Disappearing, Falling ... Whatever

Monday, December 04, 2006

Some people just can't get enough of the continuing story of the falling dollar - present company is of course included in that relatively small group.

And why not?

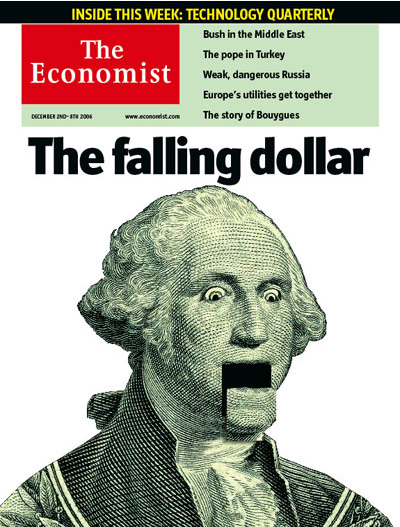

It's all become quite a spectacle, generating lots of snappy headlines and smart graphics, though many must be disappointed with the title of the lead story in the current issue of The Economist - The Falling Dollar($).THE dollar's tumble this week was attended by predictable shrieks from the markets; but as it fell to a 20-month low of $1.32 against the euro, the only real surprise was that it had not slipped sooner. Indeed, there are good reasons to expect its slide to continue, dragging it below the record low of $1.36 against the euro that it hit in December 2004.

The snappy cover art makes up for the less than snappy headline.

...

The recent decline was triggered by nasty news about the American economy. New figures this week suggested that the housing market's troubles are having a wider impact on the economy. Consumer confidence and durable-goods orders both fell more sharply than expected. In contrast, German business confidence has risen to a 15-year high. There are also mounting concerns that central banks in China and elsewhere, which have been piling up dollars assiduously for years, may start selling. The story further inside is similarly title-challenged, but for this one at least, no subscription is required - Rebalancing act.

The story further inside is similarly title-challenged, but for this one at least, no subscription is required - Rebalancing act.WELL before it happened, it looked obvious. America's economy is slowing; the Federal Reserve last raised interest rates five months ago; and the country has a vast current-account deficit. Europe's economies have been springing mostly happy surprises: the European Central Bank is almost sure to increase rates on December 7th and will probably carry on doing so next year. Asia looks strong as well, and Japan's central bank has been wondering when it will be safe to raise interest rates again. Sooner or later, the dollar had to fall.

It seems that the markets are fixated on relative growth rates. When America's housing boom made its economy boom, the dollar was strong. Now that the bloom has come off the boom, the 'ol greenback just doesn't have the same appeal.

And so it has. Against the euro, the dollar had been dropping, little by little, for more than a month before it broke through $1.30 on November 24th, going on to hit a 20-month low (see chart). Against the pound, on November 28th the greenback was at its weakest for two years. It slipped against the yen too, though it later made up the ground. Against the yuan—politically the most sensitive exchange rate these days—it continued a stately decline.

For more on the nation's economic ills, The Economist again relies on its new favorite American economist Nouriel Roubini with the obligatory counter point from the anti-Roubini in Washington, Fed chairman Ben Bernanke.Pessimists argue that recession is just around the corner: Nouriel Roubini, of Roubini Global Economics, predicts a recession by the middle of 2007. That is still a minority view, but financial markets clearly expect things to get at least bad enough for the Fed to start cutting interest rates soon. The prices of federal-funds futures suggest that investors think short-term interest rates are likely to decline within a few months.

Surprisingly, Fed funds futures are now predicting an equal chance of 5.25, 5.00, and 4.75 percent short-term interest rates after the March FOMC meeting. This all changed rather dramatically in just the last few days - a half point cut by March is now as likely as a continuation of the pause.

One person who does not sound gloomy is Ben Bernanke, chairman of the Fed. This week, in his first speech on the economic outlook since July, Mr Bernanke painted a much brighter picture. Yes, the economy was slowing, but this “deceleration” was “roughly along the lines envisioned” by the Fed in July. Mr Bernanke said output growth could be “modestly below” its trend rate in the very short term, but made clear that he expected the economy to be growing at its sustainable rate within a year. Far from hinting at lower interest rates, he noted that inflation was still “uncomfortably high”: “whether further policy action against inflation will be required”, he added, would “depend on incoming data”.

Apparently the bond market isn't as sanguine as the anti-Roubini.

But, this is not just an American story. When pundits in the U.S. were deriding mainland Europe for their sluggish growth a few years back, maybe the stewards of the "old Europe" economies were just thinking a little longer term.Those chirpy Europeans

To most Americans, what the dollar can be exchanged for overseas matters little - only about ten percent of the U.S. population has passports and most of those people never leave the country. As for import prices, recent studies have shown that only a very small amount of exchange rate movements are passed through via manufactured products.

There are two sides to any exchange rate: Europe's prospects matter as well as America's. In 2006 the euro area looks likely to grow at its fastest pace for six years. That its GDP growth is modest by American standards, largely because of its slower population growth, is not the point: what matters is that this year it has surprised the soothsayers time and again. That has lifted its currency, and not just against the dollar. A euro now buys more yen than at any time since the single currency was created.

Oil however is another matter. A steep decline in the dollar means that oil prices for Americans will go up, all else being equal - this reality may become more significant after next week's OPEC meeting where the subject of prices is sure to come up.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

4 comments:

It is odd that Americans are so inward looking, as if the rest of the world doesn't exist.

If you can demonstrate how the rest of the world is relevant to the average USian, they'll start paying attention.

Right now they'd rather pay attention to celebrities' personal lives.

-- a frustrated USian

The larger-scale question that this brings up is does the current petro-dollar regime mean that instead of depressions, every time the currency sinks we'll have stagflations instead?

"Some people just can't get enough of the continuing story of the falling dollar - present company is of course included in that relatively small group.

And why not?"

I love the dollar story. it's international. it's historical. it's the world's reserve currency. it's a story with so many twists. first of all, the dollar is doing great, and by that I mean silver and gold, the true dollars! it's Federal Reserve Notes that aren't doing well. the dollar story is the most important financial story in the US, maybe the world.

I find it odd that nobody seems to mind a falling dollar. in fact, wall street and talking heads like larry kudlow say it's good for the economy. they always add the caveat that it's good as long as it's "orderly." I can't believe how many times I've heard this on CNBC. when you think about it, it makes sense. if people weren't ok with the falling dollar, we'd never have gotten here to begin with.

I find the term old and new europe to be very telling. old means conservative, tried and true, stuffy, like your old relatives. there is no excitement, but should there be? the economy of europe is old. GDP growth is low and people save. the US is new, it's brash, it's bold and it doesn't care about the big risks it takes. from it's disastrous and bold foreign policy to it's reckless financial economy, it's definately new. being new is fun, until it's not. with big risks come big risks. suddenly one day you've lost a war and an election. suddenly the dollar is losing it's value and oil is hampering the economy. meanwhile old europe is still facing it's problems, but it's relative fiscal position is better. no big foreign deficits. good savings rate and a slow but steady growth rate. in a word, it's a boring economy. but that's the nature between old and new.

Post a Comment