Friday Lite

Friday, June 02, 2006

The jobs report came in just a while ago - it looks like the rate-hike pause may be back on for later this month. The non-farm payrolls number came in far below expectations at +75,000 for May and there were hefty downward revisions for prior months.

The miss on the downside was not unexpected as initial claims for unemployment insurance had been trending up a bit in recent weeks, however the magnitude of the miss surprised many. Recall that it takes roughly 150,000 new jobs per month to keep pace with a growing population.

New positions in Education and Health Service led the way with 41,000 new spots (mostly health care) and Professional and Business Services registered 27,000 new jobs, 11,000 in Computer System Design. The Retail Trade category took the biggest hit, with 27,000 positions lost - a broad based decline led by clothing and general merchandise stores.

The unemployment rate edged down from 4.7 percent to 4.6, as more displaced sales clerks began selling their possessions on Ebay, thus qualifying as self employed (no, not really, but there's got to be some explanation why the unemployment rate is so low).

On to the regular Friday fare...

Lower Rates to 15% to Quicken the Expansion

According to this report from Brazil, they must be living in a Volckeresque world where the economy can be given a little boost by lowering interest rates from 20 percent all the way down to 15 percent. We must be soft here in the U.S. as many of our elected officials now regularly beg new Fed Chairman Ben Bernanke not to raise interest rates any further, "Don't go past five percent - people are hurting".Brazilian central bankers lowered the benchmark interest rate to a five-year low, seeking to add to a quickening expansion in Latin America's biggest economy.

Just think what would happen if they took rates down to five percent in Brazil, or better yet, one percent - think of how much more quickly the expansion would proceed then. Completely independent of imported oil, most of their automobiles running on ethanol derived from domestic sugar cane, there's a lot to like about Brazil beyond Carnival.

The central bank's nine-member board voted unanimously to pare the rate half a percentage point to 15.25 percent, the lowest since March 2001.

...

The central bank, which has brought the rate down 4.5 percentage points since September, will likely cut it by another half point in July and by a quarter point the following month, Valdivia said.

Bubble Man and his Low Interest Rates

We've long wondered about that picture of Mark Gilbert over at Bloomberg, but he often finds interesting things to write about that you don't look too closely at the photo. In this story, he certainly seems to have found an interesting book by this blog's new favorite author, Peter Hartcher.In "Bubble Man: Alan Greenspan and the Missing 7 Trillion Dollars", Hartcher accuses the former Federal Reserve chairman of dereliction of duty for allowing a U.S. stock-market bubble to balloon and then burst on his watch.

In his book, Mr. Hartcher touches on many of the same themes that were discussed here a few months back in the four-part series Three Sins, One Gift, which concluded on the day that the former Fed Chair retired - the frequency of those White House visits, as recounted in Sin #2 - Bending to the Will of Others, still seems very odd.

Hartcher sets out to convince the reader that Greenspan, the man dubbed "Maestro'' in Bob Woodward's biography, could and should have tried to restrain surging equity prices. Much to my surprise, Hartcher succeeds.

...

In the first half of the book, he shows how Greenspan neutered the Fed's monetary-policy meetings, holding pre-meetings to preempt dissent among the governors. By drafting the Fed statement before the meeting was held, "Greenspan had kept the trappings of due process but gutted their substance,'' the author says.

Low Interest Rates, High Debt

Calculated Risk (not his real name, or for that matter, maybe not her real name) has a few words about the national debt.For the first eight months of the 2006 fiscal year (starts Oct 1st), the National Debt has increased $424.1 Billion. The previous record was $413.2 Billion for the first eight months of fiscal 2004.

The graphic is even better and flies in the face of recent pronouncements regarding the shrinking budget deficit - they really should start calling it the pro-forma budget deficit, since, like quarterly financial reports in recent years, it "excludes all the bad stuff".

...

If someone says the deficit is falling - laugh (or cry). Its not true.  Does anybody really believe anything anyone at the Treasury Department or the White House says about the nation's books? When they have to raise the debt ceiling by close to $1 trillion dollars every year or so, why does anyone believe reports of a budget deficit less than half that size and getting smaller?

Does anybody really believe anything anyone at the Treasury Department or the White House says about the nation's books? When they have to raise the debt ceiling by close to $1 trillion dollars every year or so, why does anyone believe reports of a budget deficit less than half that size and getting smaller?

Why do we have a debt ceiling if it keeps being raised? Part of its original reason for being was to shame elected officials into having to approve increased debt caused by their increased spending. But, there appears to be no shame associated with increased debt - that's the American way of life.

High Debt and Higher Interest Rates, Higher Foreclosures

The big difference between governments and individuals is that to service the debt in a rising interest rate environment, if you're the government, you just borrow and/or print the money you need. This interview of a Texas foreclosure expert from Danielle DiMartino sheds some more light. As local foreclosure rates approach the heights of the savings-and-loan scandals of the 1980s, Mr. Roddy's depth of experience enables him to draw parallels – and distinctions – between yesterday and today.

The discussion of the relationship between unemployment and foreclosures is telling. In previous cycles, increasing foreclosures lagged rising unemployment, this being the natural sequence of events where lost jobs means lost income to make house payments. Today, with near full employment, people are increasingly unable to make their mortgage payments, begging the question, "What happens if unemployment rises?"

...

What's the biggest unknown as you look to the future?

When you add in all of the other cost-of-living increases we've seen in the last two years, it's a wonder we haven't had more foreclosures.

The scary part is, what happens if we don't start to see some modification in borrowing habits? We're not yet seeing a slowdown in the foreclosure figures; in fact, we're seeing higher numbers. Where's this going to take us? We could be in for a long haul.

Either Giants Stadium or that Sopranos Meat Grinder

The FBI came up empty once again in the never-ending quest to locate the 31-year-old remains of former Teamsters boss Jimmy Hoffa. According to this story, this time they dug up a suburban Detroit horse farm, after previously digging up a swimming pool and someone's house after bloodstained floorboards were reported.The two-week search involved dozens of FBI agents, along with anthropologists, archaeologists, cadaver-sniffing dogs and a demolition crew that took apart a barn.

The current property owner probably just wanted a new barn built and found a way to convince the an old Jimmy Hoffa associate to offer up a bogus tip, knowing exactly how the FBI would respond.

...

The FBI said 15 to 20 agents worked at the site on a daily basis during the search, with five to seven agents guarding it around the clock. The search was expected to cost less than $250,000, the agency said. The government plans to pay for the barn to be rebuilt.

Religion in Finland

Here's one of the more offbeat stories from The Economist magazine in recent memory.

Nice flower arrangement and bow.

Who said religion was dying in Europe? On paper at least, the Finns show a devotion to their national church that resembles new-world fervour more than the old continent's jaded scepticism. More than 4.4m people, or 85% of the population, are registered with the Lutheran church.

...

How odd, then, that the sugar-coated mould that has long encased modern Europe's greatest collective ritual—the Eurovision song contest—was broken by a group of Finns who set out, literally, to dress in the darkest of colours.

...

But how could the relatively God-fearing Finns allow such grotesque types to represent them? Part of the answer is that Finnish faith follows a Nordic model: a secular society combined with a state-backed church to which most people sign up, and pay taxes, because they want the clergy for weddings or funerals. That need not imply a deep belief in the tenets of Martin Luther. Like most Europeans, Finns are becoming more liberal over such things as euthanasia and homosexuality, and more free-wheeling in their beliefs. “Finns are neither very attached to religion, nor very opposed to it,” says Kimmo Ketola, a sociologist.

Kenny Boy's Blog

No, Ken Lay doesn't have a blog, but he does have a website, and it appears that he's looking way past his jail sentence, already trying to soften up that other judge that awaits at the Pearly Gates.Dear Visitor:

Wait, there is a blog there - but not Kenny Boy's. If you follow the "Blog" link from Ken Lay's page you get to this blog by a Houston attorney. Be sure to check out loyal supporter Adrienne's comment at the end of this post.

Now that my trial has concluded, I would like to offer a few brief comments.

Certainly, we are surprised at the verdict against me. Perhaps it is more appropriate to say we are shocked, as this is not the outcome we expected.

I firmly believe that I am innocent of the charges against me, as I have said from day one. I still firmly believe that to this day. I will continue to work diligently with my legal team to prove this.

In spite of what has happened, I am still a very blessed man. I have a very warm, loving and Christian wife and family that supports me, as well as many, many loving and supportive friends. I’d like to thank all of the people who have shown their concern, support and kept our family in their prayers.

Most of all, my family and I believe that God is in control and, indeed, He does work all things for good for those who love the Lord. And we love our Lord.

Thank you.

Mind the Gap

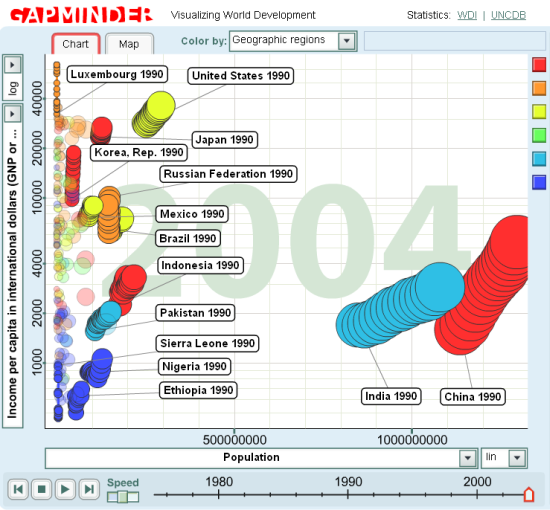

This is one of the cooler websites out there if you like to visualize data about different countries around the world and then see how the data changes over time. At GapMinder, if you plot per capita income versus population, then drag the timeline bar at the bottom, this is what you get. India and China are notable, not only because of their population, but in the different trajectories traced out over time by the income/population relationship (per-capita income rising much faster in China than in India).

India and China are notable, not only because of their population, but in the different trajectories traced out over time by the income/population relationship (per-capita income rising much faster in China than in India).

The Big Red Dots and Their Neighbors to the North

Speaking of China and its neighbors, they seem to be increasingly friendly with their neighbors to the north (the ones with all the oil and natural gas), as evidenced by this story about security cooperation.Russia and China moved to fortify their growing security cooperation in Central Asia but reassured the United States that their new-found unity of purpose in the region was not designed to subvert US interests there.

On the GapMinder website you can select military spending for one of the axes.

Russian President Vladimir Putin however acknowledged growing "competition" to a new Central Asian security organization led by Moscow and Beijing while Chinese President Hu Jintao said the new group had become an "important force" for peace and stability in the world.

...

One source who asked not to named said the US embassy in Beijing earlier this month delivered a message to the SCO (Shanghai Cooperation Organization) secretariat voicing concern that some members may regard the group as a vehicle for countering US influence in the region. This could not immediately be confirmed in Moscow.

The Big Red Dots and Internet Usage

Also at GapMinder, you can select internet usage and a number of other similar data series to see how fast China is changing in other ways - China's dots are hard to miss. This report discusses the China internet boom and how it's changing the publishing business.In China, print is being overtaken by digital dreams: at the end of last year, the country had 110 million Internet users, with 64.3 million on broadband, and that number keeps growing. Last year was also the first time revenue for the print medium dipped significantly for some companies.

They're really gettin' the hang of capitalism.

The rise of new media is being driven by a whirlwind of capital. Toodou.com, positioned as "a personal multimedia platform", raised more than US$100 million in venture capital in just 13 months after its founding.

"We are still searching for a business model that will enable us to turn a profit," said Chen Weijia, marketing director. "The cost of handling multimedia content is much more expensive. For text, thousands of words may take up only a few kilobytes, but one second of a podcast will require a few megabytes. That's why we need to set up a stable platform for our users."

Don't Forget to Send Back that Postcard Every Month

Columbia house is expanding into the lucrative prescription drug business, or so the Onion would have you believe.Music and DVD mail-order giant Columbia House is offering a new direct-mail subscription drug program for the estimated 10 million senior citizens who have not yet signed up for the government’s Medicare prescription medication plan.

Just watch out for the shipping and handling charges when you're fulfilling the terms of your original agreement - they really add up. A Celebrex fan looks over paperwork for her membership in the new Columbia House program.

A Celebrex fan looks over paperwork for her membership in the new Columbia House program.

"This is the best way to enjoy all the top medications by today’s pharmaceutical superstars at a low, low price," said Columbia House spokeswoman Sandra Farrell. "There’s no more waiting in line for the latest releases at the pharmacy, and because Columbia House sells directly to the consumer, you can kiss Dr. Middleman goodbye."

The Columbia House program, which was launched in January, offers a wide array of AARP chart-toppers and many popular prescriptions from the past through its supplementary color catalogue conveniently found in more than 400 Sunday newspapers nationwide. Qualified seniors may choose either 12 generic drugs for one cent, or five brand-name medications for 49 cents each, plus shipping and handling. Members are then obligated to buy five more brand-name medications over two years at their regular price, ranging from $12.99 to $549.99.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

6 comments:

Finland and the Eurovision Song contest

“Finns are neither very attached to religion, nor very opposed to it,”

I totally agree. I also think that one reason that we send Lordi to the Eurovision was that it is so much more fun to laugh at ourselves than at someone else. I just moved back to Finland from US and I must say that I really like peoples sense of humor here. All those pictures of monsters with the sweet Eurovision lightning and flowers are sooo funny!

i wish we americans would take our religion a littel less seriously

There is nothing wrong with religion. Until you use it to star wars and alienate people. If you can't live next door to someone of a diffrent religion, you are no better than someone who can't live next to people of another race. I say lets all have a beer together!

I'd like to remind everyone that Brazil and China still have serious problems, even though they are not declining empires as the US is.

Currently Brazil is engulfed in a huge gang war between the "drug thugs" and the "government thugs". Last time I was in the country, I experienced such delights as the police shutting down the freeways to catch drug dealers whom they suspected might be driving on them. A full third of the country is in abject poverty. There is a reason their interest rates are so high: the risk is enourmous (though I believe US interest rates should probably be similar). Brazil is still not a "serious", first-world country; even though they have done a few select smart things in their own self-interest, like becoming energy-independent.

China has its own corruption problems and speculative excessess. They have what amount to probably trillions of dollars of bad loans. Further, their imbalanced arrangement with the US does not leave them high-and-dry: they are at serious risk of a Great Depression, just as the US was at the end of the 20s in its arrangement with the UK.

I've heard lots of good things about Argentina in recent years, they seem to have figured out how the world's financial system works (the hard way) and are probably better off for it.

Wow that post from Adrienne to Kenny Boy was a doozy.

Post a Comment