Friday Lite

Friday, June 30, 2006

Well, now things are starting to get interesting. Despite the spanking they took last month, financial markets are all atwitter with the prospect of no more interest rate hikes after what many interpreted to be dovish remarks accompanying yesterday's Federal Reserve policy meeting where short term interest rates where raised to 5.25 percent.

It's about time they stopped raising interest rates - we Americans have gotten used to our credit plentiful and cheap. Short-term rates at just over five percent may already be too much to bear.

Ben, For God's Sake, Please Stop!

Bloomberg reports the results of a poll taken recently in which Americans have voiced their strong objection to the rate raising madness that Ben Bernanke has embarked upon in his short tenure at the Federal Reserve.The American public has turned against the Federal Reserve's two-year campaign of interest-rate increases, concerned it may hurt the economy by slowing growth, a Bloomberg/Los Angeles Times poll shows.

In case Rose hasn't been paying attention, it's not the credit cards that have been the problem in recent years, in fact until very recently, credit card debt had been declining. It's been the borrowing against the house to pay off the credit cards that will ultimately come back to haunt homeowners who somehow believe that they all simultaneously hit the Lotto because they happened to own real estate. By a 65 percent to 22 percent margin, Americans oppose another rate increase by the central bank, which says such moves are necessary to counter inflation.

By a 65 percent to 22 percent margin, Americans oppose another rate increase by the central bank, which says such moves are necessary to counter inflation.

...

"Anything we could do to not put the brakes on it at this particular point would be a good thing," said Steven March, 35, a Web designer from Mooresville, North Carolina, and one of the 1,321 people surveyed in the poll. March said he refinanced his mortgage in February, paying a higher rate than he would have a couple of years earlier.

...

Rose Marie Heater, a retired manager from Quincy, California, said she supports higher rates because they will encourage people to save more and use their credit cards less.

"It would slow down some of the spending of the young'' and make them more responsible over the next 20 years, said Heater, 62, who considers herself a political independent.

The survey showed that higher income individuals were less opposed to the rate hikes than middle to low wage earners and college graduates less opposed than those without degrees. Next month's congressional testimony by the new Fed Chairman should be fun to watch as he is likely to get an earful from at least a couple elected officials about why interest rates keep going up when inflation expectations are so well contained.

Gold, the Dollar, and Containment

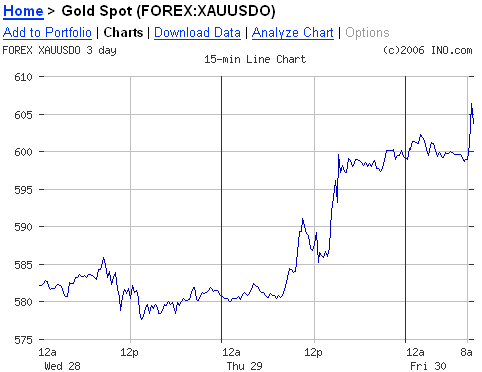

So, what does it mean when the Fed Chairman makes dovish statements regarding interest rate policy and the gold price shoots up more than $25 over 24 hours? Maybe inflation expectations aren't so well contained.

Maybe inflation expectations aren't so well contained.

One look at how the dollar responded yesterday and you'd have to think that the dollar isn't so well contained either. It didn't take long for either gold or the dollar to respond to the policy statement released yesterday at 2:15 PM EST, and they are continuing to respond today. Let's hope this isn't another case of the new Fed Chairman being misunderstood, and we're going to hear tough talk about inflation for the next few weeks.

It didn't take long for either gold or the dollar to respond to the policy statement released yesterday at 2:15 PM EST, and they are continuing to respond today. Let's hope this isn't another case of the new Fed Chairman being misunderstood, and we're going to hear tough talk about inflation for the next few weeks.

Is Larry Summers Helping or Hurting?

As if Ben Bernanke doesn't have enough to worry about trying to figure out how to stop raising interest rates while at the same time avoiding a collapse in the world's reserve currency, according to this report, Larry Summers is out on the lecture circuit encouraging our creditors to get rid of their U.S. dollars.A leading Chinese central bank official said that countries around the world should gradually rely less on the U.S. dollar for trade and their foreign exchange reserves.

Mr. Summers has been telling foreign holders of Treasury bills that after inflation and currency exchange are properly accounted for, their return "will be zero". Is this helping or hurting? It's hard to believe that this is part of some coordinated effort - he is probably of the belief that if the Asian currencies rise in value relative to the dollar, many of the world's problems will be resolved. If only it were that simple.

The remark comes after the repeated suggestions by former U.S. Treasury secretary and president of Harvard University, Lawrence H. Summers, that the world's biggest holders of U.S. Treasury bonds ought to find better ways to invest their hard-earned money.

Countries around the world should gradually rely less on the dollar for trade and their foreign exchange reserves, a Chinese central bank official said in comments. "Internationally speaking, the situation of over-reliance on a certain country's currency for international trade, settlements and reserve assets should be gradually changed," Wu Xiaoling, deputy governor of the People's Bank of China, said in remarks reported by the Financial News on Tuesday.

Those Were the Days

This arrived in the mail the other day - it could not have been stated better.To all the kids who were born in the 1930s, 40s, 50s, 60s, and 70s

Can't help but think of that classic Frazier episode that opened with Niles fully dressed except for his pants, ironing them just before he was set to go out, running to get the scissors, catching himself then walking, then one thing led to another with bleeding, fainting, and fainting again, but he would always catch himself when running with the scissors and slow to a walk.

First, we survived being born to mothers who smoked and/or drank while they carried us. They took aspirin, ate blue cheese dressing, tuna from a can, and didn't get tested for diabetes. Then after that trauma, our baby cribs were covered with bright colored lead-based paints.

We had no childproof lids on medicine bottles, doors or cabinets and when we rode our bikes, we had no helmets, not to mention, the risks we took hitchhiking. As children, we would ride in cars with no seat belts or air bags.

Riding in the back of a pick up on a warm day was always a special treat We drank water from the garden hose and NOT from a bottle.

We shared one soft drink with four friends, from one bottle and NO ONE actually died from this. We ate cupcakes, white bread and real butter and drank soda pop with sugar in it, but we weren't overweight because

WE WERE ALWAYS OUTSIDE PLAYING!

We would leave home in the morning and play all day, as long as we were back when the street lights came on. No one was able to reach us all day and we were O.K.

We would spend hours building our go-carts out of scraps and then ride down the hill, only to find out we forgot the brakes. After running into the bushes a few times, we learned to solve the problem.

We did not have Playstations, Nintendo's, X-boxes, no video games at all, no 99 channels on cable, no video tape movies, no surround sound, no cell phones, no personal computers, no Internet or Internet chat rooms..........WE HAD FRIENDS and we went outside and found them! We fell out of trees, got cut, broke bones and teeth and there were no lawsuits from these accidents.

We ate worms and mud pies made from dirt, and the worms did not live in us forever.

We were given BB guns for our 10th birthdays, made up games with sticks and tennis balls and although we were told it would happen, we did not put out very many eyes. We rode bikes or walked to a friend's house and knocked on the door or rang the bell, or just yelled for them!

Little League had tryouts and not everyone made the team. Those who didn't had to learn to deal with disappointment. Imagine that!!

The idea of a parent bailing us out if we broke the law was unheard of. They actually sided with the law! This generation has produced some of the best risk-takers, problem solvers and inventors ever!

The past 50 years have been an explosion of innovation and new ideas. We had freedom, failure, success and responsibility, and we learned how to deal with it all!

And YOU are one of them! CONGRATULATIONS!

You might want to share this with others who have had the luck to grow up as kids, before the lawyers and the government regulated our lives for our own good.

And while you are at it, forward it to your kids so they will know how brave their parents were. Kind of makes you want to run through the house with scissors, doesn't it?!

Friday Lite Goal Update

First the bad news. We are stuck in the mud, so to speak, making no progress in the quest to lock down the top spots on all three major search engines for the phrase, "Friday Lite".

As was the case a few weeks back, MSN Search, the search engine that in months prior had been so favorable to this blog (see here and here) has become extremely uncooperative, opting to position Strategic Public Relations and The View from Her before any of the fare offered here.

Again this week, it's #1 at Google, #1 and #2 at Yahoo!, and #3 or #4 at MSN depending upon where lite 96.9 - Contests shows up.

The good news regarding goals previously set on Fridays (see section titled A New Goal) is that getting mentioned in the Wall Street Journal turned out to be not nearly as difficult as getting the #1 spot at MSN. Previously noted here, the WSJ mention is being brought up again today just to tie-off on our Friday goal progress.

In fact, upon further consideration, both of these goals are going to be checked off today as complete - the MSN search engine has always been a bit quirky, and now that Bill Gates is easing away from day-to-day operations, little things like this may never be resolved.

It's time to move on to a new goal or two - stay tuned.

Iacono Research Goes Mainstream

Jim Bednar, host of the Northern New Jersey Real Estate Bubble passed on this interesting story from the New Jersey Star Ledger. It seems there's a debate going on about how inflation is measured and look who gets quoted. "In a strange twist of fate ... as short-term interest rates continue to be pushed up, what has in recent years suppressed "core inflation" -- declining demand for rental units while nearly everyone was out buying up real estate -- is now working against central bankers," said Tim Iacono, the founder of California-based Iacono Research, a firm that provides market commentary and investment advisory services.

Wow - impressive - quoted right after Dean Baker, co-director of the Center for Economic and Policy Research in Washington.

Iacono said taking a look at year-over-year core inflation -- minus housing rental costs -- "it is clear that ... core inflation has been essentially flat for some time now."

"So what's the rationale for continuing to raise rates to fight this kind of "inflation?" Iacono said. "Wouldn't it make more sense to lower rates, so more renters can become homeowners and existing homeowners can refinance at lower interest rates, removing all the recent excess demand for rental housing, thus forcing owner equivalent rents back to a benign state? Isn't raising rates now a perfect example of how not to fight "inflation?"

As we are now far from the top of the page, here's a link to the Iacono Research website and one to the welcome page - just in case any readers want to take advantage of the lifetime rate guarantee offer before it expires tomorrow.

Around and Around She Goes

In the now customary closing story from The Onion, we find that a Baggage Handling Mix-up resulted in a dirty bomb taking an extended vacation without its owner around the country's most popular airports.Even in the air-conditioned confines of New York's John F. Kennedy Airport back on June 14, Abu Basir Yousef was sweating.

We just booked tickets on U.S. Airways for an October trip to the east coast - the black duffel bag stays at home.

His sole piece of luggage—a black duffel bag—was lost upon his arrival in New York. Despite hours of waiting, and several U.S. Airways check-in counter workers and Transportation Security Administration screeners joining in the search, the Yemen-born 32-year-old had yet to hear any positive updates. Finally, a baggage claim representative approached him.

Despite hours of waiting, and several U.S. Airways check-in counter workers and Transportation Security Administration screeners joining in the search, the Yemen-born 32-year-old had yet to hear any positive updates. Finally, a baggage claim representative approached him.

"Afraid I've got some bad news," the worker said to Yousef.

Airline personnel had searched the plane, the tarmac, and the gate, but were still unable to locate his bag containing his homemade dirty bomb.

"My trip was ruined," Yousef said.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

5 comments:

Tim,

When you link to your Friday Lite top-spot nemeses, you actually help them. Unless they link to you, you're giving them an asymmetric advantage such that, all other things equal, you can't beat them.

Doh!

Doesn't that jump in the price of gold measured in US$ look like the reciprocal of the drop in the dollar? There are not two variables (inflation and the dollar) that are ill-contained. There's just one, the dollar.

Anon 9:51,

The gold chart (~4% gain) looks the same as the US$ chart (~1% drop) because the scales have been skewed to highlight the change. You might be able to establish a correlation between the charts, but it'd be pretty cavalier to try to do that with the 3 days of data shown here.

Perhaps the fed should restate inflation numbers for the last 5 years, taking into account the true price for housing, and not rents. Then re-adjust rates accordingly to 10% OMFG

Post a Comment