Model Portfolio Performance

Wednesday, January 17, 2007

During lunch today I did a radio interview about yesterday's post Seniors in Debt, a story (about a story, as it were) that quickly made it onto Seeking Alpha and Yahoo! Finance. I've never heard myself on the radio before - I'm afraid it's going to sound all nasally and maybe even a little whiney.

If it's any good I'll post a link to the radio program's archive page where it will be available as a podcast.

We'll see.

In the meantime, readers are reminded that we are in the middle of a promotion this week for the companion investment website Iacono Research, which I was able to plug in a ham-handed sort of way during the interview.

There is much to learn here about self promotion.

Last year's introductory rate for a one-year subscription is

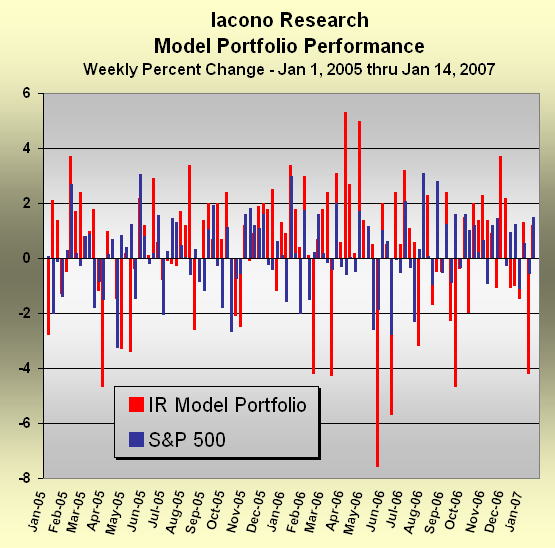

The chart below shows the performance of the model portfolio alongside the  Also note the increased volatility - this takes a little while to get used to, but it's worth it.

Also note the increased volatility - this takes a little while to get used to, but it's worth it.

As represented by the relative magnitude of the red and blue bars above, there is almost a two-to-one difference in volatility between the model portfolio and the S&P500.

During 2005 and 2006, the S&P500 had 45 down-weeks with an average loss of 1.06 percent along with 59 up-weeks with an average gain of 1.09 percent.

During the same period, the model portfolio had 36 down-weeks with an average loss of 2.02 percent along with 68 up-weeks with an average gain of 1.72 percent.

The cumulative gain for the S&P500 for 2005 and 2006 was 17.4 percent and for the model portfolio gains totaled 46.3 percent.

On an annual basis this breaks down as an increase of 3.7 percent in 2005 and 13.9 percent in 2006 for the S&P 500 versus gains of 20.7 percent in 2005 and 25.4 percent in 2006 for the model portfolio.

Is it time to add some hard assets to your investment mix in 2007?

Everyone should at least own a little gold - even Money Magazine thinks so.

If you'd just like to have a look around at the website with no obligation to purchase a subscription, click here to start a two-week free trial and you'll still be eligible for the special rate at the end of your trial period.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

2 comments:

congrats on the radio gig - let us know where we can hear you

Dump CCJ for Pinetree Capital.

Post a Comment