I've Never Been Behind Like That

Monday, July 17, 2006

This article brings back a few memories for me since a commute similar to the one featured in this story was part of my weekday routine back in the early 1990s - back before there were carpool lanes or a zillion houses along many of the Southern California freeways.

In fact the gentleman profiled in this story reminds me of an amiable fellow of similar age who lived down the street at the time. Of course, that was a different era - instead of an endless truck driving career, the soon-to-be retired mechanic down the street was just a couple of years away from a generous pension from a major defense contractor.

Many comments have been offered at this blog before about how high energy prices are affecting the middle and lower income crowd, Elizabeth Douglass at the L.A. Times does a nice job of relating how rising gasoline costs and debt service are affecting a few Southern California residents.Stopping for gas on a recent evening commute, Joseph Godino paused to make a call before feeding his credit card into the pump's built-in reader.

Joseph is like many other Americans who now find themselves squeezed by higher energy costs and higher debt service. Not more than two years ago, when interest rates were at 40 year lows and energy was cheap, everyone looked around and figured they were finally doing something right - the prosperity that had eluded them during the rise and fall of the stock market had finally arrived at their doorstep in the form of housing prices that were rising at annual rates far exceeding the median income in this part of the country.

He listened as a recorded voice delivered welcome news: His card still had $88 of credit available.

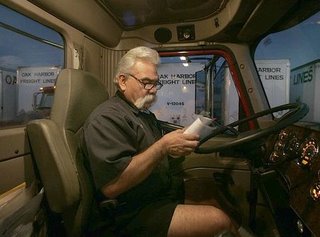

The gas-up was a go. "I had to phone up to find out if I had enough credit on there to fill up," said Godino, 58, whose workday round-trip commute is a whopping 200 miles.

"I had to phone up to find out if I had enough credit on there to fill up," said Godino, 58, whose workday round-trip commute is a whopping 200 miles.

"The gas is just really hurting me. I don't know what to do…. I can't quit my job or I'd lose my house."

Godino, an Apple Valley resident whose truck driving job is based in Buena Park, signed up for extra shifts and financial counseling, and his wife went back to work to add income. But he has fallen further behind. With his gas cards maxed out, Godino has switched to filling his tank using a Visa card.

California's sky-high gasoline prices are slamming Godino and other motorists who had been barely getting by. Californians, saddled with the nation's priciest gasoline outside of Hawaii, are paying more than 70 cents a gallon extra compared with a year ago and nearly $1 more than two summers back.

Two years later they must feel as though they've been duped.

It all probably makes sense to economists who look at statistic after statistic and today still feel that the ultra-easy lending that fostered the housing boom was the right thing to do. After the stock market boom turned into a bust, something needed to be done.

But, for people like Joseph, monetary policy means little.

He's having a tough time making ends meet and he may end up losing his home - a home far away from work that in prior decades he probably wouldn't have been able to afford. But, with the bubble economy that has developed in the last ten years or so, he was just doing what everyone else was doing.

From Joseph's point of view what has happened in recent years will ultimately seem so unnecessary - he probably would have been content to carry on as he was doing before he bought a big house far away from work when gasoline was still cheap.

This story relates a few other accounts of individuals who are being squeezed today - some going to pawn shops in order to get money to fill up their tank. This piece is well worth reading in its entirety - well written and a bit touching actually. It's easy to picture the pawn shop operator telling someone that their DVD player is of no value to them, then buying five DVDs for a dollar apiece, something for which the owner probably paid $15 or $20 each not more than a year ago when money flowed more freely.

It's as if there was a conscious decision made at the highest levels of economic policy making where it was decided that we're going to screw all the middle and lower income folks - trick them into borrowing lots of money and they'll go out and spend it and the economy will be revived and somehow things will all work out.

This is the legacy of Alan Greenspan - Joseph Godino. A mostly innocent bystander in the train wreck that is contemporary monetary policy and global finance.He tried to refinance his mortgage earlier this year, but it fell through after he had shelled out a $400 appraisal fee and used the monthly mortgage payment to whittle down credit card debt. Suddenly behind on his mortgage, Godino saw his monthly payments balloon to $2,300 from $1,800 to make up for the deficit and stave off foreclosure.

Joseph says, "I've never been behind like that".

"I've never been behind like that," said Godino, a Vietnam veteran who has spent 38 years as a truck driver.

He moved to the high desert two years ago because he was unable to afford a home closer to work. At the time, Godino's Volkswagen Beetle was getting good mileage and his employer, Oak Harbor Freight Line, was talking about opening a terminal near Apple Valley.

But the Volkswagen got totaled in an accident, forcing Godino to commute in his less-thrifty Ford Ranger pickup. His monthly fuel bills have jumped to $650. And so far, Oak Harbor hasn't opened that inland terminal.

"The commute is killing me," he said. One oil company credit card has a balance of more than $1,000. His wife cut up the other one.

"There's more money going out than coming in," Godino said. What's more, the Oak Harbor terminal where he works is moving to a larger site in Montebello at the end of July.

"It's farther," a dejected Godino noted.

Well, there's a good reason for that - money's never been so easy. Easy money has been the cure for what ails the economy for some time now - borrow more and spend more.

The economy booms, asset bubbles inflate, and everybody wins - for a while.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

16 comments:

i keep hearing more stories from friends and family about people scratching their asses to make ends meet

Looks like many unfortunate folks like Joseph are learning an expensive lesson in basic personal finance: it's not all about the monthly payment.

I fear this is only the tip of the iceberg. Joseph is not alone.

What ever happened to personal responiblity. But, but the Gov't. But, but interest rates. No one forced him to make thoughs choices.

People assume stability in prices. And when it comes to houses people are told to buy as much house as they can which eats into the cushion they should have.

And the stupid part is they keep voting Republican.

Sigh.

Toys are coming down in price. Those who have cash will be rewarded. To those that lose, sorry. So sorry. But do not expect the gov't to bail you out. the gov't is also broke and is dependant on foriegners to bail them out.

I often wonder about the personal responsibility issue. At what point should government and business prevent people from doing stupid things (e.g., risky home loans), and at what point should it do things for them (e.g., pensions for retirement savings)? So far, less regulation in mortgage lending and more responsibility on the individual to save for retirement are turning out to be colossal failures for the population as a whole.

"less regulation in mortgage lending...turning out to be colossal failures"

But, Republicans state that less regulation is better? You mean that Americans have been sold a lie by the Repubs?

I once had a quick commute to work and so did my husband. We could afford the mortage (we did fixed rate, with 10% down and paid 104k). What we couldn't afford were the continuing raises in property taxes and the costs for utilities. We sold out, moved to 2.5 acres in the woods without electricity. Husband has an oncall job and I took a $4 an hour paycut. I also commute 50 miles round trip AND pay Oregon state taxes. Since I bought the car when I made a 90 mile commute, I'm managing the commute but just barely. I think you will start to see other folks who can't afford gas and find they can't afford things like electricity and heat either. At least I can raise more of my own food now and can heat with wood. I'm hunkering down for hard times. (And my old job just started outsourcing. I am glad I left when I did.)

Anonymous said...

"less regulation in mortgage lending...turning out to be colossal failures"

But, Republicans state that less regulation is better? You mean that Americans have been sold a lie by the Repubs?

********************

It's not a red/blue issue. It's the Federal Reserve and the Greenspan years that made this mess. Please try looking at the bigger picture. Visit www.mises.org for further economic insight.

Maybe privitizing Social Security, putting the investment decisions in the hands of the people, is also not such a hot idea. people are just not going to win when the crooks see that there is money to be taken away.

Wait a second anon 10:04; are you suggesting that John Sixpack and Suzie Homemaker (folks that never went to college, or worse yet, went and recieved no financial or mathematical education) are somehow incapable of protecting themselves from financiers and charlatans (Enron, Adelphia, Fannie Mae, etc)?

That sort of logic flies in the face of fundamentalist Republican beliefs. Stop protecting the sheep from the "ownership society" so decent wolves everywhere can slaughter the surplus population.

If you had it your way, we'd be some sort of "nanny state" with police, firefighters, health care, roads, and education. That is clearly NOT the 'Mer'kan way. You must be one of those tree-higging, gay, aborted, peacenik, intellectual liberals I keep hearing about. Next you'll be wanting people to have Christmas off!

No, I am not one of those liberals(although I am watering my beloved trees to weather this hot spell.) My point is that it is hard to invest and have a good probability of winning in this market. The market is run by crooks for crooks.

Honestly, a different view upon our current retirement system / mess. Is that becuase everyone belived so much in a social safty net for their retirement, no one bothered to save enough or even to attempt to figure out How they would pay for retirement. they just assumed that someone else would cover them (Government, former employer, etc)

If we privatize our retirement then people will know from the start that they need to save, and we will save our country from future messes.

Its definatly not a Blue/Red issue greenspan had been in office for a long time. (BTW i'm a Libertarian - the party of principle)

Alex

But, a lot of people will never be in a position to save much. My position is that I've worked hard and taken advantage of the opportunities presented to me and things have worked out pretty well. A lot of others have worked a lot harder, but will never get the opportunities to really advance.

So, I don't mind paying a bit more of my income so everyone will have some basic quality of life when they can no longer work. I don't want to see old people homeless and eating cat food like it was before social security.

BTW, privatizing social security is 100% about making wall street richer. Right now the management fees for social security are way, way below what wall street would be charging.

The best way that I've figured out to look at the current administration is in terms of wealth transfer. The goal is to transfer as much wealth from the bottom 99% to the top 1% that they can get away with. Everything they have done makes sense if you look at it that way. The income tax cuts, the bankruptcy bill, repeal of the estate tax, cuts in dividend tax, not raising the minimum wage 9 years, the list goes on and on.

It just mistifies me that people keep voting for candidates who are toatlly screwing them.

[/rant]

Scott

Post a Comment