Tales of the Liquidity Bubble

Wednesday, May 10, 2006

Yes, today's title is a bit of a stretch, but there's no point in stopping the momentum that has been built up so far this week - not with the potential for story telling that may result from the release of today's policy statement from the Federal Reserve.

While everyone is expecting another quarter point hike to short-term rates, it is the words contained in the accompanying policy statement that will weigh on markets today. In the aftermath of last month's FOMC meeting and the ensuing Bartiroma-gate "misunderstanding", anticipation is at an all-time high waiting to hear the tone of the text.

Perhaps after what happened last month, the new Federal Reserve Board would be better served this month by recycling a few words from the last Fed chief in an attempt to return a sense of normalcy.

Maybe some Alan Greenspan-style obfuscation is in order. Searching the archives at ThinkExist.com reveals a number of possibilities.“The more flexible an economy, the greater its ability to self-correct in response to inevitable, often unanticipated, disturbances and thus to contain the size and consequences of cyclical imbalances.”

[That last one actually did show up as an Alan Greenspan quote, though it's hard to believe these are the words of the departed Maestro]

“It is important to remember that most adjustment of a market imbalance is well under way before the imbalance becomes widely identified as a problem”

“... the flexibility of our market-driven economy has allowed us, thus far, to weather reasonably well the steep rise in spot and futures prices for crude oil and natural gas that we have experienced over the past two years,”

“Look at it! Look at it, damn you! This is the result of your consistent, persistent, grinding, impoverishing inflation, you despicable loathsome morons!”

Inside Ben's Head

So what might be going on inside Ben Bernanke's mostly bare cranium? That is, mostly bare on the outside - there's no doubt that Ben is a pretty smart fellow. What might he be thinking as he ponders his selection of words?

It's clear that he wants to be able to stop raising rates sometime soon, and be able to resume the rate increases or begin cutting interest rates, as necessary, sometime in the future,based on incoming data. But the markets don't really like that kind of uncertainty.

What are the markets expecting him to do?

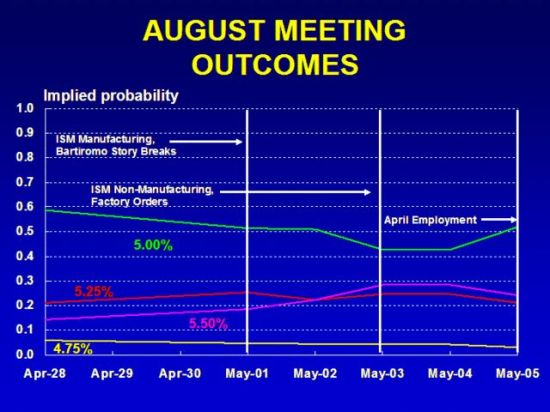

According to David Altig's excellent Macroblog, based on options on federal funds futures, the markets are expecting a pause through August as depicted in the charts below.

Of course, as David points out, this is subject to change - daily. This is best demonstrated by the "pincer pattern" in the June Meeting Outcomes chart above. (It's either a "pincer pattern" or one of those drawings where successively larger fishes are about to eat each other).

Of course, as David points out, this is subject to change - daily. This is best demonstrated by the "pincer pattern" in the June Meeting Outcomes chart above. (It's either a "pincer pattern" or one of those drawings where successively larger fishes are about to eat each other).

The Pause that Refreshes: The arguments to pause are fairly clear - it's avoiding that whole "running into a ditch" scenario that board members commented on with the release of the Fed meeting minutes from 2000 - when the Greenspan crew hiked rates a half a point in May of that year after the stock market had already peaked.

Everyone remembers what followed that rate hike and nobody wants a repeat (or even a rhyme, for that matter). The delayed effects of monetary policy make steering this huge economy quite difficult as Ben well knows. He once remarked that monetary policy is like tuning up a car while it's speeding along at 60 mph.

It's not clear if the "running into a ditch" analogy was in any way related to the "60 mph tune-up" analogy.

As there is generally a six to nine month lag between monetary policy actions and their impact on the economy, it is easy to make the argument that after the hike today, they should just sit there at the nice round number of five, and see what happens.

Increasing accounts of trouble in the housing market should add credence to this point of view, since in many once-hot real estate markets the wheels appear to be coming off rather quickly - just the increase to five percent this month will prompt objections from an increasingly unpopular Congress, from an increasingly "squeezed" electorate.

Americans have gotten used to inexpensive debt, and lots of it.

Don't Stop Now: On the other side of the debate, the arguments to keep raising rates are less compelling. Core inflation is still around two percent and inflation expectations are still well contained - how these statements relate to rising prices experienced by American consumers is, of course, not well understood and apparently of little importance in making monetary policy.

The rising costs of raw materials, the product of what CNBC is calling a "commodity bubble" that is apparently ogling peoples necklines, have not yet fed through into consumer prices as measured by the core CPI or core PCE, and if it's not in the core it doesn't count.

Economic reports have been good lately but the disappointing labor report from last Friday (nonfarm payrolls of 138,000 after expectations of almost 200,000) should provide sufficient grounds to go easy on future American debt service.

What else might influence Ben Bernanke and the board? Gold? The Dollar?

If the yellow metal weren't so darned irrelevant then maybe gold price charts that are going vertical might make a difference, but $500, $600, $700, $800? It just doesn't matter. No one pays attention to gold anymore, there are many other much better indicators for formulating monetary policy.

And as for the U.S. Dollar - the rest of the world will love us and our currency no matter what we do.

Maybe the best thing for the Fed to do at this point, given the events of the last few weeks, is to reverse course on the "openness" pledge that began the Bernanke era, and do what many companies now do - provide no guidance at all.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

9 comments:

Don't underestimate the value of gold. If you're China and you're trying to get away from the US dollar peg, what is out there? The yen? The Euro?

Gold still makes sense, especially considering billions of Asians favor it. As their savings increase and other currencies fluctuate, you can bet they'll be longing for more gold.

the dollar is going down!

Budget spend and debt levels means the Fed needs an excuse to ease. But, it must also manage inflation expectations - they actually want and need real inflation. In the end, can't be done unless we are serious about the deficit and the debt. Yet again and entirely predicable, they will say be vigilant on inflation but do the opposite to support the spend and debt. How many times do we need to see this trick?

Surprise! Not to be outdone by Iran, Russia's planning an oil bourse too:

http://en.rian.ru/russia/20060510/47932818.html

Yeah, I'm not feeling much global love for the US or its currency right about now.

Danielle, by the way, given the ECB's stated intentions on how to manage inflation, I have more confidence in the Euro than the typical major currency. They actually believe the quantity of broad money matters.

See http://themessthatgreenspanmade.blogspot.com/2006/03/issing-link.html

I have more confidence in the Euro also.

Europeans tend to manage more long term, having experienced more hardships than the Americans.

America's government is spending like there is no tomorrow. Since debt is a relatives game, it's opening up the doors for other countries to spend more.

The typical boomer has little savings, US taxes will need to increase over the long term or rates will increase. Socialist coutries around the world have been suffering from the US propensity to cut taxes as well as think and act short term. With tighter US purse strings, other countries will finally gain some breathing room.

I really think the US will go through the wringer for a couple of years.

No matter what, the US consumer is slowing. China may as well set its sight on other importing countries or itself!

With a US devaluation, commodities could look much cheaper!

China's plan, I think, is buying up mines and other commodity producers around the globe. They can sell stuff to themselves. Now, they "sell" us goods, but they are not getting any money; they are getting IOUs. All the dollars we send them for their products are being used to buy Treasury debt, which doesn't pay interest until you sell it. So China has all this Treasury debt, which is rapidly devaluing. They will slowly wean themselves off this arrangement. I think they are waiting until after the Olympics and after they have more of our technology transferred, and then they'll just buy and sell stuff to each other.

Then, who will support us?

Does anyone else think the Fed must keep raising interest rates as long as the dollar keeps falling? THey must also keep China interested in buying our debt.

Yes, Greenspan was ambiguous, the Yoda. Bernanke couldn't make up his mind "yet", the Yetti.

http://guambatstew.blogspot.com/2006/05/yoda-and-yetti.html

Post a Comment