Peak Oil in Three Charts

Thursday, January 18, 2007

For those of you with an interest in the world's most important commodity, if you haven't already done so, stop by The Oil Drum for some of the best information, analysis, and discussion on the topic of "Peak Oil".

This is a subject about which most Americans are blissfully unaware.

That feeling has only been enhanced by the precipitous decline in crude oil prices in recent months, from the uncomfortable highs near $80 to what now seems like bargain basement prices near $50.

The expense of filling up an SUV will soon be back down at comfortable levels and all will seem right in the world of energy - at least for a while.

How long a while?

That's what the peak oil debate is all about.

Google the phrase Peak Oil and you'll get Matt Savinar's Life after the Oil Crash at the top of the list. Given what appears on the main page, a casual passer-by could easily come away with the impression that peak oil means that the end of the world is at hand, quickly dismiss the whole idea, and then quickly move on. If the end of civilization as we know it really is at hand, it's not clear how you would convey that to others without sounding alarmist - it seems that's part of the problem with the Peak Oil discussion.

If the end of civilization as we know it really is at hand, it's not clear how you would convey that to others without sounding alarmist - it seems that's part of the problem with the Peak Oil discussion.

It's kind of like calling a stock market bubble a bubble, or calling a housing bubble a bubble. No one wants to be told that the good times are coming to an end - that there really are no free lunches (or, in this case, that there really isn't an endless supply of cheap oil).

Being a mere novice on the subject in comparison to the staff at The Oil Drum, all that is being attempted here today is to show a few charts on the topic to perhaps add a bit of clarity to the picture - to "dumb it down" for those without a PhD.

Three charts should do the trick.

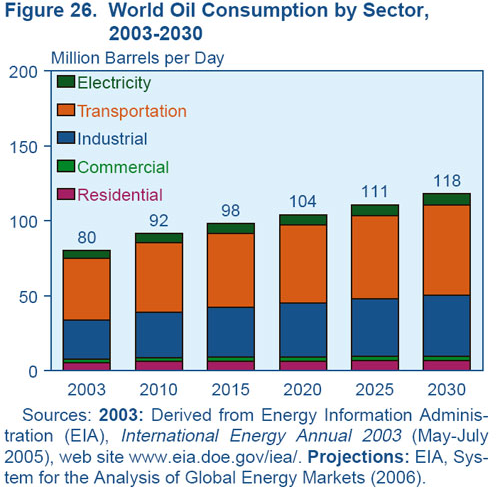

The first chart is from the International Energy Outlook 2006 report from the International Energy Administration (IEA) and shows projected world oil consumption going out a few decades.

Pretty straightforward stuff - the update for 2007 will be out this summer and this data from last summer may have been revised since it was released, but it's good enough for use here today. The second chart is from the January 2007 Peak Oil Update by Khebab at The Oil Drum, posted earlier this week.

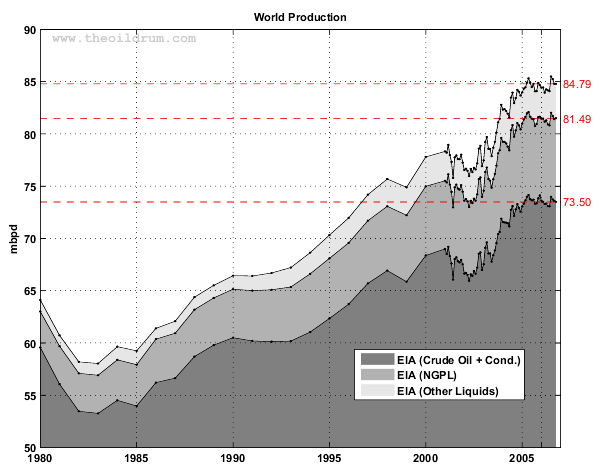

The second chart is from the January 2007 Peak Oil Update by Khebab at The Oil Drum, posted earlier this week.

Again this is pretty straightforward stuff.

What you see below is the current world oil production of about 85 million barrels per day - a production level that can be matched up with what one could reasonably extrapolate from the chart above.

The current demand is something less than the current production of about 85 million barrels per day - whether it is two million less or four million less is a discussion best left to others. Chart number three below (also from Khebab at TOD) is where things get complicated.

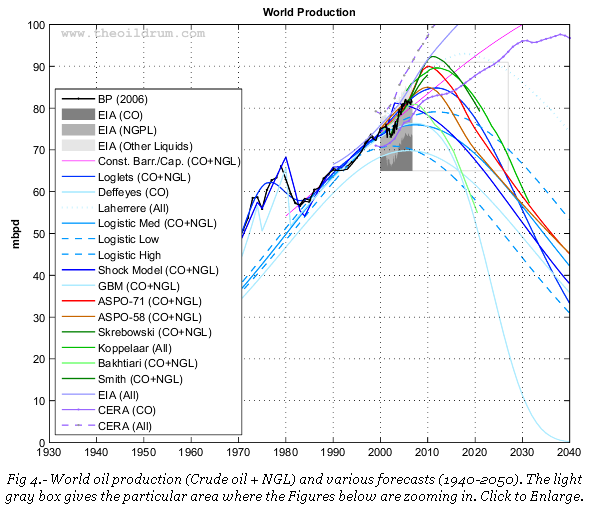

Chart number three below (also from Khebab at TOD) is where things get complicated.

The debate regarding the demand for oil in the future pales in comparison to the debate about its supply in the years ahead, as clearly indicated by the multi-colored lines in the chart below, each one showing a different rate of production over time. Which line will prove to be the correct one? Who knows.

Which line will prove to be the correct one? Who knows.

Only one of the lines intersects the year 2010 at a level above the expected demand of 92 million barrels per day. That's the outlook being offered by the uber-optimistic CERA (Cambridge Energy Research Associates), an organization whose motives many have questioned.

That could be a problem.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

12 comments:

Does that second chart look like it's forming a head-and-shoulders to anyone? ;-)

That chart shows two periods in the last twenty years where production stagnated. The first occurred when prices plunged at the turn of the century; however, the current plateau has taken place among record prices. Interesting, no?

I don't buy the doom and gloom, more fields will be discovered and replacement fuels will fill the gap. Also, I think the transportation demand for oil will go down as people buy hybrids and as we transition to renewables.

When the 2008 presidential campaign heats up, you will find that energy independence will be a unifying theme and it will be touted as this generations moonshot. Green technologies will get us out of this mess. BTW, I just saw last week an article about new solar technology being developed which has an order of magnitude higher yield and is also able to be a coating as opposed to current panel technology.

We will reason our way through this crisis imo.

I do buy the doom and gloom for this simple reason: they may find more fields, but they haven't found anything the size of Gwhar in Saudi or any of the other "superfields," all of which are heavily relied on to keep production at current levels. The "water cut" at Gwhar (water injected in to oil extracted) is at 50% according to some, consistent with an aging feild, in this case some 30 plus. That's old for a field actually. So when Saudi goes, The world will turn to the remaining sources with a vengence, and two of those would be Iran and Iraq. The problem is they consume much of what they produce and Iran is developing so quickly they will cease to export within the next ten years or so. Of course, bombing them back to the stone age might reduce that possibility....

The bombs should fall sometime this year. Bank on it.

Metroplexual:

The projections already generously account for new fields. Yes, more will be discovered, but they take years to come online and are of diminishing size.

Meanwhile, mega-fields around the world are depleting faster than expected. Ghawar has arguably peaked and the Saudis are having to go nuts with drilling to make up for it; Mexico's Cantarell is another example. The entire Afghan military campaign was a wash because the expected mother-lode of oil and gas in the Caspian basin turned out to be something like a tenth of the hoped size.

It's looking very grim. I think the world will ultimately regret that the hedge fund-induced high prices last year didn't last, to provide a disincentive to consumption.

Aaron,

The dems have polled the public and the resounding issue right now is energy independence. Higher than terrorism believe it or not. we have 1 year before the DC folks get behind this energy independence movement.

While the fields out there are being depleted, like catarell in Mexico substitutes will crop up in the short while like shale oil from Canada. You probably have heard nothing on this as an election issue but you will next year.

metroplex : no information to back your claims.

you appear to me to be seriously uninformed or misinformed on scalability of alternatives, resource requirements for their exploitation. i recommend to anyone interested the first hirsh report

(http://www.projectcensored.org/newsflash/the_hirsch_report.pdf) for a minimum understanding of the topic.

it's a difficult subject ( geology, stats, tech, economics, geopolitics, transportation...) so, metro, please stop cutting it up into bite sized political bonbons and encourage a serious look at the topic.

and you have a great site tim, thanks for it.

MP, do the research -- "shale oil" has and continues to be a non-starter. Technology will eventually solve the problem, but not nearly fast enough to spare everyone a great deal of pain for the next 5 to 10 years.

TJ

Don't get me wrong, I am not all pollyanna here. I reckognize there will be some reckoning, but I do not think it is the end of civilization.

I don't think the pain comes until 10 years out. What I am saying is that politically our heads will be taken out of the sand next year and a real effort will be made toward oil-less life.

I have read much of the peak oil writings, some bordering hysteria, some rational. I choose to be optimistic about the future.

Anonymouses, please choose an Identity of some sort.

Metro-saddam was thinking exactly the same thing:

I don't buy the doom and gloom, more loyalists will be discovered and replacement goons will fill the gap in my empire. Also, I think the rope will break and demand for Iraqi oil will go down as people buy bicycles and as "we" transition to renewed ideas. The Americans will go away and I will be the comeback kid next year.

When the 2008 presidential campaign heats up, you will find that the rope did break, that I am still alive and Iraqi nationalism will be a unifying theme and it will be touted as this generation's moonshot. Green money will get me out of this mess. BTW, I just saw last week an article about new rope tearing technology being developed which has an order of magnitude more saving of people on the gallows and is also able to be applied retroactively.

I will reason my way through this crisis imo. ... Act like men ... Praised be Allaaahhhhhhhh....

Peak Oil is nonsense. Sure, one day, oil will be economically less viable than some other source of energy... but "peak oil" is a non issue right now and will be a non event in the future.

I was explaining the correlation between the housing bubble and high oil prices on Daily Reckoning last summer and predicted that the oil price will go down as the housing bubble deflates. This is exactly what is happening now. Naturally, the production flattened too, because the demand side of the equation is not increasing anymore (or is decreasing).

Of course, many people like to prefer the "end of the world" type theories or theories about "governemnt manipulation before elections" and other sensational BS...

Christ,

Unfortunately, I'm somewhat of a 'survivalist,' in other words, you goobers can keep hoarding gold, but it won't matter 'cause folks like me have been hoarding copper in 5.56 and 7.62mm varieties...

Face it: It doesn't matter if you're buying up Uranium miners or gold miners or oil companies: if the world economy falls through it's because we're all waitin' with our fingers on the (real) trigger (but at least our portfolios are overbalanced with 'value stocks' like COF, PFE, KB, etc, etc)

BTW, we're the same 'value invester' clowns who saw a 300% return on stocks like FMD...

asshole...

http://www.youtube.com

/watch?v=2RxCpF3_Q_c

I used this video as a primer to get my wife to understand peak oil.

Post a Comment