The Week's Economic Reports

Saturday, December 16, 2006

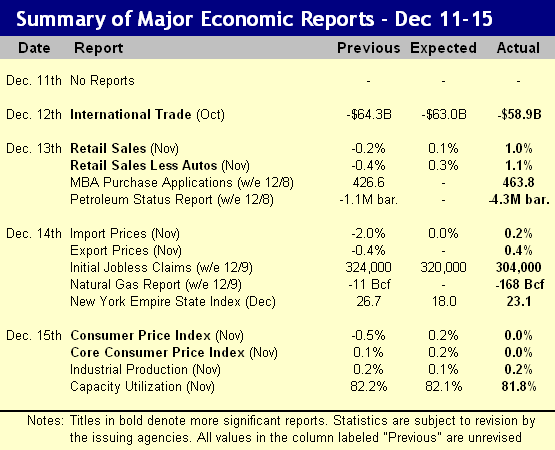

Following is a summary of last week's economic reports. The FOMC meeting was largely a non-event and economic reports were generally upbeat led by a narrowing of the trade deficit, strong retail sales, and benign inflation. For the week, the S&P 500 Index rose 1.2 percent to 1,427 and the yield of the 10-year U.S. Treasury note rose 4 basis points to 4.60 percent. International Trade: The trade gap between the U.S. and the rest of the world shrank to its lowest level in the last 16 months, largely a result of lower oil prices. The trade deficit fell from $64.3 billion in October to $58.9 billion in November, far better than the consensus estimate. The gap with China continued to grow, rising $1.4 billion to a new record of $24.4 billion.

International Trade: The trade gap between the U.S. and the rest of the world shrank to its lowest level in the last 16 months, largely a result of lower oil prices. The trade deficit fell from $64.3 billion in October to $58.9 billion in November, far better than the consensus estimate. The gap with China continued to grow, rising $1.4 billion to a new record of $24.4 billion.

Exports rose modestly, but the dollar amount of imports declined by 2.7 percent, driven by crude oil imports. While the volume of oil imports dropped slightly, most of the dollar decline can be attributed to falling oil prices that averaged $55.47 per barrel in November after an average price of $62.52 in October. As the trade report is about a month behind most other reports, this is the last economic report to reflect plummeting oil prices during the months of August and September.

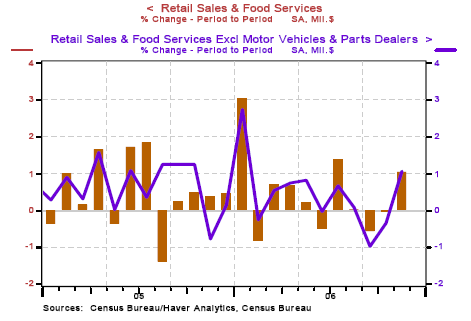

Retail Sales: Once again, those thinking that American consumers were about to give up their spendthrift ways were disappointed with a surprisingly strong retail sales report showing overall sales rising a full one percent, slightly more when automobile sales are excluded. This comes after three months of weakness in the retail sector. The largest component gain was posted by electronics sales which rose 4.6 percent - holiday shopping for the dizzying array of consumer electronics gear accounting for the bulk of the increase. Sales of building material rose almost 2 percent, an indication that the home improvement boom has not yet ended either. On a year-over-year basis, overall sales are up 5.6 percent, an increase from the previous month's year-over-year gain, the data clearly showing a resilient consumer during the month of November.

The largest component gain was posted by electronics sales which rose 4.6 percent - holiday shopping for the dizzying array of consumer electronics gear accounting for the bulk of the increase. Sales of building material rose almost 2 percent, an indication that the home improvement boom has not yet ended either. On a year-over-year basis, overall sales are up 5.6 percent, an increase from the previous month's year-over-year gain, the data clearly showing a resilient consumer during the month of November.

For an alternative view on the retail sales report see the post How Good Were Retail Sales Really? from Barry Ritholtz's always excellent Big Picture blog. Barry lists a half dozen issues that are worth considering including conflicting reports from the retailers themselves, seasonal adjustments, and a new sampling methodology used by the Commerce Department. After the last few month's of weak retail sales as shown above, a rebound was certainly due - now it's a question of whether the November data was a one off event or the start of a trend.

Import/Export Prices: Prices of imports and exports rose in November by the same amount that they declined in October, 0.2 percent and 0.4 percent, respectively. Natural gas prices that climbed 30 percent offset moderately lower oil prices for imports putting the year-over-year increase at 1.2 percent. The sharp rise in export prices for the month was attributed to a spike in the price of agricultural products that rose 4.4 percent, leaving the year-over-year increase at 3.9 percent for exports.

Jobless Claims: New jobless claims fell back in line with longer-term trends, coming in well below expectations at 304,000. Three of the last four weeks had seen higher levels of initial claims for unemployment insurance, the four-week moving average rising to almost 430,000, however, this most recent report seems to have reversed this recent trend pointing to a still sluggish, but largely healthy job market.

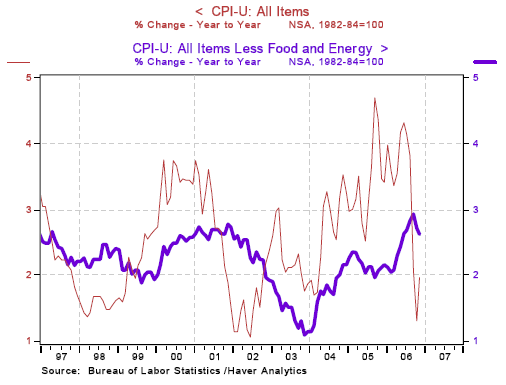

Consumer Prices: It is more than a little ironic, and a bit amusing, to see two 0.0% results in the Actual column of the table above representing November's overall inflation and core inflation. The first four pieces on the Friday Lite blog post give things a little different perspective - a prominent newspaper in the U.K. proclaiming that their government's inflation statistics are all wrong and calculating a nine percent total for the rise in prices experienced by seniors. And of course the story about the steps taken by the U.S. Mint regarding the melt value for coins that now exceeds the face value for both nickels and quarters which are both made of base metals. One of these days the people will figure out what the government is doing to their money and they won't be happy about it - the current condition of many seniors on fixed incomes who are particularly hard hit with rising energy and medical costs is just plain sad.

Overall consumer prices were unchanged in November, after a 0.5 percent decline in October. Core CPI was also unchanged, following a 0.1 percent increase the month prior. The year-over-year changes in price levels were 2.0 percent for overall inflation and 2.6 percent for core inflation, overall inflation having now bounced off of last months lows, whereas core inflation appears to have begun its descent. Energy prices have now about leveled out on a month-to-month basis, the cost of energy products falling just 0.2 percent in November after declines of 7.0 and 7.2 percent in September and October as a result of the sell-off in energy commodities that began in August. Apparel fell 0.3 percent and within the transportation category, new and used vehicles declined 0.7 percent and 1.4 percent respectively, the largest contributors to overall price weakness in this report.

Energy prices have now about leveled out on a month-to-month basis, the cost of energy products falling just 0.2 percent in November after declines of 7.0 and 7.2 percent in September and October as a result of the sell-off in energy commodities that began in August. Apparel fell 0.3 percent and within the transportation category, new and used vehicles declined 0.7 percent and 1.4 percent respectively, the largest contributors to overall price weakness in this report.

Despite the still-high 2.6 percent year-over-year core inflation rate, the current trend in prices is good news for the Federal Reserve in their "fight" against inflation. After months and months of 0.3 percent increases to the core rate (3.6 percent annualized), over the last five months this figure has moved steadily down to the most recent reading of 0.0 percent with an annualized core rate of just 1.6 percent over the last three months.

More than ever before, the inflation indexes are influenced by energy prices which have now stabilized after a tumultuous eighteen months that began with the 2005 hurricane season. Should the price of oil and natural gas move back up, the CPI will again rise - if energy prices are stable, inflation as reported in changes to the CPI as it is currently constructed, will likely continue to be benign.

Industrial Production: Industrial production rose 0.2 percent in November led by automobile manufacturing that increased 3.7 percent after a 3.4 percent drop in October. Capacity utilization was unchanged in November from a downwardly revised 81.8 percent in October.

FOMC Meeting: To the surprise of no one, the Federal Reserve Open Market Committee left short-term interest rates at 5.25 percent for the fourth meeting in a row. The only change of note was the accompanying policy statement where the word "substantial" was added to better characterization the "cooling of the housing market". There is a side-by-side comparison of the two most recent policy statements in Thursday's blog post One Little Word. Richmond Fed president, Jeffrey Lacker was the lone dissenter, voting for an increase to the Fed Funds rate for the fourth meeting in a row.

Summary: Last week's economic reports clearly demonstrate that if you remove all the bad news about housing and manufacturing, the economy has a decidedly different appearance - moderate growth and benign prices. This is exactly what the Fed has been shooting for and despite the fact that monetary policy had little to do with energy prices collapsing over the last few months, they will be credited with a successful "fight" against inflation, provided core CPI continues its decline in the months ahead. Don't be surprised if resurgent energy prices in the spring begin an entire new round of energy-driven inflation concerns.

The Week Ahead

The economic news in the week ahead will include producer price inflation and residential construction on Tuesday, the final reading on third quarter GDP and the Conference Board's leading economic indicators on Thursday, and both durable goods orders and personal income on Friday.

Charts courtesy of Northern Trust.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

5 comments:

There is more discussion of the retail sales data at Hale Stewart's new Bondad Blog:

Did Retail Sales Really Increase 1% in November?

Hi Tim,

At least with the metal value of the penny the American dollar is no longer a fiat currency, you can always trade in your paper money for 100 metal disks! Ship them out of America and melt them down.

Just an idea from NZ.

It's now illegal to ship more than $100 out of the country, anon, so not exactly cost effective to monetize pennies and nickels this way.

It's even worse if you want to carry them out physically: the limit is $5 on your person!

Punishable by 5 years in prison and/or a $10,000 fine.

New Zealand?

I heard your currency is going to merge with the Aussies. No?

They might as well merge since all the banks but one are Aussie owned. Which is one reason for the big trade deficit. But then again we have a love/hate with our friends on the other side of the pond, nationalism is strong both ways.

EU in NZ

Post a Comment