Pondering a Pause

Tuesday, August 01, 2006

Econobloggers across the land are betwixt and between, wondering what their fearless leader will do one week from today when he next convenes the venerable Board of Governors of the Federal Reserve. Right now it looks like a pause.

But, inflation is not contained!

Slowing growth will tame the inflation monster.

But, how can we be sure?

The inflation is not a result of rising wages, don't worry.

But have we tightened enough?

We'll know in six to nine months.

Have we tightened too much?

We'll know in six to nine months.

What if we can't wait six to nine months?

Uh ...

As always, with another FOMC meeting approaching, economists with blogs are pondering the possibility of a pause, attempting to read the minds of the members of the Federal Reserve as the hours tick down to the next monetary policy announcement - as this goes to print, only 172 hours to go.

Absent statistics on the subject to enable a clear determination, it sure feels like this is the closest we've been to an upcoming Fed meeting where the outcome had not already been known. Not in recent memory, it seems, was there such uncertainty with just a week to go.

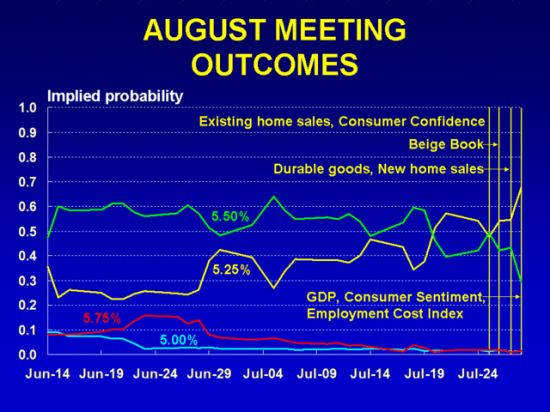

According to David Altig at Macroblog, there's a little less certainty now than just a few days ago. With a timely update to his Fed funds futures probabilities, it appears that Friday's weak GDP number has trumped the 2.9 percent annualized change to core PCE - now a pause is preferred by a margin of about 68 to 30. Not once in the last four weeks has either outcome breached the 60 percent probability mark. It seems a clear trend has developed in recent days, however, this morning's personal income and outlays report was on the strong side, so maybe it's not a done deal quite yet.

Not once in the last four weeks has either outcome breached the 60 percent probability mark. It seems a clear trend has developed in recent days, however, this morning's personal income and outlays report was on the strong side, so maybe it's not a done deal quite yet.

James Hamilton at EconBrowser says, "that's it", confirming the swing toward a kinder, gentler Fed - one that will not deliver any more medicine next Tuesday. Not that the patient doesn't need more medicine, mind you, but for fear that an additional dose right now just might cause seizures or some other unwelcome side effect.

Speaking of unwelcome side effects, James noted comments back in June by Fed chair Ben Bernanke regarding the unwelcome lagging effects of the monetary policy implemented by his predecessor:While monthly inflation data are volatile, core inflation measured over the past three to six months has reached a level that, if sustained, would be at or above the upper end of the range that many economists, including myself, would consider consistent with price stability and the promotion of maximum long-run growth. For example, at annual rates, core inflation as measured by the consumer price index excluding food and energy prices was 3.2 percent over the past three months and 2.8 percent over the past six months. For core inflation based on the price index for personal consumption expenditures, the corresponding three-month and six-month figures are 3.0 percent and 2.3 percent. These are unwelcome developments.

In an attempt to square these remarks with the latest price statistics, James continues:So what's changed? Not good news about inflation, surely

Meanwhile, Mark Thoma at Economist's View opines:

...

There is basically no way to slice the inflation data since then to come up with numbers that are any lower than these "unwelcome" numerical guidelines that Bernanke identified. The data arguing for a pause come instead from the real side.  In particular, the new home sales figures released Thursday paint a pretty clear picture that the housing slowdown we'd all worried about is now well underway. Falling residential construction made a negative contribution to second quarter GDP and has more downside potential.

In particular, the new home sales figures released Thursday paint a pretty clear picture that the housing slowdown we'd all worried about is now well underway. Falling residential construction made a negative contribution to second quarter GDP and has more downside potential.

...

The risks for real output of another immediate rate hike are all too obvious. What about the risks to inflationary expectations if there is a pause? The response in markets such as gold and the dollar was pretty dramatic the last time the pause balloon was floated.What should the Fed do? I think the Fed should pause at its meeting next week, let past tightening catch up, and reassess the situation at September's meeting. That will reduce the chances of overshooting.

Naturally, Nouriel Roubini at RGE Monitor, takes a rather dim view of the whole affair, explaining that there is little nothing that can be done at this point to avoid a recession.It is now clear that the Fed is in panic mode about the risks of a U.S. recession; they hoped to get a soft landing but, obviously, the Three Ugly Bears that I have been warning about since last fall - high oil prices, a slumping housing and rising inflation leading to higher short and long term interest rates - are now killing the economy.

Oh my! That sounds awful - 1974, 1980, 1990, 2000 and now 2006 or 2007?

...

The Fed will not be able to avoid the coming recession even if it were to pause now and ease in the fall.

...

There will no so soft landing and the recession will be painful. And the Fed will be able to do little to prevent the coming recession. The recession train wreck is having too much of its own unstoppable momentum now – as it did in 1974, 1980, 1990, and 2000 – for the Fed to be able to stop it. Fed pause or easing will not avert the coming recession. We will now pay for living above our means for too long, for making serious fiscal and monetary policy mistakes that allowed only a drugged recovery, and for creating unsustainable macroeconomic and financial imbalances that festered for too long. Thus, the coming payback will be unavoidable - whatever the Fed does or does not - and most painful for the U.S. and for the global economy.

According to Nouriel, a recession in the States is unavoidable - for the sake of us Americans, billions of Asians, and much of the rest of the world, let's hope it's not too bad.

Whatever the timing or degree of the economic slowdown, one thing seems clear - the job of the making monetary policy in the years ahead will not be an easy one.

In response to a crashing stock market at the turn of the century, good 'ol Alan Greenspan just yelled "DEFLATION" at the top of his lungs and let rates drop like a rock, kicking off the biggest housing boom and carry trade the world has ever seen. Cheap imports, cheap energy, and declining rents all suppressed the consumer price index, making the deflation story a compelling one for those who looked only at the headline inflation numbers.

In another era, Ben Bernanke might take the same approach, however, energy and rents are working against him at the moment. How will he pump up the economy without the cover of a "deflation" scare?

Put real housing prices back into the price indexes? That's an excellent idea.

But, more importantly, what happens when the pumping begins? What asset class gets inflated to grotesque proportions next time around?

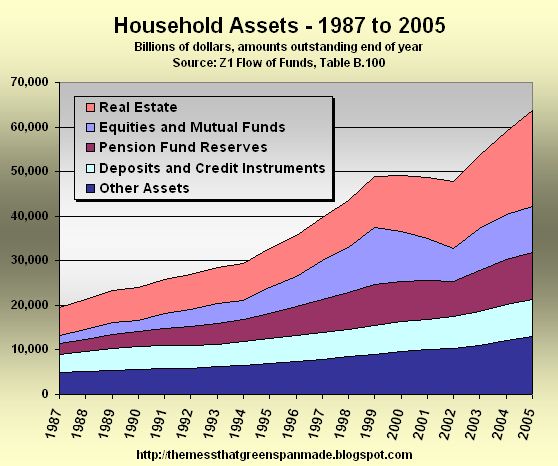

One look at the chart below and it's clear that the last time, back in 2000 to 2002, there was a neat hand-off between stocks and real estate - real estate assets soared as stock prices fell. What will soar next if home prices fall?

Where's the next bubble going to be?

That's the more important question - not whether or not there will be a pause.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

17 comments:

I'd say we aren't doomed to another bubble, because this time we'll have finally learned our lesson.

But with M3 still raging out of control, this doesn't seem so likely.

So, it seems the most likely candidate for the next bubble is commodities, which saddens me, because I think the fundamentals there are very strong.

Hmm what else... defense stocks or TIPS? European stocks. Canadian stocks, perhaps.

the next bubble already started: commodities.

"the next bubble already started: commodities."

You wish. Haven't you heard of "Peak Oil".

Saying that the commodity bubble has already started is like saying that the stock bubble had already started in 1996 and the housing bubble had already started in 2002. It doesn't really get good until the dumb money arrives and right now, they are nowhere to be found. When they are convinced that this is the real thing - in 2007 or 2008 - then it'll get good.

I don't know if we can bubble our way out of this yet again. And I see nadda to invest in.

If the majority of the "dumb" money disappears during a contraction due to housing foreclosures, how can it then be put into commodities? My question is genuine.

I don't think the "dumb money" will necessarily be condo flippers - broke daytraders from the stock market bubble did not drive the real estate bubble, just like condo-flippers who were still buying in 2005 will probably not drive the next bubble.

The problem is that there are no more bubbles to be blown that are capable of staving off a recession. Housing is unmatched as a vehicle for effortlessly pumping trillions of dollars into consumer's (and therefore businesses') pockets.

Of course, bubbles will still happen; they'll just go back to fleecing the masses of "earned" monies.

Anon 1057am,

Your question is one of extent. One could argue that any 'money' (i.e. purchasing power) held in US dollars could be considered dumb, given the correct time scale. The situation with commodities is purely supply and demand. Demand will continue to exceed supply, thereby driving up prices, until we achieve overinvestment in supply capacity. You'll know when you see it and I don't see any sign of that for a while.

I too do not see a good place for my money. That is especially true for my savings because I am in the US Gov't TSP. The thing is manipulated by the WS crooks.

This is truly a scary situation we are headed into.

I am anon 1057.

I believe there is a lot of dumb money flipping condos, trust me, the majority of people I know would be considered in this category and most of them haven't clued in yet that the tide has turned (The apparently don't read any news).

That said, these people will be struggling just to pay their debts with increases in interest rates, loss of jobs, etc. The others will suffer when they can't sell their investment properties.

When the contraction begins, the majority of this "dumb money" will already be suffering, so I don't believe will be able to invest in commodities at that point (yes now while it is expanding, but not once it turns the corner).

I don't believe the "average" type of economically-retarded person would even think of investing in commodities unless there was some sort of major panic like there has been in housing.

The dumb-but-slighty-informed people are already invested in commodities.

I also know a few of the "broke day traders" that have invested in real estate in the last couple years and will be losing money this time around too.

Maybe I just know a lot of dumb people?

On second thought, I'm inclined to think there will be natural forces that will stop the bubble chain this time (which is compatible with the fact that we haven't learned our lesson).

Normally, the Fed would handle the challenge by simply expanding broad-money liquidity, allowing another bubble to be blown somewhere.

But in recent history this has been enabled by the US's special status as an investment destination, which is linked to our "global reserve currency" status (and petrodollars, yadda yadda). This special status seems to be fast eroding, both politically and economically.

The only way to continue business as usual will be to blow an even bigger bubble with even more broad money, but we've run out of suckers (i.e. the rest of the world... too bad there's no life in the rest of the solar system!). Domestically, the best approximation would be to "print" insane quantities of and hand it out haphazardly, hoping it keeps people afloat and is invested reasonably productively.

So, yeah, this doesn't look good.

The Fed needs to raise FF 50 bp right now.

Some of the dumb money has aready been lost on commodities. Anyone who shorted them in the belief the Fed was going to head off inflation, was dumb money.

The Fed will have to continue raising rates until the inflationary commodities spiral breaks. When copper drops $2.00 per pound in two weeks, and gasoline is at 2.10 per gallon, the inflation will be broken. Unfortunately, the 50 bp shot that would have done the trick in January might not be enough now.

Especially if the Fed Board members continue their non-stop campaign in cultivating inflationary expectations by appearing clueless in public.

The Fed's preference is to enable as much real inflation as possible while keeping inflation expectations low.

CPI increases of around 3% to 4% is probably the target. Growth too high and inflation expectations start rising and that's bad news. You don't want people to start demanding higher wages and accepting higher prices just because of expectations for inflation.

It wouldn't surprise me one bit if the fed is researching the psychology of inflation expectations. They probably have PhDs advising them on how high and for how long growth in CPI can go before expectations start to change for the worse.

Why do they want inflation? How else is all the debt to be paid off?

Isn't it curious that all the same people who were convinced that tech stocks and housing were not bubbles are now equally convinced that commodities are?

It is all about inflation expectations......you never hear a Fed Chairman say inflation is contained; how could he, when its his job to grow the money supply at 10% a year while maintaining "price stability"....The economy right now needs a strong dose of medicine, perhaps a 75 bps move to 6%.....you then get an immiediate sell-off in commodities and a strong bond market rally....this would allow all those option-arm people to refi into a less risky product.....hopefully they would take the bait. All the while the fed assures the money-centers that there will be plenty of liquidity available, and any losses they incur as the fed goes into emergency cutting mode six months out, and the bond market crashes, will be covered. This would be one way to essentially monetize much of the credit bubble that has developed over the past five years, and would be highly inflationary in the end, but what else is new....at least people won't be losing their homes.....really no way out from here.

"When copper drops $2.00 per pound in two weeks, and gasoline is at 2.10 per gallon, the inflation will be broken."

Huh? Gas will remain high and if there is another storm or the terrorists pull off something big it will go much higher. Peak oil, increased demand from Chindia.

It takes a lot of energy and water to produce copper. Demand is still high. Don't see a $2 drop over 2 years, much less 2 weeks.

Post a Comment