On the Meaning of 'Yet'

Wednesday, May 10, 2006

What is it with the word 'yet'? At first glance, it's kind of a throw-away word, as in 'yet again', but when you think about it, additional meaning is conveyed when the word is used. In the Miriam Webster definition of the word, the example usage is "gives yet another reason".

So, "gives another reason" versus "gives yet another reason" - what's the difference?

The second phrase could be interpreted as meaning that another reason is not necessary, but another is given anyway - the speaker is perhaps annoyed at having to give this additional explanation.

Are there alternative explanations for the use of the word in this context versus omitting the word? The meaning 'in addition' has already been conveyed in the word 'another' - what additional meaning does the word 'yet' provide?

Dunno.

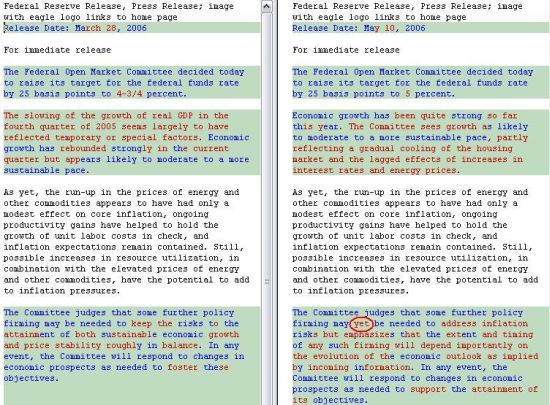

So, what is one to make of the insertion of the word 'yet' into today's FOMC policy statement, as shown below circled in red?

In this case, 'some further policy firming may be needed' versus 'some further policy firming may yet be needed' both seem to convey the same message.

Why insert the word yet? Nothing substantive was added.

Is the Federal Reserve annoyed at the possibility that more rate increases may be needed?

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

15 comments:

Don't worry, Maria will clear up the meaning for us some time next week.

Ask Maria B.

I think "yet" means "even though you market folks interpret everything I say as meaning no more hikes."

It all depends on what the meaning of 'is' is. Sound familiar?

Who cares. We already know what they will do. Just check the record. 8% real inflation vs 5% Fed funds says it all.

I think the meaning of 'yet' in this case implies that many other raises have all ready happened.

When the Chicago Bulls win their second NBA title, one might say "The Bulls won another title." After their 6th title, one might say "The Bulls won yet another title."

It is a comment on the past, not necessarily the future.

anonymous 3:40

good one. bernanke is recognizing that they have raised the interest rates quite a bit already.

but the person saying "... if the bulls win yet another title" might be annoyed, say if he was a nets fan

Has anyone considered that Bernanke might have purposefully openend up to Maria B. knowing full well she wouldn't be able to contain herself?

I think Bernanke's goal is to toy with the market. Enough to take away the complacency, not too much to freak it out.

I'm going to say it is number 3. Nevertheless/However.

Core inflation is low; productivity gains are high and inflation expectations are contained (read: you like us -- you really, really like us).

However, we have to keep raising interest rates [because gold, silver, oil, copper and anything else that can't be printed and dropped from a helicopter keeps going up despite all our speeches that states there is no inflation]

I read it as:

"We have done so much already to fight this inflation monster, but we will continue to fight the good fight, in any and all ways possible. We are somewhat apologetic for this fight to have gone on so long, but remember: we are here to fight for *you*"

My personal feeling is this fight against inflation could potentially become more than simply raising rates. God knows what this might be, but I think Bernanke might become the most creative Fed chairman ever.

The whole thing has become a massive joke. He must chuckle to himself after releasing this crap.

Q: What purpose does the Fed actually accomplish?

Anonymous:

The Fed is (surprisingly) supposed to smooth business cycles mainly by preventing/softening recessions through providing liquidity during those times.

In reality, the Fed exists to allow the banking system and others who are closely connected to it (secondarily, the government) access to free and unlimited money through inflation-related instruments. The way it basically works is: banks create money with the nod of the Fed. The well-connected get this "electronically" printed money in the form of loans. The banks collect fees/interest on the money, hence "winning" no matter what.

As any moron could predict from the above simple-but-true description of the basic workings of the Fed system, it has been a sheer distaster due to its run-away expansion of the money supply (which always creates real, broad-based price inflation, which always hurts the worst-off the most).

Ironically this persistant money-supply expansion fosters asset bubbles and inevitable collapses, the crescendo of which we are experiencing now. The Great Depression was one of these but it was particularly bad because the Fed took a brief hiatus from its bank-serving role under FDR and kept money supply excessively tight (the Smoot-Hawley global trade war and FDR's anti-business climate didn't help either).

Now, the medicine, both in times of percieve crisis (recession) and in times of "calm" is: print more money.

Before the Fed, there were more than 100 years of American monetary history, interrupted by wars and a few truly minor business cycle bubbles, yet we experienced gradual (and net) deflation. And we were fine. Why? We were on a precious metals standard; no structural inflation was allowed.

In conclusion: the Fed massively screws up the economy and transfers benefit globally from the poor to the rich. That's what the Fed accomplishes.

Nice summary of the Fed.

I'd add that the roots of the Fed are a global banking system based in Switzerland. It's important to realize the central banks are not separate entities. It is a single for-profit entity designed to lend money to countries. Countries make the best borrowers.

Over time this banking system has inserted itself into every single country on earth and convinced us they are necessary.

We've been duped!

Couldn't Congress issue a currency by itself? Why is Congress borrowing money from a central bank and paying interest on the money?

I don't know who to blame, but we've been scrued big time

Why Banks are going Out of Business?

Since late 2006, 288 banks closed their doors, while other major banks are in the process of bankruptcy. Indy mac, countrywide, washington mutual, chase wholesale and lately on the verge of a merge wells fargo and wachovia, just to mention some. People are terrified to loose all their savings, so they’re saving money in their homes instead. That is a scary situation for america and the whole world. Which leads me to this question: What is happening to the world?

Remember 5 years ago?

We used to spend money on real estate investments, luxury cars, vacations and we still had some money left, money wasn’t an issue. Back then some people looked at all these spending as a temporary ride, while others thought this dream will last forever. The problem was that 90% of us thought this dream will last forever, unfortunately the banks were part of this category and that’s where the economy crisis started.

We can blame each other or we can blame ourselves, but looking for faults will not fix anything. Many people are completely innocents, they just wanted to have a more comfortable lifestyle, but others (banks, mortgage brokers, loan officers, real estate professionals, etc) wanted to get rich from these innocent people. Why innocent people need to pay the price? Unfortunately that is how the system works in america; rich people’s money always will play a roll over the ones that don’t have as much.

We’ve trusted banks with our money, our investments and our homes. If you think about it for a second you don’t trust anybody in this world like that, so why do we trust banks? No one can understand really why, but many will blame the false advertisement and promises that banks kept on delivering to us through television, radio, newspapers, internet and other sources of advertisements. Banks are a multi billion dollar organizations that run the world, but today it’s a little different.

It’s hard for us to accept changes in life, but this change topped every other small change that we were afraid from. No body ever expects something like this to happen in the year 2008, but we have to learn how to live with this change. Many people have predicted this change to last for about 5 years or more, some say it will last for 2 or 3 years, but no body really knows.

Some of the questions that you’re probably asking your self today are:

Who will tell us what to do with our money?

Who will tell us what is the right investment for our money?

Who will tell us how much money we have?

Who will loan us money when we need it?

Who will help us sleep well at night?

Who will help us finance our homes?

Who will help us build businesses?

We have so many questions and no ones to talk to, because now these banks are fighting for existence. There are some organizations that operate by the government and they can help you with your money, but don’t ever forget that you are the master of your own mind and use it to your benefit. More important you need to learn how to live with this change and make the best of it.

Post a Comment