Debt Takes No Holiday

Tuesday, February 07, 2006

Grinding debt payments seem to be taking their toll on the good citizens of the United Kingdom. In 2005, bankruptcies shot up 45 percent from the previous year to a new record of nearly 68,000, and analysts have already predicted that the total for 2006 could exceed 100,000.

These are bubble-like growth rates.

The number of foreclosures for the year topped 10,000, an increase of 70 percent from 2004, and household debt exceeded $2 trillion. While accounting for fewer than 15 percent of the total European Union population, the British account for two-thirds of EU credit card debt.

The British are very much like we Americans.

They are one of only a handful of nations with both a trade deficit and a budget deficit, and while avoiding the disgrace of a negative number like the U.S., their savings rate has recently been in the low single digits.

Observers have often stated that the U.K. housing market is nine months to a year ahead of the U.S. housing market. If this is true, it appears that the timing of last October's new bankruptcy rules here in the States was near perfect.

The Left Coast

Out here in California, foreclosure notices are beginning to rise briskly. Nearly 15,000 default notices were sent to California homeowners in the fourth quarter of 2005, up 20 percent from the previous quarter and up 15 percent year-over-year. These rates are still very low by historical measures. A decade ago, at the bottom of the last real estate cycle, a record 60,000 notices were mailed during a single three-month period in 1996.

These rates are still very low by historical measures. A decade ago, at the bottom of the last real estate cycle, a record 60,000 notices were mailed during a single three-month period in 1996.

Throughout the 1990s, the number of notices averaged over 100,000 per year, almost double the annualized rate from the last quarter of 2005.

With home equity typically in the hundreds of thousands of dollars after the last five years of soaring housing prices, and with willing lenders eager to do business, it's a wonder how 15,000 households fell behind on their payments last quarter.

Maybe they were too busy out spending their home equity to remember to send in their mortgage payment.

There are noticeable signs of distress however. If you're interested in just how much distress is already working its way through the system, you might consider a free one-week trial offered by foreclosure.com. You can take a look at your neighborhood, or any neighborhood for that matter, and see how the homeowners in your area are faring.

It is probably way too early to think about buying distressed property, but this exercise does give a good indication of how people have managed their finances in recent years.

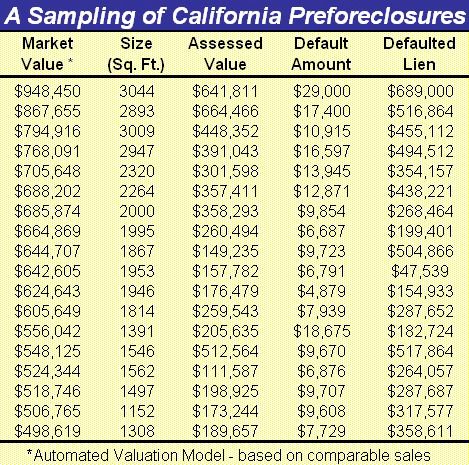

Here's a chart listing some of the preforeclosed properties in our area (this information has gone a long way in helping me explain to my sometimes skeptical wife how so many people around us appear to be so wealthy).

The term preforeclosure refers to the period of time beginning with a lender notifying a borrower that their loan payments are behind, also known as a default notice. Most people (like two of our neighbors) probably don't realize it, but when this happens, certain key information about their finances becomes public knowledge.

Oops!

Given the way that Proposition 13 works in California, much can be learned from the chart above. As in most areas, the assessed value is initially determined by the sale price of the home. Proposition 13 then restricts the rise in assessed value for homeowners who stay put.

So, for example, the last preforeclosure listed, where the market value is over two and a half times the assessed value, indicates that the owner has been there for quite a while and originally paid very little compared to the current market value of the property.

In this case, a reasonable guess would be that the home was purchased twenty years ago for a price somewhere in the low $100,000 range.

This owner has parlayed that original investment into a total outstanding debt of over three times the original loan amount, but is now having difficulty making payments.

What a country!

The outstanding debt is still well below the market value, so there is still an "equity cushion", as Alan Greenspan used to refer to it, however, the cushion appears too inflexible, in this case, to avoid falling behind on the debt repayment schedule which was previously arranged.

While the $10 per week fee charged by foreclosure.com is a bit steep, for housing bubble watchers it may be money well spent.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

13 comments:

Given California's Prop 13 law, it would seem to be to the State's benefit to churn the real-estate market as much as possible in order to get those long-term homeowners out of their houses and start collecting property taxes based on realistic values.

No membership needed. A little clicking around on the site and some cross-referencing with the county appraiser's site, and I now know the names and addresses of everyone in my neighborhood who is in preforeclosure. I would imagine that the vultures have already descended on these people.

anonymous: The problem is, you cannot squeeze blood from a turnip. Either the money/credit to purchase the churned homes (at the new property tax setting) is there, or home prices will adjust to be in line with the aggregate money/credit stock. The state will not necessarily make out positive. E.g. what it gets in additional property tax it may lose in sales & business taxes. OTOH property value may adjust to higher aggregate levels than their Prop 13 "fixed" value, if recently assessed homes won't assess much lower. But I see no indication that churn will mostly affect older home owners who benefit fro Prop 13.

Are vultures buying now? At these elevated prices? Wouldn't the vultures be more inclined to at least wait until summer to see what happens?

Here's a story on this topic out of Sacramento. Do you think the Suposs' kindly relative will regret their intervention?

Default notices are on the rise

It took less than eight months for Dustin Suposs' "American Dream" to become a nightmare.

He and his girlfriend, both in their early 20s, got caught up in the better-buy-now mentality that fueled the Sacramento area's housing market last spring. They bought a $365,000, 1,550-square-foot home in Elk Grove with no money down. The result: A $2,300-a-month payment that was more than 2 1/2 times the rent they were paying.

By December the couple were drowning in bills and debt. Now they're two months behind on the mortgage.

Experts say the pair are part of a new trend - a growing wave of distressed borrowers just beginning to hit Sacramento and across California.

...

"We're seeing the early indicators that it's only getting worse," said Pam Canada, executive director of the nonprofit Neighborworks Homeownership Center in Oak Park, which educates would-be homebuyers and helps existing owners stay out of foreclosure.

"We're creeping into the dozens of calls per month (from owners behind on their payments), and that's higher than a year ago, when it would have been half a dozen a month."

Calls from homeowners in financial distress "are rising rapidly," said Jennifer Harris, executive director of Sacramento's Home Loan Counseling Center.

...

For now, Suposs and his girlfriend look to have escaped their immediate financial trouble. A relative has agreed to buy their home before they lose it to the lender.

"There were a lot of nights of restless sleeping because they can come get the house," Suposs said.

Get out of debt. Stay out of debt. Stop spending. Save your money. The number of homes that become in default will skyrocket. Governments will go broke. They cannot tax and spend forever. It can end and it will end. Mutual funds invested in municipal funds will tank. You will be able to buy at a fraction of the cost. Times could get desperate. There are no guarantees in this world. That includes economies.

I am not a fan of gold. Valuables, buy valuables.

Buy valuables? If everything is so desperate, the price of valubles will be crashing along with everything else.

Anonymous #1, why not gold? What other "valuable" will hold its value through a serious deflation, currency devaluation, hyperinflation or even a default on Federal Government debt?

Gold and silver coins from the days of the Roman civilization are still worth their weight in precious metal today. I don't know of *any* other asset - including land and housing anywhere on the planet - that's likely to hold through a serious financial dislocation, such as what we're clearly headed for.

I believe the reason is: precious metals are "universal" money. They have the same instant recognition and perceived value whether I'm in Manhattan or a peasant's hut in Mongolia. And it's relatively easy to carry the asset from the one place to the other.

In short, for wealth preservation and transfer across time and across national boundaries - what else *is* there?

My Grandfather had a five dollar gold coin. He was scared to death that the Roosevelt Administration was going to find him out. That speaks volumes. Gold will do you no good if it gets confiscated. Don't buy it through mail order and have it sent to your house. Valuables such as collectible watches, gold jewelry with gems are what I seek, and it is out there. Other collectibles that you should buy are guns. Buy collectibles at rummage sales, if you spot a deal, it will help you immeasurably. If you want to buy gold, buy it at coin shops, but be wary that it might be confiscated.

Buy silver. At nine dollars, it is a bargain.

Go to Kitco and look at the 40 year charts before you get too excited. Silver and gold are hard money but their industrial aplications are fading with the loss of old process photography etc. Collectables and valuables can go in the toilet too as supply and avalibility outpaces demand as everyone scurrys for cash in a recession. eBay makes this flood possible.

Your cash is more or less worthless. You have to spend it all on bills, taxes, insurances, and gas to get around. There will never be enough of it. You will never be able to save enough of it. Energy stocks, coal stocks. buy and hold.

They will have to pry this property out of my cold dying hands. If left to a family member, they can't even reassess then. Doing my best to stamp out property taxes.

guns would be the anwser. that will always be valuable.

could this be why iran is building an nuke?

Post a Comment