Let's Light this Candle

Thursday, November 30, 2006

With short-term interest rates now prohibitively high, the "financial innovation" known as the Home Equity Line of Credit (HELOC) has lost much of its luster. It now seems destined for the nostalgia bin along with 80-20 loans and the idea of spending your home equity like a drunken sailor on shore leave.

The appeal of HELOCs has rapidly waned with the combination of monthly repayment rates now double what they were just a couple years ago and falling home prices that make "refinancing-away" HELOC debt much more difficult than back in 2004. Gone are the days when you could borrow on credit cards, pay off the credit cards with newly borrowed HELOC money, then make the HELOC debt vanish by rolling it into a refinanced mortgage with a higher loan balance and a lower interest rate.

Gone are the days when you could borrow on credit cards, pay off the credit cards with newly borrowed HELOC money, then make the HELOC debt vanish by rolling it into a refinanced mortgage with a higher loan balance and a lower interest rate.

The magic of it all was that you could keep that all-important monthly mortgage payment the same - maybe even bring it down. It seemed like a perfect sort of "perpetual motion machine" for a while.

A real "financial innovation" as the economists at the Chicago Fed might call it.

In this article from the December issue of Money Magazine, Gerri Willis takes a critical (and slightly naive) look at these once popular ways to "extract" money from your home. She starts out by reminding us all that not more than a couple years ago, homeowners were being encouraged to "tap their equity" for all sorts of things - buying stocks, buying investment real estate, adding a wing to the house, you name it.

Looking back, that kind of advice brings to mind office clerk Stuart's 1999-era urging to his boss Mr. P to go online and trade stocks. "Let's light this candle", he famously said in the Ameritrade commercial.

Surely, in recent years, someone used that same phrase when first "tapping their equity".

Well, now it's 2006, and it seems that many homeowners have been forcibly brought to their senses by the relentless Greenspan/Bernanke "baby-step" campaign of raising short-term interest rates from the absurdly low, "pedal-to-the-metal" rate of one percent, back up to a more reasonable level of just over five percent.

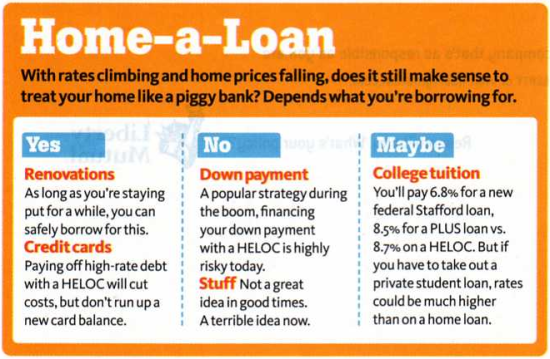

So what are HELOCs good for now? Money Magazine provides a summary in this table. It appears they are pretty much useless now.

It appears they are pretty much useless now.

Well, maybe not useless, but certainly not nearly as much fun as a couple years ago when many a homeowner literally attempted to spend their home equity faster than it accumulated.

By the looks of recent foreclosure statistics, many of them appear to have succeeded.

A Personal Story

In keeping with this week's theme of retrospectives, my home equity "candle lighting" experience is shared today - something that can be looked back upon now with some degree of wonder, knowing how many millions of other homeowners had a similar experience.

It was early 2002 and layoffs, "furloughs", and downsizing dominated the technology industry. A new car was needed as the infernal "Check Engine" light on a 1996 Ford Mustang had continued to torment its owner, ultimately resulting in a pledge to never again buy an American car.

There was plenty of cash in the bank, but not enough to completely cover the cost of a new car and, as expected, the dealer would not offer much in trade regardless of whether the "Check Engine" light could be temporarily defeated by pulling the battery cable.

After visiting a few dealers and deciding on the make and model, the necessary research at Edmunds and Consumer Reports was completed to determine a fair price and then came the magic.

The lighting of the candle.

The "extraction" of the five-figure sum was surprisingly easy. With the click of a mouse, the transfer was initiated and a day later it showed up as a deposit in a checking account - ready to go.

Like money from above.

A purchase decision was made and a check was proudly written to cover the entire cost of the new car, like a rich little old lady that paid cash for everything. The salesman must have been impressed. His offer to help with the financing had been casually rebuffed.

Naturally, a few months later the HELOC balance was rolled into a refinanced mortgage and it disappeared, the monthly mortgage payment was lowered, and the cycle was completed, ready to go again.

Financial innovation at its best.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

3 comments:

Stuart was good, but the taxicab driver that owned his own island as a result of his stock trading accumen was good too.

Funny story about your car purchase. I think all the new cars I saw in my neck of the woods between 2002 and 2005 were compliments of the magic HELOC. Even my frugal friend, an accountant, rolled his family's cars into a refinanced home a couple years ago; nothing better than trading a 6% 6 year loan into a 5% 30 year loan, right? Anyway, what happened to all those new car purchases the last year or two?

A few years ago, fresh out of my master's program, I quickly (and grudgingly) discovered I needed a car. Unfortunately, there's no such thing as a "student loan equity line of credit", so I had to sell my meager stock holdings and finance the rest to buy a $15k economy vehicle.

I later realized I had spent far more on "extra" insurance due to bank lien than I did on the financing itself.

I guess I was born too late to get in on the fun!

Post a Comment