Be Careful What You Wish For

Tuesday, December 05, 2006

With Alan Greenspan hanging around the football field like the star quarterback who graduated last year and with superstar transfer Hank Paulson joining the team to replace

fumble-prone John Snow at Treasury, does Ben Bernanke sometimes ask himself why he ever wanted the job of Fed Chairman so badly?

If he knew that energy prices would be so difficult or that many metal prices would double in his first year, would he still have taken the job?

Is this a case of "be careful what you wish for, because it may come true"?

Commodities and Dollars

First of all, it's a good thing that base metals and precious metals don't show up in any major price index. If they did, double and triple digit annual percent increases would look more than a little strange in this "low inflation" world.

Unfortunately other commodities do - like oil and gas. The recent fall of the dollar has added to the problem of rising commodity prices. The ministers of the oil exporting countries meet next week and the declining value of the dollar is sure to be a hot topic of discussion.

The recent fall of the dollar has added to the problem of rising commodity prices. The ministers of the oil exporting countries meet next week and the declining value of the dollar is sure to be a hot topic of discussion.

When asked about possible production cuts, now expected to be in excess of one million barrels a day, OPEC President Edmund Daukoru of Nigeria said, "We cannot ignore the extremely soft dollar amongst other factors".

From their point of view it's easy to see why they would be concerned. If they sell oil to the U.S. in exchange for dollars and then go shopping in Europe, those same dollars buy much less than they did just last summer. They're getting killed on the exchange rate.

What's a prince to do? What's Ben Bernanke to do?

Gasoline and heating oil prices are about the easiest prices for consumers to gauge, and they weigh heavily on the "inflation expectations" measure that is all important according to the economic textbooks.

The New Guy

According to some, Hank Paulson single-handedly solved Ben Bernanke's inflation problem last summer by pulling the rug out from under energy prices. When the re-jiggering of his former employer's commodity index resulted in the dumping of $6 billion worth of gasoline futures onto the market, other energy prices quickly followed gasoline down.

If he wasn't responsible for helping to nudge sky-high prices down a very steep slope, he sure gets a lot of credit for it. With high energy prices and inflation being increasingly synonymous, the Treasury Department now has the appearance of being the real inflation fighter in Washington.

With high energy prices and inflation being increasingly synonymous, the Treasury Department now has the appearance of being the real inflation fighter in Washington.

And the talks with China about the work to be done regarding trade relations and currency adjustment - Ben Bernanke going along now seems like an afterthought. Back when it was Snow at Treasury and Greenspan at the Fed, no one really took the meetings seriously unless the Fed Chairman was in tow.

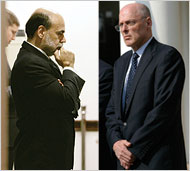

Add to this the stark difference in appearance between the two - Teddy Bear vs. serial killer (yes, here's that picture again) and the job of the Fed Chairman in 2006 probably has a much different feel than it did in 2005.

The Old Guy

Then there's retired Fed Chief and current Chatty Cathy Alan Greenspan who is now given equal billing when some of the financial media talk about Fed policy. In this Bloomberg report they are treated as co-equals - as if The Maestro is still conducting monetary policy through weekly speeches that are well attended by the media.Treasury bond investors are so bullish even Federal Reserve Chairman Ben S. Bernanke and Alan Greenspan can't stop the biggest rally in four years.

They may as well have just said "Chairmen".

Of course it doesn't help when the entire bond market thinks that you've got it wrong."The bond market is effectively saying the Federal Reserve is in denial and there's going to be more pain to the economy,'' said Michael Cheah, who manages about $2 billion in bonds at AIG SunAmerica Asset Management in Jersey City, New Jersey.

Who's in charge there at the Fed anyway? You can almost see the 2007 headlines already as a hesitant Ben Bernanke continues to talk tough about inflation while economic reports continue to show distress and the retired Fed Chairman is out promoting his new book.

...

Interest rate futures suggest traders are now almost unanimous in their expectation that the central bank will reduce its target rate to 5 percent by March. The odds reached about 100 percent on Dec. 1 after the Institute for Supply Management's factory index showed manufacturing in the U.S. contracted for the first time in more than three years. Bernanke, Greenspan

Bernanke, Greenspan

...

"In the case of inflation, the risks to the forecast seem primarily to the upside,'' Bernanke said. "Whether further policy action against inflation will be required depends on the incoming data and in particular how these data affect the FOMC's medium-term forecasts.''

Greenspan said in a Nov. 28 speech in New York that a drop in global inflation pressures has "flattened the long-term interest rate structure across the world.'' He also said "you'll see the 10-year note going back to civilized territory'' as a decline in labor costs slows.

Don't be surprised to see the headline, "Greenspan urges rate cuts".

Maybe Ben Bernanke is having second thoughts - if not he should.

If, after almost a year as Fed Chief, he now better understands the mess that he has inherited - next time he'll probably be more careful about what he wishes for.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

5 comments:

You gave up on that football analogy too early .. dropped passes, run out the clock, punting, offsides. The possibilities are endless.

James

USD depreciation prevents rate cuts. Ah yes, the external constraint.

That's what happens when a country turns itself into a massive external debtor. So, tighten belts and get ready for a hard landing.

I think its only fitting that "Easy Al" keeps hanging around...that way when the shit hits the fan he won't escape all off the richly deserved blame! I think your right about poor Helicopter Ben though.......wandering around the house at 3:00am wondering what the hell he was thinking when he campaigned for the job!

PS: I'm going to clip "that photo" and use it as my computer desktop. No slacking off under that menacing gaze!

Nobody understands the bond market... besides the fact that there are some four main theories on how it works and what it means, we have the inescapable fact that FCBs have monopolized action in the bellwether 2-year and 10-year Treasuries, making their use as a macroeconomic prognosticator dubious.

Meanwhile in junk-bond-land, the market is still behaving as if it will be smooth sailing forver, despite defaults of all kinds now creeping up off their historical lows...

And what with the latest release of relatively-happy GDP, manufacturing, and jobs numbers (from the discredited ADP, no less), investors seem to have their excuse for the sanguine behavior.

"USD depreciation prevents rate cuts. Ah yes, the external constraint."

Not necessarily.. there are other ways to make sure people keep buying dollars.

Bernanke is screwed, but I would be truly flaborgasted if he didn't see it coming. Maybe SAT scores aren't indicative of intelligence.

Post a Comment