tyranny of the paper investment and currency.

I will never buy gold paper.

(I will never buy gold paper.)

even if this happens again?

The 21st Century Gold Rush

How High Can Gold and Silver Stocks Go?

Higher Than You Might Think!!

by Edward Gofsky

December 9, 2003

Lion Mines – 1975 price $.07 / 1980 price $380

YES, that’s right. It’s not a misprint. You could have bought 1000 shares of Lion Mines in 1975 for around $50 dollars at 7 cents per share and held on for 5 years riding the wild gold and silver bull until 1980 where you then sold those same shares for $380 each for a total profit of around $380,000. Not bad hey!!!!! This is only one of many more examples:

Bankeno – 1975 price $1.25 / 1980 price $430

Wharf Resources – 1975 price $.40 / 1980 price $560

Steep Rock – 1975 price $.93 / 1980 price $440

Mineral Resources – 1975 price $.60 / 1980 price $415

Azure Resources – 1975 price $.05 / 1980 price $109

Investments pay dividends. A good speculation, yes, a good investment, no. Just know when to sell.

(What if I buy now, it goes up to $600, and then crashes back to $100 and stays there for another 25 years. That could happen, right?)

no, not going to happen. stocks and commodities trade places about every 17 years. your argument to not invest in gold stocks or gold could have easily been made to not invest in stocks in the early 80s. after all, stocks were down 70% adjusted for inflation from their highs in the late 60s.

gold stocks do pay dividends. why do people care so much about dividends? it doesn't matter in it of itself what a stocks dividend payment is. why would you want to own regular stocks because they pay dividends instead of gold stocks that were going to go up? who in their right mind, if they could go back, wouldn't buy gold stocks and take the 250% gain?

Gold and silver haven't gone up as fast as they've been printing money, pure and simple. They are printing it now both in paper and electronic form. If the money they create is supposed to hold value, why do they keep creating more of it? M3 is up by 14% this year. We didn't produce 14% more goods to sell. Its a global society based on ever increasing debt. Gold and silver are the place to put the money if you think that at some point the debt bubble is close to the bursting point. They represent the only store of value that is universally accepted and can't just be printed at will.

So why does it surprise you that Gold and Silver are going up?

Some of the first rate gold companies DO pay dividends and make excellent investments. Look at Goldcorp (G.T or GG.NY). Pays around 1% and should earn over 1USD per share in 06.

The whole system is in a rolling hyperinflation. One asset class after another asset class hyperinflates, then deflates. Gold and gold stocks are experiencing it now. Enjoy the ride.

Where are gold and silver, paper

and physical going? Inflation

adjusted, I couldnt imagine ...

Want wealth and protection?

Nuff said...if you dont get it now,

you dont belong with the smart

ones.

Gold and Silver are not an investment per se, rather an instrument of savings. You wish to invest . . . think stocks, bonds and other such securities.

There's a lot of refined definitions here that are above me. How about keeping this simple? Whether profits are paid in checks, or at sale, we should buy what goes UP and sell/avoid what stays flat or goes DOWN. I could care less what that is, or what it's classified as.

Because also for the last 400 years paper assets have alternated with commodities on a fairly regular 20 year cycle,

AND as paper assets have gone nowhere in 5 years,

AND most of the mythical 11% on index funds was monetary inflation

AND as if you choose wrong you will not have enough time in your lifetime to recover your stock losses (it took from 1968 to 1987 to recover last time--inflation-adjusted, perhaps even to 1994)

Maybe we should take a lesson from history and buy what is in the 20 year uptrend and make money now rather than 20 years from now, when I'm dead, regardless of what that asset is, or what form the profits are realized in.

Paper assets are extrordinarily risky in any country that prints money at 14% annual. Then you must make over 14% return to BREAK EVEN. Don't be fooled by what was formerly a fair return. Inflation measured by Pre-Clinton methods is over 6% and unemployment is near 12%--probably much closer to what any of us see around us. Even your vaunted 10% of the 1990's, once taxed, is a breakeven proposition now. What good will that million-dollar IRA do you in 2020 when a million will buy you a cup of coffee then?

This may sound far-out, but fiat currencies, even countries, have currency crises about every 100 years, giving a mere 1:100 chance of paper flight happening on your watch. That's far more than the odds of your house burning and you buy substantial insurance to cover that. Think about it.

Non-Anon

To understand why and when gold and silver become good 'investments', one needs to understand what is money and how the banking system manipulates it. After some research and reflection the answer will be obvious.

Chubbyray,

Congrats--you've hit the nail on the head!!

It's all about MONEY folks, and if you don't know what it is, do yourself a big favor ASAP in '06 and find out. You'll be more knowlegeable than 99.5% of people WORLDWIDE, able to teach your children, as well as preserve what you have worked hard for.

A book I highly recommend is, what else, "MONEY...." by James Ewart (google search PRINCIPIA PUBLISHING and you'll get the details. If you're short of cash, go to your local public library and request and inter library loan of the book free of charge.)

Believe it or not, the rich know what money is and the likes of "Rich Dad Poor Dad" author Robert Kiyosaki, and Warren Buffet are invested in metal(s) too--along with many other rich folks I'm sure.

MONEY--not paper--PRESERVES PURCHASING POWER. This is the SECRET of the rich, and you can be one of them if you want to.

Gold is not only a store of value but over the long run will appreciate at the growth rate of productivity, ~1-2%. This is what makes a gold standard deflationary. If that return excites you, then buy and hold to your heart's content.

In response to lord,

You're still thinking of gold/silver as an investment anchored to a return. The rich don't think of it this way. They don't pay attention exclusively to price but whether or not they can retain their purchasing power and provide balance/stability to their portfolio by holding it. It's much more limited in supply than U.S. currency and thus more capable of holding it's value over time.

I will quote the Maestro himself (Greenspan), who said the following on Dec. 19, '02:

"Although the gold standard could hardly be portrayed as having produced a period of price tranquility, it was the case that the price level in 1929 was not much different, on net, from that of 1800. But in the two decades following the abandonment of the gold standard in 1933, the Consumer Price Index in the United States was doubled. And, in the four decades after that, prices quadrupled. Monetary policy, unleashed from the constraint of domestic gold convertibility, had allowed a persistent over-issuance of money".

http://www.kitco.com/ind/Appel/dec232002.html

That's 120 + years of little or no inflation vs. almost 100 years of inflation--"over issuance" of currency or devaluation of the currency by about 90% (Just look at the dollar chart from 1913 to 2006 and tell me if you don't see a long term downtrend)

Gold vs. fiat paper currency. Stability and peace or poverty and desparation. You choose.

sorry for the dumb question but where does one actually buy gold? a bank? I know there's these online dealers who hold it for you but that sounds kinda fishy. I've got some cash sitting in a savings account that needs to be put to work.

oh and I mean bullion, not coins. isn't there a premium on coins?

I also hold some Goldcorp paper, but not much. it seemed to do well today :)

Try APMEX for bullion or coins. Spread and service are reasonably good. Think about silver too, if you're willing to hold physical. It is likely to outperform gold 2X but with volatility to match.

Lord said...

Gold is not only a store of value but over the long run will appreciate at the growth rate of productivity, ~1-2%. This is what makes a gold standard deflationary. If that return excites you, then buy and hold to your heart's content.

In a hard currency system, 1%-2% return with near zero risk is all you need since the currency does not lose any value. In our present system, the 5%-7% long-term average 'appreciation' rate of the stock averages and real estate is nothing more than the long-term devaluation of the currency. However, this is accomplished only with some significant investment risk. Most people do not manage to achieve the average.

Come on people open your eyes and see what is happening to our economy! I am 42 years old and remember back in the late 70s when my mother asked us to collect all our gold chains in which she took them to the jeweler to sell and made a fortune. I am not missing out on this opportunity of a life time to buy gold and gold stocks. Don't believe all that you hear on tv as back in the 1930s all was great the day before the crash happened. Buy GOLD!!!

Actually gold should return the growth rate of the economy over the long term, ~3.5%, better than bonds currently. The difficulty is changes in preferences as gold is preferred in times of war and panic to times of peace and plenty and these can changes can overwhelm fundamentals. Other real assets like real estate behave similarly, so do you also consider them good buys now?

Interesting question. I think the answer here is that money printing (i.e. central planning) distorts price signals that the market ultimately always corrects. This motivates investors to continually shift their investments to the undervalued asset classes. We are in the undervalued corrective phase for energy, commodities and hard currency. We are beginning the overvalued corrective phase for real estate and bonds. Gold has underperformed its long-term trend for 20 years and began the process of reversion to mean 3 years ago. This makes it one of the 'investments' to hold until the correction is complete.

Seeing gold staying steady for 20 years makes me intuitively think at some point it should bump up to catach inflation.

A lot of stocks pay little or no dividends and rents in many places are well below what you could get in interest so yearly returns are not what drives a lot of investment.

Hope of appreciaton is.

"You probably have a good 40 years to get your investment decisons correct. "

What investment decisions? The point was to invest in index funds, where there are no decisions (apart from picking the lowest-load fund). You're not picking stocks.

Post a Comment