The Week's Economic Reports

Saturday, January 13, 2007

Following is a summary of last week's economic reports. Rising credit card debt and robust retail sales for December highlighted the data - this will likely stoke new inflation fears in the weeks ahead. For the week, the S&P 500 Index fell rose 1.6 percent to 1,431 and the yield of the 10-year U.S. Treasury note rose 13 basis points to 4.77 percent. Consumer Credit: Credit card debt soared in November contributing to the $8.7 billion rise in revolving credit. After falling $1.3 billion in October, overall consumer credit rose $12.4 billion in November, likely an indication that consumers were feeling confident enough during the early holiday season to continue spending, using credit cards to fund purchases as home equity withdrawal wanes. Nonrevolving credit for purposes such as auto loans rose $3.7 billion.

Consumer Credit: Credit card debt soared in November contributing to the $8.7 billion rise in revolving credit. After falling $1.3 billion in October, overall consumer credit rose $12.4 billion in November, likely an indication that consumers were feeling confident enough during the early holiday season to continue spending, using credit cards to fund purchases as home equity withdrawal wanes. Nonrevolving credit for purposes such as auto loans rose $3.7 billion.

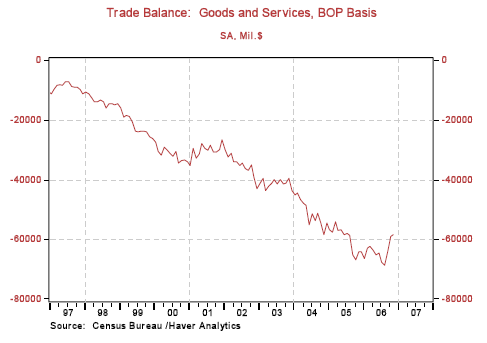

International Trade: The U.S. trade deficit contracted for the third consecutive month, from a revised $58.8 billion in October to $58.2 billion in November. The narrowing was due largely to an increase in exports rather than reduced imports, more civilian aircraft deliveries to international customers being the primary factor. Overall exports rose 0.9 percent while imports increased 0.3 percent.  Prices for crude oil fell from $55.47 per barrel in October to $52.25 per barrel in November, making the increase in the oil trade deficit much smaller than it would otherwise have been. The trade gap with China narrowed $1.5 billion to $24.4 billion per month while the deficit with Japan and OPEC countries narrowed by $0.4 billion and $0.7 billion, respectively. Most of the reversal in recent months is a direct result of lower oil prices and this will provide a boost to fourth quarter GDP.

Prices for crude oil fell from $55.47 per barrel in October to $52.25 per barrel in November, making the increase in the oil trade deficit much smaller than it would otherwise have been. The trade gap with China narrowed $1.5 billion to $24.4 billion per month while the deficit with Japan and OPEC countries narrowed by $0.4 billion and $0.7 billion, respectively. Most of the reversal in recent months is a direct result of lower oil prices and this will provide a boost to fourth quarter GDP.

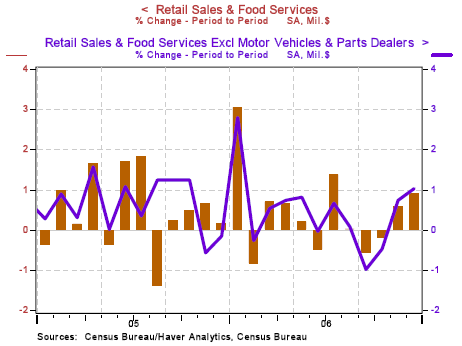

Retail Sales: The undaunted American consumer is alive and well, at least according to the latest retail sales data. Exceeding expectations, retailers reported an overall sales increase of 0.9 percent in December following a downwardly revised 0.6 percent rise in November. The two most recent months convincingly reverse the trend of the three prior months where sales fell on a month-to-month basis. Excluding automobiles, retail sales gained 1.0 percent in December after a revised gain of 0.7 percent in November. Strength in retail sales was broad based. One of the few categories losing ground was building materials which fell 1.1 percent, a result of a slowing housing market. Gains were paced by gasoline station sales and electronics, both up over three percent - rising prices at the pump were responsible for the former, however, this will be reversed in the months ahead as gasoline prices fall. On a year-over-year basis, overall retail sales were up 5.4 percent, once again exceeding wage gains over the last year, the difference being made up via new credit.

Strength in retail sales was broad based. One of the few categories losing ground was building materials which fell 1.1 percent, a result of a slowing housing market. Gains were paced by gasoline station sales and electronics, both up over three percent - rising prices at the pump were responsible for the former, however, this will be reversed in the months ahead as gasoline prices fall. On a year-over-year basis, overall retail sales were up 5.4 percent, once again exceeding wage gains over the last year, the difference being made up via new credit.

Import and Export Prices: Both import and export prices rose sharply in December, the rise in import prices largely due to a temporary rise in oil prices during the reporting period that ended in mid-December (note that the international trade report above in which falling oil prices were reported is a month behind most other reports). As oil imports are a very large component of total imports, the January report should show a hefty price decline.

The 0.7 percent increase in export prices was the largest monthly increase in nearly two decades, largely a result of higher prices for agricultural products. Prices for commodities such as corn and wheat have been rising rapidly in recent months and this is now showing up in the export data.

Summary: Higher consumer spending enabled in part by increased credit card debt has once again proved the old axiom, "Never count out the American consumer". The latest reports show that consumers are turning away from home equity withdrawal and are back to using credit cards after a long period of low credit card spending. What appeared to be capitulation during the months of August, September, and October was reversed in a big way over the last two months casting new doubt on whether a consumer led economic slowdown is in the cards for 2007.

The Week Ahead

Economic news in the week ahead will be highlighted by two inflation reports - producer prices on Wednesday and consumer prices on Thursday. Other reports include industrial production on Wednesday, housing starts and the Conference Board's index of leading economic indicators on Thursday, along with consumer sentiment on Friday.

[Note: This is one very small part of the Weekend Update published at the companion investment website Iacono Research. Since it contains no investment-specific information, it will appear here on Saturdays on a fairly regular basis. To have a look at the complete Weekend Update, including the model portfolio and much more, sign up for a no-obligation free trial today.]

All charts courtesy of Northern Trust.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

3 comments:

dean baker's take.

"The story behind the decline is a mixed bag. The biggest factor was a sharp drop in oil prices, which accounts for $8 billion of the decline from the August level. Exports have increased over this period, but they have been growing at about the same rate for the last two years. There has also been a drop in real imports over this period, most notably a drop in industrial supplies of approximately 7 percent over this period."

http://www.prospect.org/deanbaker/2007/01/good_news_on_trade.html

As long as people can borrow money, they'll spend it. That's the foundation of our economy. Enjoy.

The picture will change dramatically when energy reverses (and gas prices are especially hit). I view energy as priced way too low now relative to fundamentals. This looks like heavy hedge fund/proprietary trader influence.

I also see waning HELOC as a problem. Now we no longer have a holiday season to add any sort of boost to demand -- so fewer excuses to buy on regular, expensive credit.

Post a Comment