How to Spot a Real Estate Shill

Thursday, December 14, 2006

Normally, stupid quotes about real estate from the mainstream media are simply allowed to scroll across the screen here with the full knowledge that they are mostly harmless.

When a quote crosses the line from stupid to moronic, then maybe it will be read a few times just to get a chuckle or two.

When a moronic quote is from a source with a vested interest and it is clearly intended to influence the opinions of readers, then it's time to stop and expose the source as a shill. How do you spot a real estate shill?

How do you spot a real estate shill?

All you really have to do is read closely, think a little bit, and be able to type in a Google search box - the whole process takes a few minutes.

Such was the case for this San Diego Union Tribune story about rising rental prices.

Home Prices Down, Rents Up

According to the report, a good portion of the six percent annual increase for housing rentals in San Diego can be attributed to the continued demand from would-be homeowners who have chosen not to leave the rental housing market. Fewer residents leaving the rental market has resulted in fewer vacancies (less supply) which, amid steady demand, allows landlords to raise prices.

These prudent potential homeowners are instead waiting to see what happens with home prices that began falling in San Diego about a year ago. After home prices became detached from fundamentals earlier in the decade, this seems like a perfectly reasonable approach to the rent vs. buy decision now that a peak is clearly in place.

If you don't have to buy (who really does?), why not wait and see what happens?

Cue the shill.Renters who anticipate a steep housing price drop may be disappointed, analysts say. Because the majority of homeowners have seen high equity gains in recent years, a sudden downturn in prices is considered unlikely.

It is assumed that the "analyst" and "researcher" are one and the same. If not, then author Emmet Pierce or some anonymous analyst deserves some of the scorn soon to be directed at one Russ Valone, and apologies to Mr. Valone will be forthcoming.

The for-sale housing market reached its peak in fall 2005. Researcher Russ Valone of MarketPointe Realty Advisors said it's difficult to know when prices have reached their low point.

“The problem a lot of those people are going to have is, by the time we all recognize the market has turned, it will probably be too late” to make a timely purchase, Valone said.

High Equity Gains Will Not Prevent Price Declines

High home equity may prevent "steep" declines or "sudden downturns" because many Southern California homeowners have what Alan Greenspan termed an "equity cushion". These products of contemporary financial innovation allow troubled homeowners to continue borrowing against their equity to make ends meet until the bank stops lending them money.

This is hardly a good long-term solution, but it does keep some families in their homes and it does keep some homes off of the market - not that anyone would really notice a few more homes for sale with the current bloated inventory.

High home equity will delay price declines, but it won't prevent them.

Prices are set at the margin - by homebuilders and motivated sellers pairing up with buyers who may or may not have any idea about the direction of home prices. The homebuilders and motivated sellers have been dropping their asking prices dramatically lately - something that even the dimmest homebuyer is starting to realize.

None of the buyer/seller price negotiations are affected by the high home equity of the majority of homeowners in the neighborhood.

You Could Do a Lot Worse than Missing the Bottom

The call to action that would prevent homebuyers from missing the bottom is clearly intended to rouse the animal instincts that have driven prices to current levels over the last few years.

It is a thinly disguised suggestion that if potential homebuyers do not act soon, they may forfeit huge price appreciation - something that has become ingrained in the minds of Southern Californians since the turn of the century, only starting to change recently.

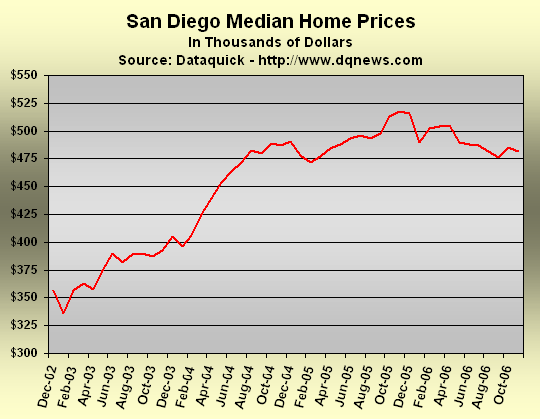

According to the latest update from DataQuick, there is a clear top in place for the San Diego real estate market after a long run-up. How long a run-up? You'd have to go back about three times the width of the chart above to get to the last bottom at around 1996.

How long a run-up? You'd have to go back about three times the width of the chart above to get to the last bottom at around 1996.

The top prior to that? Go back another five years or so to 1990-1991.

What would make anyone think that after such long multi-year moves over the last two decades that a bottom may be at-hand and that potential homebuyers would be in danger of missing it? (Opinions from the clearly delusional pair of NAR President David Lereah and retired Fed chief Alan Greenspan may not be considered when answering this question.)

The only direct quote from researcher Russ Valone says it all, "The problem a lot of those people are going to have is, by the time we all recognize the market has turned, it will probably be too late” to make a timely purchase.

Don't delay! Make that real estate purchase today! Before it's too late!

Heed Mr. Valone's advice and by this time next year maybe you too can make it into the newspaper like these people from Orange County who are furious that prices are falling all around them.

A Partial List

Oh, and the third part about how to spot a real estate shill - after reading closely and thinking a little bit?

The part about vested interests?

From the Market Pointe Realty Advisors website, here's a partial list of their clients.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

10 comments:

Real Estate shills have only two moving, interchangeble parts and the same stuff comes out of each.

A good portion of the run up in housing prices in the years upto 2005 was driven by the devaluation of the Dollar. Real Estate did get a little nutty at the end. But what else would you expect with an asset class that is so leveraged.

Again I repeat that the bearish contingent is missing the boat here.

Inflationary times accompanied with low interest rates are always great for real estate.

Unless interest rates go up real estate will not be what upends the US economy.

Real estate prices denominated in Gold prices aren't that out of line historically. And should stabilize unless interest rates go up.

Again the big story is when does this absurd monetary system blow up and the dollar start its steep inevitable decline.

Watch Gold prices. Watch the dollar. Watch bond yields. Forget about real estate.

So much of this real estate boom has nothing to do with interest rates. It is the necessary tightening of mortgage lending practices that will kill the real estate beast.Whether prices drop a little or a lot is the obvious question on many people's minds right now.

Housing prices hit by biggest drop on record

"SAN DIEGO – San Diego County housing prices slipped 6.9 percent last month, the biggest year-over-year drop on record, DataQuick Information Systems reported Tuesday."

i think he qualifies also as a shill

wula from the mar / lereah clon

http://paper-money.blogspot.com/2006/12/wluka-strikes-back.html

Maybe anon 748am is a shill.

The problem is not being too late, other than those that purchased in the last two years, but of not having enough patience, though one can grow old waiting for real estate.

Better to grow old waiting than grow old and poor 'owe-ning' Ha!

Timing is important. Now is a bad time to buy.

The real estate market can and will get worse. 2007 will make 2006 look like a good year. The worst is yet to come.

When the market reaches bottom the prices will recover slowly. So there is no need to rush to buy. When prices are declining you should wait until after they turn up again. As a decades long real estate investor, this practice has served me well.

David Lereah Watch

Post a Comment