Friday Lite

Friday, May 05, 2006

Another five days, another $20 more for an ounce of gold. Or is it $40? Is anyone keeping track anymore? It's a good thing that this economy is booming and that inflation is under control or the rising gold price would be scaring the bejeebers out of everybody. After increasing rates 13 times in 32 years, the U.S. Postal Service proposed a way yesterday for consumers to lock in the price of a first-class stamp, which officials want to raise by 3 cents, to 42 cents, next year. Postal officials pitched the idea of creating a "forever stamp" that would be good for sending first-class mail no matter how much -- or how often -- the cost of a postage stamp goes up. The announcement came on the same day that the Postal Service said it would seek to raise the price of a first-class stamp for the second consecutive year.

The Jobs Report

"Bad news is good news", the "one and out mentality", "a monkey-wrench in the works" - that's what 138,000 new jobs means for the month of April, as reported by the Bureau of Labor Statistics today. The big loser was retail trade with a net loss of 36,000 jobs, but that may have been affected by some weird seasonal adjustments around Easter this year.

Construction companies are still hiring and the always reliable Education and Health Services led the way in job creation once again. Hourly earnings rose 0.5 percent taking the year-over-year change to 3.8 percent, which is the largest increase since 2001.

M!ssundaztood

Barry and Berry over at the Big Picture about Bartiromo blind-siding Bernanke before the black-tie ...

Well, it was all kind of silly - let's see if it can be made any sillier here.

When "Lonely Girl" Maria said lets "Get the Party Started", Ben became "Numb", "Eventually" confiding, "Don't Let Me Get Me":I'm my own worst enemy

That somebody else?

Its bad when you annoy yourself

So irritating

Don't wanna be my friend no more

I wanna be somebody else

Ben confided to Maria - Alan Greenspan. This has all been a big mizunderztanding.

A Square to Spare?

If you think gas at $3.35 a gallon is bad, just think what it must be like to use a bathroom in Zimbabwe. According to this report, they've got a little inflation problem.How bad is inflation in Zimbabwe? Well, consider this: at a supermarket near the center of this tatterdemalion capital, toilet paper costs $417.

A thousand percent a year is not so bad - at the height of the Weimar inflation in 1923 Germany, prices quadrupled every month. (The meaning of the word tatterdemalion is unknown to us here - but if you ever have to go to a city whose name is preceded by this word, bring toilet paper from home.)

No, not per roll. Four hundred seventeen Zimbabwean dollars is the value of a single two-ply sheet. A roll costs $145,750 — in American currency, about 69 cents.

The price of toilet paper, like everything else here, soars almost daily, spawning jokes about an impending better use for Zimbabwe's $500 bill, now the smallest in circulation.

But what is happening is no laughing matter. For untold numbers of Zimbabweans, toilet paper — and bread, margarine, meat, even the once ubiquitous morning cup of tea — have become unimaginable luxuries. All are casualties of the hyperinflation that is roaring toward 1,000 percent a year, a rate usually seen only in war zones.

Rich Dad Don't Know Silver Storage

Robert Kyosaki has been writing incessantly about commodities lately. Not knowing his background that well and not bothering much with his book, it's hard to pass judgement on his views aside from the obvious fact that he's definitely in the right sector - oil, natural gas, gold, and silver.

In an article appearing this week at Yahoo! Finance, he talks about buying and storing silver.

Well, it's not clear how much silver Mr. Kiyosaki owns, but for a man of his wealth, storing his silver in a safe deposit box just doesn't sound right. It's even worse for coins because the bag can break and then you hear the clankety-clank of silver coins all over the vault floor, but even if you store 99.999% fine silver bars in a safe deposit box, you are confronted with the immediate problem of weight. I'm also excited about silver because -- unlike real estate, which can require a lot of money, some finance skills, lots of due diligence and property management skills to do well -- silver is affordable to the masses, and management skills are minimum. Just buy some silver, put it in a safety deposit box at a bank, and your management nightmares are over.

I'm also excited about silver because -- unlike real estate, which can require a lot of money, some finance skills, lots of due diligence and property management skills to do well -- silver is affordable to the masses, and management skills are minimum. Just buy some silver, put it in a safety deposit box at a bank, and your management nightmares are over.

Right now silver sells for roughly $200 a pound, meaning that just to store a few thousand dollars worth you're talking about 15 pounds. If you're really serious about silver investing, say you want $10,000 worth, now you've got 50 pounds in a safe deposit box, and you'll get all kinds of strange looks when you say, "Here, I'll get that, it's pretty heavy".

How Can you Get Fired Before you Get Hired?

Better half Linda raised a very good question about Donald Trump's smash hit (no, not the Vegas condo project or his hair) - the TV series The Apprentice. The question was, "If these people are on this sixteen week long job interview, and he's trying to decide which one to hire, how can he be firing someone each week? Don't you have to be hired before you can be fired?"

Details, details...

The Forever Stamp

It is presumed that the timing of this stinging criticism of the U.S. Postal Service's pricing plan earlier in the week had nothing to do with the report of a possible new "Forever" stamp from the nation's mail carriers. But, you never know.

Stinging criticism:The U.S. Post Office should learn something from the newspapers and stop their two and three cent rate hike madness by just going directly from the current 39 cents (or did they already change it to 41 cents?) to 50 cents, and then just leave it there for a while. Please. If not fifty cents, can they at least try to get two consecutive first class postage rates that are not both prime numbers?

Stamps are forever:

They say that the price of a first class stamp has increased at the same rate as "inflation" (the CPI all items category most likely, however, none of this has been investigated). An interesting long-term exercise, to better assess the government's version of "inflation", would be to track postal rates vs. inflation over time.

Not so much for years past, but for the years ahead.

Is this What Max Baer Felt Like? It's a good bet that as long as there are Hummers and high gas prices, that little story from last November is going to be popular. Six months after it's original publication, it still ranks in the top five entry pages for this site, people continuing to discover it for the first time.

It's a good bet that as long as there are Hummers and high gas prices, that little story from last November is going to be popular. Six months after it's original publication, it still ranks in the top five entry pages for this site, people continuing to discover it for the first time.

Is this what Max Baer, Jr. of The Beverly Hillbillies fame felt like?

Will Hummers be as hard to shake as Jethro's double naught spy career.

Striking Back at Exxon-Mobile

Here's a report of a small Texas town hoping to ignite a prairie fire during what has already been a record year for fires in that part of the country.Deep in the belly of Texas oil country, Bee County commissioners took a stand last week — one they hoped would ignite a prairie fire of protests throughout rural America.

Another fine example of politicians doing something ... anything, to combat high gas prices.

They passed a resolution calling on their constituents to boycott Exxon Mobil Corp. until gasoline prices plummeted to $1.30 a gallon.

What they didn't count on was how it would divide this south Texas county.

"We certainly look like hicks now!" Pam Tull wrote the local newspaper.

Added another letter writer, teacher Charles Marley: "You have a standing invitation to come to high school economics class and learn how supply and demand affects gasoline prices. You are embarrassing us in Texas."

What set off this fury was an honest effort to strike back against gasoline price avarice, said County Judge Jimmy Martinez, Bee County's top elected official, who proposed the boycott.

But it forced the citizens of Beeville, population 13,129, to make a personal decision: Do I declare war on Big Oil, or fill up at Leticia's stations?

There are three Exxon Mobil gas stations in Bee County. All are independently owned by the family of Leticia Quiroga Muñoz, who also operates the adjacent convenience stores.

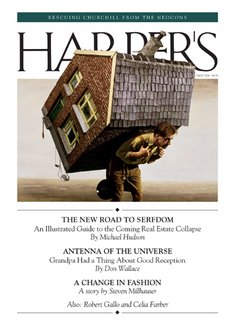

One Last Hurrah Before Serfdom

The thrill of cash-out refinancing is not gone until there's no money left to cash out.

It's as simple as that.

This soon-to-be-classic Harper's cover illustrates how homeowners can ensure that no pennies are left in any nooks and crannies - pick the thing up, strap it to your back, and shake hard.

For many, particularly in areas like Denver and Michigan where foreclosure rates are approaching all-time highs, the shaking is immediately followed by setting the thing down and casually walking away.

The Washington Post reports that home equity cash outs during the first quarter of 2006 are at fifteen year highs - at levels not seen since the peak of the last housing boom in 1990.A greater proportion of mortgage refinancers tapped their home equity for cash in the first three months of this year than in any other quarter in the past 15 years, according to an analysis released yesterday.

So, the mortgage broker and the consumer advocate have distinctly different views of what this all means. That's not very surprising. It's as if it's 2 AM and the mortgage broker is saying, "Come on, have another drink", and the stodgy consumer advocate counters, "You're going to hate yourself in the morning".

About 88 percent of people refinancing their homes took out loans for at least 5 percent more than their original balances, according to the latest quarterly review of loans owned by Freddie Mac, a government-backed home mortgage company. However, more than half took loans at higher interest rates than they previously paid. In years past, refinancers chased lower rates.

...

"The short story is that everyone has a ton of equity," said Glenn Schwartz, president of Vision Mortgage LLC in Rockville. He said local homeowners are refinancing to arrange fixed-rate mortgages, get cash for home improvements or, in some cases, to buy beach houses.

Ira Rheingold, general counsel of the National Association of Consumer Advocates, said he feared that some people are spending too much of their equity, which could leave them financially exposed.

"I don't want to sound like Chicken Little here, but we're heading for a big fall," Rheingold said. "Our policy of using our homes as our banks is bad public policy, and we need to think of the long-term implications of the debt we have. It's a homeownership economy where people don't really own their homes."

It looks like homeowners are taking that last drink, content to deal with the hangover later.

A Flock of Dodos

This story about a Harvard biologist turned filmmaker is sure to bridge the gap between the two sides of the evolution debate.The biologist in Randy Olson cringed at news reports of evangelical Christians challenging the teaching of evolution to schoolchildren in places such as Kansas on the grounds it was just a theory.

Poker playing Harvard scientists with fancy letters at the end of their names determined to convert the already converted. How is this a good idea?

But the filmmaker in him feels just as strongly that scientists have done a lousy job explaining their side of the debate.

The result is "Flock of Dodos: The Evolution-Intelligent Design Circus," a humorous and entertaining documentary that premiered at New York's Tribeca Film Festival this week.

The film shines a spotlight on "intelligent design," a school of thought that says many of the seemingly miraculous and complex elements of nature must be the work of an intelligent designer -- namely God.

...

Perhaps the brightest moments of the film come as Olson invites his academic pals to a poker game, recording an unscripted and at times tense round-table discussion among Ph.D-wielding scientists expressing frustration at the growing popularity of intelligent design.

Olson also shared his press briefing platform in New York with three actors in bright orange dodo costumes, modeled after cartoons that bridge different scenes of the movie.

Olson gives the intelligent design advocates plenty of airtime but the film exposes what Olson sees as the fallacies of best-selling authors who provide the intellectual firepower of the intelligent design movement.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

16 comments:

Kyosaki talking up commodities seems like a contrarian signal to me. He's a pop author who knows how to sell books.

All I'm missing right now is the NYC cabdriver test telling me how smart it is to buy silver and gold and coppy and lead.

Ignorant Investor aside, you don't have to store bars of silver to own the stuff.

There's now SLV, which is backed by actual physical silver stored by Barclay's. Let the physical aspects be their problem...

I heard the metal for pennys now cost $0.015 for one penny.

"Stamps are forever"

A USPS employee must be wacthing to many De Beers commercials 'Diamonds are forever.'

David

Bubble Meter Blog

unemployment:

May be a totally silly idea, but higher gas prices and interest rates may actually be increasing employment.

as households, college students, et al are running out of cash, more people are pressured to get a job.

It could definately explain low unemployment rate and deterioration of real income.

woops, they say "real income" is up in todays data. (i wish there was delete feature)

It always cracks me up when the market goes up because the jobs report is poor.

Anyone not believe the bubble has burst?

"Speculative buyers are no longer fueling demand; instead they're putting the homes they've recently acquired back on the market or are canceling contracts in mid-construction," Chief Executive Robert Toll said. Much of the excess homes for sale are being aggressively discounted, he added.

Too bad for the bagholders that recently bought or can't get out of their contracts. How would you enjoy having to close on a spec McMansion knowing that right next door there is a new one being sold at $100k discount? Ouch.

So what's Berananke's plan for after everyone has withdrawn all the money they can out of their house?

Is that when the helicopter fleet gets warmed up?

(1) A couple ounces of silver used to be a day's wage. We're probably headed back there. So, a few 100 Oz bars in a deposit box still works.

(2) If you're wanting to store a few $100k of Silver in today's dollars, most people get a big fire or gun safe and keep it at home.

(3) Physical metal = no possibility of delivery default = nobody's liability but your own. Hiding money under a mattress or burying it in your backyard isn't as backward as it sounds. You just have to pick the right money. They're still digging up money buried thousands of years ago and it still works.

Yeah, that Harper's cover is an instant classic. Superb! I wonder how many people even understand what it means when they look at it on a newstand.

"They're still digging up money buried thousands of years ago and it still works."

It didn't help the people who buried it or their heirs.

"They're still digging up money buried thousands of years ago and it still works."

It didn't help the people who buried it or their heirs.

--

Yes, perhaps. But it was not because of the money.

Comparing postal rate increases to CPI:

http://www.zealllc.com/2002/postal.htm

Wow, M1 and the postal rate seem to correlate very well.

CPI lags so far behind all the other metrics...it's laughable.

At this point, the coyote is just realizing he's gone over the cliff.

Post a Comment