www.IaconoResearch.com

Monday, May 15, 2006

Today, a new investment website is being launched - www.IaconoResearch.com. This site has been in development for many months now, and today is its formal launch. While not the prettiest website out there, it is highly functional, handcrafted, and the model portfolio boasts a gain of over 30 percent year-t0-date.

(No, it's not all gold and silver, but had it been, the gain would be almost 50% on the year, which is some serious food for thought. It does look like some of the recent gains will be given back today with perhaps more to come, however, this may be setting up an excellent buying opportunity.)

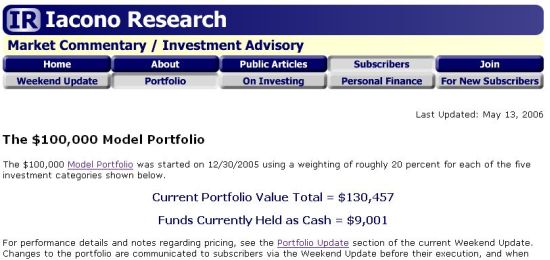

Here's a screenshot of the top of the portfolio page in the subscribers area. The subscribers area provides access to a variety of writing, the most important of which are the weekly update and a detailed portfolio of approximately thirty positions in commodities, commodity companies, and foreign currencies, with convenient buy recommendations that are assessed and revised weekly.

There's a wealth of information in the public area of the site, so there's not much point in blabbering on in this space today - in the About tab of the site you'll find a FAQ and details about both my background and the investment approach that is integral to the website.

There are just a couple of points to be made regarding the new website and its relationship to this blog.

Thank You and Don't Worry About the Blog Changing

First, I'd like to thank everyone for reading the blog, and rest assured that very little is going to change here. This is the first and last post to the blog that is devoted to promoting the website.

What will change?

There will be a couple links to the investment website - one being the new graphic on the right sidebar, the other being small, mostly harmless ads inserted into the daily posts once or twice a week. What you see below will be typical.

~~~~~~~~~~~~~~~~~ Advertisement ~~~~~~~~~~~~~~~~~~~~~

Have you seen Tim's new investment website? Click here to learn more.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The blog has been and will continue to be a fun thing to do, whereas the website is pretty serious business since the model portfolio reflects my personal investments and subscribers will be influenced by what appears there as commentary and/or recommendations.

It's Still Early for Commodities

If you are not already invested in commodities, consider this an opportunity to get in while the commodity bull market is still fairly young, enabling you to be one of those people selling when all your friends are out buying commodity ETFs in the years ahead.

If you read this blog regularly, then you are already familiar with the arguments for natural resources and precious metals in particular, but rest assured that the public is still largely unaware. Despite the recent price action, it really is still early for commodities.

If you are already bullish on commodities, consider this an opportunity to hear another point of view on the subject from someone whose views you are already familiar with by having read material posted here - the difference between the blog and the website is that you'll get a lot of questions here, whereas, at the website you'll get answers and opinions that are specific to investment decisions.

The Long-Term

I'm in this for the long-term, and I expect to be writing for both the blog and the website for many, many years. Having done well in saving and investing, semi-retirement is right around the corner, and having had such a wonderful experience writing for the blog, the natural progression to an investment website as a separate and very serious business entity makes a lot of sense for many reasons.

There will likely be many adjustments along the way, I can already feel the difference between writing for fun and writing for paying subscribers, but this is not expected to pose any obstacles.

Here's hoping to make you and me better investors.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

21 comments:

so did you pick today to work the "buying opportunities" angle? clever.

No, but that's an interesting theory

Yet another internet doom and gloom goldbugger site. Precious.

The mid-week updates may start this week - we'll see.

If you can buy only one stock, what would it be? Why? Pls, be brief.

Tim, I am going to subscribe to your site.

But please give me your take on the parabolic rise in gold. It does seem set for a pullback. Shouldn't we wait for a pullback to get in?

I see a recession ahead, and won't the recession dampen demand for commodities, lowering their prices? China is the fastest growing economy, but their growth is dependent on the US consumer. 40% of their exports are to the US. China is also dependent on keeping the yuan low to keep their exports prices down, and on the loose bank lending standards, which allows companies to borrow cheap and not repay.

I worry about the commodities as a 15-year rally, when the current rally is so dependent on the US consumer.

I suspect most of your investments are in commodities, but unless I am convinved that commodities have a strong run ahead, despite the US consumer shutting down, I can't get into that game.

Any feedback is appreciated.

Tarzan buy uranium.

Anon 10:05 - PetroChina, because Cramer said so. Seriously, less than half the model portfolio is stocks and they seem to have just started a correction right now, so I woudn't be buying any stock at the moment.

powayseller - Gold is now pulling back. How far? Who knows? In a few years gold at $700 will probably seem cheap, just like today, looking back a few years, gold at $350 seems cheap. If you have a long term horizon, $600 - $700 is a perfectly good time to buy - people are getting used to the idea of $850 and $1000 gold in their future.

Yes, a recession will dampen demand for commodities, but Asia is the real growth story these days and they will grow more and more independent of the U.S. as their consumer class develops and they'll all want cars and other consumer goods. Just think what might happen if instead of saving so much they start spending more freely, and then they all get credit cards. There will be severe corrections, but the underinvestment of the last twenty years has made this into more of a supply story.

The fun really starts when upcoming economic weakness in the U.S. is treated with the same easy money medicine that has worked so well for the last twenty years - where does all the money go this time?

Tarzan: Big correction in uranium stocks today - back up the truck?

I don't like to make predictions, but Peter Grandich doesn't mind (make a note of this to see how well his crystal ball is working - he is purely a technical analyst):

Unsustainable gold on the brink of crash, says US metals guru

An American metals guru has warned that gold could crash within hours or days after a speculative "blow-off" last week to a 26-year high of $727.75 an ounce.

Peter Grandich, publisher of the closely-watched Grandich Letter, told The Daily Telegraph he expected gold to plummet up to $150 an ounce after reaching the most extreme levels of speculative excess he had ever seen.

"I think there will be a very short, sharp correction of 10 to 15pc, in the worst case reaching a floor of around $575 an ounce," he said.

"In the long-term I'm still very bullish on gold because I think the US dollar is dying and I don't see what can replace it. But the latest rise is quite simply unsustainable."

And, there's more:

Mr Grandich believes gold will rally to record highs later in the year after touching bottom in the summer, but first it must burn off the current froth. He recommends smaller mining stocks, believing they will soon have their day of "speculative frenzy".

"Once we see a complete break-down of the dollar, then all those crazy predictions we hear of gold reaching $2,000 or even $3,000 an ounce could become realistic," he said.

He said the trigger would be a fall below 80 in the US dollar index, a basket of currencies that ended Friday at 83.83. This would be equivalent to about $1.34 to the euro, or $1.98 to the pound.

Tarzan sell house, buy 10^6 U.

With any asset - including gold - all investors should have an exit strategy for protecting their profits.

The break in prices we witnessed today is just a taste of what will come if gold goes to $3,000 an ounce ... and collapses.

What is the physical gold equivalent of one share of GLD? Anybody know?

"Anonymous said...

Yet another internet doom and gloom goldbugger site. Precious."

Yep. He even links to the homepage of David Morgan: http://www.silver-investor.com/

Wow, you too can run a precious metals investment newsletter from your own home!

If it comes to the point that one must invest in precious metals, I suggest you stock up on copper hollowpoints and prepare for the coming new world order.

One share of GLD is 0.10 oz.

I love my GLD (bought way back 4 months ago when gold was $530/oz).

However I do have a stop order to get out if it falls back below $600/oz.

"If it comes to the point that one must invest in precious metals, I suggest you stock up on copper hollowpoints and prepare for the coming new world order."

Tim, what do they say about leading a horse to water? Poor sods like this one actually believe in the central pranksters.

some of the commenters today sound like that crowd that showed up to defend the Hummer back in November, just moronic

I've been coming back ever since that Hummer story. Tim, that was probably the greatest story I've ever read on any blog. It certainly generated controversy but exposed the truths. Once I get a chance, I'll drive to the local Hummer dealer here and take a pic of their 200+ hummers sitting in the woods beside the dealership and sent it to you for kicks.

I'm considering joining IR. The webpage looks great but what other benefits will I receive as a customer besides news and disucssion?

Moman,

Thanks for the kind words - every once in a while, after I've had a drink or two, I go back and read through some of the Hummer posts - the funniest parts are the comments.

Regarding the website, if you are already invested or thinking of putting money into commodities - energy and precious metals in particular - the service should be of help to you. You get the model portfolio, from which you can pick and choose for your own portfolio, you get new recommendations over time, and you get the weekly commentary.

I just heard a story about someone who finally took the plunge and bought some GLD at the end of the day on Friday - they got spooked yesterday and exited the position at a loss. That's where I can help because I've been through it all before. I remember feeling like the biggest fool when I made a major purchase at around $350 in the beginning of 2003 and watched the price go down to $320 - you have to go through some corrections before you can appreciate how they make you feel and how people often times react.

One more thing - the feeling I just described above is about 10 times worse for the junior mining stocks, but you will be greatly rewarded over time. Note Grandich's comment from yesterday:

He recommends smaller mining stocks, believing they will soon have their day of "speculative frenzy".

I think of corrections like interval training for bike racing. What's that? No pain, no gain.

"'If it comes to the point that one must invest in precious metals, I suggest you stock up on copper hollowpoints and prepare for the coming new world order.'

Tim, what do they say about leading a horse to water? Poor sods like this one actually believe in the central pranksters."

Are we headed for Weimar style inflation? Possibly. Possibly not. Thus I have a reasonable share of my portfolio in gold and silver miners (still others in oil, finance, healthcare, retail, etc, etc, ad nauseum) and a respectable stockpile of 9mm,.45ACP, 00 buckshot and .308 (7.62x51mm) under the bed.

If worst comes to worst, your gold is still mine for the taking!

Suckers.

Post a Comment