The Big Picture

Tuesday, January 03, 2006

Having not cleared this with the subject before going to print, it is not known whether Barry Ritholtz over at The Big Picture will take this as a compliment or not, but if someone called me the "Ron Paul of Wall Street", that would be received as most welcome praise.

The precise reason why this compliment is offered can be found at the end of this post.

[If you are a new reader and are already completely lost, now might be a good time to try out the Google Blog Search box at the top of the page - type in "Barry Ritholtz" or "Ron Paul", then select SEARCH THIS BLOG for a quick and convenient list of previous posts referencing these gentlemen.]

Anyway, a couple of items have come up recently relating to Barry and his blog that it seemed natural to make them the subject of today's post.

Regular readers may recall that a few months back The Big Picture featured a story about core inflation and homeownership costs from this humble blog, and it caused a bit of a stir.

Barry's blog is one of the finest business blogs around and gets more than ten times the traffic as we are accustomed to here, so it's always a thrill to be heard by a wider, but surely no less intelligent audience.

Here are the posts:

Homeownership Costs and Core Inflation

Back Out Housing Adjustments, and Core CPI = 5.3%

Why bring up this subject again?

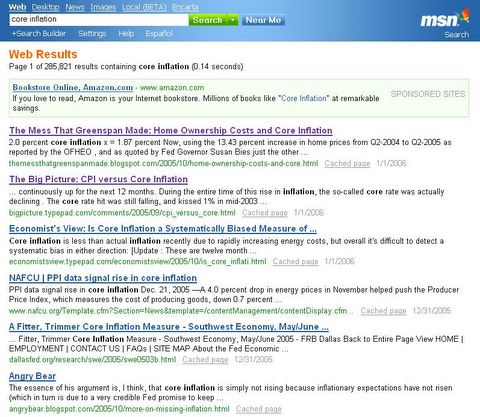

It all has to do with the oddity that is MSN Search. Absent from Google or Yahoo! search engines for this same subject, it is once again discovered that somehow a renegade blogger has made it to the top of the list when computers in Redmond, Washington are asked to supply results for a query on "core inflation".

As these results change slightly over time, a screenshot is provided below, lest this be doubted by readers:

Click to Enlarge

It is not clear what is going on at MSN Search, but it sure is fun to watch.

Since today's post is already scattered, disjoint, and only held together by a semblance of a theme, a brief divergence to a Stirling Newberry commentary at Daily KOS on the subject of inflation is reproduced here, as it has stuck with us for several months now.

This is excerpted from a follow up piece posted here about a week or so after the original core inflation story:The next day, amongst a handful of other places, a link showed up at The Blogging of the President where Stirling Newberry first introduces many of us to the term "Friedman-Mundell economy", which then became the focus of a compelling story the following day at Daily KOS entitled Revolt of the Economists.

Continuing along the long circuitous route which will eventually provide an answer to the question, "What does Barry Ritholtz have to do with Ron Paul", we come to the second item of note regarding The Big Picture.

"The architecture of economics that they have built is centered around a simple idea: allow asset inflation, and then keep the people who roll the money over very, very, very happy. The problems of "rational expectations" economics could simply be called "the rich rent the world to the rest of us".

The rise of a new economics is at hand - one which overthrows "rational expectations" and the Friedman-Mundell economy. The first shots of that rebellion have been fired - over inflation and unemployment. And not strangely, the libertarians are selling the ammo."

This is well worth reading in its entirety

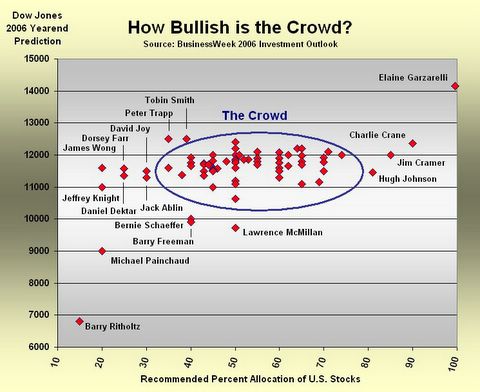

A week or so ago, Barry posted this piece about his participation in a BusinessWeek story which contained 2006 market predictions by 75 Wall Street strategists and analysts. The chart below, with the familiar TMTGM color scheme, was generated at Barry's request, and posted at The Big Picture.

Click to Enlarge

This chart is interesting for a number of reasons, the most significant of which are the grouping of the crowd and the outliers - the herding instinct and the bold prognosticators. An interesting data set to be sure.

(Barry has likely been prodded by more than one reader to take Elaine out to lunch in an attempt to resolve their differences - to meet half way and become ordinary.)

But this chart is not the whole story when it comes to the 2006 market outlook from Barry Ritholtz, Chief Investment Strategist at The Maxim Group. The rest of the story can be only be found in the details, and seems to have been overlooked by commenters when the story was posted at The Big Picture.

At the lower right of the table containing the detailed data from BusinessWeek is found this interesting data point circled in red. Barry being the most bearish of the lot is listed last, and this is his row. The column heading with the circle is "Favorite Stock".

Yes, that's right - finally an answer to the question of why Barry Ritholtz is the "Ron Paul of Wall Street".

Like Ron Paul, Barry likes gold. And, for 2006, GLD is his "Favorite Stock".

Like Representative Ron Paul of Texas and his eternal quest for sound money, who has peppered soon to be former Fed Chairman Alan Greenspan with questions about which most of his colleagues haven't got a clue, Barry's gold recommendation may make little sense to many of his peers.

Despite a five year commodity boom and the recent attention gold has received around the globe, he is the only one of 75 Wall Street strategists who see what is perhaps the greatest investment opportunity today.

Nice work Barry!

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

2 comments:

I first wrote about Gold in December 2002 -- not pounding the table, but noting that the metal, as well as US equities, would do well thanks to the Fed "Reflation."

The GLD rec was made on PowerLunch back on March 2005 -- around $41

that was a long row to hoe, but I get the picture - the theme this week is gold - and by the looks of the new york close today (+$13), a well-timed theme - it looks like everyone talked each other into buying GLD over the holidays

Post a Comment