Friday Lite

Friday, December 01, 2006

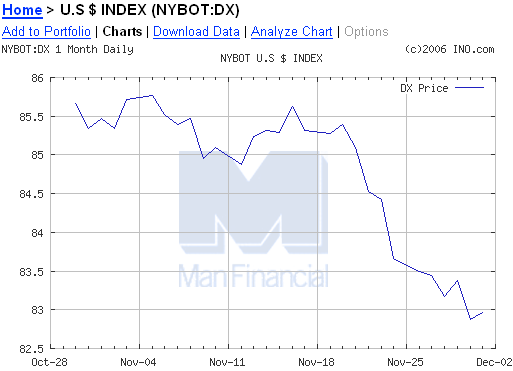

What a week for the dollar! What began early last week and was then nudged along by a few comments from a Chinese central bank official has turned into a bit of a rout. The 80 mark on the U.S. Dollar Index now stands as a sort of Maginot Line - once that level is breached, the picture changes dramatically. Oh well, it's Friday. The greenback gets the weekend off.

Oh well, it's Friday. The greenback gets the weekend off.

The Difficulty in Assessing Changes to Home Prices

It's hard to know what to think about the housing market these days. About all you can really do is look around and see what's happening to real estate prices in your own neighborhood and draw whatever conclusions you can from that data.

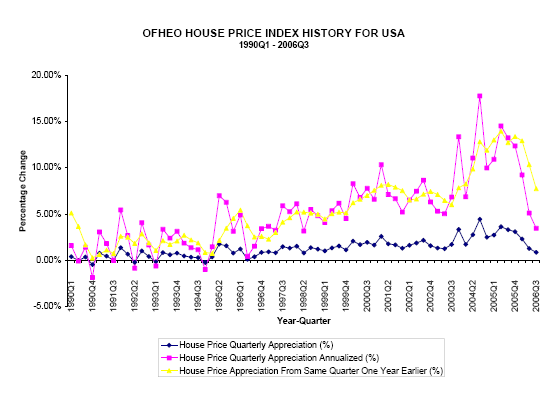

The national reports are in many cases confusing and contradictory, the latest example being yesterday's third quarter report (.pdf) from the OFHEO (Office of Federal Housing Enterprise Oversight) in which prices were shown to have increased almost eight percent from the same period last year.

The OFHEO data is unique in that it only tracks homes that are resold or refinanced and therefore has none of the "mix" problems for which the "median" home price data is often derided (e.g., sales of more higher priced homes causes the median price to go up regardless of whether prices are generally rising or falling).

Also, only Fannie Mae and Freddie Mac mortgage transactions are included, meaning that only conforming, conventional mortgages under $417,000 are used in determining the price trends. The historical data, including the results for the most recent quarter are shown below. The annualized quarterly appreciation of 3.45 percent (the pink line) is at a level not seen since the late 1990s, and with the trend of the last five quarters, the next report will be anxiously awaited.

The annualized quarterly appreciation of 3.45 percent (the pink line) is at a level not seen since the late 1990s, and with the trend of the last five quarters, the next report will be anxiously awaited.

The price trends are skewed due to the use of appraised values for refinancings which are included along with actual home sales to determine the overall price index. Also, the national home improvement craze of recent years is not factored into the data in any way, meaning that some portion of the increase in home price should be attributed to money spent on home improvements rather than in the appreciation of the underlying asset.

The OFHEO data also omits the one-sixth of total home sales that are new construction, a valuable data point when determining overall price trends as can be seen clearly in the next section.

After Escrow Closes, You're On Your Own!

This ad came in the (e)mail the other day. It is not known whether this offer can be combined with the "We'll pay your mortgage for six months offer" or if it includes a free automobile.

**Price guarantee applies only if, at any time prior to the closing date for your residence, Centex Homes enters into a purchase agreement to sell any other home within the applicable project with the same plan type as your residence for a base price that is less than the base price for your residence as set forth in your contract. If applicable, your base purchase price will then be automatically reduced to the lower amount. This reduction shall not apply to any other monetary consideration or component of the purchase price for your residence, including without limitation, any lot premiums or the price for any options or upgrades. This reduction also does not apply to any lower base purchase prices established after you close escrow on your residence. Other conditions and restrictions may apply.

It sounds like there's some wiggle room there.

Sales Volume or Price Trends?

This story about an uptick in existing home sales that was, in part, enabled by lower sales prices makes it pretty clear that realtors have a very different way of gauging the health of the nation's real estate market than do many homeowners.

Since the sales report is from the National Association of Realtors, it's hard to object to quoting their chief economist, but it's not hard to object to his emphasis on increasing sales by encouraging price reductions. As documented in Freakonomics, in the end, realtors care much more about making the sale than about the seller getting the best price possible. David Lereah, chief economist for the Realtors, said he expected home prices to continue falling for the rest of the year as sellers, accustomed to the booming market conditions of previous years, reluctantly cut their prices.

David Lereah, chief economist for the Realtors, said he expected home prices to continue falling for the rest of the year as sellers, accustomed to the booming market conditions of previous years, reluctantly cut their prices.

"Many buyers remain on the sidelines," Lereah said. "After a period of price adjustment, we'll see more confidence in the market and a lift to home sales should be apparent in the first quarter of 2007."

Please, Just Stop Talking - You're Only Making it Worse

Surely, retired Fed chief Alan Greenspan isn't doing his legacy any good by continuing to be a cheerleader for the economy that he left behind. According to this report, he's sticking to his story that the worst of the housing correction is now behind us.

A "reasonably rapid pace"? Is that like "kind of fast"? Many are now anxiously awaiting his latest analysis to be sure - Ben Bernanke must love having this guy around especially when he's in the news on the same day that the current Fed chairman gives a speech. Former Federal Reserve Chairman Alan Greenspan said on Tuesday that the worst of the housing adjustment was over, and that he was preparing to publish an analysis of the "serious dispute" over the true effect of mortgage wealth on consumer spending.

Former Federal Reserve Chairman Alan Greenspan said on Tuesday that the worst of the housing adjustment was over, and that he was preparing to publish an analysis of the "serious dispute" over the true effect of mortgage wealth on consumer spending.

...

Greenspan said he expected inventory levels to come down at a "reasonably rapid pace" and that "it looks as though sales figures have stabilized." But he also said there would be actual price declines in housing. "That will have some impact on consumer expenditures," he said. "We haven't seen it yet."

The Current Fed Chairman Gives a Speech

As noted in this story by Caroline Baum earlier in the week, tough talk from the Fed doesn't seem to be having the same effect that it used to.

The waiting platform occurred on Tuesday as Ben Bernanke expressed concern about inflation before the National Italian American Foundation in New York. The tough talk had a fleeting impact on the price of gold as shown in the chart below. Federal Reserve officials are getting a first-hand lesson in the law of diminishing returns: Try as they might, they can't seem to get the same mileage from their hawkish rhetoric.

Federal Reserve officials are getting a first-hand lesson in the law of diminishing returns: Try as they might, they can't seem to get the same mileage from their hawkish rhetoric.

In the past few months, every time a policy maker found a waiting platform, he or she used the opportunity to remind us that the Fed is more concerned about rising inflation than slowing growth.  Wow! The impact of tough inflation talk used to linger for days, if not weeks. Now it looks like it completes the full cycle in about 90 minutes.

Wow! The impact of tough inflation talk used to linger for days, if not weeks. Now it looks like it completes the full cycle in about 90 minutes.

Gongolled

The Gongol website shows this little blog at #18 on the list of Major Business and Economics Websites. Who'd a thunk that? An LA Times article talks mostly about #2 on the list - Tyler Cowen at Marginal Revolution.

Of course Barry is at the top, and it's nice to see Mish and CR in the top ten. Hmmm... why are so many economists so angry? It still cracks me up to see the name of this blog in print and people continue to advise against ever changing it, but surely it has a limited life span.

Oil and Gold Guesses - Four Weeks to Go

This is the third to last update of the chart for guesses at the year-end oil and gold prices where dozens of you entered to win a free one-year subscription to Iacono Research. A big move was made in the two weeks since the last update, and the yellow-dot has moved to the area of the chart with the highest density of guesses. There are three or four guesses at $66 and $666 - something about that combination seemed irresistible to a few of you and right now that's looking like a pretty good combination (the $90 and $900 can probably be ruled out, along with the $48 and $530).

There are three or four guesses at $66 and $666 - something about that combination seemed irresistible to a few of you and right now that's looking like a pretty good combination (the $90 and $900 can probably be ruled out, along with the $48 and $530).

Dubai Plans First Rotating Skyscraper

No, this story is not from The Onion - it is real.The Arab city with the palm-shaped islands and the sail-shaped hotel is adding to its eclectic skyline by building the world's first rotating skyscraper, a 30-story apartment tower that revolves on its base.

The developer promised that it will move very slowly, that it's not a theme park ride.

The tower, announced Wednesday, will use the Persian Gulf's abundant sunshine to power the building's slow rotation that brings it full circle once a week, said Nick Cooper, a British engineer designing the rotation mechanism.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

9 comments:

hi tim,

gere the cover from the economist

the falling $

http://www.economist.com/images/20061202/20061202issuecovUS400.jpg

it will be interesting to if the "cover" effect will wotk again......

maybe this is also interesting

china is stockpiling oil

http://immobilienblasen.blogspot.com/2006/12/china-is-stockpiling-oil.html

have an nice weekend

Hey, it ain't over till it's over, so don't dismiss my 90/900 yet! :)

what is the point of building a skyscraper that rotates..another huge waste of resources..

Looks like a clear consensus on how many barrels of oil that 1 oz of gold will buy . See, gold is money.

Tim,

For fun will you post weekly rankings of the best guesses? Oil, gold and/or shortest distance to yellow dot.

Ha-ha-ha.

Baum has one thing wrong: the bond market isn't so smart or prescient. Remember: a good half of bond market activity is driven either overtly or surreptitiously by foreign central banks. The bond market is now institutionally dumb.

jmf - that's another classic cover

tj - good guess for 2007, not enough time on the 2006 clock

anon - no idea, it's Dubai - reason has been tossed to the wind

do-da - yes, 10

anon - in two weeks, I'll try to include a list of who's closest

aaron - I really only liked the first two paragraphs from The Baumer - after the Greenspan bashing last week I think she has potential

Any comment on the following from GHPC?

[/i]Basel II

From January next year there will be new reserve requirements for banks under the Basel II regulations. The reserve requirements will be LOWERED, from now 5% of assets to 2.8%. That most likely means further debt growth and HPI.

This will be worldwide, only the US have decided to put Basel II off until 2008.

In Norway, where I now live, this was recently discussed in financial newspapers and it was assumed that BAsel II will drive house prices further up in Norway. we already had 18% HPI in the last 12 months[/i]

Basel II - hey, why stop the party now?

Post a Comment