Uh-oh, This Could Be Bad

Thursday, January 04, 2007

The employment report from ADP has already cast a pall on the New Year. Never mind that yesterday's minutes from the December Fed meeting contained threats of further rate hikes (part of the vigilance that the Fed has vowed against the menace of inflation that it creates), yesterday's tally of job losses should be what market watchers worry about now.

While not always a reliable indicator of what the Bureau of Labor Statistics (BLS) will report later in the week, the most recent data point from the people who prepare payrolls is a sharp break from what has been the norm for more than three years - job growth.

As shown below, ADP reports that some 40,000 jobs vanished in December. The ADP payrolls report had become quite popular in the last year or so, that is, until it had those two big misses last year - huge monthly increases that were not confirmed by the BLS.

The ADP payrolls report had become quite popular in the last year or so, that is, until it had those two big misses last year - huge monthly increases that were not confirmed by the BLS.

Then it just looked kind of silly.

But not nearly as silly as the BLS and their recent history of revisions. The monthly non-farm payrolls number has been frequently revised by up to 100 percent or more in the months after its original release. The monthly revisions, however, have been trivial compared to the massive upward revision of 800,000+ jobs that were part of the preliminary annual benchmark adjustment last year.

The final benchmark adjustment should be announced soon - this is where the labor department tries to reconcile their estimates with actual employment insurance filings for the previous year. The ADP report is supposed to anticipate revisions to the BLS data, so maybe the big discrepancies between the two datasets that occurred in 2006 will disappear after more BLS revisions.

Or, maybe the employment data has just become so confusing that it has lost all of its value. Who knows?

One thing is certain, except for construction workers and loan processors, jobs seem to be plentiful. Maybe too plentiful, based on the help wanted signs that appear in the windows of so many Starbucks and Taco Bells.

Where the Jobs Aren't

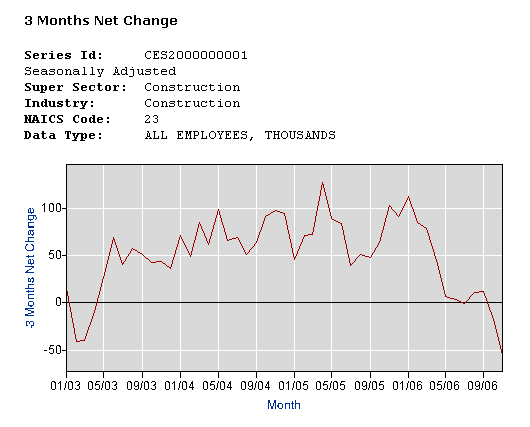

So, if the ADP report is correct, what jobs might have vanished? As noted so many times over at the fine blog of Calculated Risk (not his real name), construction employment is the first place to look. What provided support to an otherwise ailing economy for a few years after the 2000 stock market bubble burst is now reversing.

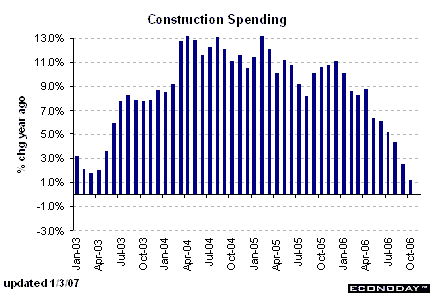

[Note that all the BLS charts are three-month net change - this takes out some of the noise and allows for comparing absolute job growth levels between sectors.] If you look at yesterday's latest update to construction spending (chart courtesy of Econoday), there's a pretty good correlation between construction jobs and construction spending, and the trend is clear.

If you look at yesterday's latest update to construction spending (chart courtesy of Econoday), there's a pretty good correlation between construction jobs and construction spending, and the trend is clear. So, what other employment sectors took up the slack as construction job growth ground to a halt last summer? Well, it wasn't manufacturing. Those jobs have been vanishing faster than construction jobs.

So, what other employment sectors took up the slack as construction job growth ground to a halt last summer? Well, it wasn't manufacturing. Those jobs have been vanishing faster than construction jobs. Did anyone really think that the U.S. was experiencing a manufacturing revival there a couple years ago?

Did anyone really think that the U.S. was experiencing a manufacturing revival there a couple years ago?

As manufacturing revivals go, in this globalized world, two and a half years of break-even should be declared a resounding success.

Where the Jobs Are

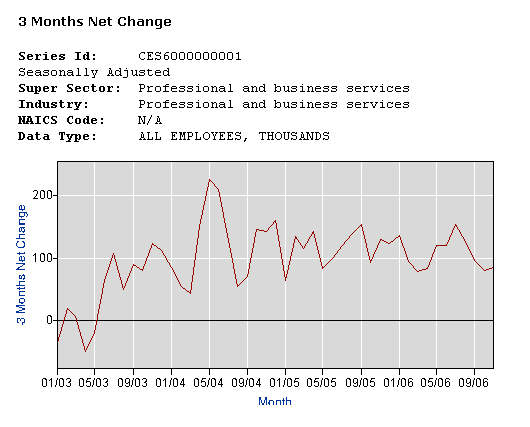

New positions in professional and business services have certainly helped to fill the void. It's near impossible to find out what these jobs really are from the BLS. Sub-categories like "management and technical consulting services" and "administrative and support services" don't tell you much more than that someone's picking up a paycheck.

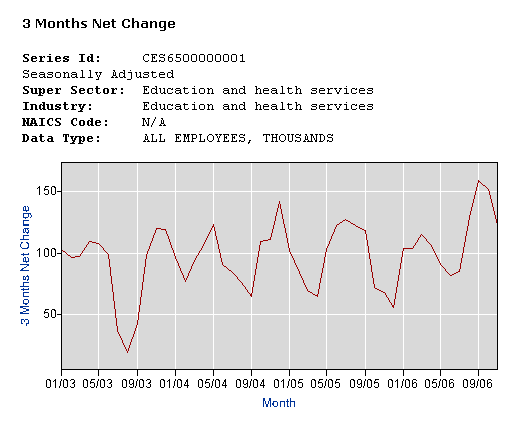

Whatever these jobs are, they have shown steady growth since bottoming out in 2003. The real stars of the job creation show have been education and health care - about the only multi-year employment chart that you'll find at the BLS that hasn't gone negative in the last few years. You have to wonder how all these salaries get paid.

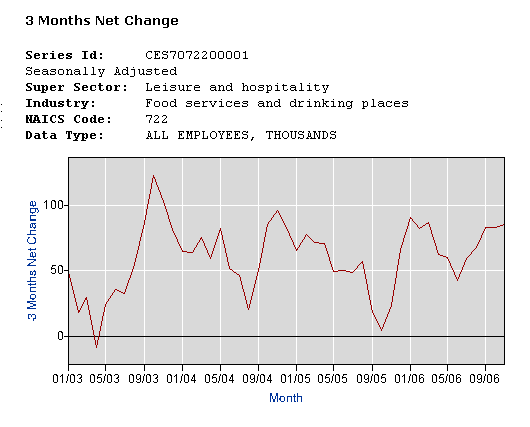

The real stars of the job creation show have been education and health care - about the only multi-year employment chart that you'll find at the BLS that hasn't gone negative in the last few years. You have to wonder how all these salaries get paid. Wages for leisure and hospitality, particularly for work at food service and drinking places (love that category name) are getting paid too - along with tips. If there were more takers for these jobs, the line in the chart below would probably be much higher - take a look at all the help wanted signs in front of eateries these days.

Wages for leisure and hospitality, particularly for work at food service and drinking places (love that category name) are getting paid too - along with tips. If there were more takers for these jobs, the line in the chart below would probably be much higher - take a look at all the help wanted signs in front of eateries these days.

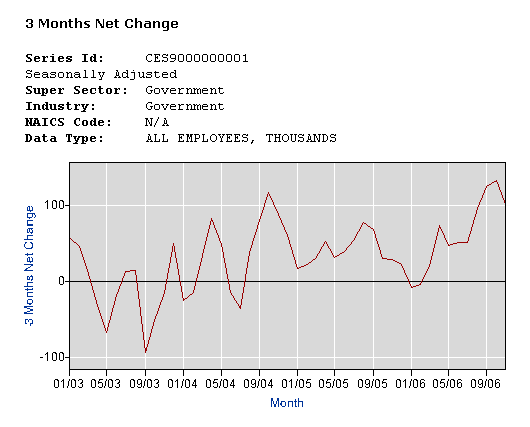

Take a look at the crowds too. Hey, the education and health care workers have to eat somewhere. Look for the chart below to continue its upward trend in the years ahead. Arnold Scharzenegger has 220 billion dollars in borrowed money to spend out here in California.

Look for the chart below to continue its upward trend in the years ahead. Arnold Scharzenegger has 220 billion dollars in borrowed money to spend out here in California. Will the BLS show its first job loss in 42 months tomorrow?

Will the BLS show its first job loss in 42 months tomorrow?

If so, which jobs will have vanished?

We'll find out tomorrow morning.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

3 comments:

jobless claims came in on the high side again this a.m. --- could be quite a day tomorrow.

Were I live are top three industries are

1) Government

2) Tourism

3) agriculture

We seem to trail the rest of the US 4~5 years. I think this ones big enough we'll see this nation wide.

Starbucks does have health care, and free coffee is a better perk then frys, so get your CV in early to beat the rush. As long as your car seats fold back for sleeping, I think your going to be just fine.

NZ

Post a Comment