Don't Spoil the Fun of pre-1982 Pennies

Thursday, January 04, 2007

All the talk about copper and how smart it is (the metal with a phD) and how the decline in U.S. housing construction is going to spoil all the fun of a pre-1982 penny having a melt value far in excess of its face value - all this leaves some of us wanting for a better explanation.

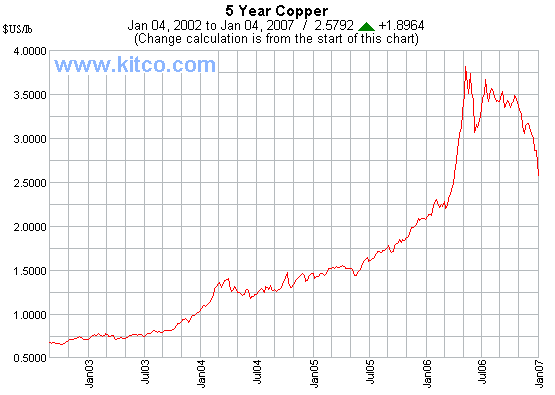

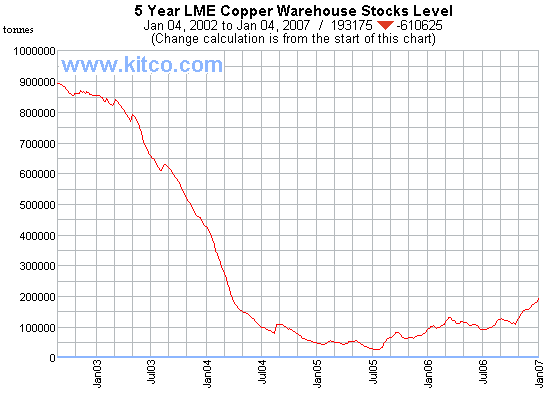

Yes, copper is getting a haircut and there's probably more to go, but with a chart like this there's plenty of room to go to the downside. Just like Florida home prices, what's 30 percent off the top when prices have gone up 400 percent in the last few years? People are talking about inventory like it's at some sort of multi-decade high - have a look at this five year chart. The recent doubling in inventories doesn't look like much when put into proper perspective.

People are talking about inventory like it's at some sort of multi-decade high - have a look at this five year chart. The recent doubling in inventories doesn't look like much when put into proper perspective. Then there's this chart that puts an entirely new spin on the whole idea that the U.S. is the world's second largest consumer of copper - it appears that there's a wide gap between #1 and #2.

Then there's this chart that puts an entirely new spin on the whole idea that the U.S. is the world's second largest consumer of copper - it appears that there's a wide gap between #1 and #2.

A housing construction slowdown in the U.S. might not be quite as important in the global demand picture as it was a couple decades ago. And what about China? Will the slowdown come this year?

And what about China? Will the slowdown come this year?

Pundits have predicted a throttling back of economic growth in China for about five years now - what are the chances of this being the year?

Maybe less than you think. Click on Mr. Pesek for the whole story from Bloomberg.

Click on Mr. Pesek for the whole story from Bloomberg.

Copper is important, but the much more significant story may be burgeoning automobile production in China and its impact on oil prices.

This will surely be the year when the commodity bulls and the commodity naysayers settle the debate - there are a surprising number of very smart people who think that it's only a matter of time before we see $40 oil, and $400 gold.

Is this the end or just the beginning of the commodities boom?

By the end of 2007 we will surely know.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

4 comments:

I think you've got the story right: most US-based analysts still analyze the markets as if the cold the US catches effects the whole world. Well, the last time this analysis worked, most global growth wasn't coming from 3 billion people in developing nations.

Nickel and zinc stocks look even worse (for industrial consumers, that is). If this continues we may see post-'82 pennies and nickels start to steal the limelight!

Most market observers still don't understand that commodities are now susceptible to amplified swings because of the massive trading leverage sloshing around.

At some point fundamentals will push the hedgies in another direction.

As I predicted over on my blog, we're now between the first and second trading peaks in oil (of 4 per year), shifted up a couple months from last year. Peak #2 will be even bigger -- expect $70 oil (plus or minus a few $ for weather).

If a shipment of slab copper goes from Morenci, Arizona to Shanghai, and is wound into a motor for a Haier air conditioner that ends up in a San Diego McMansion, where is the consumption credited? I find it hard to believe that China's gross copper consumption tripling, according to the last two bar chart entries, while the rest of the world's portion declined by a quarter, are unrelated. Worth considering when debating who sneezes and who catches cold, at least as it pertains to commodity consumption.

Econoclast

Econoclast has a point. If orders for copper bearing parts and machines are dropping, you can bet that the manufacturing sector (aka China/Emerging markets) will feel it the hardest. US Consumerism has been driving the global economy (see point #2). If the US consumer is the one sneezing, the Chinese manufacturer will end up catching cold.

Until China develops a domestic consumer base, the world economy is dependent on Western Consumers. From the Independent: "According to Credit Suisse, China is home to a quarter of the world's population, yet represents only 4 per cent of global household consumption. The average national wage is just 16,000 yuan (£1,038)."

Asia is building more cities, factories, roads, etc. Most of the commodities being imported are not being re-exported in finished goods.

Post a Comment