Technology-Driven Wealth Creation

Thursday, September 14, 2006

The Federal Reserve Bank of Chicago has released a study(.pdf) that looks at the recent rise in homeownership rates, analyzes the contribution of residential housing to Gross Domestic Product, and brushes quickly over rising home prices.

The conclusion?

The recent housing boom is the result of "technology-driven wealth creation" and not loose monetary policy by the nation's central bank. They added, "this is not to say the monetary policy has not been unusually loose, but that to the extent it has been loose, this is not what has been driving spending on housing."

Oh dear!

More economists with whom to disagree.

Where to begin?

Well, they do have a few very nice charts and a very good description of what has happened over the last few years. If there's one thing that Federal Reserve economists are good at, it's taking reams and reams of data and making up charts that show where all the money is going.

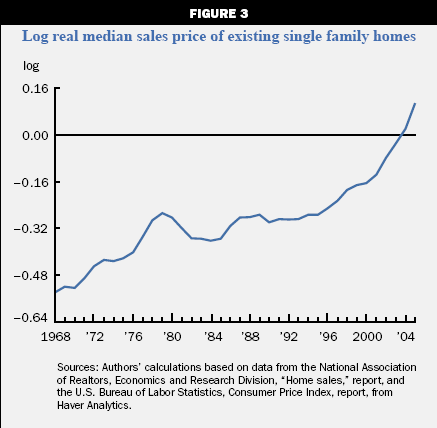

For example, this chart shows a lot of money going into real estate. If you factor in a record number of new homes added to the housing stock in the last few years, and then multiply by a dramatically rising median sales price, that's a lot of money. Of course when it comes to explaining why all the money is going where it's going and whether or not they had anything to do with it, they seem to lose some of that proficiency.

Of course when it comes to explaining why all the money is going where it's going and whether or not they had anything to do with it, they seem to lose some of that proficiency.

This is likely due to the fact that they are, indeed, economists.

Central to the report is the rapidly rising rate of homeownership, something that, on the face of it, sounds like a good thing. But as millions of proud homeowners with adjustable rate loans are now realizing, you can have too much of a good thing.Figure 2 shows the history of the homeownership rate from 1890 to 2004. The homeownership rate equals the number of owner-occupied housing units divided by the number of occupied housing units. Between 1890 and 1940, the homeownership rate varied between 43 percent and 48 percent. After World War II, the homeownership rate rose rapidly, and by the mid-1960s it had surpassed 64 percent. Upward progress in homeownership stalled in the 1970s and even fell in the 1980s. It began growing again in the mid-1990s and by 2005 had reached a new high of 69 percent.

In a funny coincidence about making policy, Capitol Hill policymakers just had a hearing yesterday about the residential real estate market - it was titled "The Housing Bubble and Its Implications for the Economy". Understanding why residential investment and homeownership have reached such unusually high levels is useful from a policymaking standpoint. For example, monetary policy has been traditionally viewed as having a strong influence over new home construction. Have the high levels of residential investment been driven by unusually loose monetary policy? Another concern of policymakers is that the unusually high level of spending on new housing reflects speculation and is not driven by underlying fundamentals.

Understanding why residential investment and homeownership have reached such unusually high levels is useful from a policymaking standpoint. For example, monetary policy has been traditionally viewed as having a strong influence over new home construction. Have the high levels of residential investment been driven by unusually loose monetary policy? Another concern of policymakers is that the unusually high level of spending on new housing reflects speculation and is not driven by underlying fundamentals.

They seem a bit concerned.

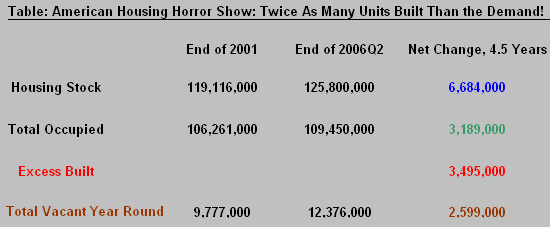

According to Jas Jain in this story over at Financial Sense Online, they may have good reason to be concerned. By his calculation, based on U.S. Census data, we appear to have built an extra 3.45 million houses in the last four and a half years. The growth in the number of houses has apparently exceeded the growth in the number of households by a wide margin. Easy money and speculation, the former a prerequisite for the latter, surely contributed to the extra 3.45 million houses, many of these homes now contributing to the freakishly high inventory of unsold homes in many parts of the country.

The growth in the number of houses has apparently exceeded the growth in the number of households by a wide margin. Easy money and speculation, the former a prerequisite for the latter, surely contributed to the extra 3.45 million houses, many of these homes now contributing to the freakishly high inventory of unsold homes in many parts of the country.

It's really a question of how the easy money caused all these extra houses to be built, and for that, there is an explanation - it's not the monetary policy, it's the technology. More specifically, it's the wealth creation technology.Before the 1990s, the standard kind of mortgage required the potential home buyer to satisfy a relatively rigid set of criteria on loan-to-value ratios, income, and other measures of creditworthiness. This rigidity was necessary for the development of the secondary market for mortgages. While beneficial in this respect, it effectively shut many potential homeowners out of the market. By reducing the remaining rigidities, the new mortgage products have expanded the pool of potential homeowners.

So, according to the wizards at the Chicago Fed, the technology used to expand the pool of potential homeowners to those with bad credit and no money down is in fact wealth creation technology, and serves as the underlying fundamental for the housing boom.

Two developments seem to have had a particularly large impact along this dimension. One development involves the so-called combo loan. These mortgages reduce or even eliminate entirely the need for a down payment. The second involves mortgages aimed at the “subprime” market. Subprime borrowers are individuals with low credit ratings. Subprime lending allows borrowers who, in the past, would not have qualified for a mortgage to qualify by paying higher interest rates and offering more equity or lower loan to- value ratios. Before the development of the combo loan, potential buyers had to accumulate sufficient savings to afford the necessary down payment. Before the development of the subprime market, most borrowers with poor credit would not have been able to get a mortgage at all. It is easy to see how these developments have lowered borrowing constraints and made it possible for potential buyers to buy earlier or buy at all.

Not loose monetary policy.

Not speculation.

Technology.

In his last year or two as Fed Chair, in addition to encouraging millions of Americans to take out adjustable rate mortgages when short-term interest rates where at one percent, Alan Greenspan also spoke glowingly of subprime lending. He marveled at how more and more good credit was being extended to more and more people with bad credit, and what a delightful effect it was having on wealth creation.

The Chicago Fed has gone one step further, extolling the virtues of no money down.

Is it any wonder why hearings are being convened in Washington?

As to the question of the source of the easy money, that is another technological marvel. It seems that the Federal Reserve and member banks have been outsourcing the job of credit creation to Wall Street firms for years now. These kindly firms securitize the mortgage debt and pass it off to yield-starved investors along with default and interest rate insurance in the form of derivative products from friendly hedge funds.

The debt then vanishes from the books of the original lenders who are free to originate more no money down mortgages to people with bad credit, and when this process is repeated a few million times, you've got yourself one heck of a housing boom and a whole lot of wealth creation.

Technology is a wonderful thing.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

8 comments:

I want some of this wealth creation technology. I think I'll put it next to my weather creation technology. then all I have is sunny days and money. Candy canes and bummle bee farts for all

Snigger. Before the invention of risk tranched mortgage securitized debt on the secondary market you needed a bank willing to make risky loans. Now the obfuscation is so complete it is impossible to find out which investment products have MBSec exposure. Charles Hugh Smith at oftwominds.com has a great chart of "synthetic collateralized debt obligations" growing exponentially. These things come of one thing and one thing only; easy money policies. Physcian heal thyself.

Tim, the situation is slightly more ironic than the "ideal" scenario of banks and other lenders securitizing mortgage debt and "passing it off to others".

Most loan originators have not at all gotten off scott-free in this way. In fact, the banking/mortgage lending industry has pretty much just separated the business of investing in mortgage-backed securities from creating them.

In reality, they've largely been selling the securities to themselves. The proof is in the fact that the banking industry still holds 40%+ of its assets in these kinds of securities, and along with loan origination, they make up a historically-high share of bank income.

So where is the risk going? Its obviously still there, but through the accounting ledgerdemain of securitization, has been subverted. How could anyone do anything so stupid? I guess because of the same kind of wishful thinking that inspired Enron to ultimately base its business well-being on its stock price which was based on its business well-being... it works as long as it works. Then one day, it doesn't.

Of course, pension funds, individual investors, and foreigners like the Chinese are in it as well, but banks and other lenders will certainly not get off scott free.

Aaron,

Any links you could provide would be helpful. Charts would be even better. I've read lots of reports about this area of banking but haven't seen any statistics lately.

Here's a little side-effect of all that wealth creation:

More fall behind on mortgages

Percentage of subprime ARM loans that were 30 days or more past due in 2nd quarter 2006.

Mississippi 26.8%

Louisiana 25.8%

West Virginia 20.8%

Alabama 19.5%

Michigan 19.1%

Tennessee 17.9%

Missouri 17.8%

Nebraska 16.5%

Indiana 16.1%

Texas 15.9%

Ohio 15.9%

Lest we not forget that fundamentally, The Fed, is a political organization. The official sounding Fed Speak is really a combination of 'White-Washing' with a pinch of 'Wagging the Dog' and a healthy heaping of good ole fashion 'Cover-Your-Ass' Speak.

In short, they commished a group of high credentialed appologists to get in front of the housing blow up with a pre-emptive 'don't blame us' strike.

--

Fiat Citizen in the land of Easy Money

Here's my dilemma:

It's obvious their conclusions are flawed.

Yet they are "educated", "intelligent" professionals in charge of the very things they don't seem to understand.

Are we that smart and they are that stupid?

Or is it: the ones who rise to those positions are truly idiots who are hired for their ability to perpetuate the lies?

anon 946pm,

i think 99% of people do what is best for their situation (career). so fed heads and their minions fall into one or more of the following:

(i) have full blinders on and don't think outside the box

(ii) have partial blinders on and rationalize away observed inconsistencies (i.e. denial)

(iii) are fully aware and choose to look away

i see this behavior in people all the time, especially when the consequences are the gravest.

examples:

- how do people respond to homeless when encounter them in the street?

- how do we always elect either democrat or republican? the two differ only in tactics. the result is the same.

Post a Comment