A Bloodbath or a Buying Opportunity?

Friday, January 05, 2007

People just love it when their investments get hammered and someone else calls it a buying opportunity. Enough mail has been directed this way during weeks like this to confirm this sentiment (none this week, but the week's not over).

But really, think about it a bit. How boring would it be if everything you owned always went up?

Oh yeah, it's called fixed income - five percent. A couple years ago it was a lot less.

From the looks of the first week in 2007, maybe that fixed income allocation should be reviewed and bumped up a little bit.

Things started out OK on Tuesday, but once trading resumed in New York on Wednesday, commodities got walloped. Oil was a big loser for the week, falling to levels many thought would never be seen again. Others think $55 a barrel is still $20 too high. The big oil companies didn't do so well either.

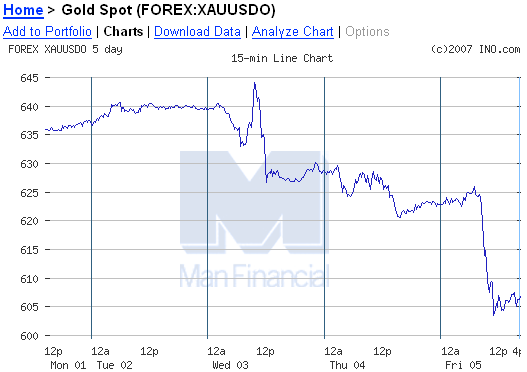

The big oil companies didn't do so well either. Gold did well on Tuesday, then after a little buying on Wednesday, the Fed meeting minutes were released and everone got scared again - a quick $15 off the top. When the labor report was released earlier today, everyone became horrified.

Gold did well on Tuesday, then after a little buying on Wednesday, the Fed meeting minutes were released and everone got scared again - a quick $15 off the top. When the labor report was released earlier today, everyone became horrified. And of course silver followed gold, just a little more dramatically when the price movement is measured as a percent change.

And of course silver followed gold, just a little more dramatically when the price movement is measured as a percent change. The chart for the unhedged gold miners looks a lot like the one for the oil producers - they held up well today even though the metals were being pummeled.

The chart for the unhedged gold miners looks a lot like the one for the oil producers - they held up well today even though the metals were being pummeled. And the dollar rebounded - let's see how long this dollar strength lasts.

And the dollar rebounded - let's see how long this dollar strength lasts. If the first week of the year is any indication, we are in for a wild ride in 2007.

If the first week of the year is any indication, we are in for a wild ride in 2007.

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

7 comments:

And I almost emailed you!

I hope it's not all as wild as this week. I don't think I've ever checked Yahoo! Finance so many times in one day or one week as this past one. And that was with two days off!

BACK UP THE TRUCK

YOU WILL NEVER SEE GOLD AT THESE PRICES AGAIN!!!

NOT IN U.S. DOLLARS

Where is all the money going Tim?

TK

The commodity markets are quite small compared to bonds, equities, and cash - a big sell off in commodities would be barely noticeble if most of the money goes to cash, which it probably did since bonds and equities both fell this week too.

I'm going to buy 100 silver eagles this week.

Can you believe I can get real money in exchange for pieces of paper?

Sometimes the metals get ahead of themselves and just correct normally. Other times, they get beat up even when they haven't been running that hard - like now. I do believe in the cartel and when I see them pound on gold and silver hard, I think they know there is trouble coming for the dollar. I only buy when they pound the metals and pump the dollar. They are like a clock you can set your watch to. It works out faaaaaantastic every time.

btw, uranium juniors holding up very well on the commodities sell off - good looking price action so far.

The groundwork is being laid to lower rates. You can't do that and seem credible with commodities and gold making new highs. This is a good buy.

Post a Comment