He's Back in the News

Sunday, September 24, 2006

This Wall Street Journal story($) finds Alan Greenspan back in the news for not saying something that he purportedly said that may have influenced the bond market.Rumors about remarks made Thursday night by former Federal Reserve chairman Alan Greenspan helped send Treasury bond yields lower Friday and increase expectations of a Fed rate cut, market participants said.

More likely it was the manufacturing report on Thursday that left a foul taste in the mouths of bond market participants through the day on Friday. However, two people who attended the event where Mr. Greenspan spoke said he didn't say anything about likely actions by the Fed, as some rumors suggested.

However, two people who attended the event where Mr. Greenspan spoke said he didn't say anything about likely actions by the Fed, as some rumors suggested.

...

During the event, Mr. Greenspan was asked about whether he thought growth or inflation was the greatest risk facing the economy, a question apparently meant to elicit his view on what the Fed should do next. He declined to answer, the people who attended said. As he often has in the past, he noted Paul Volcker refused to discuss monetary policy after Mr. Greenspan succeeded him as chairman, and Mr. Greenspan intended to do the same for his successor, Ben Bernanke.

Mr. Greenspan did say that much of the run-up in housing prices has apparently been due to speculators and investors, not homeowners, and that low interest rates world-wide have played an important role in underpinning housing, the people in attendance said. He also said it is not yet possible to say whether "mortgage equity withdrawal" is yet affecting consumption, and that it may never be possible to know for sure. Mortgage-equity withdrawal, a concept he has popularized in the U.S., refers to the ability of homeowners to increase their purchasing power by taking out larger mortgages.

Note the confessional in the second to last paragraph - the Chicago Fed says the housing boom was a result of wealth creation technology, or something like that. Here it seems pretty clear - low interest rates and speculation. Oops, my bad!

Here's this week's cartoon from The Economist:

Note that this is President Al-Bashir of Sudan, and not U.S. President George Bush.

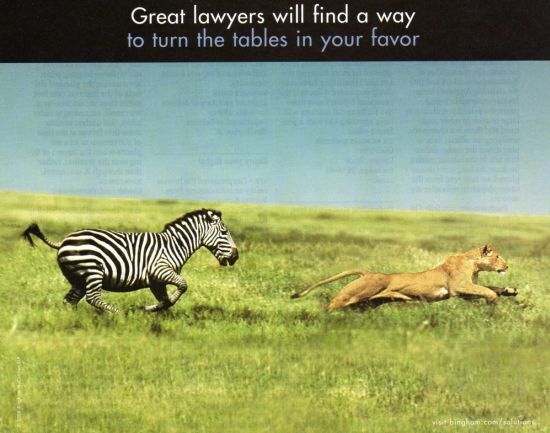

And a special bonus - as long as the scanner was already warmed up - opposite the cartoon, this ad from the law firm of Bingham McCuthchen could not be passed over.

Grrrhhh!

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

4 comments:

hello from germany,

i havn´t missed him..... :-)

i have a pice on an interview with easy al (2 weeks old) on houisng, savings rate, china, gold, and hedge funds (before the blow up from amaranth)

http://immobilienblasen.blogspot.com/2006/09/interview-with-alan-greenspan.html

Does it seem like this week's Economist has a lot more ads than usual? Watches, cars, lawyers. All I remember seeing in the past were job listings for economists and executives.

Yes, I think they've increased their ad content not only with this issue, but gradually over the last year or so - this issue is particularly thick.They've also dropped their price a bit during that same time - there is likely a relationship between the two.

classic relationship:

more ads = less objective journalism

see chomsky

Post a Comment