It's Just a Flesh Wound!

Wednesday, February 08, 2006

Like the beginning of the sword fight between The Black Night and King Arthur in the classic movie Monty Python and the Holy Grail, commodity bulls were dealt a vicious, but not life-threatening, blow yesterday.

It's about time!

Soaring prices for metals, fuel, and other goods along with hyperbolic increases for many of the associated equities have been quite the distraction lately. Secure in the underlying fundamentals, long time owners of the stuff have learned to just look away for short periods of time as prices have occasionally fallen sharply since the bull market began six years ago.

Secure in the underlying fundamentals, long time owners of the stuff have learned to just look away for short periods of time as prices have occasionally fallen sharply since the bull market began six years ago.

But, the urge to pay close attention as prices rise sharply is nearly irresistible.

For many, this has left little time for much else in recent weeks.

So, given that this may go on for a little while, possibly through a good portion of March, there will now be time for other endeavors.

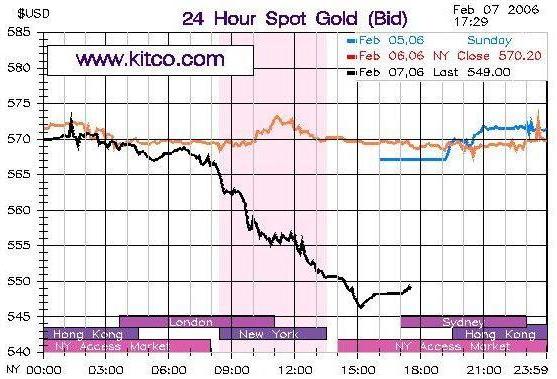

But before leaving this topic, let's take a look at what happened yesterday in the hottest parts of the commodity markets - it was a real bloodbath.

Losing Luster

Gold went down nearly $20 per ounce - from $570 to $550. Don't be surprised if it goes down further, possibly a lot further. On the other hand, don't be surprised if it goes right back up.

This time it's different. Throw out all your Fibonacci retracement levels, McClellan oscillators, and other technical analysis mumbo-jumbo because there is an entire world that is in the process of discovering gold.

Well, some would say, "It's never different". Exactly. What's going on right now isn't really different at all. This re-discovery of hard money has happened over and over the same way many times throughout history. This time, in fact it is exactly the same as it's always been - good money forces out bad.

Anyway, here's yesterday's gold chart.

Yesterday, Alan Greenspan attributed the recent rise in the gold price to terrorism, rather than inflation or some other factor. In retirement, as during his long tenure at head of the Federal Reserve, telling people what they want to hear or, speaking freely in indecipherable language, seems to serve him well.

He took home $120,000 for the one hour speech originating in New York and broadcast via hologram to Tokyo - it is left to the imagination whether it was a floating head or a slumped full-figure.

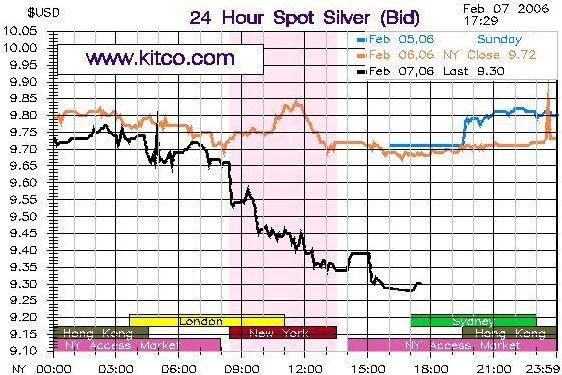

Hi-Yo Silver

Silver looked about the same as gold. So much for effects of the last week's Cheuvreux gold-rigging report out of France and forward buying for the upcoming silver ETF. The price of the "poor man's gold" went down good and hard and there may be more to come.

Recent first-time buyers are probably wondering what hit them.

It seems to be the classic "shaking out" of the weak hands - after you've been through cycles like this a few times, you learn to resist the temptation to compete against the much bigger and more powerful forces at work and just enjoy the ride, occasionally averting your gaze on days like yesterday.

Hopefully, the frequency and duration of the periods when it's best to "look away" will decrease over time, or loftier prices will make pull-backs easier and easier to take. Since last summer when the bloom came off many of the things that the world had been so optimistic about, there have been fewer and milder corrections.

What happens after the sell-off that started yesterday will go a long way in setting the stage for the rest of the year and beyond. Were the last six months an aberation or a sign of things to come? The smart money is on the latter.

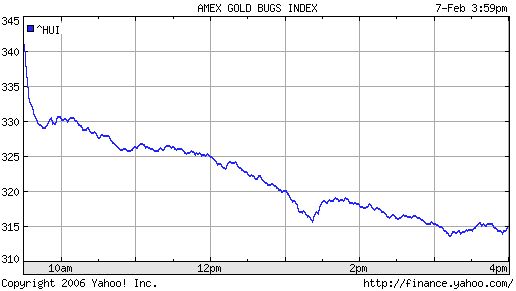

Gold Bugs

The gold bugs index was smacked down hard. From the nosebleed territory north of 340, down nearly eight percent in a single session, this is going to make some recent first-time Newmont buyers a little mad.

But, they'll get over it.

After peaking in the fall of 2003 at almost 260, it took the HUI nearly two years to get back to that level, but once it did, it didn't look back. It would be hard to believe that the recent highs will hold for a similar period of time, given all that is happening in the world's economies today.

Those that are patient and understand the fundamental forces at work will be rewarded - the only hard part is the timing.

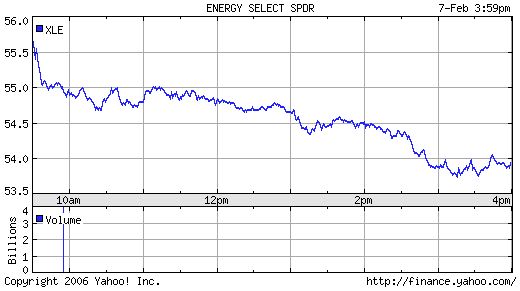

The Oil Slick

Yesterday, oil stocks paid the price for some recent irrational exuberance and oil was beaten back down toward $60. Somehow it doesn't seem like oil is going to go quietly back into the fifties this year and the odds of sub-$50 oil seem more and more remote as each week goes by.

One commentator was recently heard to say, "Oil is only $65 today". That says a lot about expectations. A mild winter and gas prices under $3 should make $65 oil a lot less painful to the average consumer, although there is growing speculation about the recent relationship between oil prices and gasoline prices.

With all the problems in Iran, Nigeria, Russia, Venezuela, ant the Middle East and then another hurricane season for the Gulf Coast - whatever price relief there is should be short-lived.

While yesterday's price action for commodities across the board may be disconcerting to many, it is not likely that today's commodity bulls will suffer the same fate as the Black Knight.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

15 comments:

Tarzan buy now.

As I recall, there was a Wizard Tim in that movie. Are you he?

If you accept the view put out by Jim Rogers (amybe others too, but I didn't see their books), the commodity bull market will last well past 2010. Though he points out that there will be some serious volatility in prices even as the asset class moves upwards overall.

One thing that bothers me: if I want to buy a large stake in a commodity index fund, doesn't that mean it's headed for a fall? The way these things work out for me, the end of a bull market usually comes a month or two after I finally notice its existence.

ii,

1. Never chase strength

2. Dollar cost accumulate on weakness

3. Know why you are buying because your convictions will be challenged every time it dumps

I'd don't know very much, young and new to the world. But, I would buy during the declines in price. Buy when it looks like its gona tank! There is only so much gold and oil. There's no counterfit oil or gold. Fire up the presses lets make more dollars. Is gold worth more or is our dollar worth less?

This is the weirdest price action I've ever seen for gold - brutal sell-off yesterday, hung tough during New York trading today, now, as I write this, up $8 in Asia.

There is something very different happening in the gold market these days.

http://www.globalresearch.ca/index.php?context=viewArticle&code=PET20060120&articleId=1758

http://orlingrabbe.com/mission.htm

I finally hopped into gold 1 day before the 8% selloff =)

I'm not worried though---long-term thesis is still the same. May, therefore, buy more.

Tarzan say last correction $8.50 -$5.50 silver, $430 - $370 gold brutal. Now, not brutal. Tarzan buy more when correction more brutal.

GFMS Ltd., a London-based consultant to the industry, last week cut its forecast for demand from jewelers in the first half of this year, saying sales will plunge by 25 percent to levels last seen in the early 1990s. The precious metal may drop to $490 an ounce as a result, GFMS said. Prices on Jan. 20 reached $568.10 an ounce in London, the highest since 1981.

Bloomberg news. January 23, 2006.

http://www.dailyfutures.com/metals/

I see gold is doing pretty good today.

If you weren't around when it hit 800 bucks an ounce in the early eighties, you can witness another go around this time. I paid eight dollars per ounce for silver in 1981, if finally arrived back to where it was 25 years later. I sold a few ounces some time later for fourteen dollars. Back in the days when some were predicting silver to hit 500 dollars and ounce, it was a fever for speculators; however, it didn't work out like they had hoped. Plenty of silver coin out there. Check out ebay. I have just kept accumulating ever since.

In the long run, stocks do far better than metals. Ford is eight dollars and change. A far better buy than silver. I don't own Ford, I've driven them and don't want another one.

GM is 22-23 dollars. It was 91 dollars. I might buy soon, I don't own any. Energy stocks. People want cars over and above gold.

If you're a gold bug, that's fine.

Oil is down to 61 dollars and change. It is going to keep going to dip. The money just isn't there to support that price. I know it is a somewhat hapless analysis, and maybe all bunkum and bosh. However, the consumer is getting tapped out. They hate chasing good, hard-earned money after what is now schlock. It's crazy. They're becoming weary. They aren't liking it one bit. It's getting to them. It will be an inadvertent boycott. Nobody intended it to be that way, but might be what it is becoming. No demand, a building supply is a recipe for some chaos and havoc. Call it economic 'shock and awe.'

Still holding the gold positions I put on last year. I would expect us to visit 540 at a minimum, 520 more likely.

The weakness Friday surprised me given what the bullish current account deficit numbers.

Has anyone seen that alleged report that took us down on Wednesday, which supposedly posits a downside in emerging market demand for commodities? The timing kind of reminds me of last May, when that rumor about a Chinese state bank collapse made a beautiful buyable bottom for us.

I regret the 8 sticks I've left on the table in my NEM, but comfort myself with the knowledge that there's been a strong seasonality in gold for the last 3 years. Each of the last 3 years, it has corrected sharply in the first half of the year. Example - look at the XAU:

http://bigcharts.marketwatch.com/intchart/frames/frames.asp?symb=%24XAU&time=&freq=

I would only expect the latecomers and weak hands to exacerbate this effect.

From reading about the performance of Canadian juniors during 1980, during the correction, I plan to put together a basket of junior producers with reserves in hospitable places.

I took profits in N and PCU, regrettably sold RIG. Still holding CNQ, believing the SEC will change the definition of reserves to include oil sands. Also still holding BHP from 27, house of pain this week, though.

From my reading of the weekly EIA reports, I think oil should be $10 below where it is now and NG in the $6s. It's plain we aren't going to have the winter many natural gas bulls thought we would. Part of the oil price is Iran, another part, I think, is lots of hedge fund firepower trying to run ahead of the normal seasonal cycles.

I would expect these to come back some into the spring, barring some exogenous event like the Iranian nonsense. You could pick up some high-quality stuff at last year's prices. This fall, I think people will literally flip out when the first storm comes into the gulf.

A bullish scenario for NG could be, this warm winter is followed by a hot summer, heavy hurricane season then cold winter. You could see $20 NG in that case, I think.

So what I am doing into the spring, just for a trade, is long those industries that use NG as a feedstock. Cement and chemicals (particularly ag chemicals) should be on the opposite side of that see-saw. Been long LR for a bit, more recently AGU and DOW.

Then as we move into the spring, I want to swap back into the petroleum complex.

On the history of GOLD as an asset class (GLD ETF):

http://www.agileinvesting.com/html/Gold%20ETF.pdf

======

1. Gold experienced a phenomenal bull market in the 1970s as the yellow metal rose from a price of $35 an ounce in 1971 to $700 an ounce in 1980, producing an annualized return of 38% over this period.

2. From 1980 through 2000, gold

produced an annual return of –4.4%. This long period of poor performance steadily eroded support for gold as a viable asset class (even though gold’s annualized return over the entire period of 1971 to the

present is a respectable 7.4%, versus 11.3% for the S&P 500 and 8.3% for intermediate-term

government bonds).

======

This is more like a recent history of USD as an asset class. For gold, you'd need to go back a lot further.

Post a Comment