Another Good Friday

Friday, January 19, 2007

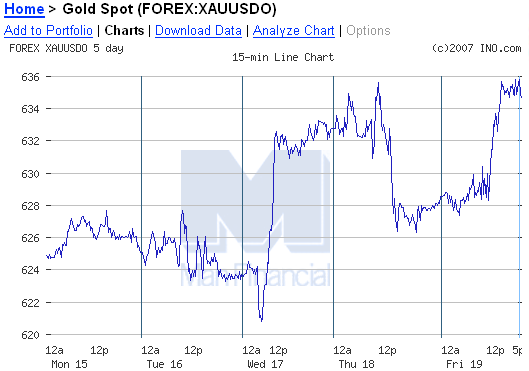

For some reason, precious metals have been going a bit crazy on Fridays since the beginning of the year. On January 5th gold fell $20, then last Friday it rose $14, and today it was up a respectable $8.

It's shaping up to be an interesting year - at least one day a week.

Just a reminder that the special subscription rate at Iacono Research expires tomorrow. After a wild first week that saw the model portfolio drop 4.2 percent, the last two weeks have showed steady strength increasing 1.2 and 0.9 percent. That's the way it usually works with commodities and related shares - quick and brutal selloffs followed by gradual rebuilding.

If oil prices are ready to head back up, the rebuilding is sure to accelerate. We'll see.

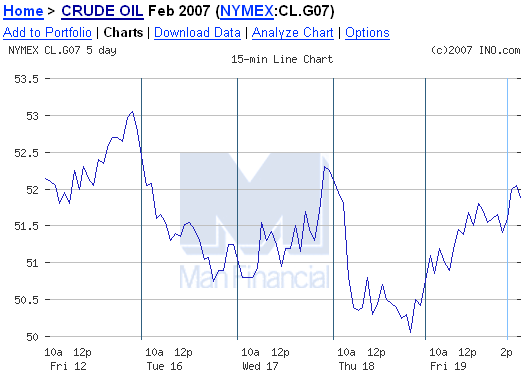

Now that cold weather has returned to much of the northern hemisphere, it looks like oil prices might stabilize at just over $50. Then again, the price may go down to $40 next week - or $60. The oil companies did well. They can still make pretty good money with $52 oil - the new Congress, however, that's a completely different challenge.

The oil companies did well. They can still make pretty good money with $52 oil - the new Congress, however, that's a completely different challenge. What happened on Wednesday?

What happened on Wednesday?

Was that the producer prices report that started that $10 rise? The gold miners continue to struggle.

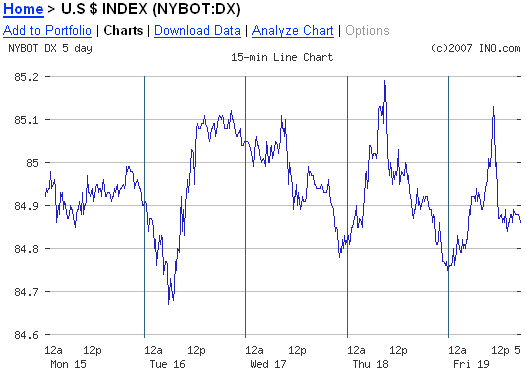

The gold miners continue to struggle. And the dollar looks like an EKG this week.

And the dollar looks like an EKG this week.

If the Bank of Japan keeps doing stupid things like they did earlier this week by giving the appearance that their monetary policy is formulated by politicians, the greenback could get a lot stronger vs. the Yen, the second largest component in the U.S. Dollar Index behind the Euro. So far this year it's been one brutal sell off and two weeks of steady gains - 49 weeks to go.

So far this year it's been one brutal sell off and two weeks of steady gains - 49 weeks to go.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

2 comments:

Those averaging-down will be handsomely rewarded.

DCAing actually does better under volatility.

Oh, btw, we're up to 13 imploded lenders.

Gold and silver are about to take off -- the multi-year chart is now very, very bullish.

Not because of a falling dollar, but because of prices that continue to rise despite oil prices falling.

Post a Comment