Random Items

Sunday, November 20, 2005

Barbara Corcoran on Real Estate and Super Bowls

Readers may think that a mild Cavuto on Business obsession is developing here, and that may be so, but it seems completely understandable given the entertainment value it has provided in recent weeks.

Neil Cavuto and Jim Rogers once again seemed to grasp things rather well, and Ben Stein seemed a little less dumb, but it was a bit difficult to determine who made the most moronic statements in this weekend's edition - Herman Cain or Barbara Corcoran.

OK, it really wasn't difficult, it was just important to mention Herman Cain here right next to Barbara Corcoran and moronic statements - kind of an honorable mention, as it were.

Here it is, for your amusement and enjoyment:Corcoran: It's funny what's happening right now - there's so much uncertainty in the market, and everybody's been spooked by all the media coverage that's out there that it really is a great time to buy. It's a great opportunity right now, and I don't think it's going to last very long.

A few corrections seem to be in order here:

I think come January, everybody who doesn't buy the house right now for the price that they could afford is going to wish they had because they are going to be paying more in January.

This "bubble babble" is baloney, and it's scaring people away and making buyers "think about it", and while they're "thinking about it", the house prices are going to go up, and I truly believe that.

Rogers: But Barbara, what's going to make them go up in January? Why are buyers coming back in January?

Corcoran: In January, you can count on it. You can set your watch to Super Bowl Sunday.

[...]

Stein: And as to why you can set your watch to Super Bowl Sunday, I'm totally mystified. Usually, people have to have a reason for something. I'm not quite sure what Barbara's reason is. Are interest rates going to suddenly turn down on Super Bowl Sunday?

Corcoran: Can I address that? First of all interest rates are not high, they're low. Even though we've had five big hikes by the federal government, what has it done to mortgage rates? Barely nothing.

But about Super Bowl Sunday, what I mean is by Super Bowl Sunday, this whole media "babble stuff" that's out there is going to get old, boring - the media is going to move on to something else, and guess what? People are going to be back in the market in droves.

Minor details all - the point is that real estate prices are going up! Don't be left behind!

San Diego: "I'm not Dead Yet!"

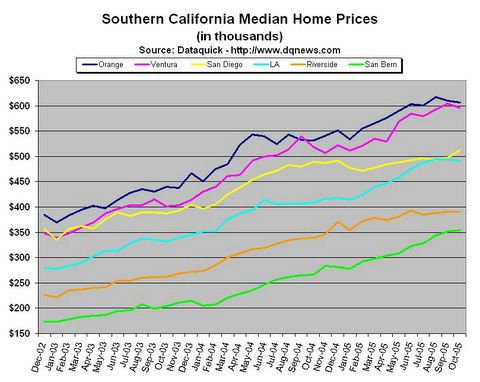

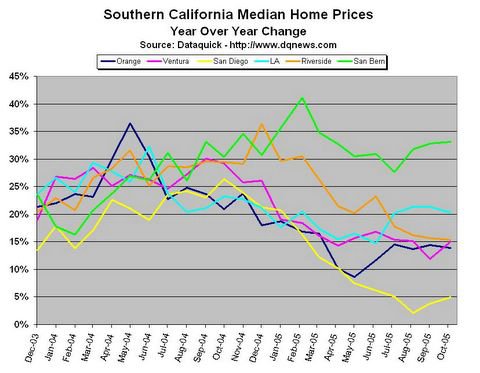

The October DataQuick real estate sales and price data is now available here in chart form. For the second month in a row, San Diego has managed to avoid going negative in its year-over-year change to median price. The market appears to be very resilient in the last few months as far as price goes - not so much so if you look at inventory levels and numbers of sales.

Unfortunately it looks like all those predicting the 2005 collapse of the great California real estate market will be proven wrong - oh well, there's always 2006.

Click to Enlarge

Click to Enlarge

There will be more on the DataQuick reporting of real estate conditions in California tomorrow - a closer look at some of the commentary in these reports has proven to be most intersting.

Money Magazine on the Housing Bubble

What does Money Magazine have to say about the housing bubble now?

Amazing - in the December issue of Money Magazine, they are now having fun with the whole idea of the housing bubble - after leading the cheerleading just a few months ago.

For previous posts on Money Magazine and real estate, see:

Money Magazine Does a One-Eighty

Money Magazine Does Real Estate

Money Magazine on "Cashing Out"

Why is This Couple So Happy?

Other Items of Note

The best DUI stop video ever

This really is, without question, the funniest DUI stop video ever.

Fun with corn starch

Try this at home, just don't taunt Happy Cornstarch Ball.

New Homeowners Rolling the Dice on State's Rivers

Another none-too-bright California homebuyer: Flooding was the last thing on the mind of real estate loan officer Errol Riego earlier this month when he, his wife and their two children moved into a $700,000 home in Mossdale Landing that he figures was half the price of a comparable one in the Bay Area.

Guardians for Profit

Riego did not know about the past flooding. In the excitement of becoming a homeowner for the first time, he said, he did not pay much attention to the builder's flood disclosure statement.

Would it have mattered?

"No, not at all," he said.

An interesting series - very sad.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

6 comments:

she is like crazy, scary

http://www.barbaracorcoran.com/

look at that smile!

If I'm not mistaken that DUI stop video is from the TV show "Reno 911".

There are about 500 professional conservators in California, overseeing $1.5 billion in assets.

500 .40 Smith&Wesson rounds @ $1 per round: $500

1 H&K USP .40 S&W handgun: $500

Ridding the world of 500 scumbags who make suicide bombers look noble in comparison: priceless.

(I'll throw in the extra buck for Ms. Corcoran, or we can bill her family, Chinese-style)

Sorry, thoe articles on the conservators really upset me.

A few corrections seem to be in order here:

1. The federal government does not raise interest rates.

I have to agree with Barbara on this one. The Federal Reserve Board is chartered by Congress and appointed by the President. And it is certainly a federal, not state or local, entity. How is it not part of the Federal Government?

Fom Wikiepedia, see:

The Federal Reserve

"The Federal Reserve System is an independent government agency. It is subject to laws like the Freedom of Information Act and the Privacy Act which cover Federal agencies and not private entities. However, its decisions do not have to be ratified by the President or anyone else in the executive or legislative branches of government, it does not receive funding from Congress, and the terms of the members of the Board of Governors span multiple presidential and congressional terms. Once a member of the Board of Governors is appointed by the president, he or she is almost as independent as a U.S. Supreme Court judge, although it is not a lifetime appointment."

Independent agencies of the United States government

"Federal independent agencies were established through separate statutes passed by Congress. Each respective statutory grant of authority defines the goals the agency must work towards, as well as what substantive areas, if any, it may have the power of rulemaking over. These agency rules (or regulations), while in force, have the power of federal law in the United States.

The executive departments are the major operating units of the U.S. federal government, but many other agencies have important responsibilities for serving the public interest, and keeping the government and the economy working smoothly. They are often called independent agencies because they are not part of the executive departments."

I suppose it is most accurate to say that it is an independent agency within the Federal Government, and that it therefore is "part of" the Federal Government. Many people (see "The Creature from Jeckyll Island") think of it more as a banking cartel which serves the interest of big banks first and the government second.

That's probably where this thought came from - I've stricken it from the list - it was a relatively unimportant point anyway.

Best DUI resources. Browse our website today and find out the local state laws in your DUI district. Also follow our blog for the latest updates relating to the world of DUI.

===========

Taylor

DUI

Post a Comment