Boinggg!

Friday, January 12, 2007

Precious metals rebounded like a coiled spring today after a strong retail sales report and a sliding dollar - maybe all that tough inflation talk from the Fed is warranted.

[That title should probably read Boinggg! Boinggg! to include both gold and silver.]

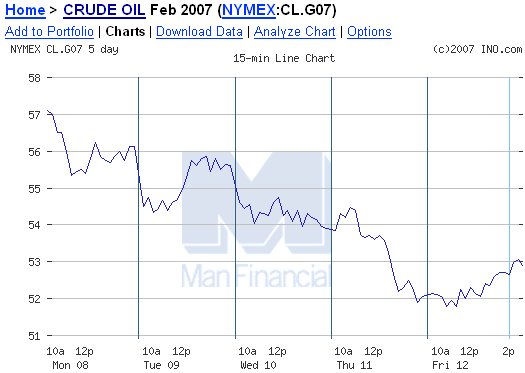

Oil continued to fall with little sign of getting up anytime soon. Prices for near-month delivery plumbed new nineteen month lows early this morning after OPEC President Mohamed al-Hamli expressed his view on oil prices below $53 a barrel - "unacceptable'' was the word he used. Now if OPEC members would just follow through with promised production cuts - just once. The big oil companies did a lot better than last week (though that's not saying much).

The big oil companies did a lot better than last week (though that's not saying much). It was a very good day for gold - it just kind of hung around all week waiting for the weekend to arrive. At noon on Friday it jumped $10 and punched out for the weekend.

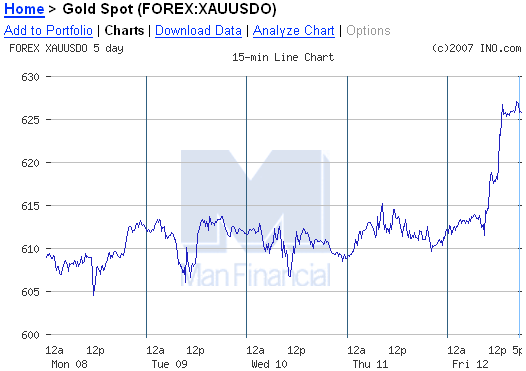

It was a very good day for gold - it just kind of hung around all week waiting for the weekend to arrive. At noon on Friday it jumped $10 and punched out for the weekend. Gold goes up two percent, silver goes up four percent - that's pretty typical. Of course it's a lot more fun going up than going down - when going the other direction, it's more like gold goes down two percent, silver goes down eight percent.

Gold goes up two percent, silver goes up four percent - that's pretty typical. Of course it's a lot more fun going up than going down - when going the other direction, it's more like gold goes down two percent, silver goes down eight percent. Gold miners rebounded, though they made up only about a third of last week's decline - last week was pretty awful.

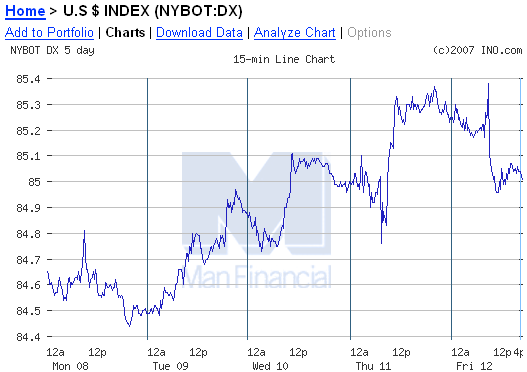

Gold miners rebounded, though they made up only about a third of last week's decline - last week was pretty awful. And the dollar continues to impress - up to 85 on the U.S. Dollar index before falling back into its old habits today. Is it time to buy Euros again?

And the dollar continues to impress - up to 85 on the U.S. Dollar index before falling back into its old habits today. Is it time to buy Euros again? The second week of the year was much better than the first. Hopefully, in this case, one week will make a trend.

The second week of the year was much better than the first. Hopefully, in this case, one week will make a trend.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

5 comments:

Is it just me, or has there been a pattern of gold and silver waiting around until US-sourced trading volume lightens up, then rocketing upwards? (Or, conversely, the dollar cratering)

The trading dynamics of the US seem to be based on a whole different worldview, and when that worldview goes on vacation, the market totally changes behavior according to... the entire rest of the world.

It will be interesting when gold breaks out of being controlled by the Keynesian paradigm ("a growing economy is inflation!") and switches to safe haven ("holy sh*t where do I we put our life's savings now???")

I think anyone with a brain already knows which way the Fed will go. In the meantime, they need a premise to allow them to go that way. This is causing volatility in the markets as those without a brain ponder whether 'inflation' or 'growth' will matter more.

Oh wise one, please let us without a brain know what the Fed is going to do. All the pondering is hurting my brain...oops the area where my brain should be.

It will be interesting when gold breaks out of being controlled by the Keynesian paradigm ("a growing economy is inflation!") and switches to safe haven ("holy sh*t where do I we put our life's savings now???")

That's what I'm waiting for!

Dear Brainless,

If the Fed were tight, they would be defending the claims of foreign creditors to US-based assets. Sound like a winning strategy? The Fed desperately needs to be loose but cannot appear that way for risk of igniting an uncontrolled run on the dollar. They want inflation but need to maintain control over inflation expectations.

Post a Comment