Thank You, Sir, May I Have Another?

Thursday, June 29, 2006

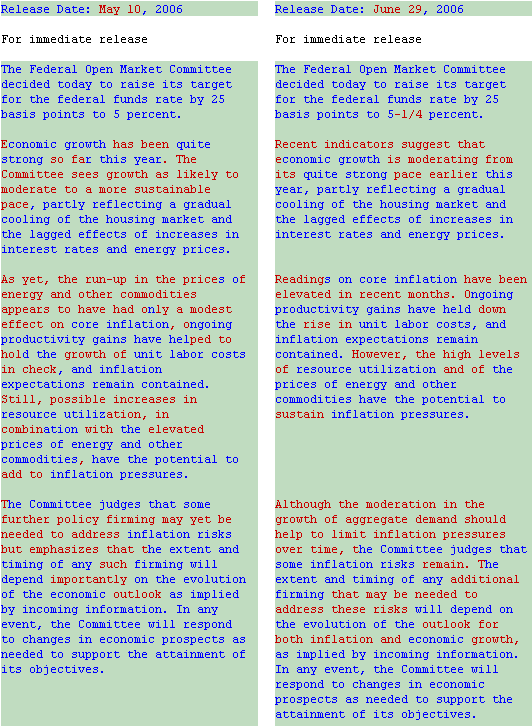

To no one's surprise, the Fed Funds rate was hiked another quarter point today, now settling in at 5.25 percent - we can all reset our six week countdown timers for the August 8th meeting and watch how the markets respond to the wording of the most recent statement.

There were a few subtle differences in the text. For example, economic growth went from "has been quite strong" and "likely to moderate" to this month's present tense "is moderating from its quite strong pace", an apparent acknowledgement of the weakness in the myriad of economic indicators that everyone else has been looking at. Last month, rising prices had "only a modest effect on core inflation" whereas this month, core inflation is "elevated". The operative phrase "inflation expectations remain contained" stays intact - comfort and security on the future inflation front apparently assured for another six weeks by a broken bond market and the many survey respondents who primarily react to gasoline prices amid the confusing staccato of inflation statistics emanating from the nation's statisticians and central bankers.

Last month, rising prices had "only a modest effect on core inflation" whereas this month, core inflation is "elevated". The operative phrase "inflation expectations remain contained" stays intact - comfort and security on the future inflation front apparently assured for another six weeks by a broken bond market and the many survey respondents who primarily react to gasoline prices amid the confusing staccato of inflation statistics emanating from the nation's statisticians and central bankers.

The last paragraph is probably the most interesting. The phrase "further policy firming may yet be needed" was dropped in favor of the hope that the developing economic slowdown will quell inflation - "moderation in the growth of aggregate demand should help to limit inflation pressures over time".

And naturally, we remain data dependent.

The real progress made this month had to do with the elimination of the word "yet", thank goodness. Nobody knew what was meant by, "further policy firming may yet be needed".

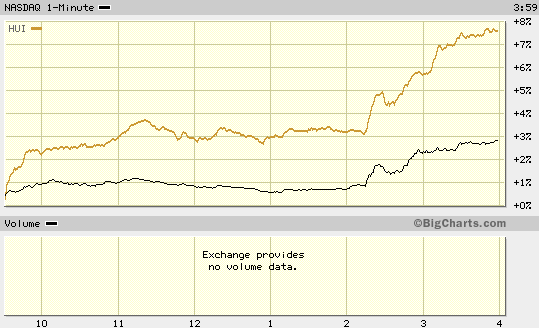

It appears that tech stocks are taking the news quite well so far, of course, not nearly as well as gold stocks.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

1 comments:

Perhaps another 25 basis points would be implemented as inflation still lurking behind and any rise in CPI as well as Core CPI would have immediate effect on FOMC to move up on the short term interest rate....

Steven Soh

Post a Comment