Two Views of "True" Inflation

Friday, January 19, 2007

Yesterday's testimony and Q&A session with Fed Chairman Ben Bernanke before the Senate Budget Committee had a couple of interesting moments to go along with much of the same sort of prattle that was the norm during Alan Greenspan's tenure.

The Chairman of the Federal Reserve telling Congress to rein in the budget deficit and fix entitlements seems like it's been playing on a continuous loop for the last ten years.

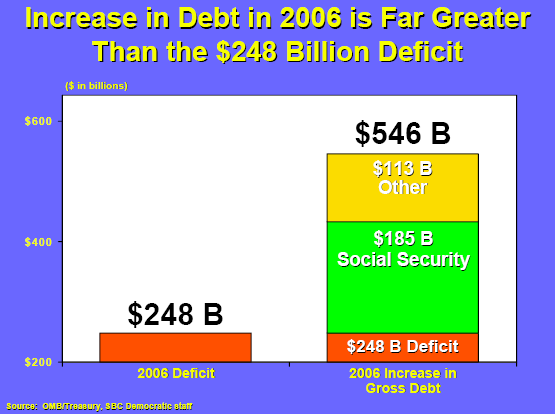

One thing that was different this time was that Chairman Kent Conrad (D-North Dakota) made a point early on about distinguishing between the budget deficit and the increase in debt. It seems that the great strides made recently in cutting the budget deficit in half, down to $248 billion, were all a bit of a ruse since the total increase in debt over the same period was $546 billion. Congressional hearings have a whole different feel now that the Democrats hold the gavels. For the last ten years the first 20 minutes of a session such as this would have been consumed by eight or ten elected officials heaping praise on Alan Greenspan for the fine work he was doing.

Congressional hearings have a whole different feel now that the Democrats hold the gavels. For the last ten years the first 20 minutes of a session such as this would have been consumed by eight or ten elected officials heaping praise on Alan Greenspan for the fine work he was doing.

Now, all they seem to want from Ben Bernanke is help in solving the massive long-term financial problems facing the government and its citizens.

Alan Greenspan had it pretty good.

"True" Inflation

By far the best part of the Q&A session had to do with measuring inflation.

In an insight to how the current Fed Chairman views the world of money and prices, he spoke about what he called "true" inflation, or, as Merriam-Webster might put it, the measure of inflation that is "in accordance with the actual state of affairs" or "conformable to an essential reality".Sen. Wayne Allard (R-Colorado): The Bureau of Labor Statistics has recently introduced a new price index, it's called the "chained CPI". I wonder if you'd elaborate on that - they're claiming that it's more accurate than the current CPI. I would like to hear your feelings on that new measurement.

So, given last year's overall inflation of 2.6 percent, "true" inflation - the measure of price increases that are "in accordance with the actual state of affairs" or "conformable to an essential reality" - would be just below two percent.

Ben Bernanke: Yes I think it is somewhat more accurate. The existing CPI, the one we're all familar with, takes a fixed basket of goods and values the change in the cost of that basket from month to month and from year to year. The problem with that is that it doesn't take into account that as prices change, people will change the goods and services that they choose - if oranges become more expensive, I might eat more apples.

The chain weighted CPI allows, to some extent, for adjustments that people make to go from higher price goods to lower price goods, and therefore is probably a better measure of the true cost of living increase than the standard CPI.

Allard: Do you think that the procedure that we're using now at the CBO and the OMB, that those projections overstate inflation?

Bernanke: Well, presumably the projections they're making are in terms of what they think the standard CPI inflation will be. At the Federal Reserve we've done numerous studies of these indices and we do think that the standard CPI does overstate "true" inflation, if we could measure "true" inflation, by some amount between a half and one percentage point.

Allard: Do you think we could go to those agencies and change CPI to get a better result?

Bernanke: Well, the operational question that we might ask is whether we should use the chained CPI or some other measure to index entitlement benefits or index the tax code. In congress, if your objective is to tie benefits payments and the tax code to what I would call "true" inflation, you would have a more accurate measure of "true" inflation by using the chained CPI or some alternative measure.

An Alternative Essential Reality

The definition of "true" inflation for Ben Bernanke stands in stark contrast and will comes as a great surprise to Jim in Washington who wrote in response to Tuesday's post, Seniors in Debt. Jim has granted permission to share some of his thoughts:I am a disabled veteran, I am no where near being elderly at 49, yet I am on a fixed income just as the retirees are. My veteran disability check is $2,314 per month, and that is not (income) taxable, I also get full medical and dental with no cost to me.

The new improved "chained CPI" may capture this substitution effect.

When this payment began in February 2005 I was able to get by relatively comfortably, I would not say it was middle class because I could not afford to buy a home (my first prerequisite for entrance to the middle class is enough money to AFFORD a home which eats no more than 33% of gross income for PITI), I was in California and that was simply not even close to enough income to buy even the cheapest house on the market. So, not middle class but close for one doomed to rent the for next 30 years.

Twenty four months later I can tell you that prices have so far outstripped these puny COLA raises the congress has granted that I am now actually considering going homeless, at least for the four months of the year when weather is warmer.This year was a classical example, the congress initially announced a 4.1% COLA for retirees and veteran's , but the GOP on the hill said that was too much and they got their way in one of their last acts before getting curbed by the democrats in the elections. They trimmed the COLA to just 3.3%, that was in a year when my landlord raised rents from $700 to $800, some 15% for the renewal on the lease. Rents are up even more since. Food is getting to be a problem, and I have had to resort to the food bank more than once.

Economists really do need to occasionally pull their noses away from reports and computer screens full of statistics and get out more.

...

My living standard has not just noticeably dropped it has plummeted. I am scrambling to pay off my only credit card with a balance of some $2,500 because I cannot afford the interest and fees. Mind you I am one of the LUCKY ones, my income is far higher than most on social security or other disabled veterans even. It seems every month I have to find something else to cut out, and every month I find prices spiking all around me, a haircut went up from $12 to $15, a car wash at the automatic place went from $5 to $6.

...

This is the reality for fixed income people, the federal government is blaming retirees and disabled people for their budget problems, Bernanke said it today, if they do not CUT entitlements the USA will be bankrupt.

This is a gross violation of the social contract by which the USA was able to build a thriving middle class in the first place, and I am not alone when I say that the middle class is the goose that laid the golden eggs that the rich so enjoy. Their greed is so boundless that they do not care if old folks die or veterans live out of dumpsters.

They WILL care however when these millions come and haul them into the town square for a lynching. So, they will hire some of the poor to be in their private armies and we will have taken the last steps to feudalism again.

Apparently, "truth" is all a matter of perspective.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

12 comments:

Bernanke thinks inflation is overstated?!? If that's the case, then why the hawkish talk about inflation over the past year? Why is it that none of our representatives in Congress are calling this douchebag on his pack of lies (except Ron Paul, God bless him).

Bernanke needs to be under oath when he's spewing lies like this so that they can throw him into a cell next to Bernie Ebbers for purjury.

And if I stop eating hamburger and go to dog food, that would reflect an even lower inflation rate.

Sure, if you change the basket around, you can manipulate the inflation rate, but the whole idea is to measure the inflation of the SAME BASKET OF GOODS, i.e. the SAME STANDARD OF LIVING.

This is only going to get worse over time...one by one people catch on regardless of what they are told...Jim is one of the smarter ones. I caught the tail end of the Q&A and one of the Republicans on the committee asked about "inflating our way out" of our problems...Beranke promised that they wouldn't do that. What a load of crap...is it time for them to start giving away cheese again?

oopsie - spellchecker should have known what I meant - thanks

or jim could move to a southern state where you can get haircuts for $9 and rent is 650 for a 1/1

eternal optimist

Indeed, while the point is taken about Jim's dire straights, he should (bluntly) get used to it - it's only going to get worse for him from here.

Here's a few thoughts on what he needs to do:

1) Move. No, seriously. Move. Now. There are lots of low cost environments where $2300 after tax income will let you live really quite well. Mississippi comes to mind - or anywhere underdeveloped and rural. So does Costa Rica, and Thailand. Most of those square states in the middle of the country also qualify.

2) Get a roommate. Most of the younger (<40 yr old) people I know have one. Now he needs one too.

3) Get a job. Yes, you're a disabled vet. You can also type up a coherent email. That qualifies you for a variety of jobs that could net you $500 or more a month even with your (presumably severe) disability.

Doing these things will won't make it all better - but it will delay by up to 20 years the true crushing poverty that's coming your way as someone without savings on a fixed, COLA income.

Do I sound bitter? My retirement plan, entirely self funded, is going to require me to live off about $3000/month, with no COLA increase, ever. I don't expect to ever receive Soc Sec, since that will be (effectively) bankrupt within a few years of my drawing on it, anyway. While I would never trade places with a disabled vet who's doubtlessly in pain, his financial situation is hardly dire - yet.

I live in one of the square states in the middle... for $780 a month, in 16 years I'll have my charming 1500 sq foot home paid off thanks to cheap midwestern houses and those 5% fixed rate 20 year mortgages from 2003. Back then I'd never spared Alan Greenspan a thought and never heard of "Austrian" economics.

It never occured to me at the time to use the cheap credit to load up on debt. It was screaming "get out of jail on a song" to me.

Jim has my empathy but I gotta tell you I hate the term "social contract" when it's applied to a welfare program. (Is it applied to anything else?) I don't see how I can break a contract made between two other parties to benefit each of them at my expense. My portion of the tax is really cramping my style; it interferes with the aggressive gold and cash hoarding I've been doing for the past two years. I can't save the elderly and it drives me crazy that the money that should be protecting me from that mess is only going to help obscure the problem for a future and bigger set of needy retired people. But now I'm probably ranting to the choir.

Ack, er, sympathy.

“it doesn't take into account that as prices change, people will change the goods and services that they choose - if oranges become more expensive, I might eat more apples.”

If a house gets foreclosed, the former homeowner becomes a renter. I get it now, it’s all good.

Great post.

I was going to make a snarky comment in response to Bernanke about scaling back to a standard of living consisting of being homeless, but apparently reality has a quicker wit.

BERNAKE SHOULD TEAM UP WITH THE NEW CHIEF JUSTICE (OR MAYBE ALREADY HAS) AND SEE IF THE UPPER HIGH CLASS CAN GET A RAISE--AS IN FEDERAL JUDGES NEED ACCORDING TO THE NEW CHIEF'S END OF THE YEAR REPORT. REMEMBER FOLKS, COLA, STANDS FOR COST OF LIVING ADJUSTMENT. CAN ANYONE TELL ME WHEN THERE HAS BEEN AN ACTUAL RAISE FOR THOSE ON SOCIAL SECURITY OR OR FOR DISABLED VETERANS?

"The chain weighted CPI allows, to some extent, for adjustments that people make to go from higher price goods to lower price goods."

Isn't it likelier that the opposite effect would happen? That is, if some products (electronics) become cheaper, while others (housing) are inflating faster, wouldn't most people be spending a higher percentage of their income on the latter? Especially if the latter is essential to live while the former is a luxury? Wouldn't this raise inflation over time, even keeping the rates of increase/decrease the same? And the bigger the differences in inflation, wouldn't this become a bigger problem? Is this completely obvious or am I missing something? I must be missing something.

Post a Comment