Dissecting the Duck Diagnosis

Tuesday, May 23, 2006

Having much more than a passing interest in commodity investments these days, Caroline Baum's recent commentary at Bloomberg can not be allowed to just lie (in at least one sense of the word, possibly two).

Her sweet utterances, delivered to adoring readers with perfect timing during a major market correction last week, have likely been accepted as comfort food by thousands of hungry Wall Street types, eager to have their purpose in life confirmed by an industry veteran.

Paper good, things bad.

The report, coyly titled, "Commodities Pass Duck Test for Bubble Diagnosis", is a whimsical journey filled with faulty analysis and wishful thinking, short on facts and long on self absorption. These two sentences best capture the spirit of the piece:The gold bugs have come out of their permanent depressive state. Who would have ever dreamed that in this low-inflation world gold would challenge the 1980 highs of $850?

You get the impression that she was giggling the whole time she was writing this story - "walks like a duck - that cracks me up - acts like a duck - here we go - quack, quack, quack".

...

What if the commodities markets are (whisper it, please) one big bubble waiting to pop? Money chasing returns -- it's the oldest game in the book.

To her credit, one sentence in the story is commendable - the word "bubble" was defined. You never know what someone means when this word is offered up, in this case it was deemed to be "divorced from the fundamentals".

After that, while trying to fill in details about gold, copper, and new Wall Street products, things degraded rapidly.

The Problem with Gold

The problem with gold seems to be new money. Buyers and sellers of the StreetTracks GLD ETF don't seem to be adding enough new money to please one analyst - apparently they're just selling the shares, representing one-tenth of an ounce of the yellow metal, back and forth to each other like Pets.com stock, driving up the price.Then there are signs, in the gold market at least, of "paper shuffling,'' according to Ian McAvity, editor of Ian McAvity's Deliberations on the World Markets, a newsletter based in Toronto.

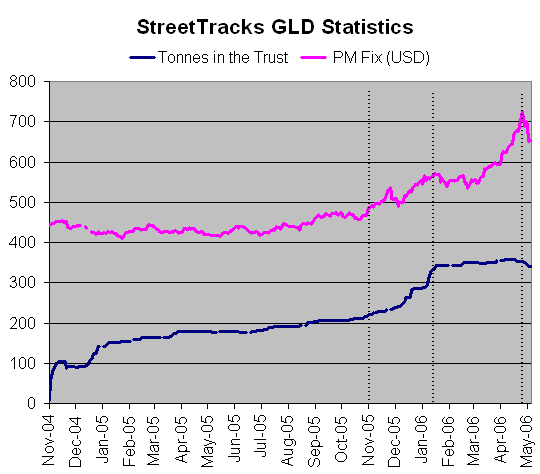

While the figures here are correct and the conclusion is sound, this has nothing to do with the price of gold - a small detail it seems. The numbers referenced above, right out of the StreetTracks spreadsheets, are shown in the chart below.

"The $125 increase in the gold price from November to January saw 135 tonnes go into the vault'' of the gold ETF, or exchange traded fund, McAvity says. The next $160 run added less than 3 tonnes. That says a lot of paper trading, but no new money of consequence.'' According to the fund's prospectus, the investment objective of GLD is to "reflect the performance of the price of gold bullion", less expenses. In other words, the market price of gold drives the share price of GLD. How does this fund impact the market price? Again, per the prospectus, market prices will be affected when the fund purchases or sells gold in support of the ongoing operation of the fund.

According to the fund's prospectus, the investment objective of GLD is to "reflect the performance of the price of gold bullion", less expenses. In other words, the market price of gold drives the share price of GLD. How does this fund impact the market price? Again, per the prospectus, market prices will be affected when the fund purchases or sells gold in support of the ongoing operation of the fund.Purchasing activity associated with acquiring the gold required for deposit into the Trust in connection with the creation of Baskets may temporarily increase the market price of gold, which will result in higher prices for the Shares.

So, this in fact may be a very bullish sign for the fundamentals of gold. In recent months, while former Pets.com traders were selling shares back and forth to each other thinking they were driving up the price, the real price drivers were elsewhere.

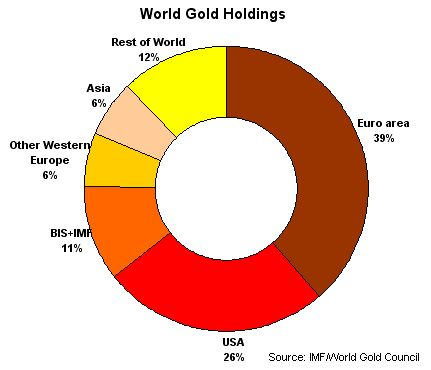

Maybe it was the central banks for our Asian and Middle Eastern trading partners who have recently been trying to make this chart a bit more balanced. According to this report, the process is already well underway, and likely to accelerate when China joins Russia, South Korea, Argentina, and others (that is of course, if they haven't already done so, which many suspect).

According to this report, the process is already well underway, and likely to accelerate when China joins Russia, South Korea, Argentina, and others (that is of course, if they haven't already done so, which many suspect).

Is there any better fundamental for the price of gold than central banks buying the stuff?

The Problem with Copper

The problem with copper seems to be that it is simply inexplicable. Traditional U.S.-centric relationships between supply and demand provide no evidence of upward price pressure, homebuilding here in the states offering proof.Another sign of the degree to which commodities have separated themselves from reality is the disconnect between home building and copper. Housing data "used to move the price of copper,'' which makes sense since the homebuilding industry is the marginal buyer of copper, Shaoul says.

Uh. Yeah.

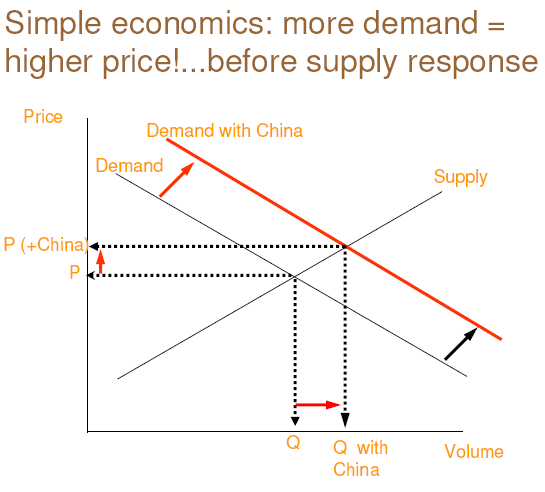

Year to date, the Standard & Poor's 500 Homebuilding Index, which includes large builders such as Pulte Home Inc. and D.R. Horton, is down 20 percent while copper prices are up 86 percent. Is China really buying all that copper? Here's another chart that might be helpful in the discussion of the price of copper.

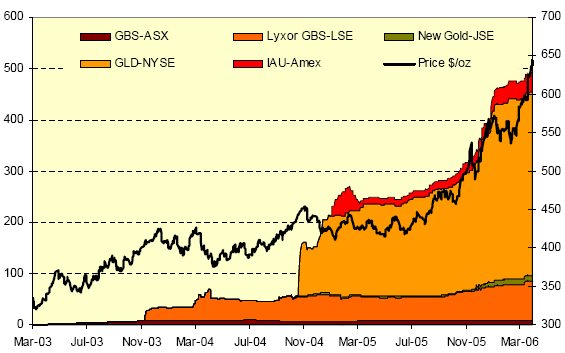

Here's another chart that might be helpful in the discussion of the price of copper. These last two charts were taken from this study (.pdf) done by Macquarie Bank which contains a good number of other very enlightening charts - information that Ms. Baum may have been interested in looking at had she not already known the answer to the question posed early on in her piece.

These last two charts were taken from this study (.pdf) done by Macquarie Bank which contains a good number of other very enlightening charts - information that Ms. Baum may have been interested in looking at had she not already known the answer to the question posed early on in her piece.

The Problem with the Post Office

The logic of the final section, the third reason why commodities are quacking, is not at all clear. Somehow, the fact that there are now a total of about ten commodity funds trading is an indication that the top is in?The silver ETF, launched in April, "attracted 54 million ounces in its first eight days,'' McAvity says. "Call me old- fashioned, but Wall Street's history is one of creating new products late in a cycle. The British Post office pension fund bought art and rare stamps in 1980, and a state of Alaska fund bought gold for the first time ever after it topped in 1980.''

Huh? You can kind of imagine Ms. Baum and this McAvity fellow exchanging emails with "quack, quack, quack" mixed in with the text. It's not clear which one comes across as more foolish, the quoter or the quotee.

Duck-like behavior, to be sure.

Speculating on Fundamentals

Of course there is speculation in the commodity markets, and of course prices have gone up rather quickly in recent months, and of course there will be corrections - brutal corrections.

But, readers will have to look elsewhere for support to the argument that a commodities "bubble" has formed - that the price action in recent years is not supported by fundamentals.

The reasons offered above are far from convincing.

UPDATE - 12:30 PM PST - Here's a chart hot off the presses from the World Gold Council. It looks like there was a bit of an overshoot as gold moved to the mid $500 range and then sat there for a while a few months back.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

13 comments:

More evidence of how narrow minded some people are -- if the U.S. markets aren't driving the price then there is no good explanation.

"The gold bugs have come out of their permanent depressive state. Who would have ever dreamed that in this low-inflation world gold would challenge the 1980 highs of $850?"

How much of this does she really believe and how much of this is part of a loosely coordinated effort to discredit what has been happening in commodity markets for the last couple years, particularly gold. I mean when do these people stop saying that we're in low-inflation world?

It's kind of like saying, "We're winning in Iraq". You can keep saying it over and over, but eventually people will figure it out.

tim

does gold holding include pvt holdings?

I feel asia could be lot higher than shown if you include pvt holdings?

is it correct to include it? i dont know

desi dude,

The chart is for central bank holdings - I should have marked it as such. You are right in that much of the above ground gold is held by individuals in India and other parts of Asia and the Mid East.

Why is it that people who never predicted this bullmarket in Gold are foaming at the mouth to discredit it and claim its a sham.

Why even care about Gold. Go buy your tech stocks and track houses and forget about Gold.

Why this constant harping on it.

What is it that scares them so much?

bubble=almost 20 years of down activity. sorta like what commodities are emerging OUT of, not into. stocks are only 6 years into their secular bear market and are still wildly overvalued.

a bubble implies a devastating market for years. commodities will have a steep correction and march right no back upward. it will be just like stocks in 1987. by 1990 they were back to their old levels and on the march over 10,000.

COMMODITY BUBBLE!!! Yet another reason why the American public will be the last ones to try catching the commodity train. Anyone in the 3rd world with savings is already on it because they're too 'unsophisticated' to believe in anything else but hard assets.

I guess a bubble is something only the other guy buys into. Quack.

I agree there is more inflation than what the Fed claims. But what is the relationship between gold and inflation? I can understand the appeal of commodites such as oil that are consumed and commodities such as steel that have industrial use. What use does gold have other than the belief that it is a better money store than paper currencies. You can print lots of paper but can't produce as much gold as one wants. In that case, why not buy oil or steel or something which has practical use as well as has the property that it can't be produced on whim? It appears that people want to own gold because they believe it will go up in price. Isn't this the same kind of thinking as with tech stocks? Folks chased tech stocks not because it was useful to them (didn't pay dividends) but because they believed it would go up in price so they could sell it at a higher price to a greater fool. Isn't that the same kind of thinking behind buying gold? I'm trying to understand the appeal behind buying gold. I already understand how paper currencies and inflation are related, but don't seem to understand why people think they are safe with gold when the world loses faith in paper currencies. When that unthinkable event occurs and we go back to bartering goods, isn't it good to own useful hard assets such as livestock, farm land, steel, and oil? Why gold?

I'm going to go ahead and answer this since I saw the comment come in and most regular readers are probably not paying attention to this post any longer.

1. Relationship between inflation and gold?

Don't have nearly enough time to address this properly, but it is a great idea for a daily post - thanks.

2. What use does gold have other than the belief that it is a better money store than paper currencies?

Jewelry mostly, a few insignificant industrial applications.

3. Why not buy oil and steel?

There's no reason not to buy other commodities - they're all good.

4. It appears that people want to own gold because they believe it will go up in price. Isn't this the same kind of thinking as with tech stocks?

Yes, you could make the same case for much of what people have "invested" in over the last ten years.

5. When that unthinkable event occurs and we go back to bartering goods, isn't it good to own useful hard assets such as livestock, farm land, steel, and oil? Why gold?

Yes, all other commodities are good to own, but what's special about gold is that between the time that our current monetary system ends and the next one gains people's confidence, gold will do very well. I don't really subscribe to the Mad Max, apocolyptic predictions of the future where we go back to bartering, but anything is possible. We are due for a major overhaul to our global monetary system - they seem to happen every twenty or thirty years. When the next big global monetary crisis hits, people will flock to gold and with central banks not willing to sell as much as in years past, and with many central banks now buying, there will be less downward pressure on the price.

"The Mess That Greenspan Made" is somewhat inaccurate. I find it disconcerting that so few people have really figured out how the stock market bubble got started. Look no further than the Secretary of the Treasury in late 1994. That's right, Trader Bob from Goldman Sachs - chief angineer/architect of the bubble. He had all the contacts and market savvy of how the sewer of Wall St. works. Rubin was brought on board at Treasury to assist in building the legacy for a self-serving redneck with a fifteen year-old mentality who inhabited the White House at the time. Greenspan was just a stupid, witless tool who got tricked into feeding the thing. It's true that Greenie is ultimately responsible for the mess, but he had some good help in the creation of it.

Thanks for the detailed answer Tim. Helps me get a feel for the appeal behind Gold. I've also been reading Marc Faber's commentary and noticed that at one point before the 82 bull started, the DOW traded at about the same price as 1 oz of gold. I'll have to dig into gold (no pun intended) and determine if I should invest. The big picture with Gold, as I understand it, is that for some reason the world sees it as a good store of value and when that bullishness is rising, you want to hold it hoping to flip when that perception reaches extreme proportions.

The equity and bond markets have benefited from a long period of low inflation, but ongoing and massive central bank liquidity injections point to a far less benign environment of elevated inflation ahead. Research by our firm, Agcapita Farmland Investment Partnership (Calgary, Canada based agriculture private equity firm) shows investors must be prepared to rotate into asset classes with different characteristics.

During the last commodity bull market & high inflation period in the 1970’s, equities materially underperformed farmland. Western Canadian farmland went from around $100/acre to $550/acre (550% total return and 176% in inflation adjusted terms), cash held in a money market account barely kept ahead of inflation (6% inflation adjusted return) and the S&P 500 index returned less than 2% per year (a loss of almost 50% in inflation in adjusted terms)

We believe the world is still in the early stages of this current commodity bull market. When agriculture commodities prices are compared against their previous inflation adjusted highs they are significantly discounted implying scope for further increases:

Corn is US$ 5/bushel currently compared to US$16/bushel in 1974,

Wheat is US$ 7/bushel currently compared to US$27/bushel in 1974

Canadian farmland is C$ 660/acre currently compared to C$1,100/acre in 1981

Agcapita’s investment team has over 40 years private equity and fund management experience and over $1 billion in total career transactions. The team currently manages a group of private equity funds with almost CAD$ 100 million of assets under management and previously managed a group of emerging market funds with almost C$500 million in assets for one of the largest banks in Europe.

The Canadian farmland investment premise is driven by several key points:

1. Canadian farmland is high quality: Canada is the third largest wheat exporter in the world and in aggregate one of the largest agricultural producers in the world. The three western Canadian provinces alone have approximately 135 million acres of farmland and produce approximately 20 million tons of wheat a year.

2. Canadian farmland is low cost: Agcapita believes Saskatchewan farmland in particular is an undervalued asset. With an average price of $390 per acre, Saskatchewan farmland is some of the least expensive in the world. The prices in Alberta are almost 3 times higher than Saskatchewan at an average of $1,000.

3. Canada has world class farming infrastructure: Unlike investing in farmland in emerging markets such as Argentina, Brazil or Russia, Canadian farmland is supported by first world storage, processing, and shipping infrastructure. This infrastructure is extremely costly to reproduce.

4. Canada has low political risk: Unlike emerging markets, Canada lacks significant political risk. Canadian farmland owners benefit from a transparent and enforceable title system with no material risk of de jure or, worse yet, de facto expropriation. See recent agriculture export tariffs in Argentina.

Post a Comment