Friday Lite

Friday, August 04, 2006

The Labor Department released the July jobs report earlier this morning. Falling short of expectations, a seasonally adjusted total of 113,000 jobs were created, while the unemployment rate rose from 4.6 percent to 4.8 percent.

Categories leading the way in job creation were Professional and Business Services (+43K), Leisure and Hospitality (+42K), and Education and Health Services (+24K). Manufacturing employment declined (-15K) and Retail Trade finished the month where it began.

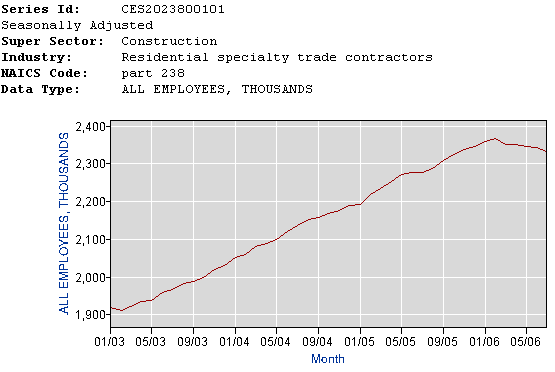

While Construction payrolls increased by 6,000 positions, residential and non-residential construction activity are clearly parting ways. While almost 10,000 positions were eliminated in residential building, a total of 16,000 spots were added in non-residential construction. Recall that residential construction averaged nearly 30,000 new jobs per month during 2005, providing a significant boost to the overall jobs picture. Even more significant than the recent weakness in construction employment is the decline in retail trade jobs which peaked about a year ago. Having created almost a half million jobs since the housing boom accelerated in 2003, almost 100,000 of those positions have now been eliminated.

Even more significant than the recent weakness in construction employment is the decline in retail trade jobs which peaked about a year ago. Having created almost a half million jobs since the housing boom accelerated in 2003, almost 100,000 of those positions have now been eliminated. The real question at this point is whether sectors such as non-residential construction and computer system design (+12K) will be able to compensate for the ongoing losses in the formerly strong job creation categories.

The real question at this point is whether sectors such as non-residential construction and computer system design (+12K) will be able to compensate for the ongoing losses in the formerly strong job creation categories.

Today's report is consistent with reports of the last few months showing a clearly weakening job market related to housing and consumption, further confirmation of the effect that a slowing real estate market is having on overall employment.

Fed fund futures changed dramatically after the news release, now showing only an 18 percent chance of another rate hike when the Federal Reserve meets next Tuesday. This of course is not good for the dollar as other banks around the world continue to raise interest rates.

Rates On the Rise in Europe

Following Wednesday's quarter point rate hike in Australia to 6.0 percent, both the Bank of England and the European Central Bank raised rates by a quarter point yesterday. In the U.K, short-term interest rates now stand at 4.75 percent, while in mainland Europe it's an even 3.0 percent. According to this story from Bloomberg, while the ECB rate hike was expected, the one coming from London was a surprise.Inflation risks are mounting throughout Europe as near-record oil costs drive up prices and growth quickens.

If you're going to have inflation, it's much better to have quickening growth to go with it, unlike here in the States. More rate increases are expected from both banks in the months ahead - a total of 15 central banks around the world have now increased borrowing costs in just the last month.

...

Growth in the U.K., Europe's second-biggest economy, reached the fastest pace in two years last quarter and inflation in June remained above the bank's 2 percent target for a second month.

"The pace of economic activity has quickened in the past few months,'' the Bank of England's seven member policy-making panel, headed by Mervyn King, said in a statement. Inflation is "likely to remain above target for some while,'' it said.

Friday Lite Sweet Mexican Crude

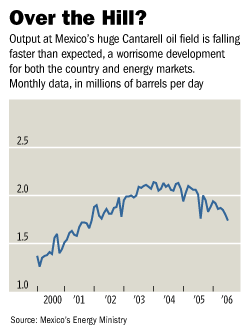

Well, this news out of Mexico sure isn't going to help out on the inflation front. This story from the Wall Street Journal paints a rather stark picture of expected output from one of the few oil exporting countries still friendly to us Americanos.

It's a shame that the world can't have an unlimited supply of cheap energy - it would make the job of the world's economists and central bankers so much easier.

Crude-oil production at Mexico's biggest oil field is falling far more quickly than predicted by the country's state oil monopoly, stoking fears of a precipitous drop in coming years that could further tighten global supplies and squeeze finances in this oil-dependent nation.

Output at Cantarell oil field -- responsible for about six of every 10 barrels Mexico produces -- fell to 1.74 million barrels a day in June from 1.92 barrels in January, according to figures released by Mexico's Energy Ministry. That compares with the official prediction by Petróleos Mexicanos, the state oil company, that production would decline to a daily average of 1.9 million during 2006.

Such a drop is bad news for the global oil market. Thanks mostly to the decline at Cantarell, Mexico's overall crude output fell 4% in June, compared with a year ago, company data show. That will further tighten global supplies at a time when demand is rising, pushing prices ever higher.

Inflation by any other name

Speaking of economists, this story from The Economist explains just how that whole oil-inflation relationship works.DISMAL scientists are finding more reasons than ever to worry about the prospects for America's economy—even though the country's GDP somehow still manages to grow at a decent lick. Oil prices are high, of course; partly as a result, inflation is rising. Consumer debt is at record levels. America is borrowing from abroad on a gargantuan scale to finance its current-account gap. And the housing bubble may be bursting.

Oil prices are high and therefore inflation is rising. Hmmm... It sounds like high oil prices and inflation are two separate things - an interesting, yet slightly, twisted view of the world to be sure, unless of course you're a dismal thinker and when you hear the word "inflation" you automatically think of the "core" rate.

Central bank calls for reins on bank lending

This report from China seems to confirm the general trend in economic news theses days - there's just too damn much money in the world (and too damn little oil).A report from the People's Bank of China has warned that unrestrained lending growth will continue to fuel economic overheating unless it is controlled.

It's a good thing that inflation is still low around the world, or that 15 to 20 percent increase in the money supply might cause prices to rise.

The report suggested measures to curb the excessive growth of total lending, starting with raising the reserve requirement of commercial banks by a 0.5 of a percentage point from August 15.

...

Despite the government's macro-economic controls and stringent monetary policy, money supply jumped rapidly, noted the central bank.

By the end of June, M2 supply surged by 18.4 percent year on year to 32.3 trillion yuan (4.1 trillion US dollars), and M1 supply by 13.9 percent to 11.2 trillion yuan, two percentage points higher than the same period last year.

A Bull Market in Pre-Foreclosures

Of course, in recent years, much of the extra money supply growth that doesn't get counted as inflation has gone into real estate - California real estate is a good example. But these days, it's starting to look like some of that money is beginning to reverse direction. Yesterday, DataQuick reported that foreclosure activity is now rising at a blistering pace in these parts.

Coming off of historic lows, recent levels of foreclosures activity aren't anything to be overly concerned about yet, however, the rate of change is certainly not good news - especially if it continues. Second quarter California foreclosure activity rose at the fastest pace in at least 14 years, the result of waning home price appreciation.

Second quarter California foreclosure activity rose at the fastest pace in at least 14 years, the result of waning home price appreciation.

Lenders sent 20,752 default notices to homeowners statewide during the April-through-June period. That was up 10.5 percent from 18,778 the previous quarter and up 67.2 percent from 12,408 in the second quarter of last year, DataQuick Information Systems reported.

...

Despite the second quarter surge, defaults remained below historically normal levels. On average, lenders filed 32,762 notices of default each quarter over the past 14 years. Last quarter's 20,752 total was the highest since 25,511 were filed in first quarter 2003.

"This is an important trend to watch but doesn't strike us as ominous," said Marshall Prentice, DataQuick's president. "The increase was a statistical certainty because the number of defaults had fallen to such extreme lows. We would have to see defaults roughly double from today's level before they would begin to impact home values much."

Marshall "almost all, if not all, of those gains are here to stay" Prentice is once again quick with assurances of stable home prices. But what would possibly make him think that defaults would have to double from here "before they would begin to impact home values much"? Annualizing the quarterly rate of almost 21,000 works out to be 84,000, which when doubled yields a number that is in excess of the previous all-time high.

Annualizing the quarterly rate of almost 21,000 works out to be 84,000, which when doubled yields a number that is in excess of the previous all-time high.

Granted, population has increased, so in order to equal the previous high on a per-capita basis, a larger total would be needed. However, given that last time around home prices began dropping in 1991, when annual foreclosure activity was just above the current annualized rate, and then continued for the next five years, the claim seems dubious at best.

At worst, it is yet another example of the real estate talking heads attempting to influence public opinion yet again, attempting to convince wary readers that things are not as bad as current trends might indicate. Someone should keep an eye on Marshall.

Let the Liteness Begin

Very little of the above is consistent with the normally lite fare to be found here on Fridays. Employment, interest rates, inflation, and housing news can cause some to develop an unhealthy fixation on bad news while ignoring good news or paying insufficient attention to amusing items of a more general interest.

It is far too little, far too late, but here are a few items that are not so weighty. Gold seems as lite as a feather with the release of the labor report and the near certain pause coming next week. Silver too seems liter than air, having risen four percent today to $12.50 - for very dense metals, these are both very lite today.

Gold seems as lite as a feather with the release of the labor report and the near certain pause coming next week. Silver too seems liter than air, having risen four percent today to $12.50 - for very dense metals, these are both very lite today.

The Upside to Global Warming

This story provides new hope for the world's long-term future now that forward-thinking businessmen have found a way benefit from global warming.A brewery in Greenland is producing beer using water melted from the ice cap of the vast Arctic island. The brewers claim that the water is at least 2,000 years old and free of minerals and pollutants.

So, at least our children and grandchildren have that going for them - coastlines that are potentially much different than the current ones, but better suds to enjoy as they try to stay cool.

..

It is claimed that the Greenland beer, officially launched in Copenhagen on Monday, has a softer, cleaner taste than other beers, because of the ice cap water.

The gigantic island of Greenland measures 2.2 million square km (844,000 square miles) - 85% of it covered with ice that is up to 4,000 metres (11,000 feet) thick.

Pass the Bacon Bits Please

And, finally, this story from The Onion confirms the worst fears of many regarding the diet and health of ordinary Americans.Though once defined as just a stand-alone meal, meat has risen quickly up the ranks to become the nation's second most popular condiment, according to a study released by the U.S. Department of Agriculture.

Salads always taste better with bacon, and vegetables wrapped in "slabs of bacon" have been proven to make ordinary vegetables much more appealing to both adults and children who may otherwise not be getting enough green stuff in their diet. "In the past several years, meat's use as a way to enhance the flavor of foods has increased exponentially," said Agriculture Secretary Mike Johanns. "Ketchup is still number one, but at the rate people are putting meat on top of other meats and foods, it may very well surpass it by 2010."

"In the past several years, meat's use as a way to enhance the flavor of foods has increased exponentially," said Agriculture Secretary Mike Johanns. "Ketchup is still number one, but at the rate people are putting meat on top of other meats and foods, it may very well surpass it by 2010."

"American consumption habits have made meat a necessity just so people can notice that they're eating something," Johanns added.

Johanns cited the rise of bacon as a condiment as the most universal example of this trend. "By 2015, our researchers predict bacon alone will supplant condiments as diverse as mustard and Worcestershire sauce," Johanns said. "Crumbled 'bacon bits' are a classic addition to salads, and in recent years, slabs of bacon are increasingly used to wrap vegetables, fruits, and seafood. Adding bacon as a topping to cheeseburgers is old news, but now we are seeing bacon-topped meatloaf, bacon-covered chicken wings, and deep-fried, bacon-wrapped bacon sprinkled on pork chops."

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

4 comments:

Ah, Bacon. its just for breakfast anymore. Also, Bacon is the #1 food craved by vegetarians.

hello from germany,

we have had a artikel on the nr. 1 buisness newspapaer in germany "handelblatt" (the german wsj) with a quote about the housingbubble in australia

"rate hike worse than al kaida attack"!

the highlights in english on

http://www.markettradersforum.com/forum1/1389.html

jmf (germany)

http://www.immobilienblasen.blogspot.com/

I heard about several builders in my area trying to unload big chunks of condos/apartements in new developments that have not sold to wealthy investors/funds. For example, Condos that sold for 220K are being offered for 80K (the builder was trying to offload 4/5 of the community that is not sold yet). And this is not the only deal to be had.

Looks like until the builders can offload the inventory, this is going to be ugly.

good ole santa cruz and marin. best places to live in calif.

Post a Comment