The Week's Economic Reports

Saturday, January 06, 2007

Following is a summary of last week's economic reports - the unexpectedly strong labor report along with a small rebound in manufacturing highlighted the data. For the week, the S&P 500 Index fell 0.6 percent to 1,410 and the yield of the 10-year U.S. Treasury note fell 6 basis points to 4.65 percent. ISM Manufacturing Index: The Institute for Supply Management's manufacturing index rebounded from last month's sub-50 reading, the level below which a contraction in manufacturing activity is indicated. Up from 49.5 in November to 51.4 in December, an increase in new orders bolstered the index while inventory levels improved. The prices paid category continued to fall, from 53.5 in November to 47.5 in December - recall that this was as high as 70 last summer.

ISM Manufacturing Index: The Institute for Supply Management's manufacturing index rebounded from last month's sub-50 reading, the level below which a contraction in manufacturing activity is indicated. Up from 49.5 in November to 51.4 in December, an increase in new orders bolstered the index while inventory levels improved. The prices paid category continued to fall, from 53.5 in November to 47.5 in December - recall that this was as high as 70 last summer.

Construction Spending: Construction spending fell 0.2 percent in November after an upwardly revised dip of 0.3 percent in October. This marks the eighth consecutive month of declines for overall construction spending coming off of some very high levels early in 2006. Private residential construction continued to lead the downturn, falling 1.6 percent, now down 11.1 percent on a year-over-year basis.

Private nonresidential construction and public construction rose 1.4 percent and 1.0 percent respectively, continuing to provide support for construction spending overall. This may be short-lived however, as there is normally a multi-month delay between peaks in residential and nonresidential construction where, new infrastructure build-out follows residential construction as neighborhoods expand.

ISM Non-Manufacturing Index: The ISM's index of non-manufacturing activity slowed a bit in November to 57.1 from 58.9 the month prior. New orders fell from 57.1 to 54.4, but backlog orders also fell, from 54.5 to 48.0. The measure of employment rose 1.7 points to 53.3 while prices paid fell from 59.1 in October to 55.6 in November.

It appears that falling energy prices are continuing to work their way through both indexes published by the ISM, both reports showing a continuation of the decline in prices paid from much higher levels last year.

Pending Home Sales: The index of pending home sales continued its decline, falling 0.5 percent in November after declining an upwardly revised 1.5 percent in October. The November decline was led by the Northeast region that dropped 2.8 percent. On a year-over-year basis, the index is down 11.4 percent and has now declined 11 of the last 15 months after peaking in September of 2005.

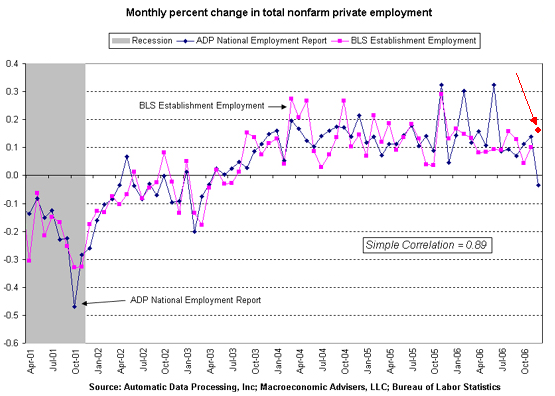

Labor Reports: The Wednesday release of the nonfarm payrolls report from Automatic Data Processing, showing a loss of some 40,000 jobs in December, turned out to be at odds with the tally from the Bureau of Labor Statistics which showed an increase of 167,000. That's a large discrepancy (207,000 jobs), but the BLS data has been subject to such huge revisions lately, you don't know where the number will finally end up.

Looking at the chart below (the most recent BLS total indicated in red), there is a pretty good correlation between the two measures of employment up until 2006, so it's possible that the BLS data for December may be revised downward in the months ahead, or possibly with next year's annual benchmark revision. Along with strong job growth for December, the employment report from the BLS also contained upward revisions of 22,000 for November and 7,000 for October. The service sector led the way in job creation once again, professional and business services adding 50,000 positions while education/health services and leisure/hospitality added 43,000 and 31,000 respectively. Once again, the number of both construction and manufacturing positions declined, this month by a combined 15,000.

Along with strong job growth for December, the employment report from the BLS also contained upward revisions of 22,000 for November and 7,000 for October. The service sector led the way in job creation once again, professional and business services adding 50,000 positions while education/health services and leisure/hospitality added 43,000 and 31,000 respectively. Once again, the number of both construction and manufacturing positions declined, this month by a combined 15,000.

The household survey showed the unemployment rate unchanged at 4.5 percent and the workweek was steady at 33.9 hours. Average hourly earnings came in on the high side, rising a half percent after a 0.3 percent increase in November. Wages have risen 4.2 percent on a year-over-year basis.

With the combination of massive revisions to the BLS data, rising unemployment insurance claims in recent months, and the ADP report showing job losses in December, there may still be trouble ahead this year for employment - perhaps as soon as the next few months. Recall that, by their own admission, the BLS's birth-death estimation modeling performs poorly during "turning points" in the labor market - this may be an important factor in the months ahead.

FOMC Meeting Minutes: The minutes of the early-December Fed meeting showed continued concern over inflation, however, some board members expressed a desire for their monetary policy stance to be more evenly balanced rather than the current stance that is tilted more toward rising inflation than slowing growth. One member's view was that "although the risks to inflation remained the predominant concern, the statement should emphasize that policy could be adjusted in either direction depending on the evolution of the outlook for inflation and economic growth." Note that this meeting was held just prior to the December report on consumer prices where core inflation posted a 0.0 percent increase from the prior month - this was the first reading at this level after a year and a half of rising month-to-month core inflation.

Summary: The labor report was by far the most significant development of the week - it moved markets in a very big way, the dollar strengthening and precious metals selling off. The increased hourly earnings in the labor report combined with the FOMC meeting minutes have put inflation firmly ahead of slowing growth as the primary threat to the economy in the eyes of most economists.

You have to wonder why, if so many jobs are being created and if wages are rising, poll respondents consistently rank "the economy" as one of their top concerns. There is little doubt that jobs are plentiful these days in many parts of the country and the employment situation is by far the most important of all economic statistics.

Why are people concerned about the economy?

In my view, people don't really understand yet what is wrong - they don't know what it is about the economy that is making them uncomfortable. They continue to fall behind month after month in real terms, and the long, slow, painful "stealth tax" of inflation (that doesn't show up in the government's statistics) just wears away at them month after month, year after year.

The Week Ahead

Economic news in the week ahead will be highlighted by the first major report on December retail sales on Friday. Other reports will include consumer credit on Monday, international trade on Wednesday, and both business inventories and import/export prices on Friday.

[Note: This is one relatively small part of the Weekend Update published at the companion investment website Iacono Research. Since it contains no investment-specific information, it will appear here on Saturdays on a fairly regular basis. To have a look at the complete Weekend Update, including the model portfolio and much more, sign up for a no-obligation free trial today.]

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

7 comments:

Please watch "Real Financial Heros" bideos in YouTube.com:

Real financial heros part 1 of 3

http://www.youtube.com/watch?v=ECIuteQB8hw

Real financial heros part 2 of 3

http://www.youtube.com/watch?v=33OE65bNclc

Real financial heros part 3 of 3

http://www.youtube.com/watch?v=TxylHPnoloI

Hope you enjoy it!

http://www.predatorix.com/files/cases/orix/SFEvsORIX.pdf

Funny videos, scary lawsuit.

Completely OFF TOPIC... Highly recomended reading......

http://www.thenation.com/doc/200...20070122/ moyers

Best regards,

Econolicious

> In my view, people don't really understand yet what is wrong - they don't know what it is about the economy that is making them uncomfortable. They continue to fall behind month after month in real terms, and the long, slow, painful "stealth tax" of inflation (that doesn't show up in the government's statistics) just wears away at them month after month, year after year.

I'm sure there's also the "investment banker" effect, whereby the lucky conditions of a few select economic sectors pull up the averages, throwing the analysis of actual bulk economic conditions for a loop. A simple example is that while average compensation is up slightly above inflation (reported inflation, at least), median compensation most definitely is not.

I think most people are looking at their own checking accounts and credit card bills and grumbling.

Then of course there are the "Lou Dobbs" aspects of the economy -- like deteriorating job security. That kind of thing doesn't show up in any popular government data streams, but people sure do feel it...

I'd also like to add that we should hold back on sending Dubya a fruit basket for a job well done on the economy with job creation stats like they have been in the past couple years; we need about .1% monthly job growth (or ~122k jobs) just to keep up with population growth, all other things equal. And we're right about at that level, treading water.

The government shouldn't be in charge of jobs nor the economy. That is the whole problem with central planning. People who look for the government to take care of them are just going to have their heads handed to them.

Most of these jobs were added in the service sector. What is the service sector? what is the median income for someone in the service sector? Can some one who was recently laid off from Ford Motor Co. find the same salary and benefits in the service sector? The thing that concerns people is the constant threat of having to take a lower paying job if they are let go.

Post a Comment