Friday Lite

Friday, February 10, 2006

Another weekend draws nearer. As the Steelers-Seahawks contest begins to fade from memory and a test of Barbara Corcoran's Super Bowl Real Estate theory quickly approaches, there are but a few random items to share today.

Everywhere a Sign

In a short walk around the neighborhood yesterday, there were clear signs of an early spring. Plenty of fertilizer and an unusually mild winter seem to have already brought one type of native vegetation to full bloom - For Sale signs.

Realtors may rue the summer of 2006, accustomed as they have become to giddy sellers, desperate buyers, quick sales, and fat commissions.

The commissions will likely be no less fat this year, but they will surely be fewer and further between. Sellers may prove to be pricklier and more easily agitated as they are paired up with fewer buyers, most of whom will be a bit, maybe a lot, pickier and demanding than in years past.

What's Up with Greenspan?

Maybe it was the Alito vote, or the State of the Union Speech, or maybe just the Bernanke confirmation, but it seems that someone may not have gotten enough attention on his last day at work last week. Perhaps perturbed by the lack of ink spilt in his name, Alan Greenspan thus far has not gone quietly into retirement.

Perhaps perturbed by the lack of ink spilt in his name, Alan Greenspan thus far has not gone quietly into retirement.

He seems to be reacting to the perceived slight by moving markets in his new unofficial capacity as hologram for hire.

First he appears like Obi Wan Canobe before a Tokyo audience to explain the connection between rising gold prices and global terrorism. Then he breaks bread at Lehman Brothers and forecasts higher short-term rates.

You know it has to be bad if he incurred the wrath of long time admirer Caroline Baum who shows her displeasure by quoting Bill Fleckenstein.

Of course, the exorbitant fees of $120,000 and $250,000, respectively, may have been accompanied by contractual fine print requiring market-moving utterances.

Did You Miss the Gold Correction?

If you were too busy to check the gold price on Tuesday, Wednesday, and Thursday you missed a couple of wild trading days - down $20, up $15, then down again $8 last night in Asia. Who knows where it's going to go from here, but it seems to be stretching it's legs, warming up for something.

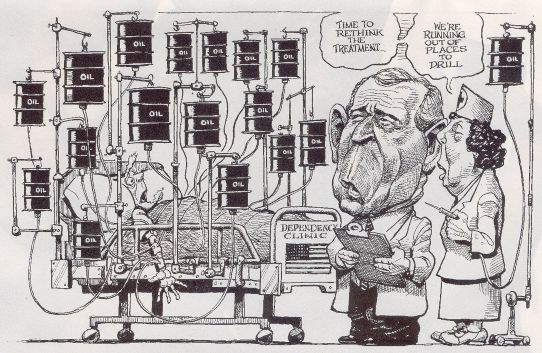

Addicted to Oil?

The Economist magazine views the recent State of the Union about-face regarding oil consumption as disgraceful, given that much of the early life of our president was spent trying to profit from this addiction.

They label our leader, "The Pusher-in-Chief" for his most recent sound bite which is seemingly at odds with a natural aversion to regulate his oil patch buddies.

The guy drawing the cartoons has a view that is no less dour.

Saturday Night Live on Alan Greenspan and Credit Card Debt

While the Daily Show features about Alan Greenspan were a bit disappointing, the Weekend Update segment from last weekend's Saturday Night Live hit the mark with the following brief story:On Tuesday, Alan Greenspan retired as chairman of the Federal Reserve. When five o'clock rolled around, Greenspan did what he's done every day for the last eighteen years, he put on his overcoat, stuffed his pockets with thousand dollar bills, and casually walked out of the building.

A skit about credit card debt from the same show was so good that it was quickly transcribed for future use. Yesterday a reader provided this link to the archived video and commented that at some point in the future, we are likely to see something similar for home equity borrowing.

The same thought occurred to us here.

Steve Martin and Amy Poehler are distressed, sitting at their kitchen table sifting through a pile of bills trying to figure out what to do, when, in comes a helpful Chris Parnell.

Amy Poehler: Oh, I just can't get these numbers to add up

Steve Martin: Like we're never going to get out of this hole.

Poehler: Credit card debt, does it ever end?

Chris Parnell: Maybe I can help.

Martin: We sure could use it.

Poehler: We've tried debt consolidation companies.

Martin: We've even taken out loans to help make payments.

Parnell: Well, you're not the only one. Did you know that millions of Americans live with debt they can not control? That's why I developed this unique new program for managing your debt. [Holds up book] It's called, "Don't Buy Stuff You Cannot Afford"

Poehler: Let me see that. [Reading from book] If you don't have any money, you should not buy anything. Hmmm ... sounds interesting.

Martin: Sounds confusing.

Poehler: I don't know honey, this makes a lot of sense. There's a whole section here on how to buy expensive things using money you've "saved".

Martin: Give me that. And where do you get this "saved" money?

Parnell: I tell you where and how in Chapter 3.

Poehler: OK, what if I want something but I don't have any money?

Parnell: You don't buy it.

Martin: Let's say, I don't have enough money to buy something. Should I buy it anyway? Parnell: No.

Parnell: No.

Martin: Now I'm really confused.

Parnell: It's a little confusing at first.

Poehler: What if you have the money, can you buy something?

Parnell: Yes.

Poehler: Now, take the money away. Same story?

Parnell: Nope. You shouldn't buy stuff when you don't have the money.

Martin: I think I've got it. I buy something I want, then hope that I can pay for it. Right?

Parnell: No. You make sure you have money, then you buy it.

Martin: Oh, then you buy it! But shouldn't you buy it before you have the money?

Parnell: No.

Poehler: Why not?

Parnell: It's in the book. It's only one page long. The advice is priceless and the book is free.

Poehler: Wow. I like the sound of that.

Martin: Yeah, we can put it on our credit card.

Announcer: So, get out of debt now. Write for your free copy of "Don't Buy Stuff You Cannot Afford". And, if you order now, you'll also receive, "Seriously, If You Don't Have the Money, Don't Buy It" along with a twelve month subscription to "Stop Buying Stuff" Magazine. Order today.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

8 comments:

What is on the horizon? Massive default and an uprecedented cold economic winter.

looks like three corrections in four days for gold

let's hope Barb Corcoran gets a good correction

great cartoon.

Bush's oil announcement was very wierd. Its as if we've given up on oil in the middle east. It didn't seem like it was the policy even 1 year ago.

It was a very active week. Re-introduction of the long-bond. Complete inversion of yield curve.

the dollar is still strong fellas.

US yield curve inversion grows after 30-year sale

http://today.reuters.com/business/newsarticle.aspx?type=reutersEdge&storyID=2006-02-10T214456Z_01_N10552162_RTRUKOC_0_US-MARKETS-BONDS-INVERSION.xml

The $14 billion in new 30-year bonds auctioned on Thursday are now yielding 4.55 percent — about 14 basis points lower than what two-year notes are yielding.

Investors’ willingness to accept lower long-term yields can suggest they see signs the economy is weakening, and expect yields to go even lower. The expectation of slower growth can be a self-fulfilling prophecy, as businesses turn cautious.

A flat or inverted yield curve also squeezes banks’ profits and makes them less willing to lend, dampening growth.

http://www.cbsnews.com/stories/2006/02/11/ap/strange/mainD8FMLVLO0.shtml

A house erroneously valued at $400 million is being blamed for budget shortfalls and possible layoffs in municipalities and school districts in northwest Indiana.

================

What a mess!!

On the history of GOLD as an asset class (GLD ETF):

http://www.agileinvesting.com/html/Gold%20ETF.pdf

======

1. Gold experienced a phenomenal bull market in the 1970s as the yellow metal rose from a price of $35 an ounce in 1971 to $700 an ounce in 1980, producing an annualized return of 38% over this period.

2. From 1980 through 2000, gold

produced an annual return of –4.4%. This long period of poor performance steadily eroded support for gold as a viable asset class (even though gold’s annualized return over the entire period of 1971 to the

present is a respectable 7.4%, versus 11.3% for the S&P 500 and 8.3% for intermediate-term

government bonds).

======

The problem is trade barriers will not address the main issue. We are less competitive for goods we import and we are not sufficiently more competitive for those we export. We need to find a way be better at what we do, or find something else. If someone does your job better, you can only hide for so long.

mtnrunner2,

free trade does not exist. As long as governments continue regulate rules of business, and subsidize certain industries it can't happen.

Ie. We have low cost for electronics, yet high costs for health care.

Post a Comment