There are Wonderful Opportunities Today

Thursday, June 01, 2006

What does it tell you when the largest pension fund in the U. S. hires a commodity veteran as their chief investment officer? Russel Read, set to take over the California Public Employees' Retirement System (CalPERS) today, is of the opinion that at least 10 percent of the $207 billion fund ought to be invested in things like crude oil and lean hogs or the related equities, with maybe some gold coins and silver bars thrown in for good measure.

Wait a minute - that's at least $21 billion!

It's clear that people who manage money for a living are embracing the whole idea of commodities as an investment class and, as the months go by, they are growing more and more comfortable with the thought of parking school teachers' nest eggs in things like sugar, natural gas, and nickel.

Maybe in a year or two you'll see some sort of commodity fund in your 401k plan - or at least an equity fund that specializes in natural resource companies.

~~~~~~~~~~~~~~~~~~~~~~~~Advertisement~~~~~~~~~~~~~~~~~~~~~~

As of last Friday, for the year, the Dow was up 5%, the S&P500 was up a few percent, and the Nasdaq got a goose egg - with CDs now paying over five percent in the U.S., it hardly seems worth the trouble.

Over at Iacono Research the commodity-rich Model Portfolio has achieved a hefty 23% year-to-date gain, and the best part is, aside from a well-timed rebalancing in April, there have been only a handful of trades all year. To learn more about this successful investment approach, click here.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

So, CalPERS and commodities - lots of commodities, apparently, in the months ahead. They will join a growing number of institutional investors who seem to be more scared by the future of the dollar than they are the future of copper.

According to this story($) from the current issue of BusinessWeek, it's all a matter of thinking long term - when more and more investors look out years from now, decades from now, more and more of them think their bottom line will improve by investing in hard assets.The volatile markets of the past few weeks have shaken many investors' faith in commodities. Not Russell Read. The former Deutsche Bank Asset Management investment picker, who begins his new job as chief investment officer at the $207 billion California Public Employees' Retirement System (CalPERS) on June 1, finds comfort on the tree farm he started five years ago near his summer home in Brooks, Me.

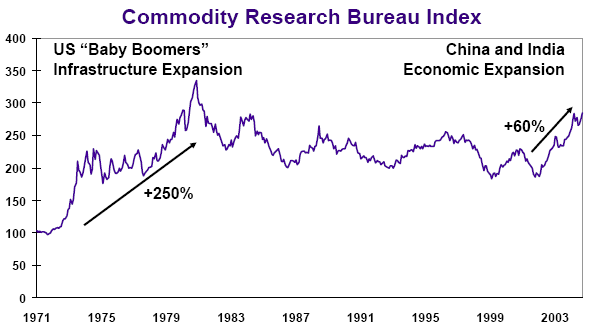

It's not clear exactly what asset classes the Ibbotson study examined, because it's hard to make the case that commodities have outperformed equities since 1971 when looking at the charts below, but commodities sure had a good run through the seventies. The farm is part of a project Read is conducting with the University of Maine to restore the land to the way it looked in the 1700s. It'll be 45 to 100 years before his 10,000 trees reach maturity, a fact that doesn't bother Read. "The investment world can be dominated by short-term thinking," says the 43-year-old. But this "is a reminder that some of the best investments can take lots of time."

The farm is part of a project Read is conducting with the University of Maine to restore the land to the way it looked in the 1700s. It'll be 45 to 100 years before his 10,000 trees reach maturity, a fact that doesn't bother Read. "The investment world can be dominated by short-term thinking," says the 43-year-old. But this "is a reminder that some of the best investments can take lots of time."

Read will need patience in his new job managing the largest and most closely followed pension fund in the U.S. CalPERS is often at the forefront of hot investment topics, from securities regulation to corporate governance. With Read, it'll wade into another controversial arena: commodities. Read says that, while crude oil, pork bellies, and the like aren't part of CalPERS' investment mix now, they will be -- soon. "Commodities [have been] fairly scary investments for most institutions," he says. But "there are wonderful opportunities today."

In March, investment research firm Ibbotson Associates released a study showing that, of the asset classes it examined, commodities were the top performer in the years since 1970. Commodities are also considered a diversification tool, because their performance does not track that of stocks or bonds. Ibbotson found that in each of the eight years in which stocks declined, commodities were the top performers. "The models are telling us a very large percentage -- 10% or higher -- should be allocated to commodities," says Thomas M. Idzorek, Ibbotson's director of research. Read agrees with that view.

And today, it feels a lot more like the early 1970s than it does the early 1990s. You keep hearing that bad word from the 1970s economy - stagflation.

Many individuals today are of the mistaken impression that investment history began when the last bull market in stocks started in the early 1980s. They have little appreciation for what happened in the fifteen years prior to that time and how that may relate to today.

Many individuals today are of the mistaken impression that investment history began when the last bull market in stocks started in the early 1980s. They have little appreciation for what happened in the fifteen years prior to that time and how that may relate to today.

They may have more appreciation for a longer view of history in another few years - individuals are always the last to adopt broad changes such as the shift to commodities, and this time will likely be no different. The change in thinking amongst institutional investors is well underway.

Yet, there are skeptics - worried that commodities are in some sort of a bubble - that the top is in after only a few years of stellar returns, where some commodities have not exceeded their nominal peak from twenty five years ago and are still far below the inflation adjusted levels seen when Ronald Reagan had his eye on the Oval Office.Skeptics worry that CalPERS is entering too late. The prices of many commodities have doubled in recent years, and investors are getting twitchy. "Right now a lot of people are struggling with the fear that they may allocating at a cyclical peak," says Bryan Decker, chief investment strategist at the consulting firm Evaluation Associates. Read acknowledges that this isn't a good time to plunge in headlong. He says he'll be looking less at the commodities themselves and more at companies and technologies that benefit from their high prices, such as oil and alternative energy producers. "It's a great time for innovation," he says. "It's as if long-dormant technologies like wind and solar power have been reborn."

It's funny that the author of this story refers to commodities as "an asset class that has already been discovered". Like that's a bad thing? It just starts getting good after others "discover" an asset class, which seems to be the case for institutional investors and commodities - most retail investors have yet to join the party.

Read's interest in commodities runs deep. His grandmother was a trader in Chicago; his father managed a chemical company. Attending high school in Houston during the 1970s oil boom, he entered a national science competition with solar panels he made from spray-on silicon. He went on to get a PhD in political economy from Stanford University, writing his thesis on the impact of natural resources on economic growth. In 1997, he helped create the first commodities mutual fund, the $2 billion Oppenheimer Real Asset fund.

Read's investment ideas blend with CalPERS' social activism. In the past, though, CalPERS got superior returns by shaking up companies other investors had abandoned. By targeting commodities, Read will have to figure out a way to beat the market in an asset class that has already been discovered.

Institutional investors, especially the ones managing the largest pension fund in the land, don't make rash decisions when it comes to allocating money in their investment portfolio - they make sound, long-term decisions, and the news from CalPERS is one of the most bullish signs for commodities yet.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

5 comments:

My 401K fund at work allows me to allocate up to 20% in a "self directed" account that has a broader choice of investment options. Although ETFs per se are not allowed, it does have funds like PRNEX that invest in resource companies (which I did invest heavily into).

Needless to say, I don't have all of my money in the 401K, and have significant ETF holdings in other brokerage accounts, as well as physical metals.

- Pete

our plan has a brokerage account also where you can buy whatever you want -- only 20% as well, but better than nuthin' -- only problem is that if you've been invested in resource companies in the last year or two, you can never add funds to the brokerage account because its gone up so much and now its like 40% of the overall account.

tim, if you are talking the early early 70s, the study may be right. the S&P in your chart looks like it went up about 14X. what was a barrel of oil price at then? under $5? if it was $5 at a certain point, it's gone up about 14X. I think it's closer than most realize. gold was made legal in the US and traded near $35 I believe. it's gone up more than 14X.

of course, what this just shows is that a balanced long-term portfolio of gold(and other commodities) and stocks, with major rebalancing at peaks(hopefully), will be a winner.

I guess it all depends on what index they used - if the index was made up of just oil and precious metals, for example it would far exceed what is shown in the CRB index which is equally weighted across 17 or 19 items many of which are food and soft goods.

20%? My 401k lets me self-direct 100%, which is what I'm doing. Most of it is already in commodities areas.

However, very few people actually self-direct, so when the 401k plans around the country start offering commodity funds, there will be a another large influx of money coming into the market.

Post a Comment