Monopoly Money, Monopoly Houses

Monday, July 31, 2006

This story about the Phoenix housing market was a refreshing read, not just because of a job well done by the reporter, Glen Creno, but for the candor of those who were interviewed for the piece - both the realtors and homeowners.

The last few years of Holly and Aaron Mueller's finances will be analyzed in a minute, but first it is the story of the lady flipper who dropped by the real estate office of Brett Barry that inspired the title of today's fare.A woman walked into Barry's Realty Executives office about nine weeks ago, sat down and began crying. She said she bought two houses last year, fixed them up and quickly sold them, making a $50,000 profit on each.

On one hand you feel that the lady flipper got what she deserved, while on the other hand you think that our bubble economy has caused ordinary people to do extraordinary things - in this case, as it turns out, extraordinarily dumb things.

She was a novice investor, but it all looked easy. She took her profits, threw in some extra money and bought five more houses. She spent money fixing them up, but when she put the houses on the market, she realized she had bought at the peak, Barry said.

"Her eyes just started to well up, and she just started bawling," Barry said. "She said she couldn't sell them for what she bought them for. She said her monthly payments were about $20,000."

Barry suggested turning them into rentals. She told him she couldn't get enough rent to make it worthwhile.

"She was expecting to flip them," he said. "The market flipped her. She was devastated. People have forgotten that houses are not a liquid asset. They never were meant to be."

Absent anyone acting to regulate mortgage lending or interest rates in recent years, one can only conclude that the nation's real estate market has been a lot like playing Monopoly to many people. A fun game with funny Monopoly money used to purchase funny Monopoly houses - two at a time, five at time - while the players keep going around and around, rolling the dice, until people start going bankrupt.

You'd think that if the lady flipper had been able to sell the five homes, she would have then gone on to purchase a big red hotel.

This is the Alan Greenspan legacy - good luck Ben.

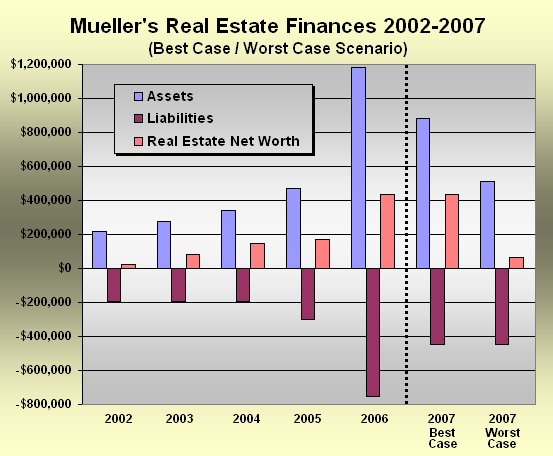

On to the finances of the Muellers. Enough detail was provided in this story that a chart can be whipped up to better demonstrate what the Phoenix real estate market has done to the finances of one couple, and where their finances may be headed.

The couple was brave enough (or, insert alternative adjective here) to share their story and many of the specifics with a local reporter. Here are the facts and figures as they appear in the report.

Holly and Aaron Mueller have indeed been busy - buying and selling property in Phoenix and then in Minneapolis. Buying a second home in the last year without having sold the first may be their undoing.

Using estimates such as paying ten percent down for all purchases, paying cash for the upgrades, and closing/moving costs of $30,000 per real estate sale, their recent history can be charted along with a best case and worst case scenario for the sale of the Arizona property and the future value of the Minnesota house. The specific numbers are not all that important - obviously the worst case scenario for 2007 above includes a steep decline in value for both properties while in both scenarios, the debt remains the same.

The specific numbers are not all that important - obviously the worst case scenario for 2007 above includes a steep decline in value for both properties while in both scenarios, the debt remains the same.

That is the key point here, as the chart above is representative of the nation's finances. In recent years debt has skyrocketed, but it hasn't been a problem because real estate values across the land have risen even faster. This all works out swimmingly as long as asset prices continue to go up, as stocks did in the late 1990s.

But when the assets stop rising and then reverse course, and the debt remains - there are problems.

The best case scenario above includes the sale of the Phoenix home at the current asking price, in which case, the note is paid off and the Mueller's pocket a few hundred thousand dollars to go along with the half million dollar Minneapolis house and a $400,000+ mortgage.

As the story references two mortgages on each of the current homes, the debt assessment above may in fact be shining a too-favorable light on their current situation.

The worst case scenario includes a precipitous decline in price on the Phoenix home prior to someone signing on the dotted line, along with a lesser drop in the value of the Minneapolis home. Despite the assessment ($710,000?!?), having paid $373,000 in 2005 and despite having invested another $60,000 in upgrades, the odds of getting anywhere close to the current asking price seem to be pretty slim.

That would be a 50 percent increase from 2005 to 2006. In Phoenix.

In fact, if they were smart, they'd probably go directly to something like $550,000, or even lower, and get rid of the thing as quickly as possible. Human nature being what it is, it is indeed possible that the Muellers will ride the market down for the foreseeable future, settling for a much lower price sometime next year.

It happened all over California in the early 1990s, and it will quite possibly happen all over the country this time around. There is an uncomfortable finality about settling for something far less than your initial expectations - it is many times easier to delay defeat than to accept it.

The bars hanging below the zero axis in the chart above are the ones that are most interesting. Back in 2002, after the purchase of a modest home, did this couple have any idea that they'd have almost a half million dollars in mortgage debt five years later?

And, did they ever consider the possibility that their fast growing net worth in 2004 and 2005 - $200,000, $300,000, $400,000 - could possibly reverse course?

Apparently not.

Like many other Americans the Muellers were emboldened by the three or four years of recent real estate history. Fearless and confident, purchasing a second home without having unloaded the first, they are wished good luck and advised to cut their losses as quickly as possible. This is likely just the beginning.

They are like many, many Americans in 2006, finding out the hard way that this is real money spent on real houses whose value is determined by a market that is changing rapidly.

This is not Monopoly.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

4 comments:

this guy thought it was a FUN article:

http://www.bloodhoundrealty.com/BloodhoundBlog/?p=156

Interesting.

Schultz suspects market manipulation

The International Harry Schultz Letter's portfolio has gained up 94.9% over the past 12 months according to the Hulbert Financial Digest, vs. 9.8% for the dividend-reinvested Dow Jones Wilshire 5000.

Schultz hasn't always shown up so well in the Hulbert ratings, although over the past five years his portfolio has appreciated at a 21.31% annualized rate, vs. 4.02% annualized for the DJ Wilshire. But he has been around a long time, nearly four decades.

Schultz's latest letter arrived Sunday night. He offers this acid assessment of the recent rally: "There is a paradox in market prices as I write. We have gold, U.S. dollar, oil and most stock market indexes all showing a readiness to move up. It is an illogical combo. It may be a temporary fluke or it may be there's manipulation of the indexes going on."

Schultz, never afraid of a radical idea, takes manipulation seriously. He says: "It is fairly easy to manipulate stock indexes via just three or four blue chips, and the multinationals appear in several indexes. We've seen it before. Most stock markets were in virtual free fall and suddenly reversed into reverse head-and-shoulders buy patterns. This is a rarity. The U.S. dollar index may also be subject to manipulation."

http://www.marketwatch.com/news/story/Story.aspx?guid=%7B88655570%2D6211%2D4954%2DB878%2DB86C52BCC3C3%7D&siteid=

Somebody found a Gold Nuget and then the all the Fool's rushed in !

One hopes there are a few of these so the damage is concentrated and is not so widespread as it would otherwise have to be to accomplish the same result.

Post a Comment