Ventura Overtakes San Diego

Thursday, December 14, 2006

Just a quick update to the Southern California real estate sales charts after the report from DataQuick yesterday.

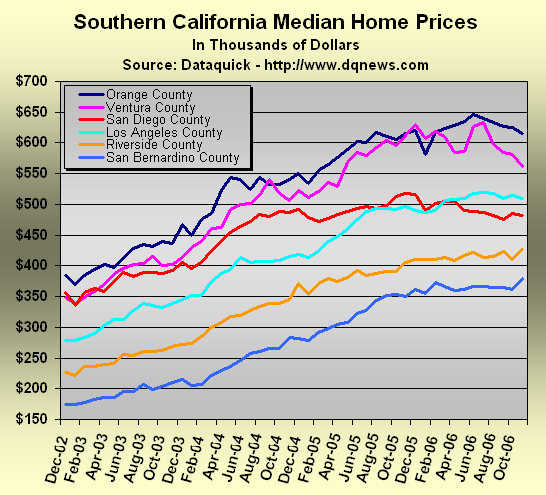

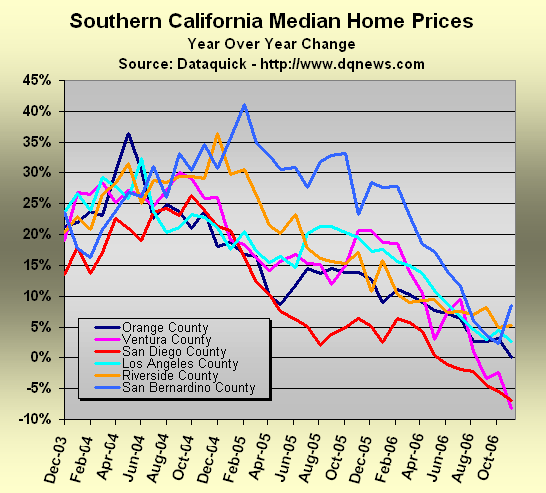

This month's report and the one coming in January will be the toughest year-over-year comparisons for San Diego which had its two highest median price months last year at this time. All the other Southern California counties made new highs in 2006 which will make for continuing difficulty in year-over-year comparisons.

The median settled at $562,000 last month, down $50,000 from $612,000 in November 2005, according to La Jolla-based DataQuick Information Systems.

It's not clear what's going on in San Bernardino (the blue line in the chart below). That was quite a counter move after gradual declines, month after month.

...

"I still think that it's buyers waiting for the bottom of the market, but there isn't going to be the crash that some buyers are waiting for," said Stuart Monteith of Prudential California Realty in Ventura. "We're already seeing a pickup in interest and activity, so I really expect to see a very strong beginning of the year and spring."

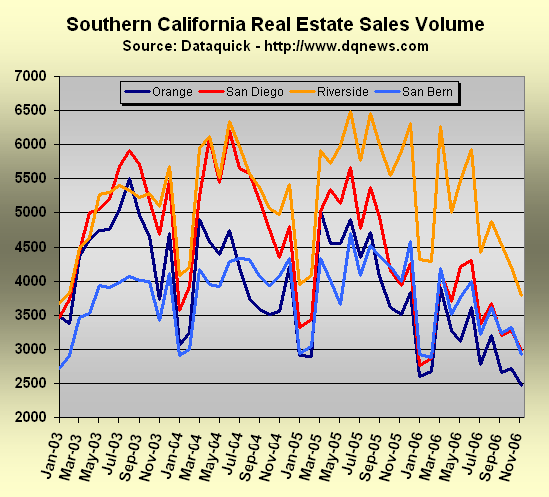

The big annual plunge in volume occurs in the data for January and February as shown below - who knows what to expect in the months ahead since recent sales volume is already below the sales volume levels of the two slowest months of the year.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

6 comments:

That newspaper article says there are an extraordinarily high number of homes currently in escrow (high for this time of year). I wonder if price declines are somehow involved.

The Ventura market is the smallest of all the SoCal regions. Ventura also has very conservative land use policies. Additionally there has been a marked shift in the distribution of new houses for sale. What is happening everywhere is showing up in exagerated form in the Ventura data. Hek, zillow informs me that my primary residence has lost $69,000 in the last 30 days. Eventually, the volitility will average out and the Inland Empire, Antelope Valley and such will take their rightful places as the biggest losers.

I went to couple of open houses, I fess up 4 actually !! :)

That must have counted towards the interest and activity.....

But I dont have any intention of buying in 2007 :) unless ofcourse there is a deal, PITI= my rent+10% premmium on a 30 year fixed mortgage

happy holidays realtors :)

I work in Ventura County and quite a few of my coworkers are renters wishing they could afford to buy in the local housing market. Prices may have dropped relative to last year but prices are still in the Stratoshpere. With prices looking to continue on the downward trend, prices haven't dropped ANYWHERE near enough to lure my (relatively well-healed) coworkers out of the rental market. "Interest and activity are picking up" says the local realtor - haven't we heard more-or-less the same thing for months now?

Parts of San Bernardino and Riverside County are full of suckers who are still getting coaxed into homeownership. They are typically Hispanic with lower incomes. They want the American Dream and they trust their real estate and loan buddies to have their best interests in mind. All of the homes I've sold this year have been purchased by undereducated, hardworking, lower income, Hispanic families. Why isn't this happening more in San Bernardino? Because the prices are still low enough for these people to qualify using a neg-am loan!

Meant to say "Why is this happening more in San Bernardino?"

Post a Comment