The New Cold War

Thursday, January 11, 2007

What is currently happening in energy markets could eventually have a disastrous impact on both the global economy and the tenuous peace that currently exists in many parts of the world - the combination of plunging oil prices and shaky suppliers makes for a potentially lethal combination.

To put things into proper perspective, Speigel Online, the internet version of Europe's biggest and Germany's most influential weekly magazine, has an ongoing series titled "The New Cold War - The Global Battle for Natural Resources". Is this over dramatizing the energy situation?

Is this over dramatizing the energy situation?

Probably not if you live in Europe and are dependent upon imports from Russia - the events of earlier this week demonstrate why this is so.

On Monday, the pipelines from Russia temporarily ran dry:Russia Halts Oil Deliveries to Germany

On Tuesday, Ms. Merkel was none too pleased:

The conflict between Moscow and Minsk over energy prices worsened on Monday, with potentially serious consequences for Western Europe. Russian pipeline operator Transneft shut down its Druzhba pipeline, which is the source of 20 percent of Germany's oil imports.

Transneft has accused Belarus of illegally tapping oil from the Druzhba pipeline, whose name translates as "friendship".

...

"I view the closure of the important Druzhba pipeline with concern," German Economics Minister Michael Glos said Monday. "I expect the deliveries through the pipeline to resume completely as soon as possible."

...

Earlier on Monday, deputy Polish economy minister Piotr Naimski told Polish TV station TVN24 that the pipeline had been shut off because of the ongoing energy dispute between Minsk and Moscow. Russia dramatically increased gas prices on Jan. 1 and acquired a controlling interest in Belarussian natural gas pipeline operator Beltransgas. In addition, the Russian government imposed an export duty of $180 per ton on petroleum.Merkel, EU's Barroso Condemn Russian Pipeline Shut-Off

Much of Europe was talking about their unreliable energy supplier to the East:

German Chancellor Angela Merkel and European Commission President Jose Manuel Barroso have criticized Russia for shutting down a pipeline pumping oil to Europe. Russia's move has dented its image as a reliable energy supplier, said Merkel. She also hinted that Germany may reconsider its phaseout of nuclear power.

"That hurts trust and it makes it difficult to build a cooperative relationship based on trust," Merkel told a news conference.

...

The pipeline is the source of 20 percent of Germany's oil imports. Germany, Poland, Hungary, the Czech Republic and Slovakia have been affected by the shutdown.Russia Becoming 'Frighteningly Arrogant' Over Oil

Wednesday saw the crisis averted, but not without a lasting impression:

The latest energy spat between Russia and one of its former Soviet neighbors has cut off oil supplies to western Europe and led to fresh concerns over the west's dependence on Russian oil. It highlights how ruthless and arrogant Russia has become with its energy policy, and forces Europe to step up its search for alternative supplies, say German media commentators. Business daily Handelsblatt writes:

Business daily Handelsblatt writes:

"The case of Belarus harbors a lesson for western Europe: Russia is once again showing how irresponsibly it is handling its increased global role. The world's second largest oil exporter and most important gas producer should be aware that trust and reliable supplies are the most important assets in the energy industry."

"It's precisely this asset that Moscow is putting at stake in its row with Belarus. And in the wake of the conflict with Ukraine, the Kremlin is again proving that it's prepared to use energy supplies as a political weapon. That is why Europe must lessen its dependence on Russian oil and gas despite all Moscow's assurances of friendship."

"And Russia must accept the rules on dispute settlement enshrined in the European Energy Charter. The Russian mechanism of simply turning off oil and gas supplies or doubling prices whenever there's a row is more than impertinent."Belarus resumes Russian oil flow, ending 3-day halt

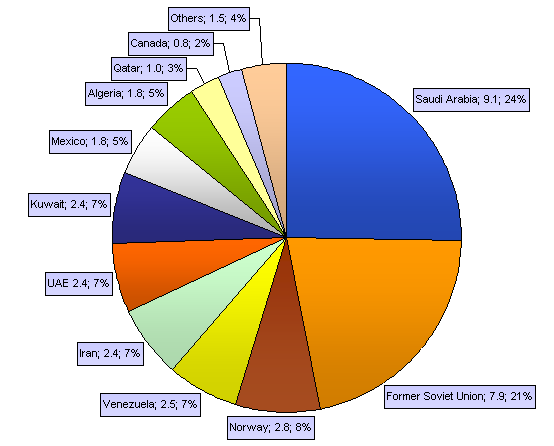

As the world's number two exporter of oil, this will likely not be the last time that the flow of oil temporarily stops - it's a long way from number two to number three and the Russians know it (chart courtesy of The Oil Drum).

Belarus said on Wednesday it had restarted the flow of Russian oil through a major pipeline across its territory, ending a three-day stoppage that rattled Europe.

The resumption came hours after Belarus scrapped an oil transit duty it imposed last week on shipments of crude through the Druzhba ('Friendship') pipeline linking Russia's Siberian oilfields to central and eastern Europe.

...

The shutdown marked the climax of a trade dispute in which Moscow doubled gas export prices to Belarus at the New Year and imposed a crippling crude oil export duty equivalent to 10 percent of the gross domestic product of its western neighbor.

Minsk retaliated last week by imposing its own oil transit duty. Transneft shut off the oil flow on Sunday night, accusing Belarus of siphoning 80,000 metric tons of oil from the pipeline to take payment of the levy in kind.

Minsk caved into pressure from Moscow after Putin said on Tuesday Russian oil firms should prepare to cut production if no compromise was reached, threatening prolonged supply cuts to Europe just a year after a Russia-Ukraine gas crisis.

Russian Energy Minister Viktor Khristenko met oil bosses on Tuesday night and Wednesday to discuss reductions. But further discussions were called off when Belarussian Prime Minister Sergei Sidorsky said that Minsk had withdrawn the transit duty.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

9 comments:

Time for Germany to build some nuclear power plants.

More from Der Speigel:

Russia Resumes Oil Shipments to Europe

with some really cool pipeline maps.

Niall Ferguson addressed this issue last month in a WSJ op/ed

http://online.wsj.com/article/SB116650072474754178.html? mod=opinion_main_commentaries (subscription required)

Mr. Ferguson briefly looked at history through a commodities paradigm indicating when conflicts occurred between commodity rich "haves" and commodity poor "have-nots." He condluced that: "It will be ironic indeed if the next big story in the commodity market is a price slump in the context of a global economic slowdown. For then the joke will be on the haves, and particularly the energy-exporting empires. And it will be the turn of the have-nots to put their lips together and blow."

Of course if commodity prices continue to rise all bets are off.

Thanks for the link - this part is good too::

The lesson of history is that commodities are not destiny. A booming global economy and rising commodity prices may in theory increase tensions between commodity exporters and importers. But haves and have-nots are not doomed to conflict; wars may equally break out between rival haves. At the same time, falling commodity prices may be as disruptive of international order as rising commodity prices. The fall of the Soviet Union, after all, can be plausibly explained as consequence of cheap oil in the 1980s.

Pretty obvious, imo, who is in control now for the forseeable future. Faber is fond of saying you'll never see $12/bbl oil again. May be that is a clever way to say we have already surpassed Peak Oil (i.e. peak cheap oil).

His latest from the DR (hilarious!):

http://www.dailyreckoning.com/Issues/2007/DR010907.html

It's too bad we didn't start a 200 Billion dollar a year research program into making Fusion a reality back in 2002, instead of 200 Billion dollar a year fight.

We might have been free of the arabs, and be recieving the endless adulation of the europeans right about now.

But no, 'energy efficiency is impossible' -- better to attack and kill, though that only makes things worse.

Think it's too late to start again?

I do.

If I didn't know any better, I would have expected Russia's strongarming of Belarus to push the price of oil higher ... where's the fear premium??

If the oil will be expensive for a longer period of time, people will find alternative energy to replace it. Its just a matter of time. Therefore I think 'peak oil' theory is rubbish. And it is quite possible that we will see 20 usd again (as well as 100 usd).

Wind power, nuclear and hybrid vehicles will make a dent. Not to mention as the economy slows people buy smaller vehicles sending consumption down.

LAEF2

Post a Comment