Zooming Out on Precious Metals

Thursday, August 03, 2006

Those precious metals are resilient little buggers, aren't they? They're not supposed to get into gear until next month or so when Asian jewelry demand heats up, but either they're off to an early start for the new buying season, or they're just getting in a good warm-up while the temperature is still elevated and muscles stretch easily.

It could be one heck of a show this fall.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~Advertisement~~~~~~~~~~~~~~~~~~~~~~~~~~~

It's shaping up as another excellent week for the Model Portfolio at Iacono Research. One recent addition has climbed 49 percent since it was recommended earlier this summer, while another is up 20 percent - both in just the last few weeks.

Many readers of the blog have already taken advantage of the introductory subscription offer, and it is being extended one last time through the middle of next month. A risk-free two-week trial is also available, click here to learn more.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

It's been a tumultuous year so far for gold and silver, as well as for their owners. Millions of people around the world watched as new 25 year highs were made for both metals, then the May correction sent many of the proud new owners away humbled, their fingers singed after touching what had become much too hot.

That's the way these markets work - there's really nothing new here, except of course for the price levels, and even they're not really new. Current prices for both gold and silver are more than twenty-five years old.

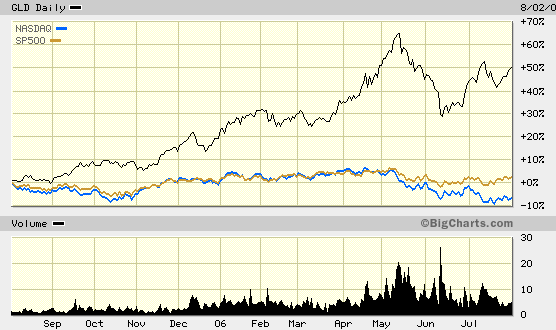

As represented by the ETFs below, gold (GLD) has now recovered about half of the decline since the May highs and while silver looked like it was headed back up to the half-way mark yesterday, it has now fallen back again just a bit.

The timing of the introduction of the silver ETF (SLV) was really something - not more than ten days after investors could buy silver on the AMEX, it set out to lose almost 30 percent of its value. Many fingers were burned, but many of those fingers will also be back for more this fall, little worse for wear. Looking at the year-to-date numbers, it's clear that after only seven months, it's been quite a ride. In addition to going in the wrong direction, the Nasdaq looks downright tame next to the price of gold, and despite the ups and downs, the yellow metal hangs in there with a 25 percent gain for the year so far.

Looking at the year-to-date numbers, it's clear that after only seven months, it's been quite a ride. In addition to going in the wrong direction, the Nasdaq looks downright tame next to the price of gold, and despite the ups and downs, the yellow metal hangs in there with a 25 percent gain for the year so far.

As for the rest of the year, the months ahead have been, historically, the strongest months of the year for both gold and silver. However, both caution and history have increasingly been thrown to the wind as we continue along in uncharted territory - the whole world now sensing trouble in the relationship between paper money and the price of goods. Of course, if you go back an entire year, then the events of the last few months begin to blend in better with the overall trend, which is decidedly up. Over the last twelve months, the gains have been quite impressive - fifty percent for gold and over seventy percent for silver.

Of course, if you go back an entire year, then the events of the last few months begin to blend in better with the overall trend, which is decidedly up. Over the last twelve months, the gains have been quite impressive - fifty percent for gold and over seventy percent for silver.

In the last year, individuals investing like it was still 1999 have been disappointed to be sure. But then old habits die hard - for the most part, people are slow to change their ways. Going back even further, it is necessary to switch over to the Philadelphia Gold and Silver Index of mining stocks (XAU) as a proxy for the price of gold at BigCharts, since the gold ETF was not available prior to December 2004 - about the time that some people started noticing gold.

Going back even further, it is necessary to switch over to the Philadelphia Gold and Silver Index of mining stocks (XAU) as a proxy for the price of gold at BigCharts, since the gold ETF was not available prior to December 2004 - about the time that some people started noticing gold.

In this four year chart, going back to the bottom of the last cycle for the broader stock market, the precious metal miners have outperformed the SP500 and Nasdaq by a factor of two or three to one. A similar performance was turned in by oil and gas stocks during the same period, yet somehow, many investors still fancied technology stocks - again, old habits die hard. Now, this next chart is really interesting. The ten year view of these three stock indexes includes the manic blow-off years of 1999 and 2000 for technology stocks along with an S&P500 which more than doubled from 1996 to 2000. That black line at the bottom is the same black line that's been at the top of all the previous charts.

Now, this next chart is really interesting. The ten year view of these three stock indexes includes the manic blow-off years of 1999 and 2000 for technology stocks along with an S&P500 which more than doubled from 1996 to 2000. That black line at the bottom is the same black line that's been at the top of all the previous charts.

The gold miners don't look like much in this view, the late 1990s dominated, as it was, by technology stocks and a wide variety of other equities having nothing to do with digging holes in the ground. Going all the way back to the origins of the last great bull market in stocks, both mining companies and the price of gold become almost irrelevant - a big goose egg based on the chart below.

Going all the way back to the origins of the last great bull market in stocks, both mining companies and the price of gold become almost irrelevant - a big goose egg based on the chart below.

Though BigCharts provides no handy way to go further back, it is reasonable to conclude that if you went back to before 1980 comparing precious metals and shares of mining companies against the broad stock indexes, you might see something like that Nasdaq curve below. After all, back in the 1970s, gold went from $35 to over $800 - up about 2,300 percent, similar in magnitude to the rise in the Nasdaq below. So what is there to learn from all this zooming out?

So what is there to learn from all this zooming out?

Well, for one thing, anyone comparing the recent run-up in gold prices and mining stocks to the Nasdaq bubble can be assured that this particular comparison is not a very fair one. The Gold Bugs Index (HUI) of unhedged gold miners would have performed a little better over most timeframes above, but nothing like the nearly two thousand percent gain seen by the Nasdaq when it peaked in 2000.

Another observation worth making is that people might say to themselves today, "Well, gold is done. I'm not going to buy anything now after the run-up that it's had - it'll probably just come tumbling down." The last time those thoughts were considered here was in 2002. Less prone than others to sticking with old habits, especially after the performance of equities in 2000 and 2001, it became clear that something had to change.

The doubling of the HUI in 2002 (from the 60s to near 150) was followed by another doubling over the years 2003 to 2005.

When will it double next?

Dunno.

But, after the last few years, given the state of the world's paper money relative to things that you have to dig out of the ground, there are surely more doubles left to go.

Zooming out shows that there may be many more doubles to come, for both gold and gold stocks, than you might think if all you were looking at were the last few years.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

9 comments:

Judging by the number of comments received so far on your post today, it looks like the gold/commodity angle is a tough sell.

Don't worry, you're just a little early still.

Yes dlp, that's the way it appears - either that or it's just too hot to type.

Well, unless PMs are never to be money again, that last chart makes a strong case for mean reversion.

precious metals may not ever be money again (because there isn't enough of it), but between the present and future monetary systems, precious metals are going to go up in value, probably a lot

I am waiting for gold to go back to around $560, and then will stock up. Zeal Intelligence has laid out all the reasons for the pullback and why we must be patient. The last 2 rallies were sucker rallies, too, and gold reverted to its 200dma. So we must be patient and wait for this short term correction to play out. Then, it's time to load up, because where else is our money safe?

The dollar will keep losing value. Euro is questionable. Maybe Canadian dollars? Swiss francs?

As far as cash, Treasuries are the best option. there will be many bank failures. Everbank is rated E- by weiss ratings. It takes a long time to get your money back under an FDIC bailout. Don't assume your bank is safe.

The argument that PMs will not be money again because there is not enough is complete nonsense. This just means if/when they are fully remonetized, they would buy very much more than now. 1-2 oz of silver used to be a very good day's wage, once upon a time. However, at present, I'd say convenience and familiarity are the main drawbacks. That will change, of course, as the paper alternatives proven to fail as stores of value.

PM as de facto currency?

At that point copper will be worth more than gold as folks stock up on 7.62 FMJ.

There's no limit to the fed fund rate in order to kill such an unspeakable abomination as PM currency.

Higher interests rates alone have never been able to rescue failing currencies. If anything they are symptomatic of that fact. Fiscal restraint is the antidote but there is no sign of this anywhere. Debt is killing the dollar and it is already too late to solve this by raising fed funds rates.

If it's silver we're talking about, I got on and worked out most of my anxieties during the $5-$8 swings, just as some are sweating the $10-$15 movements now and as others will eventually do likewise at higher prices. In general, I tend to think the smart money, powers that be, etc. have already foreseen the dollar will fail and are positioned accordingly. They just continue to feed this fed funds type nonsense to the public in order to maximize 'mileage' and maximize panic when it does fail

Post a Comment