A Mid-Year Check on 2006 Predictions

Wednesday, June 28, 2006

On the first day of the year nearly six months ago, a few prognostications were proffered, duly recorded in the first post of the year appropriately titled Predictions for 2006. It's time to do a mid-year check to see how well the crystal ball was working at the time.

~~~~~~~~~~~~~~~~~~~~~~~~Advertisement~~~~~~~~~~~~~~~~~~~~~~~~

This week's ad for the companion website to this blog was slated for tomorrow's post, but when the marketing department saw how well the predictions made six months ago were holding up at mid-year, they insisted that it be placed here today - here it is.

Yes, that's right, if you're interested in investing in commodities, charter memberships are still available for the investment website Iacono Research allowing new subscribers to lock in one low rate for a lifetime. A free two-week trial offer is also available and those requesting a free trial this week will still be eligible for the rate guarantee through the end of the trial period. Click here to learn more.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

And now, on to the predictions - to see how well the future was foretold, to determine the precision of the predictive powers, and last but not least, to see if anything really stupid was dreamt up on New Year's Day.The Housing Bubble Will Not Pop

This prediction is looking good so far - forty and fifty year loans are not quite the rage that some may have expected and it's taking a long, long time for rising inventory to have a broad impact on prices, but next year is shaping up to be a whopper with ARM resets, seller capitulation after a year of skyrocketing inventory, and the widespread realization that home prices don't always go up.

Despite everything that bubble blog readers, writers, and commenters may feel in their loins, there are just too many willing lenders and too many dumb buyers out there. While 2006 homebuyers may hear something about a "housing bubble", it won't register until 2007, at which time, it might register in a very big way.

Housing is still affordable with all the wacky loan products available today and guidance is no substitute for regulation - look for wackier loan products in 2006 as the greatest fools achieve the American dream of home ownership.

Sure, the speculators are going to squeal a little, and in some of the hottest areas, don't be surprised if by the end of 2006 you see year-over-year declines of maybe 10 percent or more, but nationally, prices should be about flat to up a little for the year.

Having observed the phenomenon that is the worldwide housing bubble for a few years now, it seems that the turning of the real estate market will be akin to turning an aircraft carrier - very slow, but near impossible to stop - a long, drawn out period of flat to gently falling nominal prices with falling real prices, after maybe a fairly large jolt to the price structure in 2007.The Dollar Will Not Tank

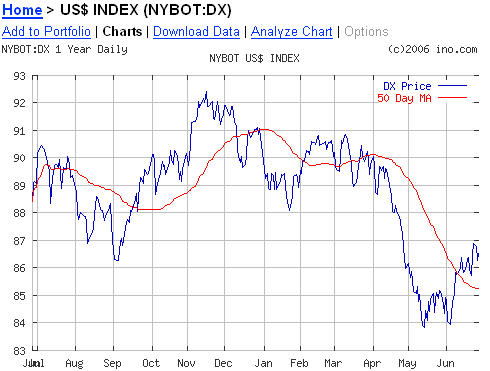

The decline from around 90 on the U.S. Dollar index is well underway, a sharp jolt back up began in mid-May as emerging markets and commodities lost their bloom. There is more work to be done here, but the low eighties by year-end looks about right.

The trade weighted U.S. dollar index (against the Euro, Yen, Pound, etc.) will resume its decline and be positioned firmly in the low eighties by the end of the year. Against commodity based currencies found in countries such as Canada, Australia, and New Zealand, the U.S. dollar will fare worse, but not by much.

After a lackluster 2005 for U.S. investors, foreign currencies and bonds should once again be a good place to park money in 2006.

After closing out some of his previous positions in 2005, when you hear that Warren Buffet has once again placed more bets against the U.S. dollar by buying foreign currencies with some of Berkshire's huge pile of cash, it will have been too late - most of the gains will already have been made. No news on Warren Buffet yet aside from him turning over his personal pile of dough to Bill Gates' charitable foundation, and what the heck is happening down in New Zealand? That currency is in near free-fall - too much of that good ol' Anglo Saxon borrow and spend consumption leading to a runaway trade deficit it appears.

No news on Warren Buffet yet aside from him turning over his personal pile of dough to Bill Gates' charitable foundation, and what the heck is happening down in New Zealand? That currency is in near free-fall - too much of that good ol' Anglo Saxon borrow and spend consumption leading to a runaway trade deficit it appears.Stocks Will Not Tank

The Nasdaq is down about five percent, while the Dow and the S&P500 average out to about a goose egg. Energy and mining stocks are up five or ten percent, and at this juncture, the Chicago Mercantile Exchange (CME) is being substituted for Google (GOOG). Are substitutions allowed?

U.S. equity markets should be about flat for 2006, with growth limited mostly to energy and natural resource companies along with some big multi-nationals. Asian markets will fare better, particularly overseas natural resource companies supplying commodities and related services in support of Far Eastern growth. Google should hit $700.

There will be a couple of nasty sell-offs in U.S. equities and a couple of miraculous recoveries - short sellers will be confounded for yet another year as Plunge Protection Team conspiracy theories swirl once again.

These market gyrations will generate only a minor disturbance in the force that is the American investor continuing to dump retirement money into a stock market that they have been trained to believe will provide for them in their golden years.

There has been nary a sign of the plunge protection team, although their services really haven't been needed here in the states - Dubai and India are completely different stories and we should look into exporting this service as a way to help square the current account deficit.

Money continues to flow into retirement funds, and many potential retirees have learned a valuable lesson about adding fifteen to twenty percent of foreign stocks as part of a diversified portfolio. Ouch!Interest Rates Will Rise Further Than Most People Think

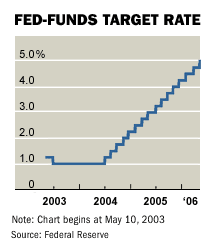

The call for a 5.5 percent Fed Funds rate appears to be spot on. At the beginning of the year, the one-and-done crowd had continued to believe that the next time would be the last time that rates were raised, with only a few bold calls for the Fed Funds rate of over five percent.

Absent any big external events, the Fed will raise rates to 5.5 percent by late 2006 and stop there. Getting to 4.75 percent is a given, as incoming Fed chair Ben Bernanke must show his mettle, but rising commodity prices and reasonable growth will have even Mr. Bernanke erring on the side of fighting inflation.

Our Asian trading partners will keep long rates fixed at 4.5 percent, so toward the end of 2006, there should be almost 100 basis points difference between the 30-year note and the Fed funds rate.

The 2006 inverted yield curve will accurately predict the recession of 2007.

Five and a quarter is a done deal for this Thursday with an outside chance of a half point hike to 5.5 percent - what happens after that is anyone's guess, but many are now guessing that the pain stops at 5.5 and everyone will just look at that number for the rest of the year.

However, with commodities doing what they've been doing this year, and with all the inflation talk that has been heard in recent weeks, Ben Bernanke may just keep raising rates through the end of the year.

The part about our Asian trading partners keeping long rates fixed below five percent was obviously in error, however, there is plenty of time left for the yield curve to invert, and long rates may head back down toward 4.5 percent later in the year if continuing weakness in the housing market accelerates.Energy Prices will Continue to Climb

The average price of oil appears to be on the mark so far (note to Steve Forbes: still waiting for your $35 oil prediction to materialize), however the thesis for a $3 ceiling on gasoline prices appears a bit shaky, at least in California, where prices have been over $3 for some time now.

Though oil will average almost $70 per barrel in 2006, gasoline prices will remain under $3 gallon. The entire world learned a valuable lesson about the American consumer and gasoline prices - nobody wants to repeat that bout of lost confidence in the Fall of 2005, and one way or another, gasoline prices in the U.S. will stay under $3.

Natural gas and heating oil will remain uncomfortably high, gently squeezing the thirty percent of the populace that do not own their own homes. Most of the population will be able to borrow against their homes, if necessary, in order to continue to heat them.

Global warming seems to have contributed to a mild winter with mild heating bills, but air conditioning costs this summer and electricity costs to operate all the sump pumps on the east coast as a result of recent rains have yet to be tallied. Stay tuned - natural gas may once again rear its head and return to double digits.Gold and Silver Will Soar

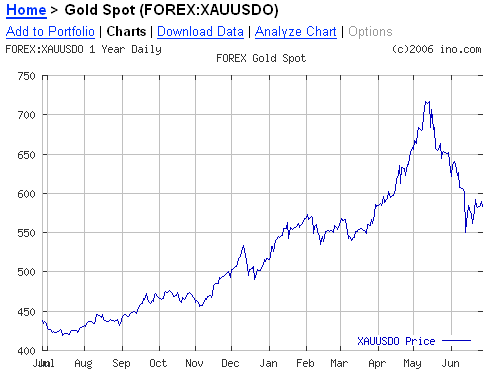

Precious metal prices did indeed soar, and then they abruptly stopped soaring - the$650 peak for gold turned out to be a bit low, but nonetheless, it was the right idea. While the recent correction was undoubtedly gut-wrenching, note that gold is still a double digit gainer for the year. It looked like it was heading for triple digits there in May, but that was quickly put to an end as a whole new generation of investors learned about volatility in the commodity markets.

One of the best places to be invested in 2006 will be precious metals - gold and silver. Look for highs near $650 an ounce with a year-end price just below that figure for gold, while silver surpasses $11 an ounce.

Shares of mining companies in general, but junior exploration companies in particular, will see huge gains as the price of the underlying metal rises. Most U.S. investors will discover these smaller Canadian companies after they land at the AMEX or announce that they are now in the uranium business, so for maximum gains, be sure to get in before they make that move off of the pink sheets and before they make their uranium announcement.

There will be at least one gut-wrenching correction that will cause many new investors to make an early exit from this sector. But, when the gold dust settles on 2006, there will be a lot more precious metal investors and prices will be much higher. Silver had an even more dramatic rise and fall, but it too boasts a year to date increase of well over ten percent while many junior mining companies went on a wild ride during the early months of the year. The wild ride that is the commodities bull market is just getting warmed up - taken out for a little test run in the early part of 2006, a long way from being over.

Silver had an even more dramatic rise and fall, but it too boasts a year to date increase of well over ten percent while many junior mining companies went on a wild ride during the early months of the year. The wild ride that is the commodities bull market is just getting warmed up - taken out for a little test run in the early part of 2006, a long way from being over.Economic Growth will Slow, Consumption will Continue

Sad, but true. Many have only two options when regarding their standard of living - cut back to levels supported by income or borrow more to maintain current levels. As borrowing more is the much easier short term solution, consumer spending will be supportive of economic growth for some time.

The still-undaunted overly indebted American consumer will continue to provide support for the American economy, however GDP growth will slow noticeably into the 2 percent range. Consumption will remain fairly strong, with an increasing portion financed by home equity withdrawal, which will be a big story of 2006.

As more and more seniors use reverse mortgages, more and more younger people will rely on home equity as a source of income. There are many trillions of dollars still available via home equity extraction, and if you think those Ditech.com commercials were annoying in 2005, you ain't seen nuthin' yet.

Advertisements for home equity withdrawal will be ubiquitous in 2006, as millions and millions of homeowners are forced to tap their housing wealth to make ends meet for a lifestyle that they can no longer afford.

Unfortunately, for many seniors, the lifestyle that they can no longer afford consists primarily of paying for prescription drugs and heating their home.

Has anyone ever calculated the frequency that Ditech.com commercials appear on CNBC? They must be airing ten spots an hour throughout the day, every weekday, on every cable channel, for every cable company, in every state in the country. The ads are not so much for home equity lines of credit, but rather to refinance at a fixed rate, taking out cash - the era of the HELOC appears to be about over as they have been revealed as just another adjustable rate mortgage.Reported Inflation will Remain Contained

The proliferating measures of inflation have certainly come to pass (see yesterday's post), but the talk about inflation and inflation itself no longer seem to be benign.

Reported inflation for 2006 will once again be benign. Three new measures of consumer prices will be developed and widely publicized in the new year - they will all measure inflation at around two percent.

Long-term inflation expectations will remain contained.

There will be a growing chorus within the mainstream financial media that question the continuing rate hikes by the Federal Reserve while reported inflation remains under control. A new commodity based inflation indicator will be developed, showing inflation near twenty percent, but most economists and the mainstream financial media will pay little attention.

Ben Bernanke will awkwardly refer to this commodity based inflation indicator during a Q&A session before a Congressional subcommittee, sparking a $25 rise in the price of gold the next day.

The July testimony by Ben Bernanke on Capitol Hill should be fun to watch - lots of elected officials will be asking why interest rates are still being raised if inflation is only two percent while continuing to be overstated by 0.8 percent, according to our new Fed Chief.

The part about the commodity based inflation indicator was apparently a joke, although a $25 rise or fall in the price of gold doesn't seem like such a big deal six months into 2006.Job Growth Will Slow

The mass migration to rebuild the Gulf Coast appears to have come from the South rather than the North. As for the perpetual cycle of destruction and rebuilding, we'll see - the water in the Gulf of Mexico is warm and getting warmer.

As nationwide residential construction employment levels out and begins reversing, Gulf Coast re-construction employment will take up the slack. There will be a mass migration of sorts, from the Rust Belt to the Gulf Coast for those seeking steady employment and a better way of life.

More hurricanes will cause more destruction later in the year and more re-construction will be planned. This cycle will continue for many years, providing stable employment for hundreds of thousands of workers who otherwise would be unemployed.

Retail sales and food service jobs will continue to be available as homeowners continue to tap their home equity in support of the lifestyle to which they have become accustomed. Overall, employment will slow, but not by much.There will be Major Unrest Somewhere in the U.S.

This one sounds dangerous - as the temperature rises across the land, let's hope that it doesn't come true, and if it does come true that it does so far away from here.

Somewhere within the continental U.S. there will be major unrest - likely in either the Gulf Coast or the Rust Belt. It will look a little like recent events in France or Australia, except that, with ready access to handguns, people will be shooting at each other.

In part, the unrest will be spurred by a growing realization by many people that their experience in the world is not matching what the government is telling them it is.

As the gap between rich and poor widens, and as the middle class and senior citizens are squeezed, more people will question the oft-repeated proclamations that our economy is strong and that inflation is not a problem.

More people will attend church and more people will buy handguns

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

4 comments:

those ditech.com commercials are friggin' annoying and you can't get away from them, their everywhere

Your construction employment thesis may not pan out very well this year. Builders may accelerate construction to get their inventory finished and onto the market faster than originally planned, before prices decline further, requiring a few more drywallers and concrete pourers this year, but many less in 2007.

In past California housing busts, y-o-y prices did not decline significantly the 1st year fall owing the peak. However, the 2nd year fall owing the peak registered declines of up to 30%.

To add to the predictions. Expect some bad news from CHINA. The economy doesn't seem to respond to the government moves. This could be ominous for the commodity market.

Post a Comment