Fox Business News, Oil, and Gold

Sunday, April 23, 2006

In a somewhat unusual hour of rapid Tivo-style sampling of all four Fox business news shows yesterday - Bulls and Bears, Cavuto on Business, Forbes on Fox, and Cashin' In - there is a clear sense that the commodities bull market is beginning to go mainstream.

In fact they didn't talk about much else.

The most popular question of course was about gas and oil prices - how high and how long - but gold and gold stocks are increasingly the subject of debate on these shows. This of course means that in about six or eight months every Mom and Pop with a brokerage account who today still think that tech stocks are going to soar again will come around to realizing where to put their money, after it is pounded into their thick skulls for another twenty or thirty weeks.

Speaking of thick skulls, Barbara Corcoran and Ben Stein were on this weekend.

Barbara Corcoran is making more sense than she did a few months ago with her Super Bowl theory - now she claims that people are not buying homes because they're paying more and more for gas week each week, which affects their home buying decisions. Of course making more sense than she did a few months ago is not hard to accomplish.

And Ben Stein had this to say when someone reccommended the gold ETF:It seems to me that gold is more or less a pure bubble. We are having a price point for gold which is wildly in excess of the price it would be for an industrial or medical or dental uses. It's a price based on speculation. To me gold is this year's equivalent of the internet stocks in the early 2000 and late 1999. I love gold when it's around $300, but at these prices it's just a bubble waiting to happen. I don't know when it will burst, but it will burst.

A quick check over at Wikipedia confirms that Ben has the classic economists view of the shiny metal - trained as an economist he believes that gold is irrelevant and increasingly inexplicable.

Oh Ben!

What a bunch of newbie commodity bulls on these shows - $100 oil and $800 gold is no big deal, recommending Newmont and GoldCorp. Jonathan Hoenig at Cashin' in, a long time gold bug who has been laughed at for years because of the gold bars he used to wave around on the show - well, they're not laughing as much as they used to, and Jonathan is probably right to go easy on the gold stocks right now. He favors USO, the new oil ETF, and it's hard to disagree.

It's not clear what Eric Fry of the Rude Awakening/Daily Reckoning was doing on one of these shows - he seemed like a fish out of water.

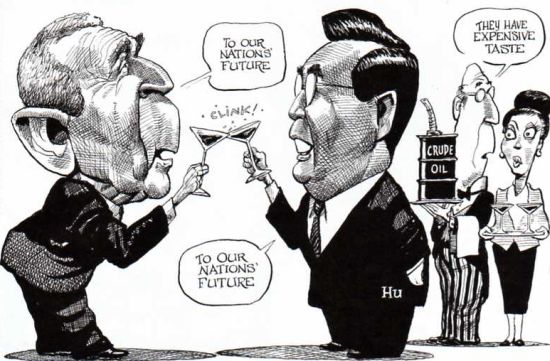

This week's Economist cartoon:

And, speaking of The Economist, after just having read this story($) about oil in the most recent issue, and not being able to muster the energy to comment again this week about more overly-optimistic world views on the part of more dismal thinkers, this smackdown over at The Oil Drum was happened upon which saves effort and stress on the digits, so the popcorn machine can get warmed up early in preparation for another episode of Desperate Housewifes.

A sampling:Oh, dear it looks as though I have to disagree with an economist again. But this time it is the magazine rather than an individual. As has been pointed out, and to an extent discussed in recent comments thanks to which I was able to read the initial article, the Economist came out with an article this past week that suggested that the current problems with the supply of oil are not really serious, or long-term.

This is a pretty good read from some guys with a great blog who really seem to know what they're talking about.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

6 comments:

Tim,

What do you say to PIMCO paper:

A Zero Interest Rate Policy (ZIRP)

Remedy to Global Imbalances

http://www2.pimco.com/pdf/A%20ZIRP%20Remedy%20to%20Global%20Imbalances.pdf

Abstract

========

The pro-Keynesian mix of US monetary and fiscal policies established following the defeat of George H. Bush in

1992, and super-charged after the internet-investment bust of 2000 seeded the current US twin deficits on trade and

fiscal balance. In particular, the large foreign debt accumulation in the US, resulting from continued trade deficits, is

creating a dangerous debt dynamic exacerbated by a restrictive monetary policy in conjunction with an expansionary

fiscal policy and asset-inflating tax policy. The paper considers the current mix of policy as a misguided attempt to

bluntly address the problem, which in reality is leading to a deterioration in the US twin deficits via higher interest

expenses, increased national defense costs, and asset-inflation induced dis-saving, and puts the US twin deficits

in their appropriate historical context in terms of vulnerability and structural intractability. The paper proposes a

Japan-style zero interest rate policy (ZIRP) in combination with strategic and iterative fiscal tightening as a targeted

response to global imbalances, creating a “synthetic” trade tariff for foreign exporters of capital, and effecting a redistribution

of wealth from asset-rich savers to debt-laden consumers in the US. The desired policy objective is to

eliminate the US twin deficits and reduce US debt levels without either inducing an asset-deflation driven economic

recession or explicitly legislating protectionism to reverse the progress of globalization.

Hey I saw that show and Eric Fry was recommending water stocks - is that what you mean by 'fish out of water"?

I wonder what Ben Stein thinks of Greenspan voicing preference to be paid in gold...

anon 6:08,

I haven't finished reading it yet, but it's an interesting paper so far. I like this section - I'll have to remember it next time someone asks me what's wrong with having a huge trade deficit and lots of foreign debt:

"Why is the stock of U.S. debt held by foreigners so important? In simple terms, it is the mechanism via which today's misguided monetary and fiscal policy mix will destabilize the global economy."

The paper identifies some important problems but fails to see the root cause. The answer is already quoted on the blog's main page.

"To combat the depression by a forced credit expansion is to attempt to cure the evil by the very means which brought it about; because we are suffering from a misdirection of production, we want to create further misdirection - a procedure which can only lead to a much more severe crisis as soon as the credit expansion comes to an end."

- Friedrich Hayek 1933

Get ready sheeple for the global interest rate bubble. Argentina style!

Post a Comment