The Correction is Here

Tuesday, May 16, 2006

Wow! What a day to launch a commodity investment website! Yesterday was probably a good example of what's in store for commodity markets - prices often go down faster than they go up. Many new to this area of investing were probably lulled into thinking that the promised future had arrived ahead of schedule and it was smooth sailin' from here on out.

It's not that easy - get used to it.

The coming days and weeks should give a good indication of what to expect in the months ahead. If this is a short quick correction, or a quick stabilization to lower levels for a while, that's a good healthy sign. If this is the beginning of a grinding downward trek that extends for many months, then there will be lots of disappointed recent adopters, but in the end, the long term-result will be the same - much higher gold prices.

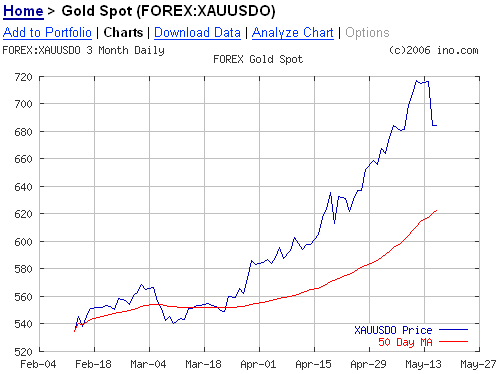

This chart shows yesterday's gold price action best and if 50-day moving averages mean anything to you, there's a $60 gap there that many will now agonize over (better to not look at the gap between the current price and the 200-day moving average).

Maybe that trip through the $600 range was a bit too quick. After returning back under $700 yesterday, that marked only the seventeenth day closing between $600 and $700 after having spent years in the $300 to $400 range, then a mere 90 trading days in the $500s.

OK, curiosity once again got the best of us and here's the same chart with the 200-day moving average.

It's a good thing that those red lines hold little meaning for long-term holders of the yellow metal and new buyers over there running the central banks of Asia. Do you think that the Russian and Chinese bankers wait for some retracement level to be reached before exchanging U.S. Dollars for more gold bars?

Nyet.

Yesterday, Peter Grandich of the Grandich Letter commented that he expected a 10-15 percent decline, possibly going as low as $575. Ten to fifteen percent from $720 puts the bottom at between about $610 and $650, with that possible foray back into the $500 range.

We'll see.

It all seems kind of silly when you think about the big picture. The U.S. Dollar has seen its best days and while there appears to be an emerging effort to manage its decline against other currencies, managing its decline against hard assets may be difficult this time around.

There's a lot less gold in central bank vaults today than there was ten or twenty years ago - if the price action of recent months has proved one thing, it has proven that gold is trading freely, subject to the same market forces that any other commodity is subject to.

Those agonizing over a difference of $20 or $50 an ounce when evaluating a level at which to buy would be well served to consider that in the years ahead, the price may swing that much in a matter of minutes.

The guys running the central banks in Anglo Saxon countries must be feeling a little relieved after yesterday's pullback. Gordon Brown, the current British Chancellor of the Exchequer (just love that title - no idea how it's pronounced) and future Prime Minister is constantly maligned for dumping half of their gold stash back when gold bottomed out at the turn of the century.

No one ever said that central bankers were good market timers.

And Stephen Roach is now all over this "commodity bubble" problem. In his Monday commentary he goes on and on about commodity bubbles, mentioning precious metals and gold early on in the commentary, then using the word bubble about seventeen times, finishing with this:Nor am I expressing a view on gold or other precious metals that seem to have some very special characteristics of their own. My focus, instead, is on industrial materials -- and their relationship to real economic activity in the global economy.

While it would be interesting to hear more about the "special" characteristics he mentions you can't help but wonder how any economist can sleep soundly at night when the scrap value of pennies and nickels is higher than the monetary value - and this with base metals.

We've been through this before with precious metals when silver was removed from coinage in the 1960s, but now it's being repeated with base metals in the new century? It must be a bubble.

One last note before leaving the subject of commodities and gold for a few days.

Steve Forbes was seen the other day on CNBC talking about inflation and Federal Reserve policy. While there is little confidence in his predictive ability when it comes to the price of oil, having forecast a post-Katrina decline to $35, he makes a little more sense when it comes to inflation and money.

In this exchange with Steve Liesman he sounds like a downright genius.Forbes: If I had my way the Fed wouldn't even jigger interest rates - they should just focus on commodities, especially gold and set a target there, say $400 an ounce, and let the rates float where they may.

The Steves are making sense - Forbes moreso than Roach.

Liesman: That's the same thing as going back to a gold standard, isn't it? That's what you want to do. You want to peg the dollar back to gold?

Forbes: Yeah, it worked for 4,000 years, it might work for the next couple months ... We've got to get away from this Phillips Curve idea that prosperity causes inflation. Inflation is caused by excess monetary creation. The Fed has been creating too many dollars - you see it all around the world. Now we're going to pay the piper for it - the sooner we do it, the more prosperity we'll have in the future.

[Thanks to the anonymous commenter last week for teaching me a thing or two about screen captures and image formats]

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

9 comments:

Funny how Roach has suddenly become retroactively incompetent, don't you think?

For the record - assuming you weren't being coy - it's pronounced "ex-CHECK-er." And for the record, all the best on your investment site, Tim. Knock'em dead.

For the record - assuming you weren't being coy -- it's pronounced "Ex-CHECK-er." It has a fabulous 19th Century ring, doesn't it? Anyway, best of luck with your new website Tim, you're smart as a whip, so I don't think you'll need luck, really. Knock it out of the park! (P.S. this latest gold pull back: buying opportunity...)

Always remember Roach is a believer in central pranking. At some point, he will stop getting it right and start getting it all wrong. Seems like that is about now.

So has Steve Forbes always been a gold lover? He's obviously still crazy about the flat tax, but gold?

I do believe ANYONE would sound like a genius when involved in a discussion with CNBC's Liesman....the master of the obvious....chief of the useless talking heads...IMHO that is!

That is indeed the smartest thing I think I've seen Forbes say.

Actually it was a "checker" board. Dates back to the Middle Ages. Read below:

The origin of the name “exchequer” derives from the chequered table (based on the abacus) which was used from about 1110 for calculating expenditure and receipts. Exchequers were normally held twice a year when the Chief Justice, the Lord Chancellor, the Treasurer and others sat round the chequerboard, auditing the accounts of each local Sheriff who collected and spent money on behalf of the Crown.

“The Exchequer is an oblong board measuring about 10 feet by 5…with a rim around it about four finger breadths in height, to prevent anything set on it from falling off. Over it is spread a cloth, bought in Easter term, with a special pattern, black, ruled with lines a foot, or a full span, apart. In the spaces between them are placed the counters, in their ranks.

The accountant sits in the middle of his side of the table, so that everybody can see him, and so that his hand can move freely at its work. In the lowest space on the right, he places the heap of the pence; in the second the shillings; in the third the pounds…As he reckons, he must put out the counters and state the numbers simultaneously, lest there should be a mistake in the number. When the sum demanded of the sheriff has been set out in heaps of counters, the payments made into the Treasury or otherwise are similarly set out in heaps underneath. The lower line is simply subtracted from the upper.” The Dialogue on the Exchequer, 1177.

B.

It looks like the correction might be 'here' for a little while.

Post a Comment